How To Find Support and Resistance Levels in Crypto Trading

Crypto markets transfer quick. To make sense of that motion, merchants use help and resistance ranges as a fundamental framework. These ranges don’t simply seem on charts: they signify the collective conduct of patrons and sellers reacting to the identical worth ranges again and again.

Understanding these ranges provides you greater than chart information. It provides you construction, a method to plan your trades, restrict losses, and time entries with goal. Whether or not you’re scalping short-term swings or holding for bigger worth actions, figuring out help or resistance zones is among the few universally relevant expertise in crypto buying and selling.

What Are Help and Resistance Ranges within the Crypto Market?

Help and resistance are key worth ranges on a crypto chart. These ranges present the place the worth tends to cease and reverse.

- Help is the extent at which the worth stops falling and will bounce again up. It’s the place shopping for stress is powerful sufficient to beat promoting.

- Resistance is the extent at which the worth stops rising and will fall again down. It’s the place sellers overpower patrons.

Consider it like a ball bouncing inside a room. The ground is help: it prevents the ball from falling decrease. The ceiling is resistance, because it retains the ball from going greater. The ball (worth) strikes between them till it breaks by means of.

These ranges aren’t actual costs. They’re zones the place merchants typically act based mostly on previous conduct. When many merchants count on a stage to carry, their trades assist reinforce that stage.

Help and resistance can type:

- After massive worth strikes

- Round psychological ranges (like $20,000 or $30,000 for Bitcoin)

- Close to shifting averages or Fibonacci retracement ranges

Understanding these zones helps you determine when to enter or exit trades, and keep away from shopping for at peaks or promoting at lows.

Do I Must Use Help And Resistance When Buying and selling Crypto?

Sure, you do. At the least, if you wish to enhance your general buying and selling efficiency.

Help and resistance ranges should not non-obligatory instruments. They’re the muse of technical evaluation. With out them, you’re buying and selling blind. These ranges enable you to perceive the place shopping for or promoting stress is more likely to enhance. Each vital worth motion in crypto occurs for a motive. Most reversals, breakouts, and consolidations happen close to help or resistance zones. Ignoring them means lacking clear alerts, or worse, coming into trades on the mistaken time.

Let’s say you purchase Bitcoin just under a resistance stage. With out figuring out it, you’ve entered proper the place many merchants are planning to promote. The value is extra more likely to drop than rise. That’s how skipping resistance/help evaluation can damage your trades.

Once you use help and resistance accurately, you’ll be able to time entries with higher precision, set more practical stop-loss and take-profit ranges, in addition to filter out noise in risky markets. You don’t want a posh system. You simply want to search out help or resistance areas, perceive how worth reacts to them, and make knowledgeable choices based mostly on that conduct.

Okay, we’ve already decided that help and resistance ranges are necessary. However how precisely do you discover them?

Easy methods to Establish Help and Resistance Ranges

The best method to spot help and resistance is by following seasoned analysts or crypto market consultants. However that’s not a technique. Nobody cares about your portfolio greater than you do. For efficient danger administration, you have to discover ways to determine help and resistance ranges by yourself. Right here’s how to try this utilizing commonplace instruments and strategies.

Analyzing Historic Worth Information

Begin by worth charts over completely different timeframes. Concentrate on zones the place the worth has reversed a number of occasions up to now. For instance, if Bitcoin constantly dropped close to $100,000 and bounced again from it, that stage turns into a robust help space. Equally, if Ethereum has repeatedly failed to interrupt above $4,000 and falls each time it approaches that stage, then that turns into a robust resistance space.

When worth reacts to roughly the identical worth level over time, it alerts the place market contributors have a tendency to position purchase or promote orders. Historic knowledge doesn’t predict the long run, however it helps you perceive crowd conduct.

