Bitcoin miners are earning less despite BTC’s high price – Here’s why

- Bitcoin miners confronted squeezed income as transaction charges hit historic lows.

- Community issue and rising prices are difficult smaller miners’ survival.

Bitcoin [BTC] miners are dealing with a difficult panorama in 2025 as key factors squeeze profitability. Transaction charges have hit their lowest ranges since 2012, whereas community issue continues to climb.

The 2024 halving has elevated competitors, and income per unit of computational energy is quickly declining.

As well as, USD-denominated mining income stays risky, creating uncertainty even for main gamers.

As revenue margins tighten, miners are being compelled to optimize operations, shut down out of date tools, or take into account mergers.

With smaller gamers susceptible to exiting, business consolidation appears imminent, leaving solely probably the most environment friendly and well-capitalized operations to outlive.

Bitcoin mining faces profitability pressure

Supply: Alphractal

The Bitcoin mining ecosystem is dealing with important challenges, as a number of key metrics level towards declining profitability.

The Bitcoin mempool, which tracks unconfirmed transactions, has fallen to its lowest stage in years, signaling lowered community demand.

This drop straight impacts miners’ income from transaction charges, that are important alongside block rewards.

Traditionally, comparable declines in transaction exercise have been adopted by bear markets, and this downturn – regardless of Bitcoin’s excessive worth — might point out a structural shift within the community.

