XRP Sell-Off Rumors Swirl As Expert Questions Ripple’s War Chest

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

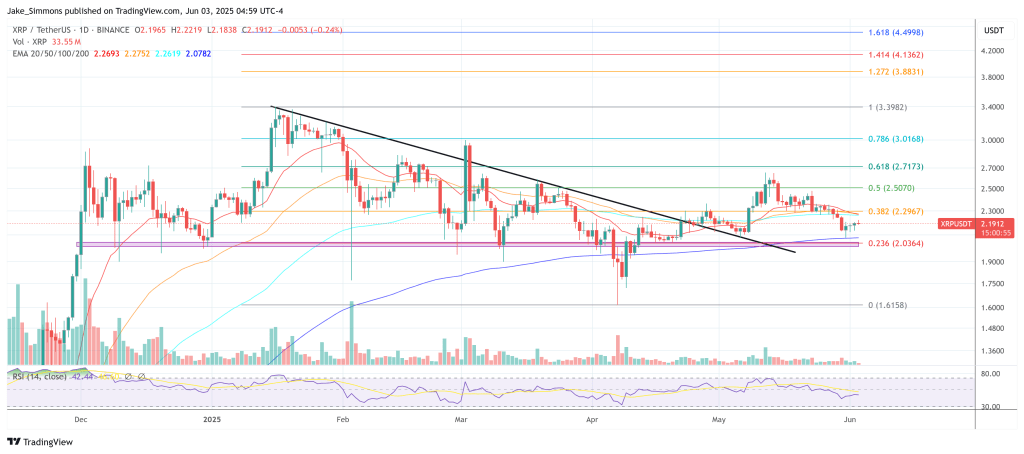

CoinRoutes chief govt Dave Weisberger detonated a contemporary spherical of tension within the XRP market on Monday when he requested, on Scott Melker’s podcast, whether or not Ripple Labs may finance a takeover of Circle “for $10 to $20 billion” with out off-loading roughly $10 billion in XRP. “Who’s going to purchase the $10 billion price of XRP they would wish to promote out of their treasury?” Weisberger said, warning {that a} sudden provide surge may overwhelm order books and “hammer the value.”

Is A XRP Promote-Off Conceivable?

Inside hours, pro-XRP lawyer Fred Rispoli fired again on X. “I really like @daveweisberger1, however on this level he’s mcgloning so laborious,” he wrote, invoking Bloomberg strategist Mike McGlone’s popularity for bearish hyperbole. “Simply primarily based on what I’m getting supplied for my Ripple shares on the secondary market, I don’t assume Ripple would even should promote one XRP to purchase Circle.” Rispoli agreed that Ripple can’t increase $10 billion in pure money, but insisted the corporate may “simply afford the acquisition for a mixture of money and debt” and a heavy equity-swap.

Associated Studying

When Weisberger replied that Circle’s board would doubtless demand laborious {dollars} until it accepted Ripple fairness or XRP “and not using a haircut,” Rispoli dug in. “No technique to get $10B in money—and $10B is simply too excessive anyway,” he wrote, citing late-2024 private-research valuations that positioned Ripple at $15 billion excluding its ~36 billion escrowed XRP. If Circle’s price ticket fell to $7–9 billion, he stated, Ripple may shut with “$1–3 billion money readily available, a heavy inventory alternate, and debt,” particularly with “all that GCC cash sloshing round crypto world proper now.” Rispoli conceded it will be “a attain” however “doable with out meaningfully promoting XRP.”

Weisberger acknowledged the mathematics—“That’s an inexpensive evaluation,” he wrote—but cautioned that any worth on the higher finish of Rispoli’s vary “might be some short-term ache for us XRP holders.”

Ripple’s tender-offer buyback in January 2024 valued the corporate at $11.3 billion, disclosing greater than $1 billion in money and about $25 billion in digital property—principally XRP—on its books. The agency nonetheless controls roughly 52 billion XRP (about 40 p.c of provide), although 36 billion sit in timed escrow releases, limiting rapid entry. At right now’s $2.20 spot worth, the spendable portion is price a little bit underneath $35 billion, however transferring even a fraction shortly would collide with skinny venue depth—a degree Weisberger hammered dwelling.

Associated Studying

Ripple’s money pile additionally shrank after its $1.25 billion buy of prime dealer Hidden Highway in April, a deal settled with a mix of money, fairness and RLUSD stablecoins. That acquisition suggests the corporate prefers hybrid buildings, bolstering Rispoli’s declare that Treasury XRP needn’t flood the market.

Is Circle Even For Sale?

The talk could also be tutorial. Circle, issuer of USDC, has repeatedly declared it “not on the market” whereas marching towards a New York Inventory Trade itemizing that now targets a $7.2 billion valuation. Ripple’s rumored strategy earlier this spring reportedly topped $5 billion, nicely beneath Weisberger’s stress case and inside Rispoli’s “doable” band, however Circle rebuffed the talks and up to date its S-1 two weeks later, enlarging the float slightly than in search of a purchaser.

Strategically, Ripple already fields its personal dollar-token RLUSD, launched in January and positioned by president Monica Lengthy as “complementary to XRP, not a competitor.” Absorbing USDC’s issuer would immediately rocket Ripple in direction of the scale of Tether.

Even underneath Rispoli’s optimistic construction, Ripple may nonetheless have to liquidate a number of hundred million {dollars}’ price of XRP for working capital and shutting prices. At present volumes, unloading simply 500 million XRP (≈ $1.1 billion) would equal half every week of world turnover—sufficient to distort worth until executed as personal blocks.

At press time, XRP traded at $2.19.

Featured picture created with DALL.E, chart from TradingView.com