Bitcoin Faces More Downside After Recent Crash, Data Shows

Bitcoin suffered a sudden and deep drop in November, shedding practically 1 / 4 of its worth and wiping out over $1 trillion throughout the crypto market.

Associated Studying

Whales Trim Positions Earlier than Crash

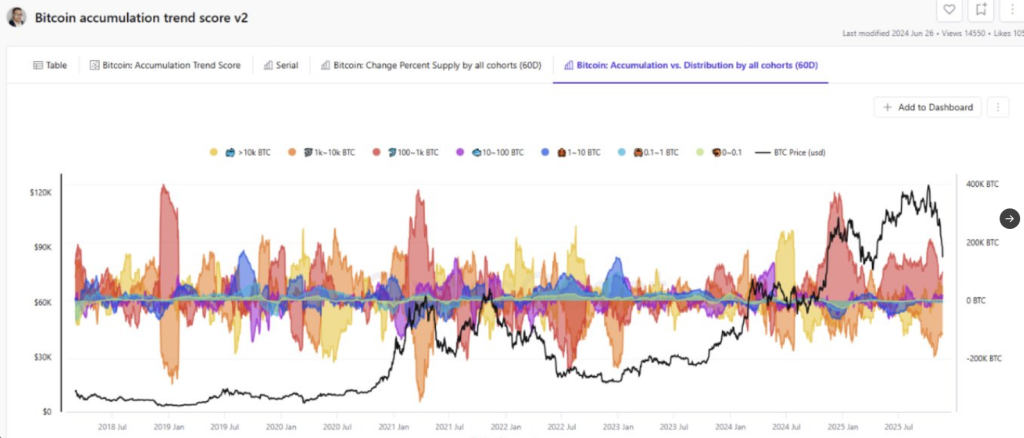

In accordance with on-chain knowledge from CryptoQuant, giant holders performed a central position. Wallets holding between 1,000–10,000 BTC pared again their stakes within the weeks main as much as the autumn.

These huge sellers took income after the October rally, and in lots of circumstances promoting was regular slightly than panicked. When giant gamers step again like that, market depth can vanish rapidly.

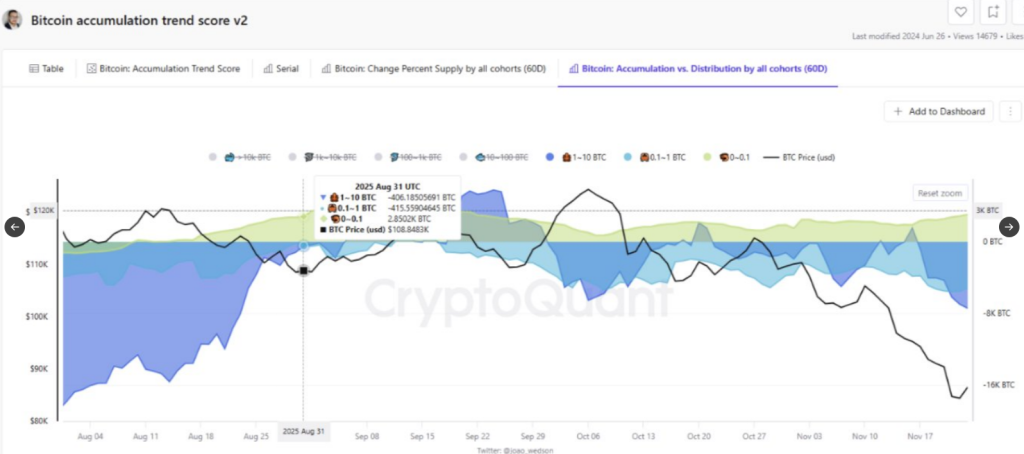

A fast overview of Bitcoin’s value decline exhibits costs slid from document highs above $126,000 in October to roughly $81,000 on the lowest level, earlier than a partial bounce to $87k was recorded. Merchants and funds had been caught off guard by the velocity of the transfer.

On the time of writing, Bitcoin was buying and selling at $87,086, up 1.5% within the final 24 hours.

