Bitcoin: Key metric suggests ‘bull cycle is over’- Should you sell now?

- The detrimental development of the market cap vs. the realized cap is traditionally a bearish sign

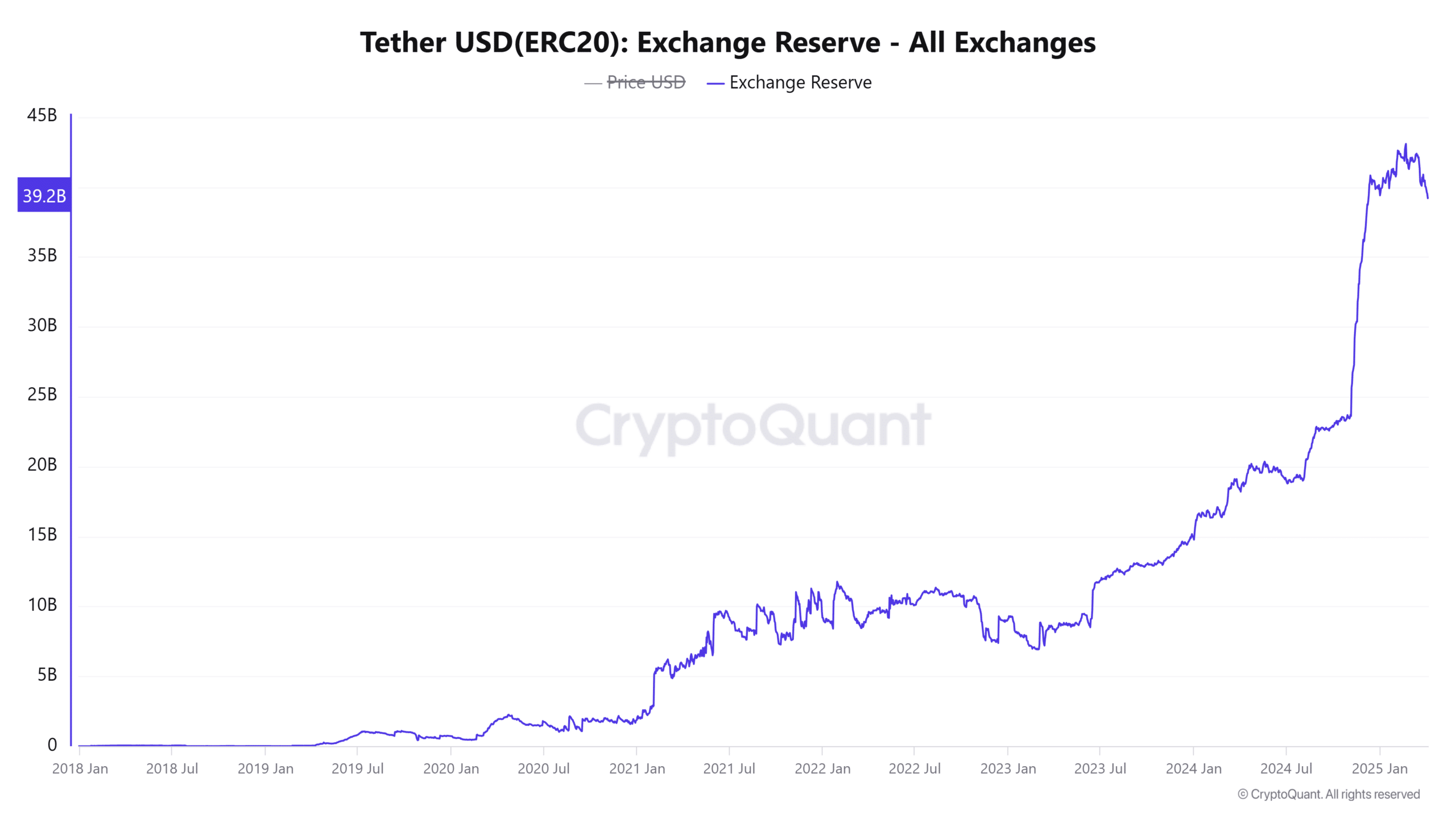

- The halt within the Tether reserve progress pointed to steady, reasonably than rising, shopping for energy

The worldwide M2, a cash provide classification that features cash market funds, refers back to the cash provide from main economies comparable to the united statesA., China, and the Eurozone.

In a current report, it was famous that the worldwide M2 cash provide went parabolic in 2025 whereas Bitcoin [BTC] was consolidating.

Traditionally, such divergences don’t final lengthy. Therefore, there’s a likelihood for Bitcoin to understand.

Alternatively, the commerce battle initiated by the U.S. has dented investor confidence. China’s retaliatory 34% tariff on the 2nd of April deepened tensions, affecting the crypto market as properly.

Assessing the bearish arguments for Bitcoin

The Bitcoin spot ETFs have been weak in current days. The pessimistic macroeconomic outlook because of the continuing commerce wars was an element right here.

Blackrock’s spot ETF IBIT (iShares Bitcoin Belief ETF) noticed some inflows up to now two weeks, however most different merchandise have witnessed promoting strain just lately. This outlined a bearish short-term sentiment.

Amidst this bearish backdrop, the CEO and Co-Founding father of in style crypto analytics agency CryptoQuant said that the “bull cycle is over”.

Is the BTC bull cycle over?

In a post on X (formerly Twitter), he defined the idea of the Realized Cap to assist this argument.

The Market Cap of an asset is calculated by multiplying its circulating provide with its present market value.

In distinction, the Realized Cap measures Bitcoin’s market capitalization based mostly on the worth at which every coin was final moved. This offers a extra correct view of the capital flowing into the Bitcoin market.

The analyst used 365-day Transferring Averages (MA) for each Market Cap and Realized Cap to calculate the 365-day MA of the delta progress.

A decline on this metric indicators a rising realized cap paired with a falling market cap—a development noticed since November-December 2024.

Ki Younger Ju emphasised that capital inflows failing to drive value good points point out a bear market. On the time of study, the delta progress’s MA was detrimental, which aligns with bear market situations.

An identical state of affairs occurred in December 2021, following Bitcoin’s earlier all-time excessive of $69k and its subsequent decline. Ju additionally predicted {that a} short-term rally is unlikely, and this bearish part may persist for an additional six months.

In response to the realized cap knowledge, the onset of one other bear market appeared doable. In the meantime, then again, the change reserve of Tether [USDT] has halted its progress in current months.

Opposing these views, the rising world M2 talked about earlier pointed towards rising shopping for energy out there.

A slowdown within the Tether reserve progress accompanied the earlier market prime.

The info right here prompt one other bear market may very well be underway, however it should be famous that not one of the normal cycle-top metrics have but reached overheated ranges mirroring the earlier cycle.