Best XRP Buy Zone? Analyst Breaks Down The Key Levels

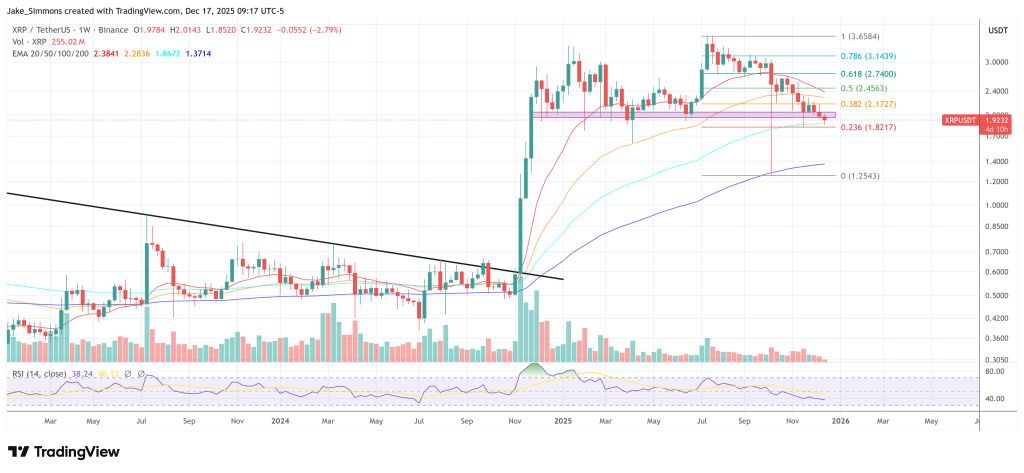

Will Taylor, founding father of CryptoinsightUK, frames XRP’s “greatest purchase space” as a risk-to-reward query, not a certainty name. In his newest YouTube video from Dec. 17, he argues that XRP is buying and selling again within the decrease portion of a well-defined vary, which is often the place entries take advantage of sense for vary merchants—as a result of invalidation ranges are clearer and upside targets are structurally outlined.

“We’re on the backside of the vary […] this space, the underside of the vary, and the underside of the vary has been fairly large,” Taylor stated. “So, I’d say between like $2.01, then all the best way right down to about $1.60. This has been the very best space to enter […] for the final […] principally yr and a bit.”

And his emphasis is that it’s engaging as a result of the commerce is measurable, not as a result of it’s assured. “Does this imply we will’t break down additional? Does this imply we will’t lose assist? No, that’s not what I’m saying in any respect,” he added. “However what I’m saying is if you happen to use vary buying and selling, if you wish to know the very best areas for risk-to-reward, we’re at them now.”

Associated Studying

On decrease timeframes, Taylor stated XRP has already swept a lot of the draw back liquidity, leaving a smaller pocket under that would nonetheless get tagged. He pointed to ~$1.83 because the remaining space of curiosity.

“XRP has taken most of this pink liquidity to the draw back. There’s a small pocket of liquidity under us nonetheless at $1.83,” he stated. And crucially, that stage just isn’t tutorial for him — it’s tied to his personal cease placement and whether or not the market is prone to wick decrease earlier than any sustained transfer up.

“That is one thing that I’m contemplating […] as as to whether to maneuver my cease loss under this liquidity down at like say $1.79,” Taylor stated. “My cease loss [is] $1.834 on the minute. Do I take it to say like $1.79 […] give us […] the underside of this wick as potential assist and that liquidity. That’s a possible dialogue.”

The Upside Set off For XRP

Taylor’s near-term bullish set off is a reclaim of ~$2.07. His reasoning is positioning-driven: he thinks the market has constructed a significant quantity of quick publicity in the course of the drawdown, and a transfer again above that stage may power protecting.

Associated Studying

“Whenever you begin to get a buildup of […] decrease highs like this, all it takes is a little bit of momentum to interrupt us above,” he stated. “So, say for XRP, if we begin to get again above $2.07, you in all probability ought to see value squeeze to $2.58-$2.60 fairly rapidly […] as we squeeze out all of this […] open curiosity that’s been including in as value has been coming down.”

Taylor’s XRP view is nested inside a broader “crypto is mispriced” thesis. When evaluating crypto’s market cap efficiency towards a basket of conventional belongings, he argues that crypto has decoupled sharply for the reason that Oct. 10 crash, whereas sentiment has deteriorated.

“Crypto has like decoupled from each different asset class […] crypto is about the one asset that has decoupled this tough,” he stated. “I personally consider it is a deep worth zone […] we’re clearly mispriced versus different belongings.”

He additionally repeatedly leaned on the concept positioning is skewed: rising open curiosity into draw back, unfavorable premium, and funding flipping between constructive and unfavorable — situations that may arrange a squeeze if value begins reclaiming ranges.

“I believe a number of the market typically is establishing for a little bit of a brief squeeze to the upside,” Taylor stated. “And I believe that persons are overly unfavorable and […] the sentiment’s overly bearish in comparison with the place the worth is.”

At press time, XRP traded at $1.92.

Featured picture created with DALL.E, chart from TradingView.com