Drawing Pattern Strains

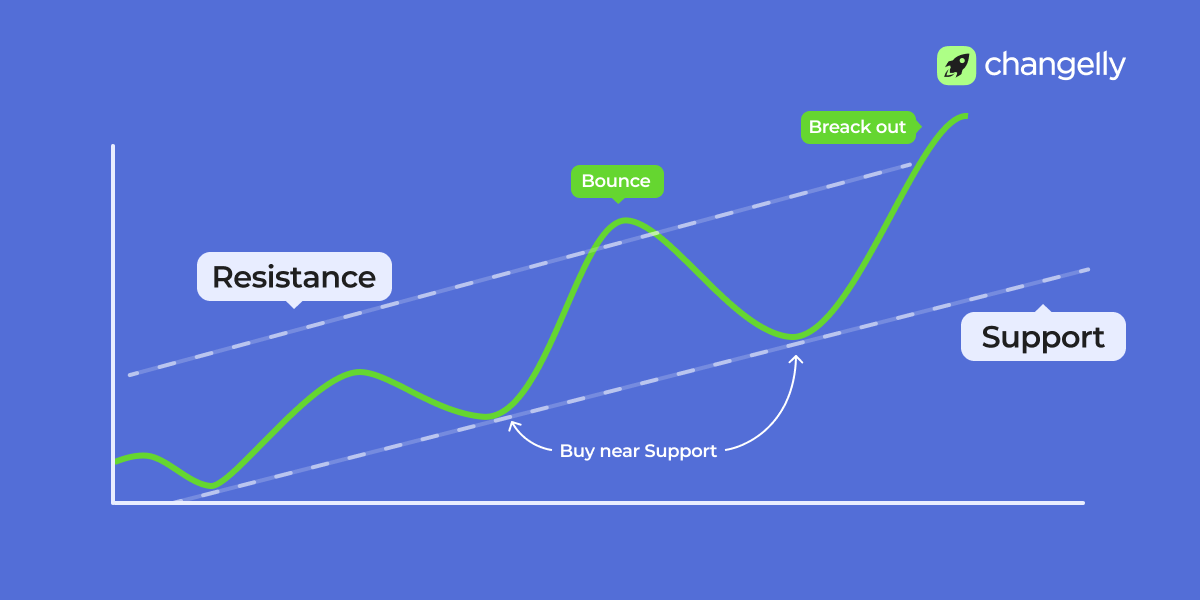

Pattern strains join a collection of upper lows (in uptrends) or decrease highs (in downtrends). When drawn accurately, these strains present dynamic help or resistance. In contrast to horizontal ranges, pattern strains transfer with time and worth.

If a rising pattern line has been examined three or extra occasions, it typically turns into a robust help zone. A break under that pattern line may sign a shift in momentum.

Recognizing Psychological Worth Ranges

People suppose in spherical numbers. So do merchants. Ranges like $1,000, $20,000, or $50,000 typically act as psychological help or resistance. These numbers appeal to consideration just because they’re straightforward to recollect and broadly watched. You’ll typically see worth stall, reverse, or break aggressively round these areas. That’s as a result of many orders cluster there, and never because of logic, however human conduct.

Using Technical Indicators

Indicators add context to uncooked worth motion. They don’t create help or resistance, however they spotlight zones the place worth might react. Use them to substantiate what you see on the chart.

Transferring Averages

Easy and exponential shifting averages (e.g., 50-day or 200-day) act as dynamic help throughout uptrends and resistance in downtrends. Worth bouncing off these ranges is widespread, particularly once they align with historic zones.

Fibonacci Retracement Ranges

These ranges are calculated from current worth drops or rallies. Widespread retracement factors like 38.2%, 50%, and 61.8% typically match actual response factors on the chart. They work finest when worth is in a corrective section.

Pivot Factors

Used closely in day buying and selling, pivot factors are calculated from the day past’s open, excessive, low, and shut. They challenge potential intraday help and resistance ranges and are helpful for short-term setups.

Incorporating Quantity Evaluation to Validate Ranges

Help and resistance zones are stronger when quantity confirms them. If the worth bounces off a stage with excessive buying and selling quantity, meaning many merchants agree on its significance. When the worth breaks a help stage however quantity is low, it could be a false transfer. Excessive quantity throughout a breakout or breakdown exhibits actual conviction.

Quantity provides perception into whether or not a stage is more likely to maintain or fail, making it some of the highly effective affirmation instruments in your buying and selling setup.

Easy methods to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero value

Sensible Examples with Bitcoin Charts

Let’s check out a sensible instance of discovering help and resistance ranges on a Bitcoin worth chart.

Standard Buying and selling Methods Utilizing Help and Resistance

In fact, merely figuring out what help and resistance ranges are isn’t sufficient to robotically make a revenue. No, you want a coherent buying and selling technique. When the present worth nears a help stage or approaches robust worth boundaries, it typically units the stage for strategic entries or exits. Two widespread approaches—bounce and breakout buying and selling—depend on these patterns.