Retail Promoting Added To Strain

Primarily based on reviews, small wallets additionally leaned towards security. Holders below 10 BTC and teams as much as 1,000 BTC decreased positions, eradicating one other layer of potential patrons.

Has Bitcoin Discovered Its Backside? Cohorts Inform the Complete Story

“BTC could have shaped a neighborhood backside, supported by a robust rebound and accumulation from:

100–1k BTC holders.

>10k BTC holders.

Nonetheless, the essential 1k–10k BTC cohort remains to be distributing, stopping a full… pic.twitter.com/dGU4CBD1Bw

— CryptoQuant.com (@cryptoquant_com) November 25, 2025

Shopping for curiosity from informal traders was weaker than anticipated. Mid-sized holders — these with 10–100 and 100–1,000 BTC — did purchase through the correction, and their exercise helped gradual the slide. Nonetheless, their shopping for energy was not sufficient to match the big outflows.

Futures Liquidations Intensified The Drop

Stories present that futures market dynamics turned a correction right into a crash. Over a 13-day stretch, lengthy positions had been forcefully closed out.

That cascade eliminated bids and created a sequence response of promoting that pushed Bitcoin from round $105K right down to $81K. Liquidations had been heavy, and the promoting stress was compounded as every compelled sale fed into the following.

A Tentative Rebound Reveals Life

After the lows had been hit, Bitcoin climbed again to about $87,500. This rebound has been taken by some as an indication {that a} native backside could be forming.

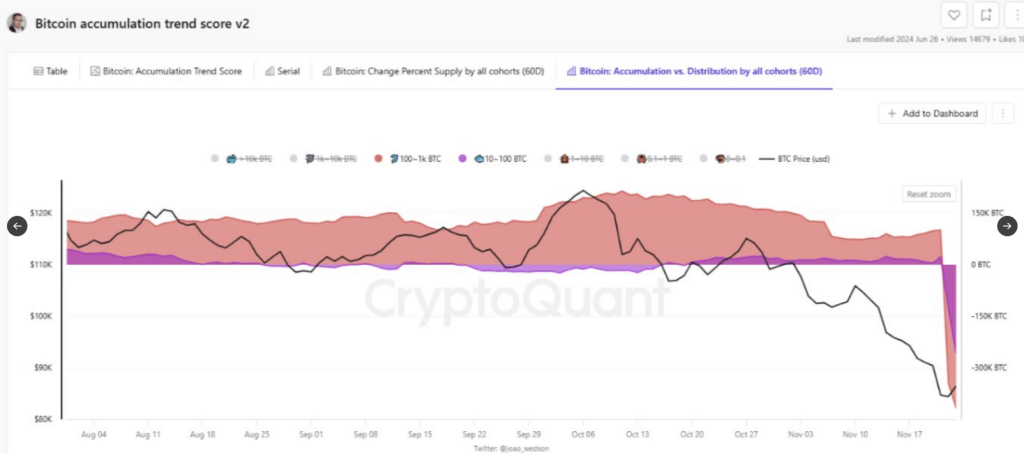

In accordance with CryptoQuant, nonetheless, the restoration can’t be thought of safe whereas the 1,000–10,000 BTC group retains decreasing holdings. The market’s well being was being examined by who selected to promote and who selected to purchase.

Backside Standing Hinges On Whale Exercise

Market watchers say a real reversal wants promoting from giant wallets to cease. If these whales pause, mid-sized patrons would possibly construct a firmer ground and confidence might return.

If promoting continues, decrease ranges could also be explored as soon as once more. The approaching periods will likely be watched carefully by merchants who wish to see whether or not giant holders change course or maintain cashing out.

Associated Studying

For now, the scenario is easy and tense on the identical time: costs have recovered barely, however the structural weak spot that allowed a 25% fall was uncovered.

Bitcoin might face additional losses after its current crash, if CryptoQuant’s knowledge is something to go by. Giant holders have been taking income, whereas retail traders have additionally been promoting, leaving fewer patrons to help the market.

Analysts say the following transfer will rely upon whether or not these huge holders proceed promoting or if mid-sized patrons step in to stabilize costs.

Featured picture from Vecteezy, chart from TradingView