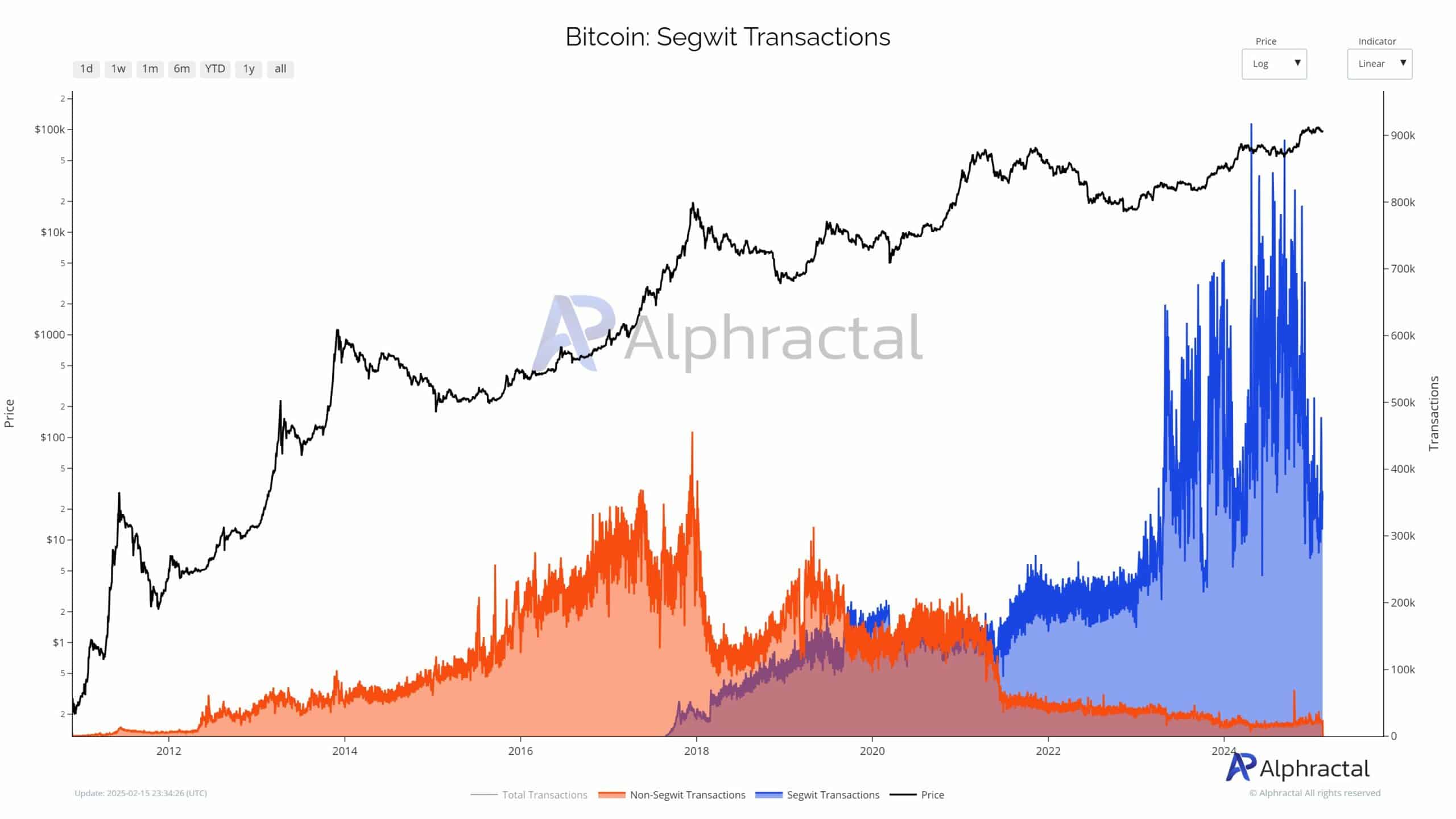

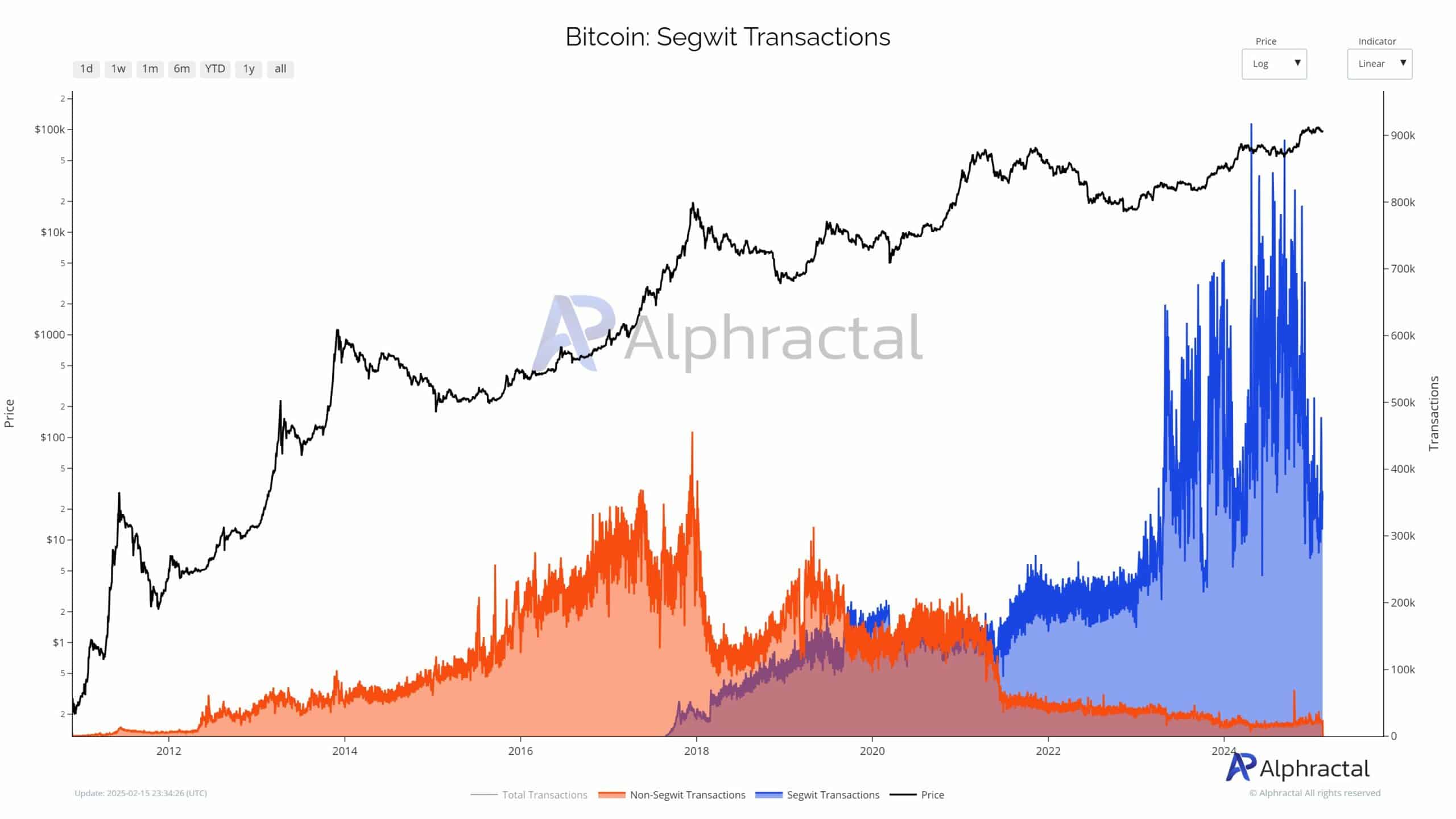

Supply: Alphractal

Furthermore, SegWit transactions, which have been as soon as the dominant and environment friendly transaction kind, are actually in decline.

This reduces general community effectivity, growing the demand for block area, and placing additional stress on miners’ earnings.

