How to Take Profits in Crypto: Strategies, Timing, and Tools

You’re watching considered one of your cash surge, and it feels nice—that’s, till the value drops again to the place you began. Crypto earnings can evaporate quick. You don’t wish to be caught wishing you had offered sooner. You need a plan. You need blueprints, not hope. This text will present you confirmed exit methods—utilizing instruments, orders, and alerts—that provide help to determine the right way to take earnings in crypto buying and selling.

What Is Crypto Revenue-Taking and Why It’s Essential

Put merely, crypto profit-taking means promoting your crypto property after they’ve gone up in worth, so you’ll be able to lock in positive factors and minimize future danger. Till you promote, your revenue is just on paper—what’s typically known as unrealized P&L (revenue & loss). However when you do promote, it turns into realized P&L—and that’s the one revenue you’ll be able to really use or transfer into stablecoins, fiat, or different property.

Crypto profit-taking methods are necessary as a result of the crypto market is notoriously unstable. Costs can swing double-digits in hours, wiping out positive factors you thought had been secure. Revenue-taking turns these fragile, potential positive factors into money or stablecoins you’ll be able to management. It additionally helps you propose for taxes and buying and selling charges, since realized earnings set off capital positive factors tax in lots of nations (for instance, that is the way it works with the IRS within the US).

Why Learners Ought to Take Earnings (Not Simply HODL)

Learners ought to take earnings as a result of HODLing alone doesn’t shield you from crypto market fluctuations, which might be extraordinarily unstable. Holding on can work long-term, however with none profit-taking, you danger watching your hard-earned rewards disappear in a single downward transfer. Promoting some at deliberate factors locks in actual positive factors and reduces your danger, providing you with money or stablecoins to redeploy.

HODLing—holding property by way of short-term ups and downs—stays a legitimate long-term funding technique, however it works greatest when mixed with clear revenue targets. Even small gross sales at key milestones can fund your subsequent transfer, pay taxes, or just safe your hard-earned positive factors. By taking earnings alongside the best way, you keep away from emotional decision-making and FOMO, two traps that hit new merchants hardest.

Learn extra: What Is ‘HODL’?

How the Crypto Market Cycle Impacts Your Revenue Technique

Your profit-taking technique has to match the crypto market cycle, as a result of every section rewards a distinct method. In a bull market, the place costs pattern upward, taking earnings at mounted targets or utilizing trailing cease methods can lock in positive factors whereas nonetheless driving the momentum. In a bear market, the place costs are falling, promoting sooner or rotating into stablecoins can shield your capital. Throughout range-bound markets, partial sells at resistance ranges and buys at help provide help to grind out regular earnings as a substitute of ready for giant strikes.

Market cycles mirror shifts in provide, demand, and sentiment. They’re formed by catalyst occasions like halving dates, regulation adjustments, or geopolitical information that may spark sharp value strikes. Recognizing these phases with technical evaluation instruments corresponding to transferring averages (MA), help and resistance ranges, and on-chain metrics just like the MVRV ratio provides you an early sign to regulate your plan. With out this consciousness, you danger utilizing the fallacious technique on the fallacious time.

Learn extra: The Full Information to Crypto Evaluation

Elements That Decide When to Take Crypto Earnings

It’s best to take crypto earnings when clear, measurable elements inform you it’s time, not when concern or pleasure strikes. In case you base buying and selling selections on these info as a substitute of feelings, you retain extra of your positive factors. Listed here are three necessary guidelines to remember:

- Know Your Numbers.

Monitor your entry value, place dimension, and the typical value foundation (the typical value you paid per unit of a crypto asset, together with charges) to see precisely how a lot you’re up. All the time set a danger/reward ratio—many merchants intention for at the least 2:1. It helps determine when a commerce has paid sufficient to exit. In case you don’t have these numbers to anchor you, your profit-taking turns into blind guesswork. - Learn the Room.

