Bitcoin sees a death cross on active addresses

- Bitcoin could possibly be set for an extended interval of stagnation, because the demise cross happens on 30DMA & 365 DMA.

- BTC has reasonably recovered on every day charts by 2.58%.

Over the previous 24 hours, Bitcoin [BTC] has skilled a robust upswing, reclaiming the $100k stage.

Nevertheless, it has made a pullback over the previous few hours. In reality, as of this writing, Bitcoin was buying and selling at $99417 after rising by 2.58% on every day charts.

This slight pullback displays the general BTC battle with maintaining with an upward momentum. As such, this stagnation has left analysts predicting a bearish outlook for the Crypto.

Inasmuch, CryptoQuant analyst Yansei Dent has instructed a possible mid to long-term worth stagnation, citing the emergence of a lifeless cross.

Demise Cross emerges on Bitcoin’s lively addresses

In his evaluation, Dent noticed that Bitcoin has entered a stagnation part, with lively addresses signaling a weakening momentum.

Supply: Cryptoquant

In line with him, a demise cross has emerged on the 30-Day Shifting Common (DMA) and 365 DMA. This demise cross alerts a decline in short-term exercise amongst buyers.

Traditionally, comparable patterns in lively addresses have coincided with bearish market circumstances, appearing as destructive indicators.

Moreover, the evaluation reveals that the transaction rely has been declining since This fall 2024. This additional reinforces the chance of mid to long-term market stagnation.

Subsequently, with these circumstances nonetheless prevailing, BTC may battle to keep up an uptrend till the general market alerts enchancment.

What does it imply for BTC charts?

Notably, a decline in exercise and an emergence of a demise cross, sign weakening market fundamentals which may see BTC battle to maintain an uptrend.

