Bitcoin’s ETF rumor impacts USDT in this manner

- USD transaction climbed over $5 billion as massive wallets gathered.

- Massive pockets accumulation moved near 25%, with the highest 10 wallets holding 1 / 4 of the provision.

The false report of a Bitcoin [BTC] ETF approval had a notable affect on the cryptocurrency neighborhood, inflicting ripples of concern. Tether [USDT], too, skilled a major impact, with latest information indicating a noticeable enhance in a vital metric.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

USDT high wallets enhance accumulation

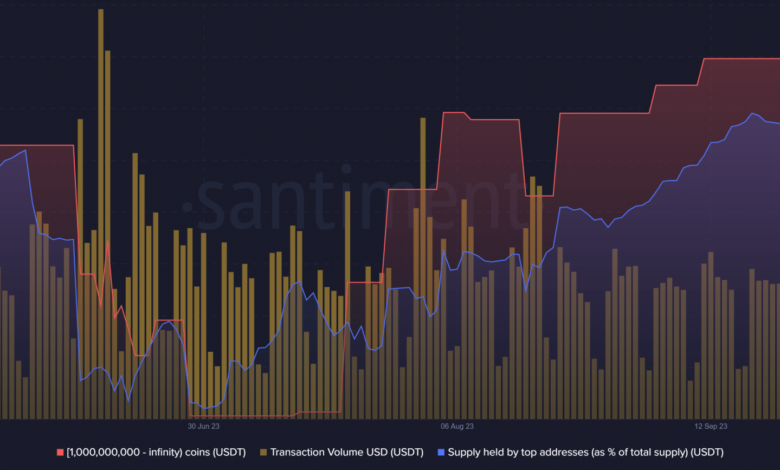

On 16 October, the circulation of false info relating to the approval of a Bitcoin spot ETF triggered notable spikes in a number of key metrics associated to Tether’s USDT that hadn’t been noticed for a number of months.

In keeping with information from Santiment, this information spurred elevated accumulation by the biggest wallets.

Moreover, it induced a surge within the on-chain transaction quantity of the stablecoin, with the Transaction Quantity surpassing $5.6 billion. This marked the very best Transaction Quantity for USDT since August. As of this writing, the Transaction Quantity remained above $5.5 billion.

Supply: Santiment

Moreover, the misinformation led to a substantial enhance in accumulation by the biggest wallets related to the stablecoin. In keeping with Santiment’s metric, the highest 10 wallets held greater than 24% of the entire provide at press time.

This degree has not been seen since March, as noticed from the chart information. Furthermore, wallets containing 1 billion USDT or extra collectively held over 5 billion USDT throughout this era.

USDT stream shifts to adverse

In keeping with information supplied by CryptoQuant, the occasions of 16 October initially led to a noticeable surge within the motion of USDT to cryptocurrency exchanges. Nevertheless, the stream has since reversed route, turning adverse, as clearly illustrated on the stream chart.

By 17 October, the chart depicted an outflow exceeding 73 million. Additionally, on the time of composing this textual content, the outflow remained in adverse territory, with over 20 million being withdrawn.

Supply: CryptoQuant

Is your portfolio inexperienced? Test the BTC Revenue Calculator

What the buildup and adverse stream may imply

Deciphering this stream sample alongside the buildup metric, it appeared to counsel a flight to security in response to elevated market volatility.

With the corresponding rise within the value of Bitcoin and the following minor decline, merchants appear to be accumulating extra USDT to safeguard their property and put together for potential market turbulence.