Examining Ethereum’s latest liquidations and its value as an investment now

- About $165 million in lengthy ETH positions have been liquidated as ICO participant deposited 1,700 ETH price $3.18M into Binance

- Regardless of ETH’s market cap, the community noticed a fall in transaction exercise, consumer development, and charges/revenues

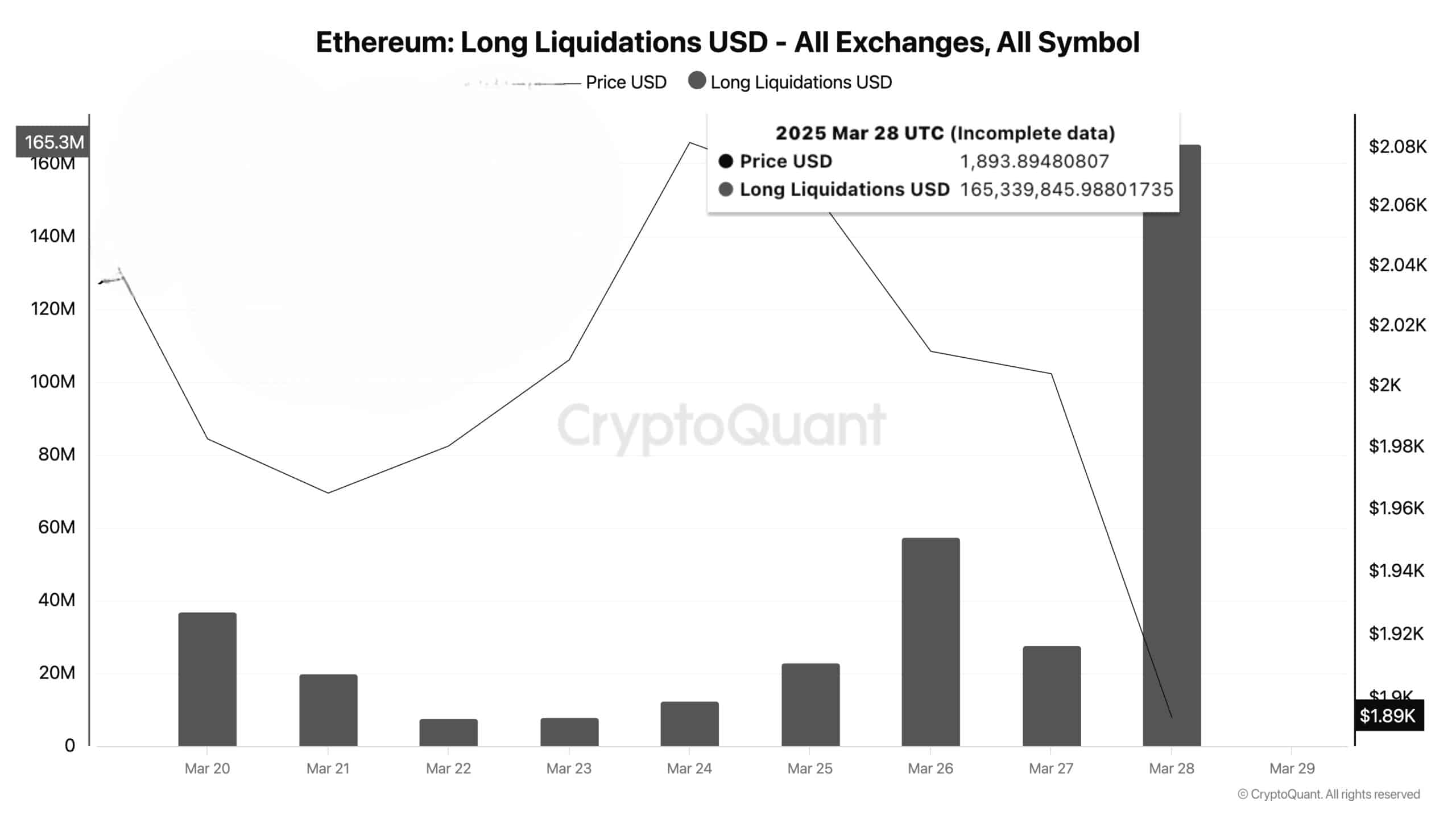

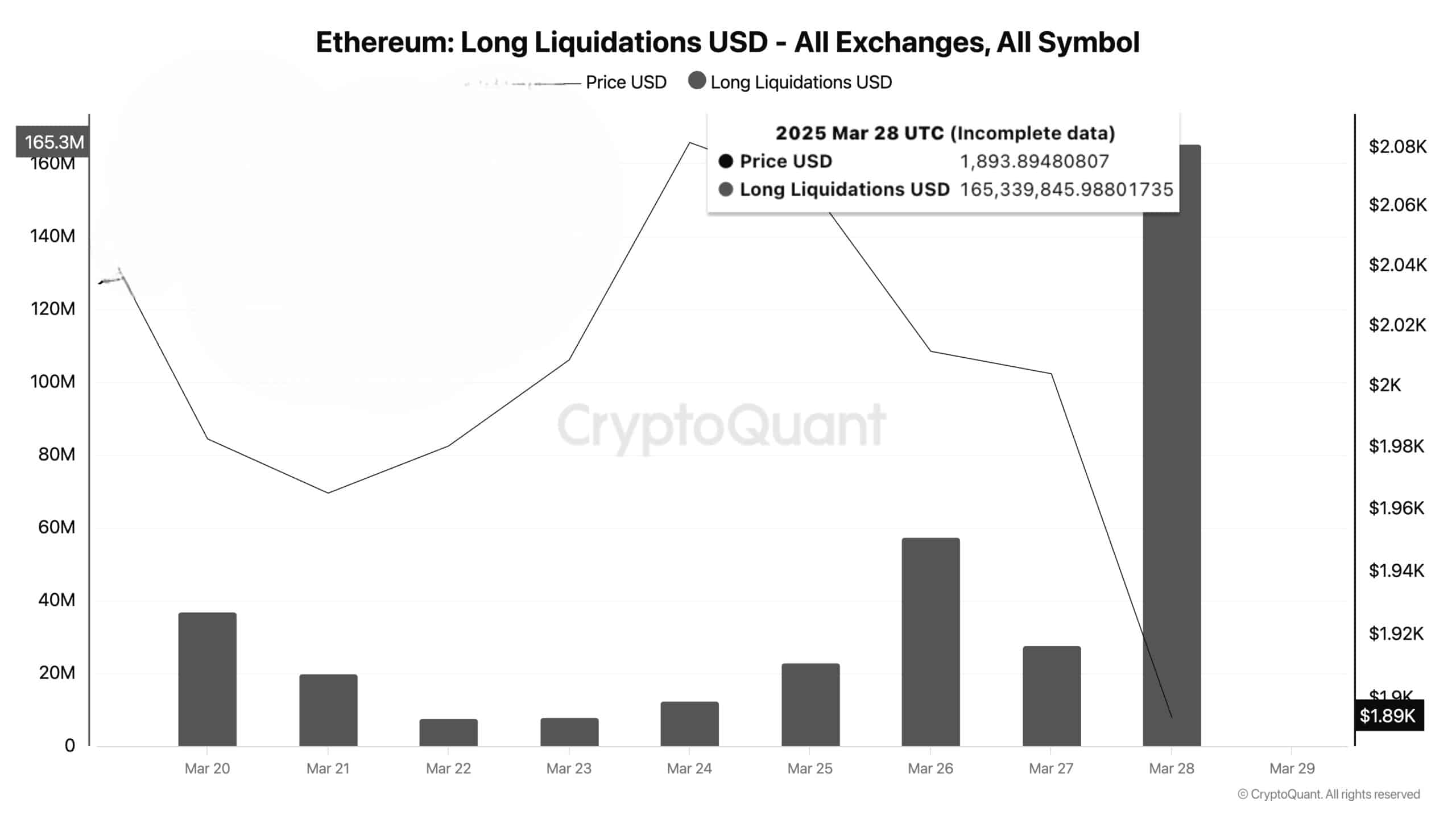

Ethereum [ETH] has seen vital market correction these days. Due to the identical, merchants have confronted losses of $165 million from lengthy place liquidations.

Massive-scale liquidations occurred as leveraged merchants encountered sudden worth declined which compelled many merchants to promote their property.

Prime quality market liquidity might proceed to push ETH’s worth south, which might result in better worth fluctuations on the charts.

