- Spot Bitcoin ETFs absorbed 4,349.7 BTC, far surpassing miner provide this week.

- Institutional demand tightens liquidity, amplifying Bitcoin’s worth sensitivity and volatility dangers.

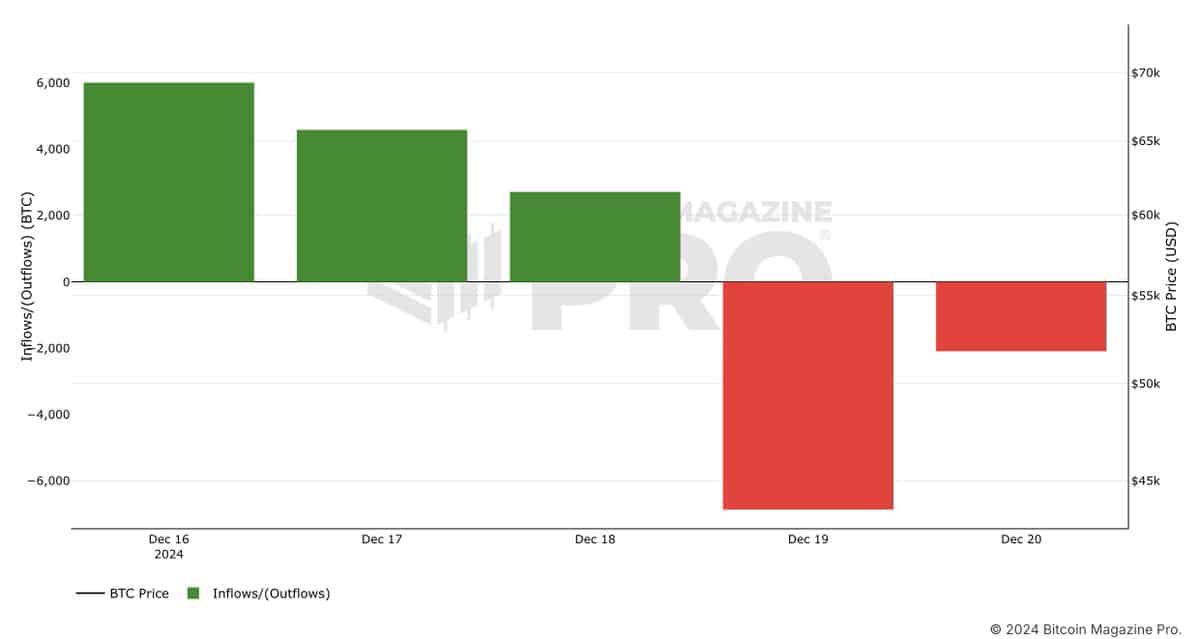

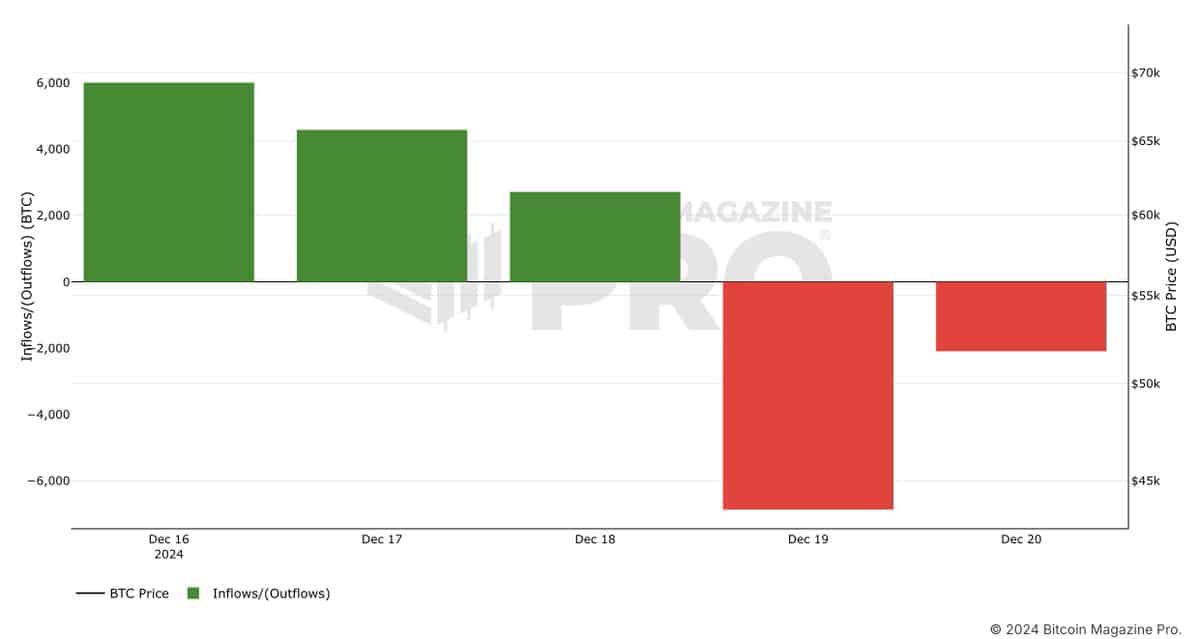

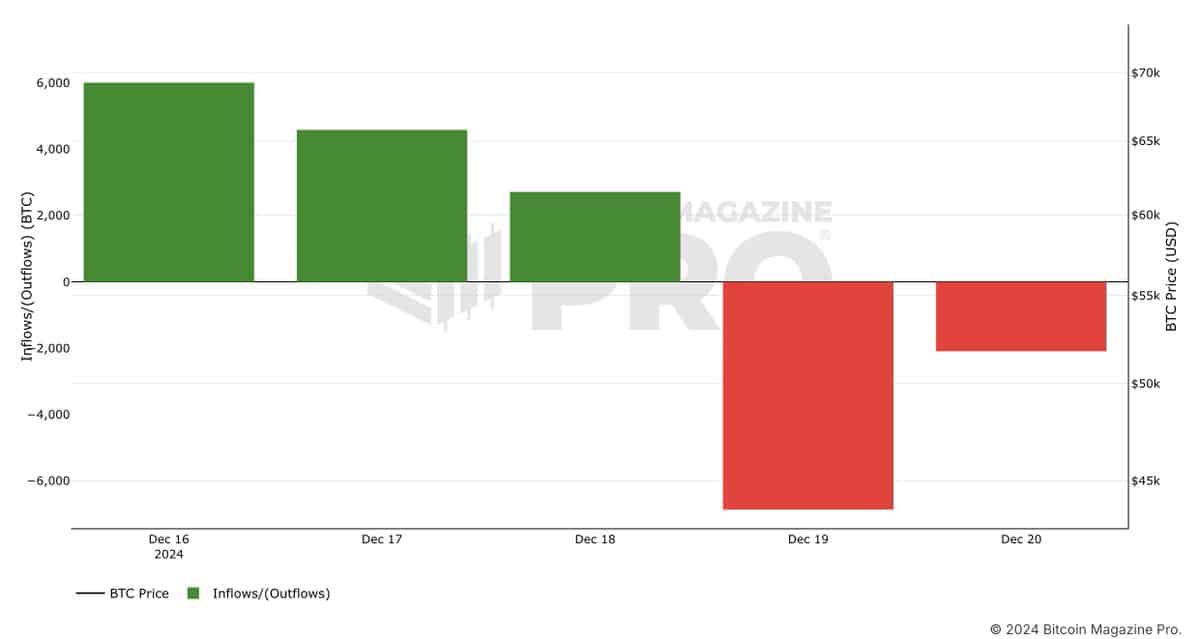

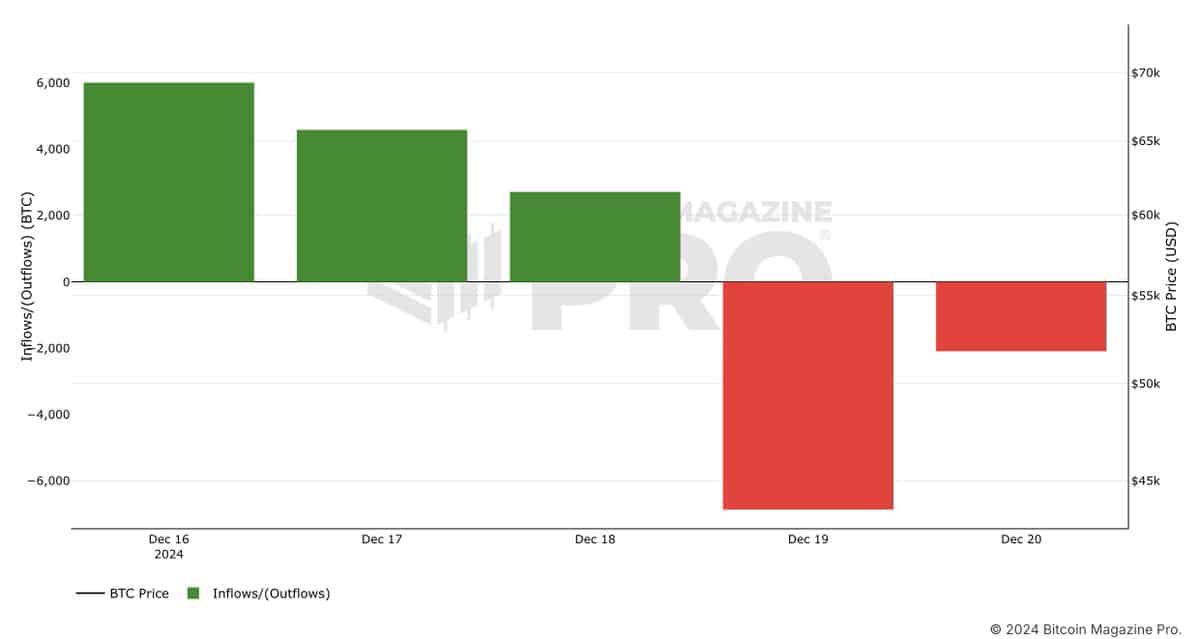

Institutional demand for Bitcoin [BTC] reveals no indicators of abating, even amid worth volatility. Up to now week, spot Bitcoin ETFs recorded inflows of 4,349.7 BTC, value $423.6 million – almost double the two,250 BTC mined in the identical interval.

This imbalance highlights the rising dominance of institutional traders in shaping market dynamics and raises vital questions on Bitcoin’s capability to satisfy escalating demand.

Bitcoin ETFs take in liquidity quicker than miners provide

Spot Bitcoin ETFs have emerged as a cornerstone for institutional publicity to Bitcoin, providing a simplified different to direct asset custody. This week’s inflows exemplify the altering dynamics, with ETFs accumulating extra BTC than miners can produce.