Market circumstances, liquidity, and volatility decide how briskly earnings can vanish. Technical evaluation instruments like help and resistance, transferring averages, and Bollinger Bands present when momentum weakens. Elementary evaluation of upcoming protocol adjustments or political occasions, for instance, also can warn you to tighten stops or rotate into stablecoins. - Plan for Invisible Prices.

Taxes and buying and selling charges eat into web revenue. For instance, realized revenue triggers capital positive factors tax within the US. Issue these prices in earlier than promoting crypto property so that you don’t overestimate your return.

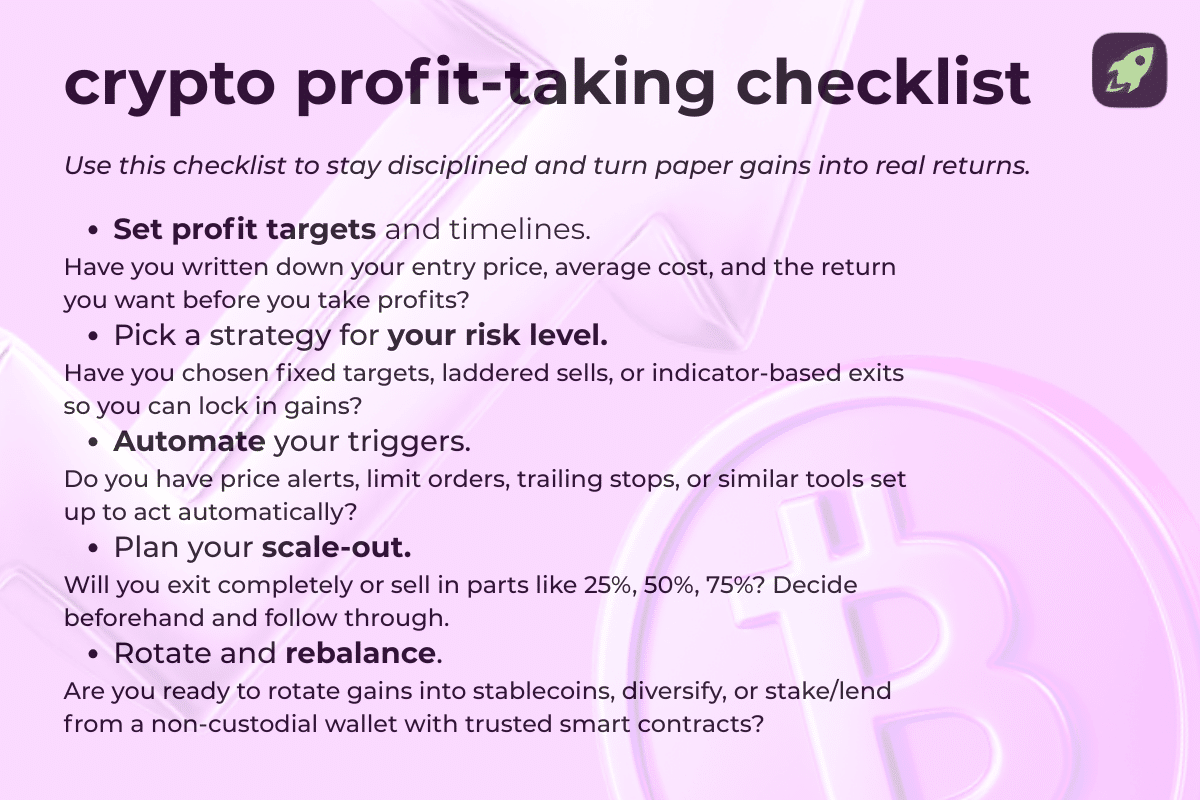

The right way to Create Your Personal Revenue-Taking Plan

A strong plan provides you management over when and the way you are taking earnings. Let’s undergo the steps of making one.