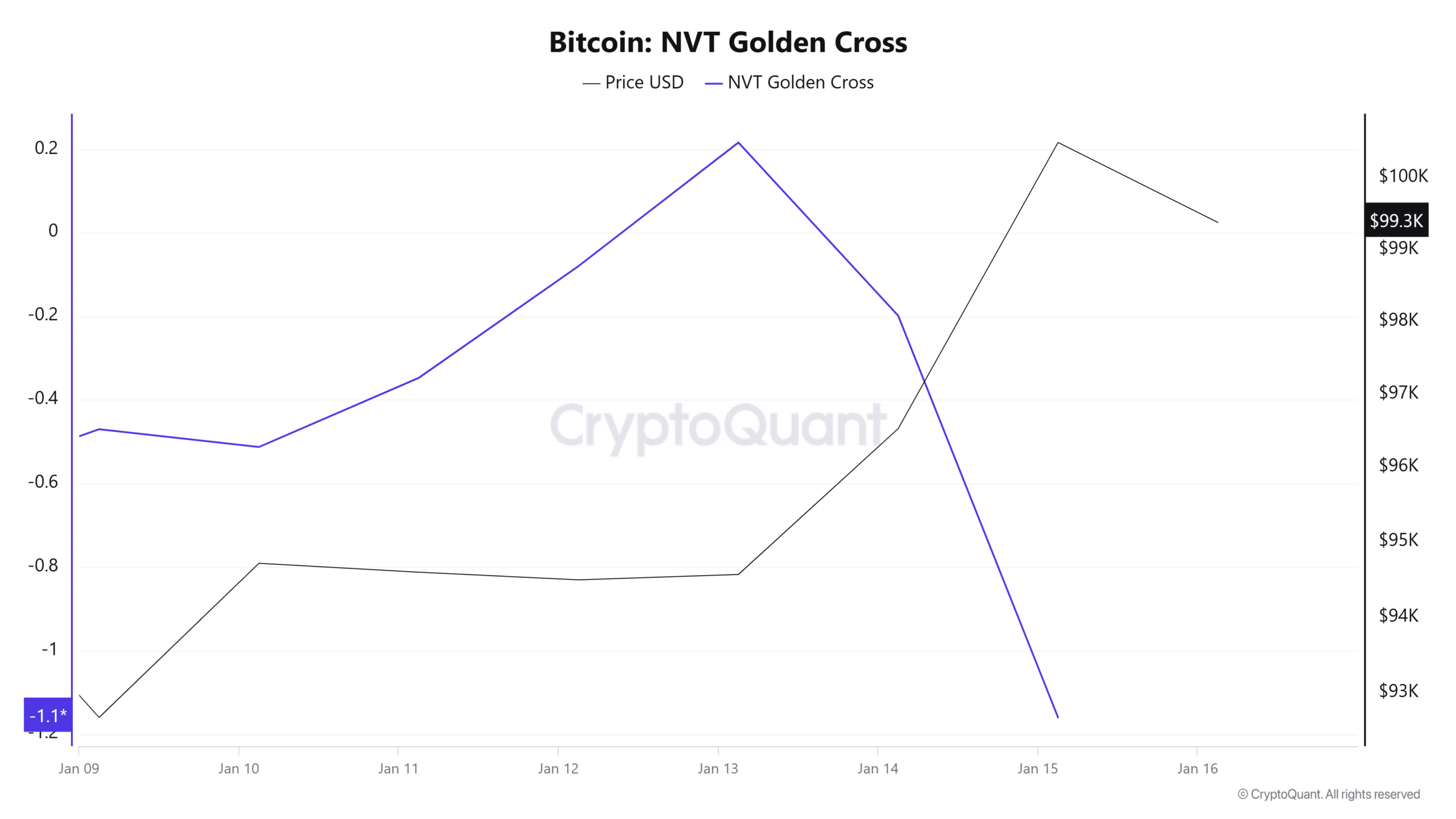

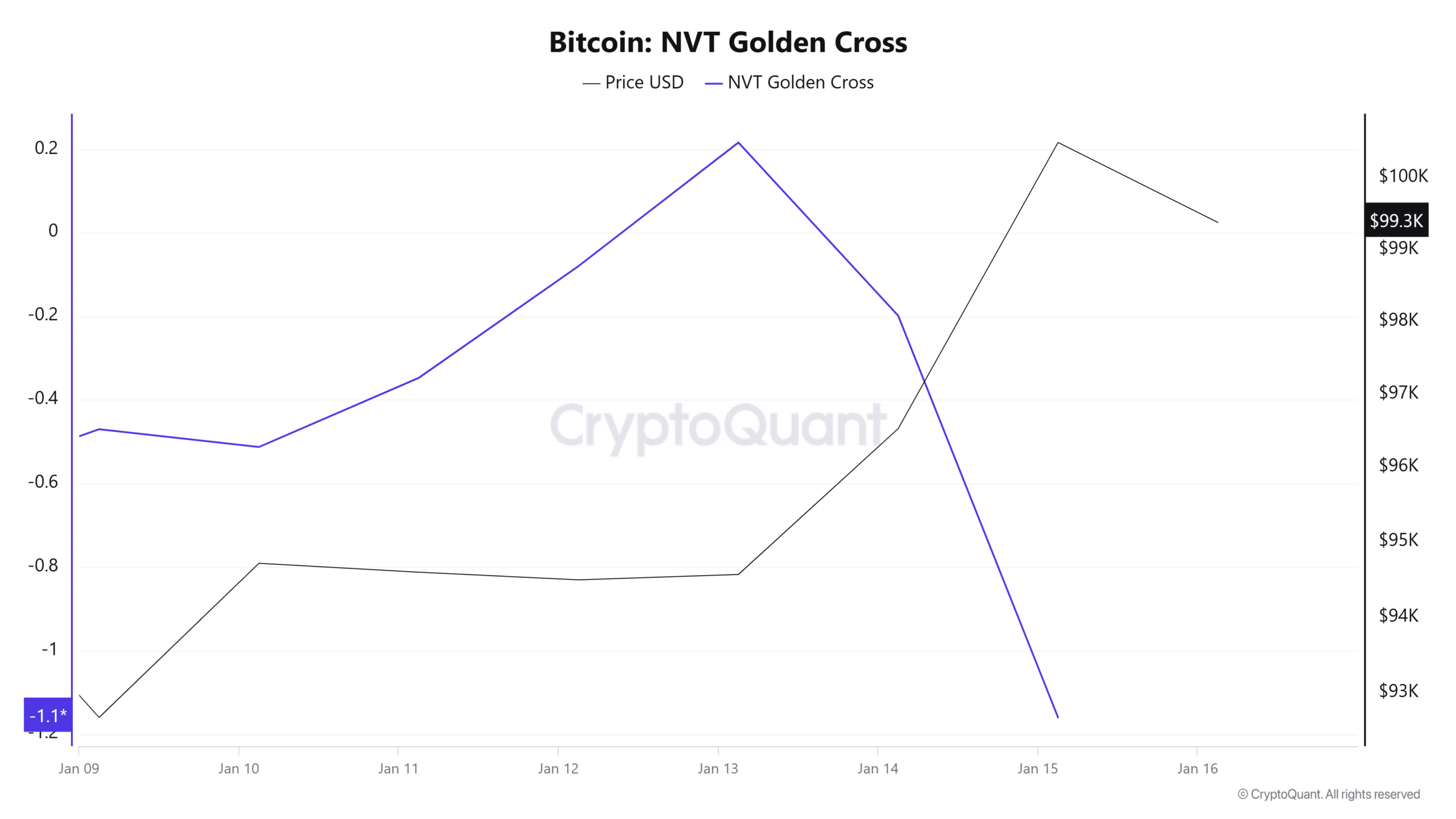

Supply: CryptoQuant

For starters, we will see this short-term bearishness by way of the declining NVT Golden Cross. This has declined to succeed in the destructive zone of -1.1, at press time.

When the NVT golden cross reaches destructive, it suggests reducing Bitcoin’s market worth relative to transaction exercise.