Supply: X

The divergence between ETF inflows and miner output displays tightening liquidity in Bitcoin markets. Whereas miners grapple with post-halving challenges, ETFs proceed to soak up a good portion of the circulating provide.

Institutional traders, undeterred by current worth declines, seem dedicated to Bitcoin as a long-term macroeconomic hedge, reinforcing its attraction past speculative buying and selling.

Institutional inflows dominate

In December alone, spot Bitcoin ETFs have attracted $5.5 billion in inflows, additional widening the hole between demand and provide. This demand surge illustrates institutional confidence in Bitcoin’s enduring potential regardless of worth corrections.

Nonetheless, the imbalance may heighten market volatility, as constrained liquidity makes costs extra delicate to shifts in investor sentiment.

The growing reliance on institutional capital underscores Bitcoin’s evolving market construction. Whereas this pattern strengthens its legitimacy as a macroeconomic asset, it introduces dangers related to concentrated demand, amplifying each worth potential and draw back volatility.

Liquidity squeeze heightens volatility dangers

The persistent mismatch between ETF inflows and miner manufacturing has created a liquidity squeeze, positioning Bitcoin for heightened worth sensitivity.

If institutional demand stays strong, constrained provide may drive upward worth stress. Conversely, the focus of holdings amongst institutional gamers might exacerbate sell-offs throughout market downturns.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

As Bitcoin’s function as a macroeconomic hedge deepens, its market faces challenges balancing institutional reliance with stability.

Navigating these dynamics would require cautious consideration from traders, as Bitcoin’s worth trajectory turns into more and more influenced by the shifting tides of institutional sentiment.

Subsequent: Shiba Inu eyes reversal as whales accumulate amid downturn – What now?

Source link