Outline Your Revenue Objectives and Timeline

Write down precisely how a lot revenue you need and when. Monitor your entry value and common value foundation so you recognize the place you stand. Set a revenue goal and a time window—quick time period or long run—to determine when to take earnings. Additionally be sure that to regulate these targets as wanted over longer timeframes. Clear numbers hold you from transferring the goalposts after each value transfer.

Decide the Proper Technique for Your Threat Degree

Match your plan to your danger tolerance. Mounted-target profit-taking locks in positive factors at set ranges. Laddered promote orders break up exits throughout costs. Greenback-cost averaging can assist easy volatility. Trailing stops observe a rising value and exit robotically if it reverses. Combining these crypto profit-taking methods helps you seize earnings successfully in numerous market circumstances.

Set Up Value Alerts or Restrict Orders

Don’t depend on reminiscence or late-night display screen checks. Use trade instruments to set value alerts and place restrict orders (orders that execute solely at your chosen value) so that you’re prepared when value hits your revenue targets, even if you happen to’re offline. Add a stop-loss order (an order that sells as soon as value drops to a preset stage) or a trailing cease order (a cease that robotically strikes up with the value) to guard positive factors in unstable markets. You can even use an one-cancels-the-other (OCO) order or a bracket order to mix entry, cease, and revenue targets in a single setup.

Promote Your Whole Place

It’s a critical pivot, however typically promoting your total place is the cleanest transfer. A market order (an order that sells instantly on the present market value) will get you out quick when circumstances change with a catalyst occasion and also you’ve deliberate an event-driven exit. This may be helpful in bearish chart patterns, when liquidity dries up and also you wish to offset losses earlier than they develop.

Promote Solely a Portion of Your Complete Lengthy Place

Extra typically, promoting in elements (quite than in complete) reduces danger and retains upside. Laddered promote orders or dollar-cost averaging out allow you to take earnings incrementally at completely different value factors. Rotating some earnings into stablecoins preserves positive factors whereas leaving you with publicity to potential progress. You can even shut a derivatives contract corresponding to a perpetual or choices place to cut back danger with out promoting your spot positions. This method works properly when market traits look sturdy however you wish to de-risk step by step.

Keep Protected within the Crypto World

Learn to spot scams and shield your crypto with our free guidelines.

5 Straightforward Crypto Revenue-Taking Methods for Learners

These 5 easy profit-taking methods work in most market circumstances and provide you with a framework for when and the right way to promote. Decide one or mix a number of to suit your danger tolerance and buying and selling type.

Mounted Goal Technique (Promote at Pre-Set Value)

Set clear revenue targets at particular costs earlier than you enter a commerce. Place a take-profit order (an order that robotically sells at your chosen value) so the exit occurs with out hesitation. This works properly in an upward pattern the place you’ve deliberate your positive factors forward of time.

Instance: You purchase ETH at $1,800 and place a take-profit order at $2,200. When value hits that stage, your order fills robotically and locks within the achieve.

Laddering or Scaling Out (Promote in Components)

Break your place into chunks and promote parts at completely different value ranges. Laddered promote orders allow you to lock in earnings step by step and nonetheless profit if the value retains climbing. This reduces danger in comparison with promoting your complete place directly.

Instance: You maintain 1 BTC purchased at $30,000. You intend to promote 25% of your place at $38,000, one other 25% at $42,000, and the remainder at $45,000 to seize rising costs with out exiting too quickly.

Cease-Loss and Trailing Cease Orders

A stop-loss kicks in if value drops to your preset stage, whereas a trailing cease strikes up robotically as the value rises. They guard your positive factors with out you having to hover over the charts 24/7.

Instance: You purchase an altcoin at $5, set a stop-loss at $4 to restrict loss, and a trailing cease at 10% under the very best value so if it peaks at $6.50 you exit robotically at $5.85.