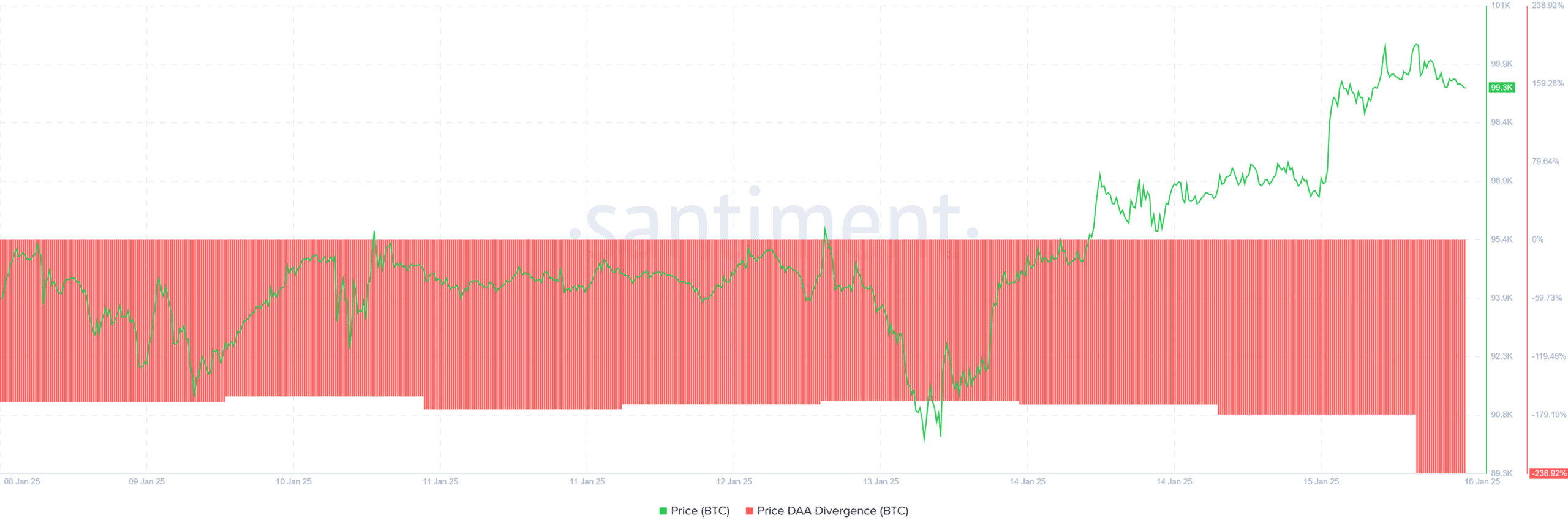

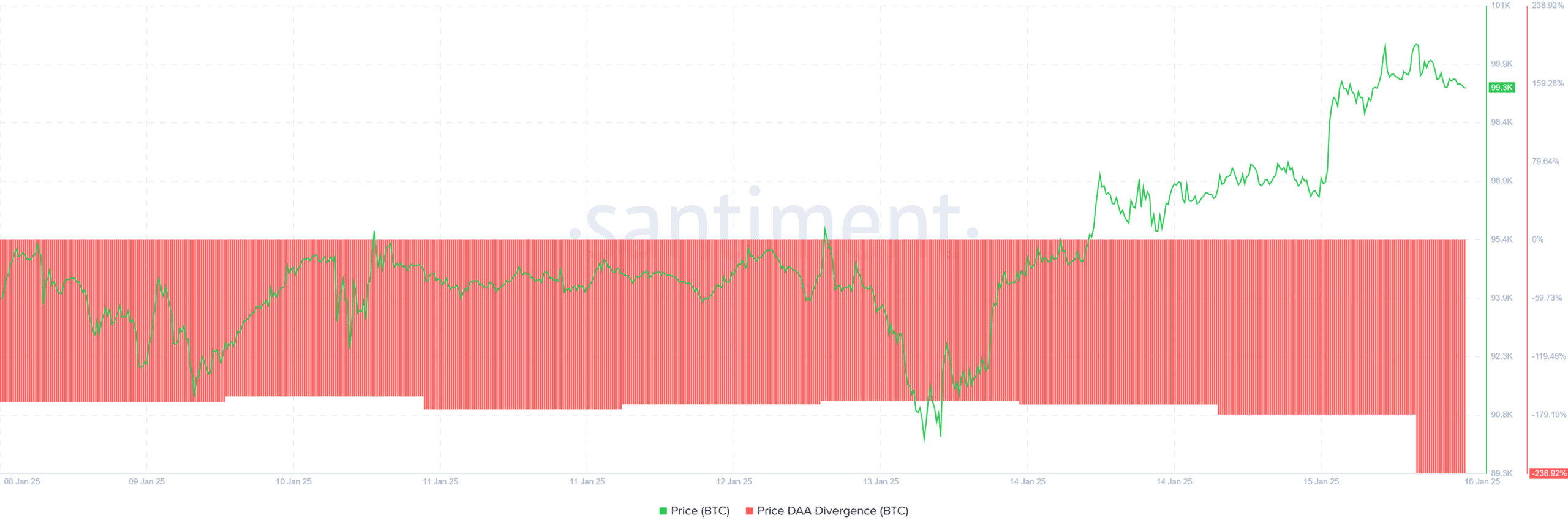

Supply: Santiment

This diminished community exercise is additional confirmed by a destructive worth DAA Divergence. This reveals that market fundamentals are weakening and present BTC worth could be unsustainable.