Supply: CryptoQuant

These large lengthy place liquidations are an indication that bullish energy has been weak, making future leveraged entry unlikely within the coming classes. The damaging market impressions would possibly make ETH unable to achieve crucial help areas. This might gas further large promoting that will prolong the downtrend.

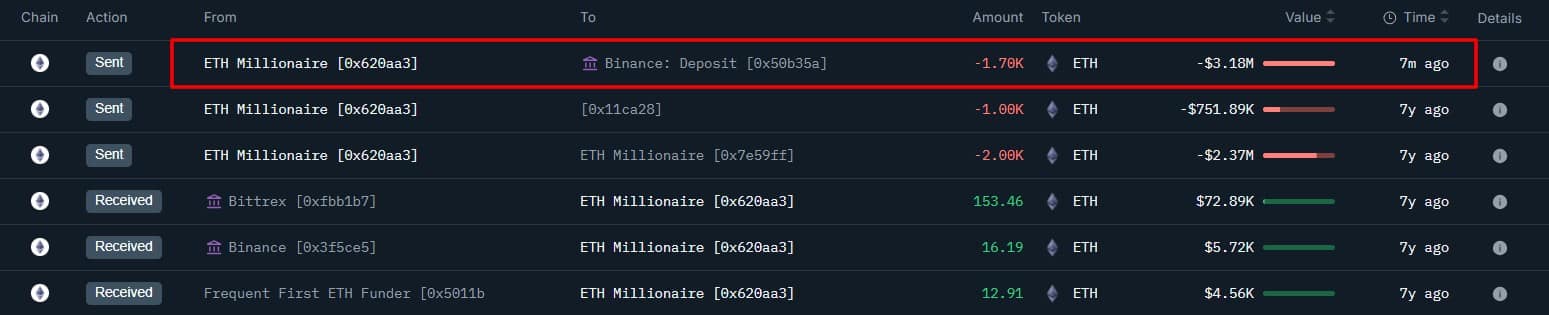

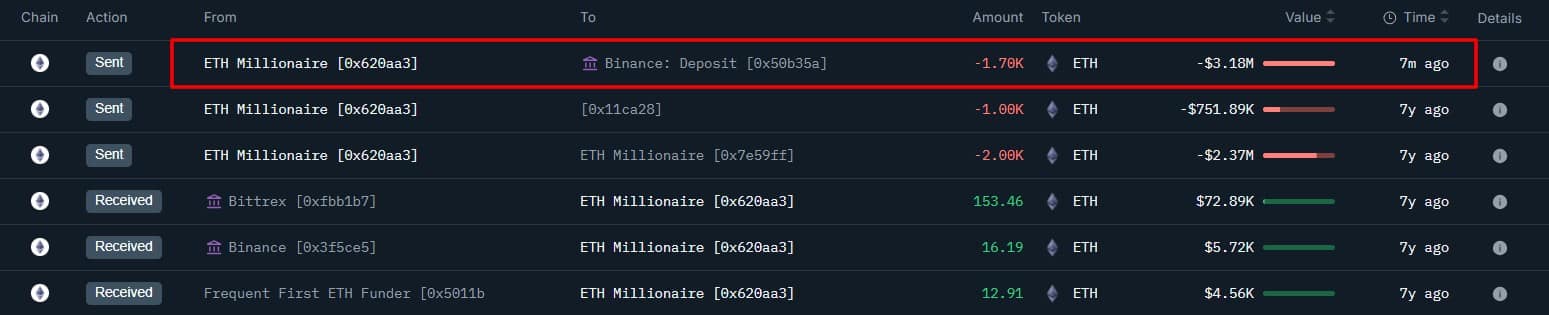

That’s not all although as moreover, an Ethereum ICO participant with no latest exercise in seven years despatched 1,700 ETH valued at $3.18 million to Binance.

The bizarre motion demonstrated that the holder might have deliberate to promote their cash – An indication of sell-side stress.

Supply: Onchain Lens

Whales generate market instability by relocating their present property since market speculators attempt to predict their goals. On this specific case, the deposited ETH would possibly result in actual gross sales by buyers so unfavorable market situations might emerge for Ethereum.

Nevertheless, ETH has not too long ago confirmed minimal modifications if the whales carry out funding methods with their funds, as an alternative of conducting gross sales actions.