Greenback-Price Averaging Out (DCA Exit)

Promote equal quantities of your crypto on a set schedule as a substitute of making an attempt to time the highest. The dollar-cost averaging method smooths out volatility and removes the stress of guessing when to promote.

Instance: You promote $500 price of SOL each week over three months no matter value, step by step decreasing publicity and locking in earnings.

Technical Indicators for Revenue-Taking (RSI, Fibonacci)

Use easy alerts to information an indicator-based exit. Overbought readings on the Relative Energy Index (RSI, a momentum indicator that measures how stretched a value transfer is) or value hitting Fibonacci retracement or extension ranges (mathematical ratios merchants use to mark potential help and resistance) can flag the place to take earnings. Mix these with transferring averages or Bollinger Bands to substantiate momentum earlier than you promote.

Instance: BTC rallies from $30,000 to $39,000 and hits the 161.8% Fibonacci extension whereas RSI reads 75. You promote a part of your place at that stage to lock positive factors earlier than a pullback.

Step-by-Step Revenue-Taking Instance with Bitcoin

Think about you acquire 1 BTC at $30,000. Let’s break down an instance profit-taking plan you may use:

- Promote 25% at $36,000: a few 20% achieve. You are taking some cash off the desk when the value hits your first revenue goal or a key resistance stage on the chart. This covers your preliminary danger and frees up capital with out closing the entire commerce.

- Promote 50% at $42,000: a few 40% achieve. You exit half your remaining place if momentum slows, RSI exhibits overbought circumstances, or the value hits a significant Fibonacci extension stage. You’ve now banked most of your revenue and might journey the remainder stress-free.

- Promote 75% at $48,000: a few 60% achieve. You lock in almost the whole lot if a catalyst occasion (like regulatory information or a pointy reversal in market sentiment) threatens the rally. This leaves you with a small piece to seize any ultimate push increased whereas defending the majority of your positive factors.

This staged method turns imprecise hopes into a transparent exit technique (what merchants name a danger/reward goal exit). It makes use of mounted targets, technical indicators, and market cues to determine when to scale out, holding you disciplined at the same time as value strikes quick.

Managing Threat and Reinvesting Crypto Earnings

Taking earnings is just half the job. Managing danger and deciding the place to place these earnings subsequent retains your portfolio wholesome and your stress low.

- Lower your publicity first. Transfer some positive factors into stablecoins to protect them from sudden drops whereas nonetheless staying within the crypto ecosystem. Some platforms additionally allow you to use cryptocurrency as collateral for loans, providing you with entry to capital with out promoting your property. Simply be sure that to consider buying and selling charges and any tax legal responsibility earlier than you progress funds so you recognize your actual web revenue.

- Diversify your method. A rebalancing technique—promoting high-performing property to return to your goal allocation—retains one coin from dominating your portfolio. Following a easy place sizing rule (risking only one–2% of your capital on any single commerce) and setting a most drawdown restrict (the utmost loss you’re prepared to tolerate earlier than stopping) stops small errors from turning into disasters. Basically, this diversification rule helps hold all of your eggs out of 1 basket.

- Put your earnings to work. You don’t at all times need to promote out of crypto to earn yield. Staking can generate passive earnings. You can even earn regular returns by lending your property by way of respected platforms or taking part in liquidity swimming pools and automatic market makers (which offer liquidity with out conventional consumers or sellers). Liquidity mining—depositing crypto property to facilitate trades on a DeFi platform—is one other widespread supply of additional earnings, and a few traders even use crypto financial savings accounts to earn increased curiosity on deposited cash.

Learn extra: A Sensible Information to Crypto Threat Administration

Avoiding Greed, FOMO, and Emotional Promoting

The quickest approach to lose crypto earnings is to let feelings drive your trades. Greed makes you maintain too lengthy, concern makes you dump too early, and FOMO pulls you into dangerous entries. With out a plan, these temper swings value greater than any charge. Let’s learn to keep away from them:

- Set guidelines earlier than you commerce. Resolve your revenue targets and cease ranges when you’re calm. Write them down and keep on with them. This prevents impulse exits and helps you keep away from emotional decision-making, even when costs spike or drop.