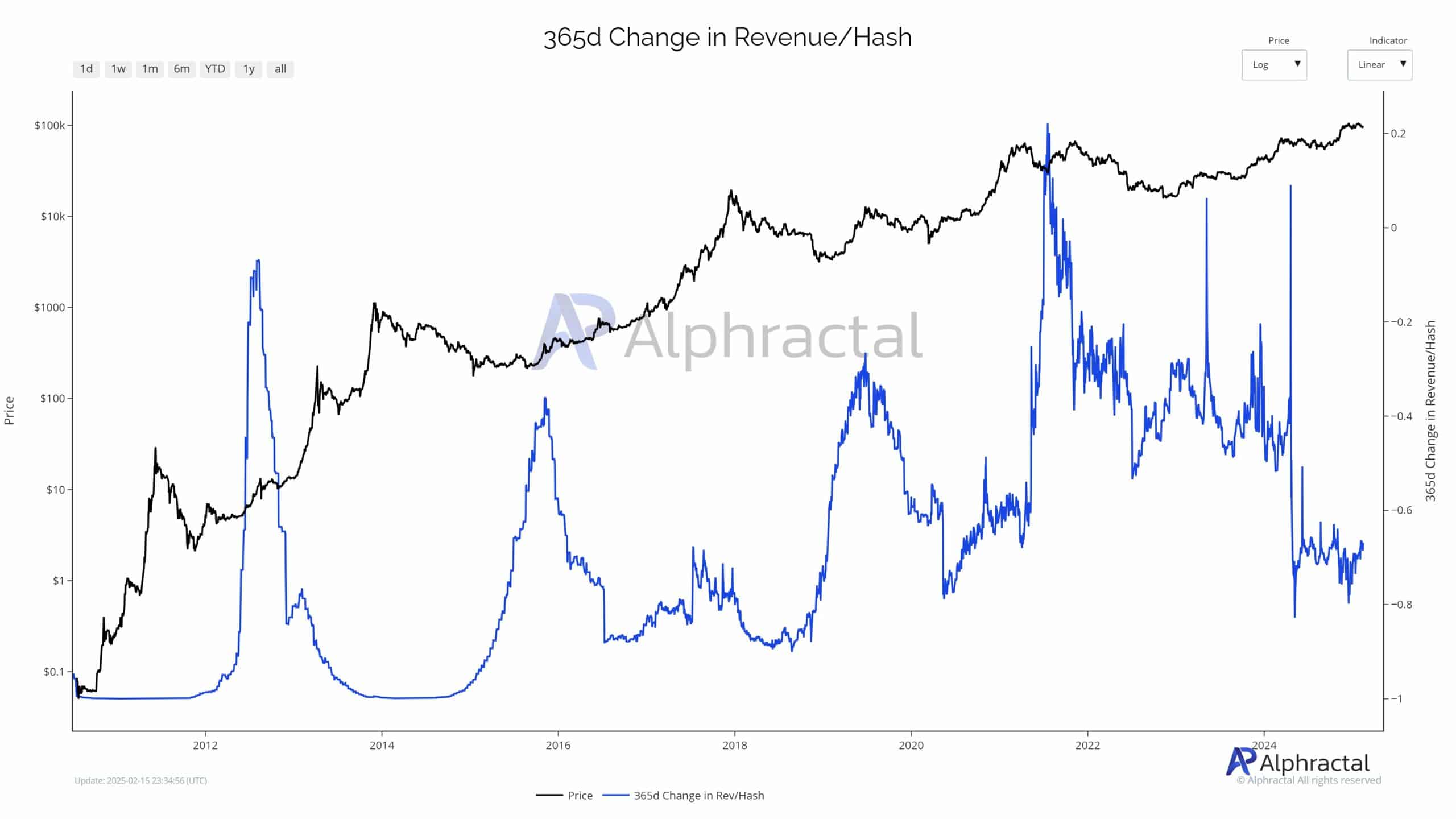

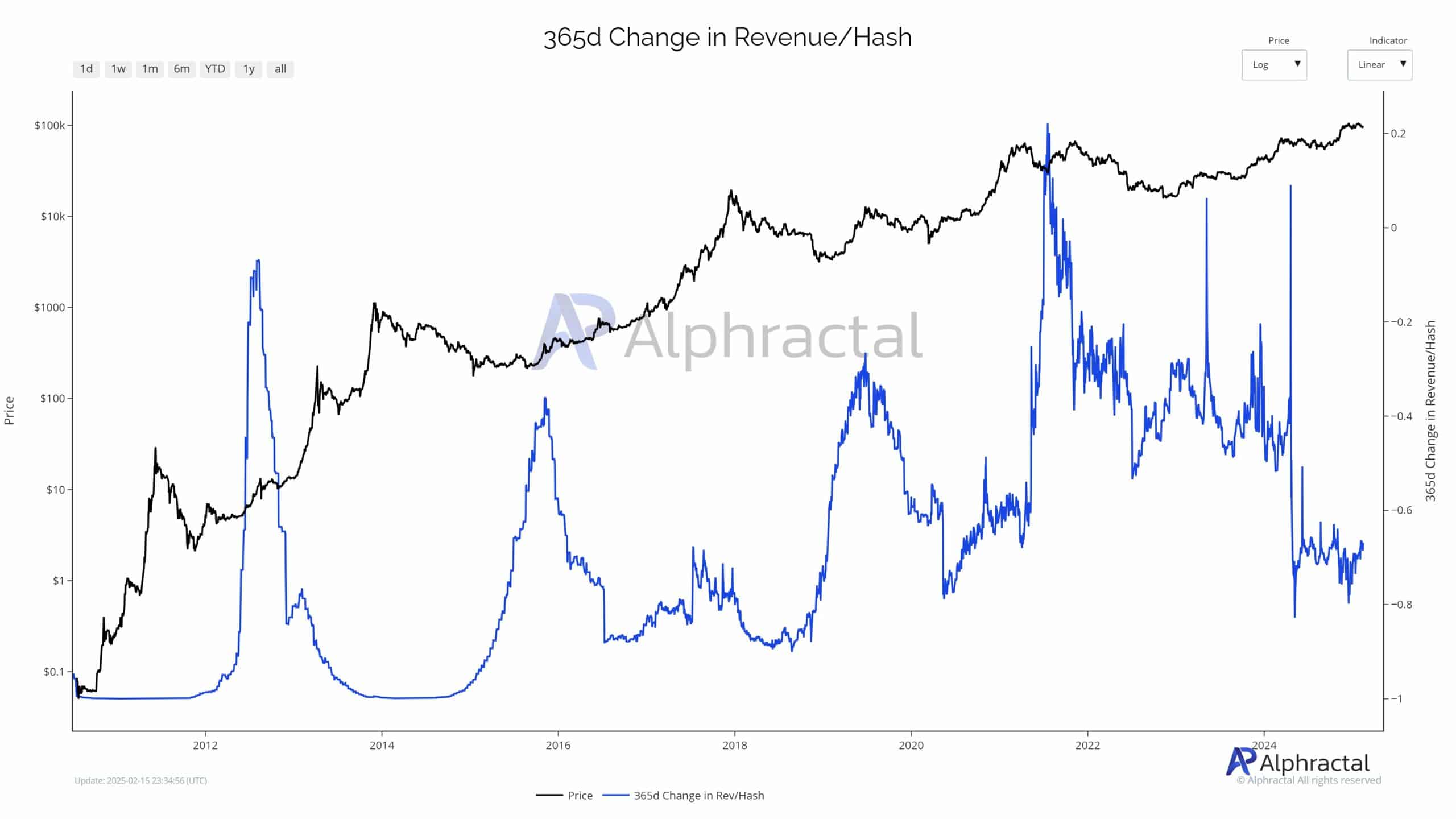

Supply: Alphractal

The Income/Hash ratio, a key metric for miners, is at historic lows. Regardless of Bitcoin’s rising worth, diminishing returns point out that rising community issue and competitors are eroding profitability.

With the halving approaching, lowering block rewards, smaller operations might wrestle to stay worthwhile.

This dynamic might result in elevated centralization, the place solely massive, technologically superior miners will thrive, doubtlessly forcing smaller gamers out of the market.

Rising issue and rising prices

Bitcoin miners are dealing with an growing squeeze on profitability as community issue reaches document highs.

The declining income per hash is making it tougher for smaller operators with outdated tools to compete, particularly as vitality and {hardware} prices proceed to rise.

To outlive, many miners are migrating to areas with cheaper, extra sustainable vitality sources, corresponding to hydro or geothermal energy.

Some are additionally diversifying income streams by branching into computing providers, whereas others are looking for mergers and acquisitions.

These efforts might result in additional centralization within the business, with solely probably the most capitalized and environment friendly mining corporations surviving.

This might have broader implications for Bitcoin’s decentralization, notably concerning the geographic distribution of mining energy.

A reshaping of Bitcoin’s safety mannequin might observe, elevating issues in regards to the long-term well being of its decentralized nature.

Market rebalancing

As operational prices surge and profitability declines, Bitcoin’s hashrate may even see a pure downturn, with inefficient miners shutting down.

This rebalancing will possible depart solely probably the most capitalized and technologically superior gamers standing, reinforcing mining as a high-barrier business.

Nevertheless, this shift raises issues over centralization. With a shrinking pool of dominant miners, Bitcoin’s decentralized ethos could possibly be in danger, doubtlessly concentrating community safety in fewer arms.

Whereas bigger entities might guarantee stability, this consolidation might result in questions on censorship resistance and belief within the community’s long-term integrity.

The 2024 halving has already examined the resilience of the Bitcoin mining ecosystem.

The aftermath of this occasion is an important interval in figuring out whether or not Bitcoin mining stays an open, aggressive discipline, or whether or not the sector continues to consolidate into the arms of some dominant gamers.