Max ache worth stage and community exercise

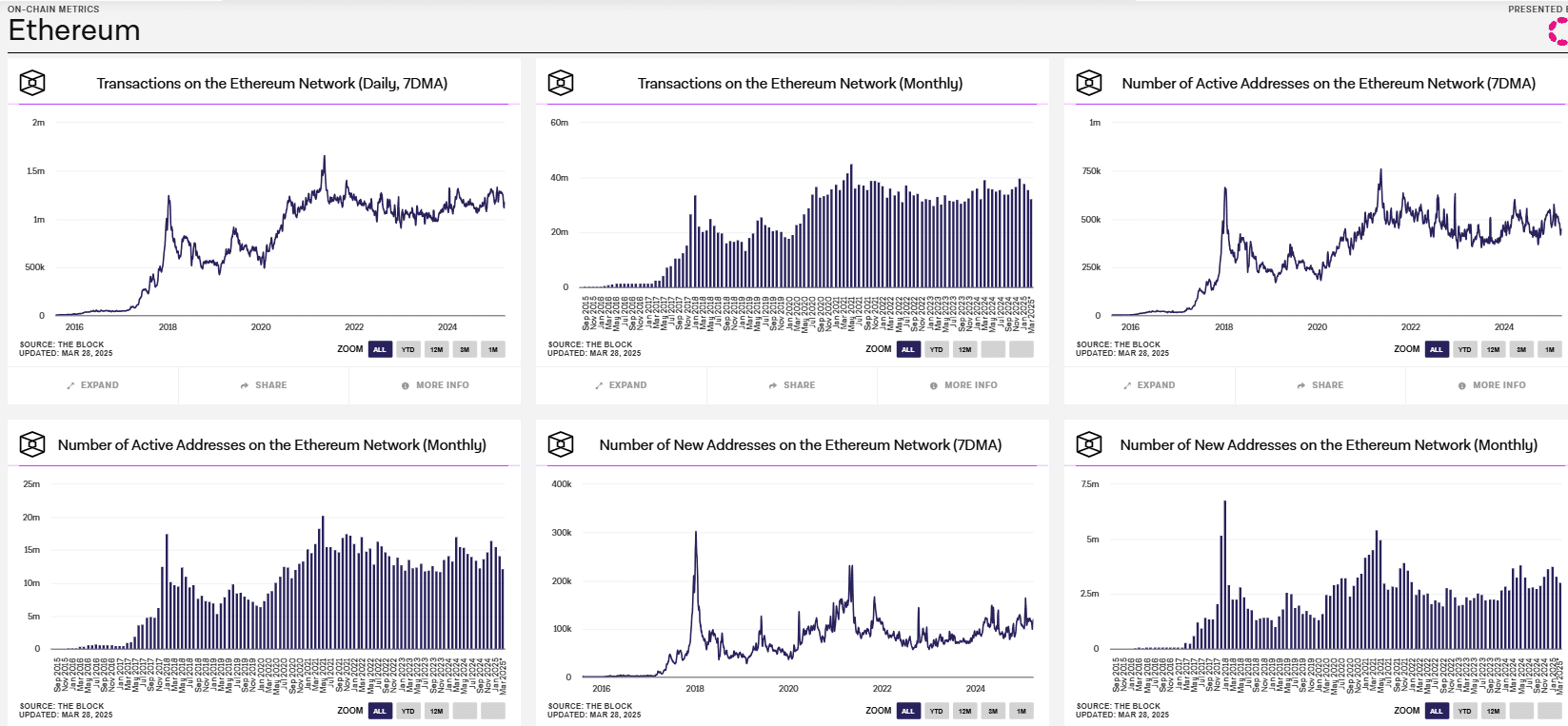

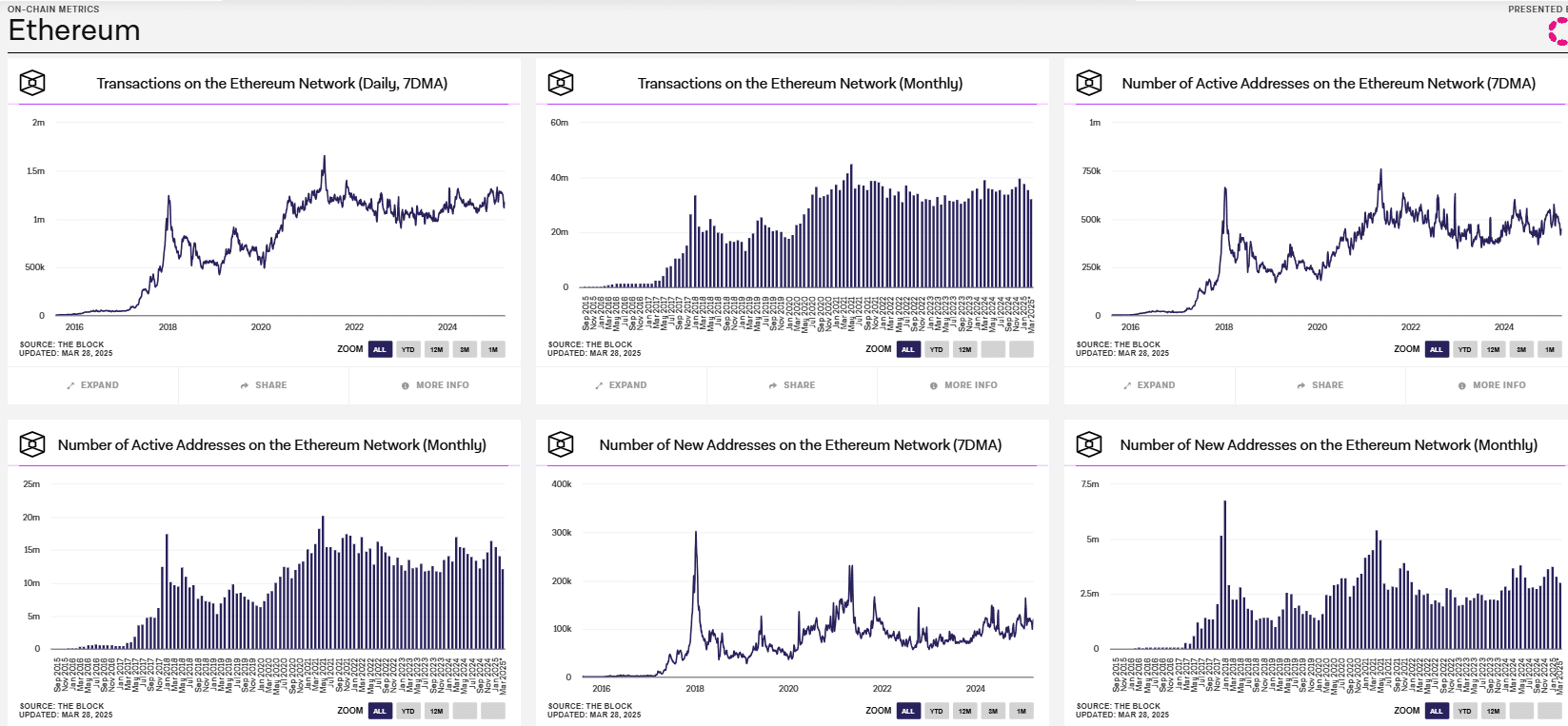

On the time of writing, bearish sentiment gave the impression to be emanating from the Ethereum blockchain. For instance – The variety of every day transactions remained round 1M because the utilization steadily decreased throughout the board.

Whereas transaction frequency for a month surpassed 40M, nonetheless, it fell in need of reaching its peak numbers.

Lively addresses stayed under 750k as consumer involvement gave the impression to be declining. And but, the month-to-month lively addresses totaled greater than 10M – Indicative of sustained consumer engagement within the long-term.

Supply: X

New Ethereum community addresses (7DMA) revealed declining statistics since they fell to numbers underneath 100k. The two.5M month-to-month new addresses created much less most affect than beforehand recorded spikes of recent addresses.

For its half, Ethereum’s worth broke down by means of the April max ache level of $2,200 – A stage that has traditionally served as help.

Supply: X

What this implies is that extra draw back might be anticipated.

Is ETH good as an funding or as a utility community?

Proper now, Ethereum may be functioning extra as a major utility system. Particularly for the reason that information steered consumer addition and transaction operations didn’t mirror rising developments.

The enchantment of Ethereum investments might fall relying on fixed adoption charges remaining stagnant. The autumn in community use, together with main holder sell-offs of whales and hike in liquidations of lengthy positions, are all indicators of damaging sentiment. Lastly, ETH’s falling worth continues to create doubts about its functionality to function an funding asset.

To place it merely, the market setting for Ethereum is unclear proper now.