- Automate the place attainable. Use buying and selling bots and restrict orders to execute your exit technique robotically, or run an algorithmic technique that scales your exits. Automation removes the necessity to watch value charts 24/7 and retains you from second-guessing your plan when the market strikes quick.

- Monitor your individual habits. After every commerce, observe why you entered and exited. Over time you’ll see patterns—possibly you at all times promote on a dip or chase a pump. Recognizing these habits helps you appropriate them and construct self-discipline like different merchants who final by way of cycles.

By controlling your feelings with guidelines and automation, you shield your positive factors, take earnings with confidence, and place your self for long-term success as a substitute of short-term errors.

Widespread Errors to Keep away from When Taking Crypto Earnings

Even a strong profit-taking plan can fail if you happen to fall into these traps. Let’s go over these widespread errors once more so you’ll be able to spot them early and obtain long-term success.

- Ready for the proper high.

Attempting to promote on the precise peak often backfires. Set reasonable revenue targets and keep on with them as a substitute of chasing each uptick. - Ignoring buying and selling charges and taxes.

Buying and selling charges and capital positive factors tax can quietly eat into your web returns. All the time calculate what you’ll really hold earlier than you promote cryptocurrency. - Promoting the whole lot or nothing.

Dumping your complete place directly can go away cash on the desk. By no means promoting in any respect can erase paper positive factors. Use laddered sells or dollar-cost averaging out to scale earnings step by step. - Skipping danger administration.

Skipping stop-losses, trailing stops, or a most drawdown restrict exposes you to huge losses. Construct these guidelines into your exit technique to guard your crypto property. - Letting feelings drive your selections.

FOMO and panic typically trigger retail merchants to exit positions too early or maintain too lengthy. Automating your orders with restrict or take-profit orders helps you keep away from emotional selections.

Ultimate Ideas: Is Backtesting Value It?

Backtesting—testing your crypto profit-taking technique on previous value information—enables you to see how your exit technique, revenue targets, and stops would have labored with out risking actual cash. It will possibly’t predict the long run, however it highlights weak spots in your technique and exhibits how your plan behaves in numerous market circumstances. Used this manner, backtesting is certainly price your time. It provides you knowledgeable selections, helps you refine your technique, and turns your profit-taking plan into one thing you’ll be able to belief when the crypto market will get unstable.

Typically, clear objectives, the suitable crypto take-profit technique, and disciplined danger administration flip unrealized positive factors into lasting outcomes. Use mounted targets, laddering, trailing stops, or dollar-cost averaging with automation to take earnings confidently.

FAQ

How do I do know when it’s the suitable time to take earnings in crypto?

Take earnings when your preset targets, technical alerts, or danger/reward guidelines are met, and never when concern or hype strikes. This retains your exit disciplined as a substitute of emotional, and extra prone to profit you in the long term.

Ought to I promote all my crypto or simply part of it?

Promoting a part of your place locks in positive factors whereas holding upside publicity. Full exits work greatest when market circumstances flip sharply bearish or your plan requires it.

What proportion of revenue ought to I take when my coin goes up?

There’s no magic quantity, however many merchants scale out 25%, 50%, and 75% at deliberate value ranges. Select the quantity that works in your objectives, anticipated taxes, and danger tolerance.

Is it higher to HODL or take earnings usually?

Combining HODLing with deliberate profit-taking works greatest. You retain a core long-term stake however safe positive factors alongside the best way to keep away from watching them vanish.

What if I miss the highest—is it too late to take earnings?

It’s hardly ever too late. You’ll be able to promote in accordance with your plan on the subsequent revenue goal or rotate a part of your holdings into stablecoins to guard what’s left.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.