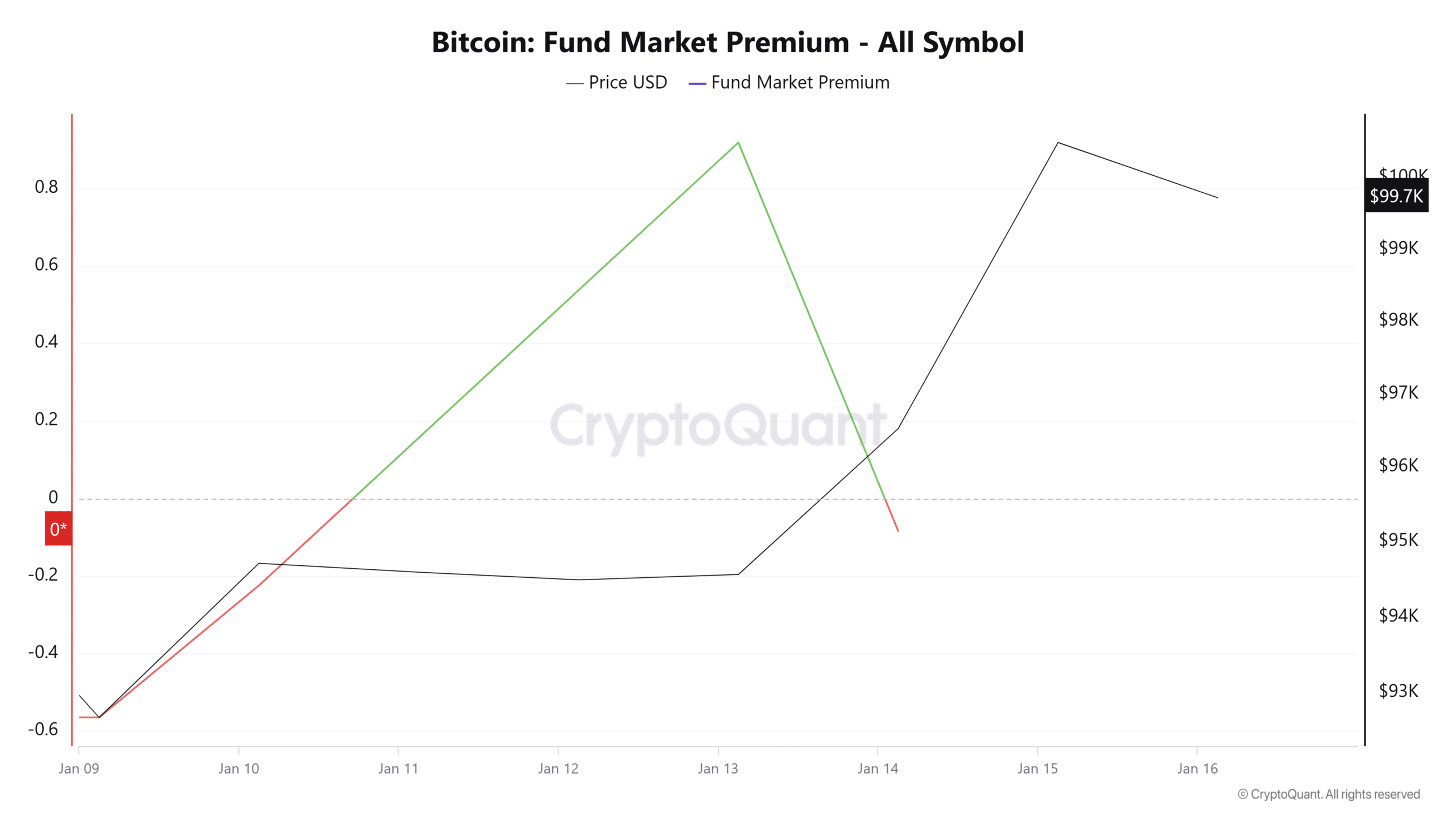

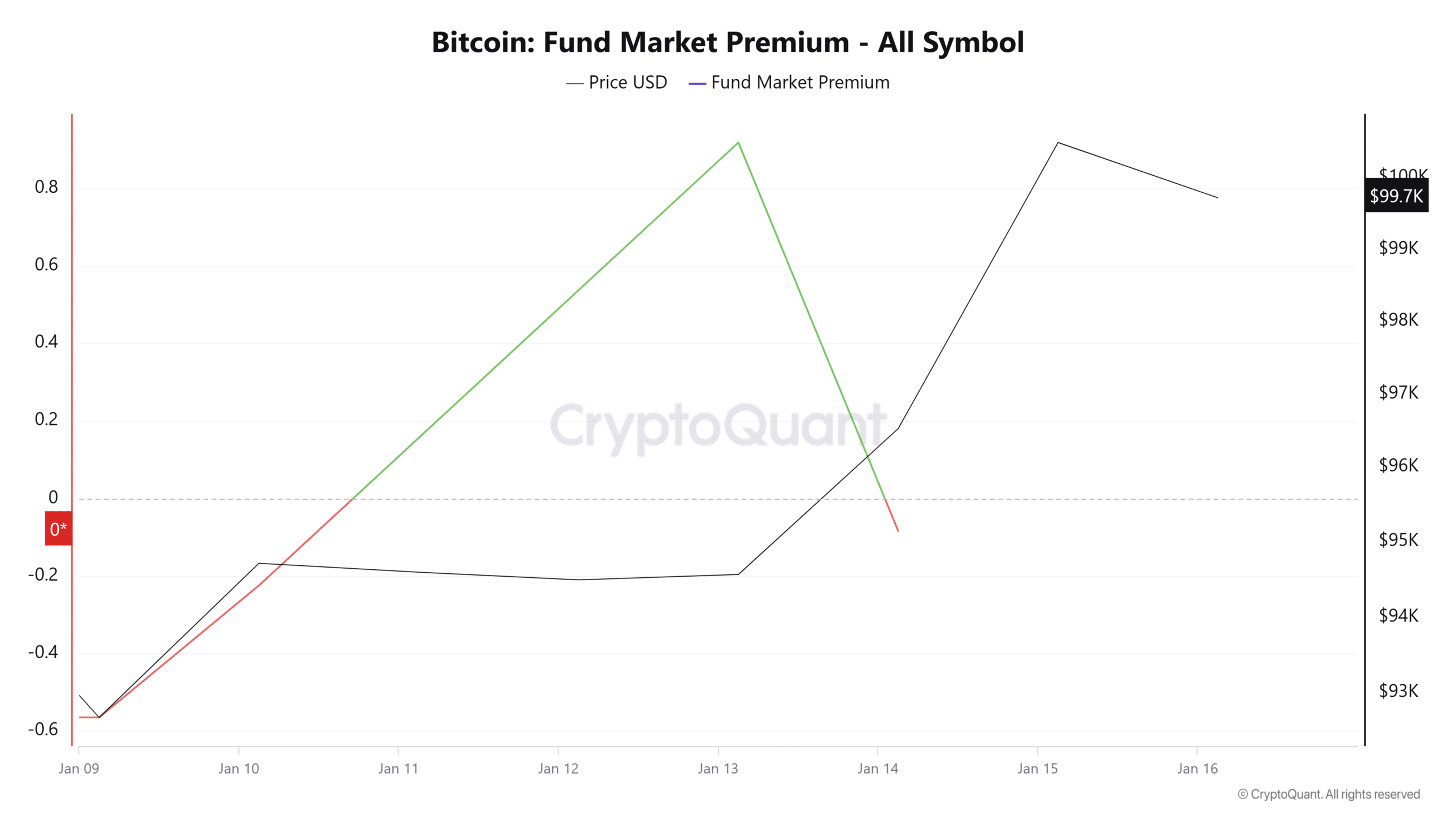

Supply: CryptoQuant

Bitcoin’s fund market premium has declined to -0.08. When the fund market premium reaches this stage, it signifies that futures costs are buying and selling beneath spot costs. This means a excessive demand for brief positions.

– Learn Bitcoin (BTC) Worth Prediction 2025-26

Though Bitcoin has reclaimed $100k over the previous day, the markets will not be wholesome sufficient for a sustained uptrend.

The present beneficial properties come up from speculative exercise, particularly following the U.S. inflation information launch.

Subsequently, with weakening fundamentals, BTC will proceed to consolidate inside a spread of $94k and $100k.