Bounce Buying and selling Technique

Bounce buying and selling relies on the concept that worth typically reacts at acquainted ranges. When the worth declines and touches a identified help stage, it could reverse course. This bounce happens when shopping for curiosity exceeds promoting stress, typically because of earlier market conduct.

Right here, the entry level is positioned close to help. Merchants count on the worth to rebound, utilizing the help stage as a protecting zone. A stop-loss is often set just under help to handle danger in case the bounce fails.

This technique works finest when help has been examined a number of occasions. Inexperienced merchants are likely to ignore quantity or market situations, however a profitable bounce setup typically comes with clear affirmation—similar to a rejection wick or worth stalling close to help.

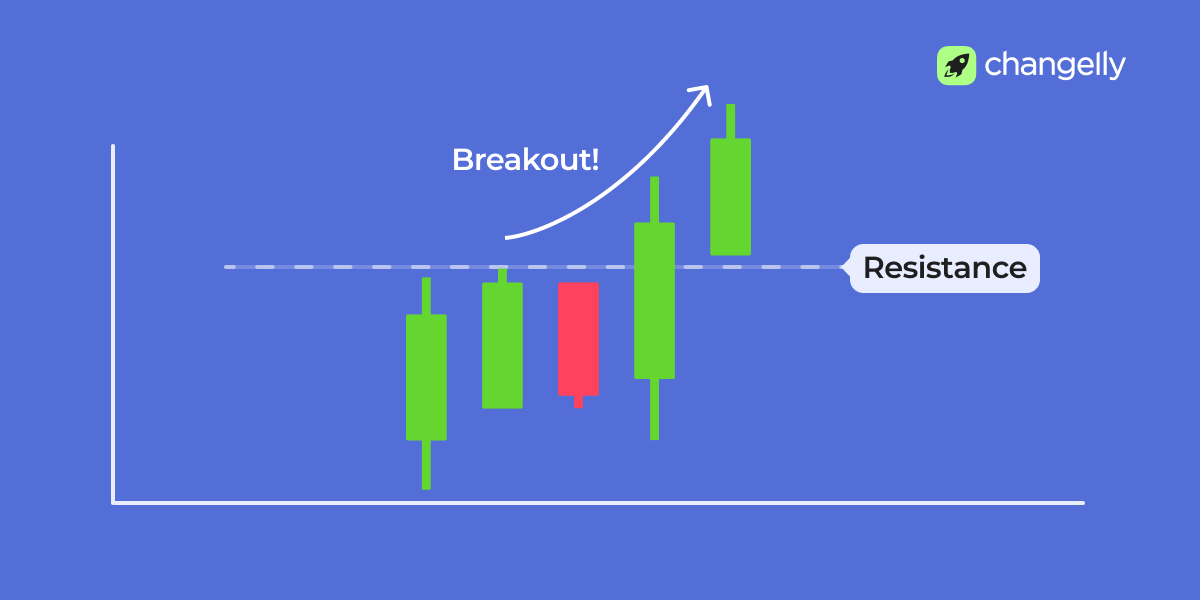

Breakout Buying and selling Technique

Breakout buying and selling focuses on the worth breaking by means of robust resistance ranges. When promoting, curiosity weakens and shopping for stress builds up, so the worth might surge past resistance. That breakout is often quick, and the transfer is backed by excessive quantity.

Merchants enter simply above resistance after a confirmed breakout. The thought is to catch the momentum that follows as soon as the worth clears the barrier. The identical logic applies to breakdowns under help—when help ranges fail and a fast worth decline follows.

This technique requires self-discipline. Many false breakouts lure inexperienced merchants who enter too early. To keep away from this, skilled merchants look forward to affirmation, similar to a robust candle shut past resistance and a rise in quantity.

Breakout setups are highly effective however have to be backed by clear alerts and danger controls.

Errors Learners Typically Make (And Easy methods to Keep away from Them)

The risky crypto market tempts new merchants into speeding trades. However most losses come from fundamental errors, not market situations. In case you perceive find out how to use help and resistance ranges, you’ll be able to keep away from these pitfalls and handle danger successfully.

Learn extra: Crypto Buying and selling 101.

