Ethereum Consolidates Against BTC – Altseason Hopes Hinge On ETH/BTC Breakout

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is displaying spectacular resilience because it continues to carry above crucial ranges regardless of ongoing market volatility. Whereas Bitcoin struggles to interrupt previous its all-time highs, ETH stays steady, sustaining bullish construction and fueling hopes for a broader altcoin rally. Analysts throughout the market are eyeing a possible altseason, with Ethereum anticipated to guide the cost as soon as it clears main provide zones.

Associated Studying

Nevertheless, the highlight is shifting to a much less mentioned however extremely important chart—ETHBTC. In accordance with prime analyst Daan, the ETHBTC pair has been consolidating in a good vary between 0.022 and 0.026 for the reason that final squeeze. This consolidation suggests a interval of accumulation and diminished volatility, however it additionally acts as a vital sign for altcoin momentum.

If ETHBTC breaks above the 0.026 resistance degree, Daan suggests it might set off a brief however highly effective rally in ALT/BTC pairs. Sectors intently tied to Ethereum—comparable to DeFi protocols, ETH-based memecoins, and Layer 2 ecosystems—may gain advantage most from such a transfer. Till then, traders are intently monitoring ETH’s efficiency relative to BTC, because it stays one of the vital dependable indicators of capital rotation throughout the crypto market.

ETHBTC Chart Turns into Key to Altseason Outlook

Ethereum is at present buying and selling at a pivotal vary, with traders intently looking forward to a breakout that would result in new highs and doubtlessly ignite the long-anticipated altseason. Regardless of international tensions and continued macroeconomic uncertainty—significantly surrounding the aggressive and unstable Bond market—ETH has remained comparatively robust. Bulls are optimistic, viewing the present consolidation as a wholesome pause earlier than the following leg up.

One of the crucial vital indicators for altcoin momentum just isn’t discovered on the USD chart, however within the ETHBTC pair. Daan points out that Ethereum’s value relative to Bitcoin has been consolidating between the 0.022 and 0.026 BTC vary for the reason that current squeeze. This vary now acts as a stress level for the market. A breakout above 0.026 would probably catalyze a surge in altcoin power, particularly amongst Ethereum-related belongings like DeFi protocols, ETH-based memecoins, and Layer 2 options.

Nevertheless, Daan warns that if ETHBTC drops beneath 0.0224, it might sign weak spot for alts relative to BTC. It’s vital to do not forget that ALT/BTC pairs can fall even when altcoin USD costs rise, significantly throughout aggressive BTC rallies. The identical applies in reverse. For now, ETH’s place on this vary stays one of the vital telling indicators of the place the broader crypto market may head subsequent.

Associated Studying

Ethereum Faces Resistance As Bulls Try Breakout

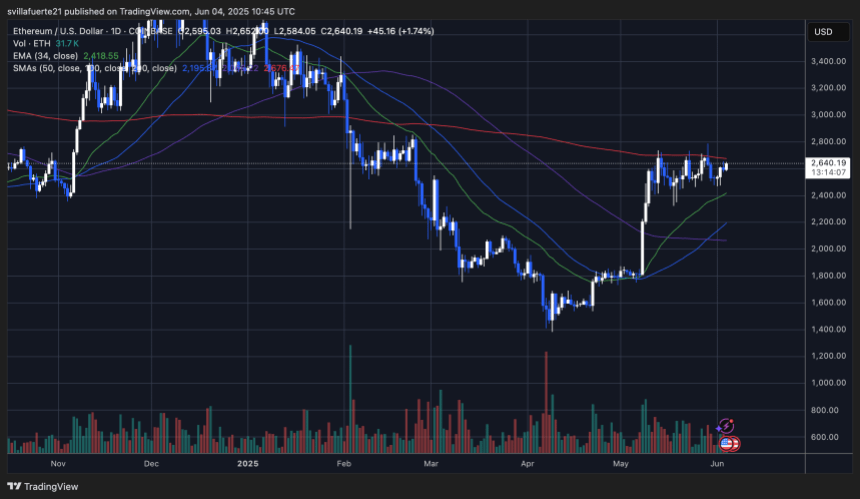

Ethereum (ETH) is at present buying and selling round $2,640, displaying indicators of power after holding its floor above the $2,500 mark. On the every day chart, ETH is forming a transparent consolidation sample just under a key resistance zone outlined by the 200-day shifting common (at present at $2,676). This degree has repeatedly capped value motion over the previous few weeks, signaling robust provide stress on this space.

Regardless of the dearth of a decisive breakout, Ethereum is sustaining a bullish construction with increased lows and constant quantity assist. The 34-day EMA has turned upward and at present sits at $2,418, offering dynamic assist and reinforcing the short-term uptrend. If ETH can reclaim the 200-day SMA and push above $2,700, a broader rally might comply with, doubtlessly opening the trail towards $3,000 and past.

Associated Studying

On the draw back, if value fails to interrupt this resistance and sellers take management, fast assist lies close to $2,500, adopted by stronger demand round $2,350–$2,400 the place the 50- and 100-day SMAs converge. For now, Ethereum stays in a balanced state, displaying resilience, however nonetheless wants a powerful catalyst to beat the technical ceiling that continues to stall upward momentum.

Featured picture from Dall-E, chart from TradingView