Bitcoin: Fidelity’s latest report points out this crucial detail about BTC

- Bitcoin’s stock-to-flow could surpass gold as per Constancy’s newest report.

- Though Bitcoin’s reputation has soared, its demand painted a contradictory image.

You could have in all probability heard of the favored Bitcoin [BTC] stock-to-flow mannequin. Properly, it’s again within the headlines because of a brand new Fidelity report, and maybe it is likely to be price lending some consideration.

What number of are 1,10,100 BTCs price right this moment

One of many main takeaways from the Constancy report was that Bitcoin’s stock-to-flow ratio may surpass that of gold. It didn’t supply an correct prediction nevertheless it steered it as a probable end result after the following Bitcoin halving.

From a Constancy report on the case for Bitcoin:

After the upcoming halving in ~8 months, Bitcoin could have the next inventory to circulation ratio than Gold pic.twitter.com/csd6hsn4cR

— Will Clemente (@WClementeIII) July 25, 2023

So, what does it imply for Bitcoin to have the next stock-to-flow ratio than Gold? Properly, the stock-to-flow ratio assesses the ratio of the prevailing provide and new manufacturing or incoming provide. In different phrases, it’s used to focus on the extent of shortage.

Shortage determines worth

The report steered that Bitcoin will likely be extra scarce than gold after the 2024 Bitcoin halving. This may very well be a serious turning level so far as demand is anxious. The report additional identified demand drivers that spotlight Bitcoin’s enchantment. A few of these causes had been inflation, rising cash provide, central financial institution, and authorities intervention.

We now have already seen vital regulatory intervention this 12 months however there was one sudden issue that has been shortlisted. In response to the report, low-interest charges may additionally be an element. Thus far greater rates of interest have had a major affect on the value of BTC and it will proceed nicely into the long run.

The PlanB’s notorious stock-to-flow mannequin has been the sufferer of scrutiny prior to now for not being as dependable as anticipated. As such, there is likely to be some friction in opposition to this new S2F prediction. There are numerous elements to contemplate that will have an effect on Bitcoin particularly within the close to time period.

Thus far the regulatory panorama remains to be foggy, therefore the result may nonetheless be a toss-up. Nevertheless, it’s clear that Bitcoin’s reputation has grown to ranges the place governments can’t ignore it.

Is BTC recovering then?

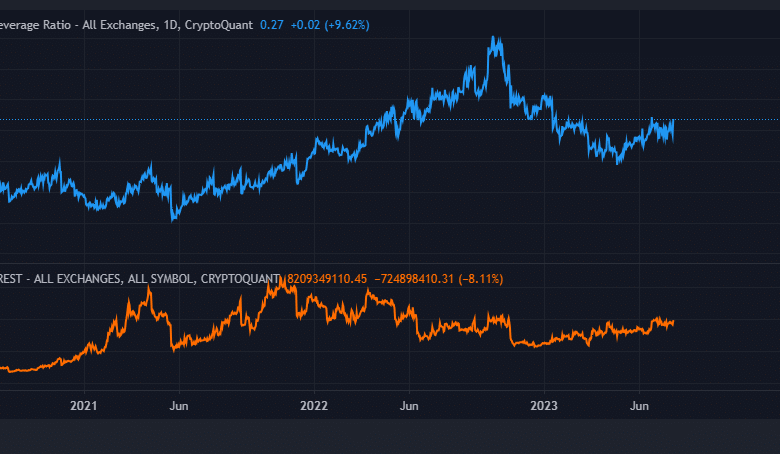

Regardless of the character of the aforementioned data, demand for the king of cryptocurrencies was nonetheless low. The extent of open curiosity in BTC was nonetheless considerably decrease than it was in the course of the 2021 bull market. However, its demand within the derivatives market was rising.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] worth prediction 2023-24

Bitcoin’s estimated leverage ratio has been on the rise from its lowest level this 12 months. Whereas it might not essentially be an correct yardstick for measuring demand, it highlights the recovering confidence in BTC’s future.