Listed here are widespread (and a few not-so-common) errors cryptocurrency buying and selling rookies make relating to help and resistance ranges.

- Treating help and resistance as actual worth factors

Worth hardly ever stops on the identical stage to the cent. These are zones, not strains. Anticipate some worth motion across the stage earlier than the market reacts. - Getting into trades too early

New merchants bounce in as quickly as the worth nears help or resistance. With out affirmation, that is simply guessing, not technical evaluation. - Ignoring earlier resistance turning into help

After a breakout, earlier resistance ranges play a brand new position as help. Lacking this may result in late entries or poor exits. - Forcing trades in flat or unsure markets

If the chart exhibits no clear worth tendencies, don’t guess. Look ahead to construction to type. Resistance buying and selling with out context is a shedding recreation. - Utilizing the identical ranges throughout all timeframes

A stage on the 1-hour chart might not matter on the each day. At all times align your ranges along with your buying and selling technique and timeframe. - Neglecting quantity affirmation

Breakouts or bounces with out robust quantity are more likely to fail. Quantity helps affirm the power of a worth stage response. - Blindly copying ranges from others

Following different individuals’s charts with out understanding the context results in errors. Be taught to attract your personal help and resistance ranges based mostly on how different contributors of the crypto market behave. - Relying solely on horizontal ranges

Dynamic ranges, like shifting averages, may be simply as necessary. They regulate with the market, and sometimes catch worth motion that static strains miss.

Finest Instruments and Assets to Establish Help and Resistance

To investigate help and resistance ranges successfully, you want the proper instruments for various components of your workflow. From studying worth charts to confirming worth actions and managing trades, every class of instruments serves a particular perform. Right here’s find out how to construction your setup.

1. Charting and Technical Evaluation

These instruments enable you to draw resistance strains, mark help zones, and spot dynamic help ranges based mostly on market tendencies.

- TradingView – hottest charting software with customized indicators

- Binance / Bybit – exchanges with built-in superior charting

- Changelly App – an trade with built-in worth charts and real-time updates

2. Market Monitoring and Information

For monitoring elementary occasions and worth exercise which will have an effect on resistance/help areas:

- Cointelegraph – the preferred digital crypto information platform

- CoinMarketCap / CoinGecko – coin monitoring, quantity spikes, trending tokens

3. On-Chain and Sentiment Evaluation

Use these to grasp whether or not a worth stage is more likely to maintain or break by analyzing pockets exercise and investor conduct.

- Glassnode – pockets balances, trade flows

- CryptoQuant – miner actions, reserve modifications, quantity metrics

- Santiment – social sentiment and community exercise

4. Alerts and Automation

Keep knowledgeable when worth nears a resistance zone or help stage:

- TradingView alerts – set off alerts when worth touches key ranges

- CoinStats / CoinMarketAlert – price-based notifications and portfolio monitoring

Last Phrases

Help and resistance aren’t magic strains. They’re a mirrored image of how individuals behave when worth reaches areas they’ve seen earlier than. Realizing find out how to learn these reactions can flip a random commerce right into a calculated determination. Don’t deal with them as a one-time guidelines. As market situations change, so will your ranges. Mix your technical information with observe, regulate your risk-reward ratios, and keep affected person. The market at all times provides you one other probability—should you’re prepared for it.

FAQ

Does help and resistance work in crypto?

Sure, help and resistance ranges work in crypto simply as they do in different markets. Whereas crypto is extra risky, worth actions nonetheless are likely to respect areas the place help refers to purchasing power and resistance ranges happen when promoting stress builds.

What’s the finest indicator for crypto help and resistance ranges?

There isn’t a single “finest” indicator, however instruments like shifting averages, Fibonacci retracements, and pivot factors assist spotlight the place a worth stage would possibly act as help or resistance. These indicators add construction to your buying and selling technique and enhance your market timing.

Which period body is finest for help and resistance?

It is dependent upon your buying and selling technique. For day buying and selling, the 15-minute to 1-hour chart is efficient. For swing or place buying and selling, the 4-hour and each day charts supply well-defined help and resistance zones with higher risk-reward ratios.

Which chart is finest for help and resistance?

Candlestick charts are the best for figuring out help ranges, worth reversals, and entry factors. They provide clear visible cues when worth approaches prior help or resistance and assist affirm response zones.

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.