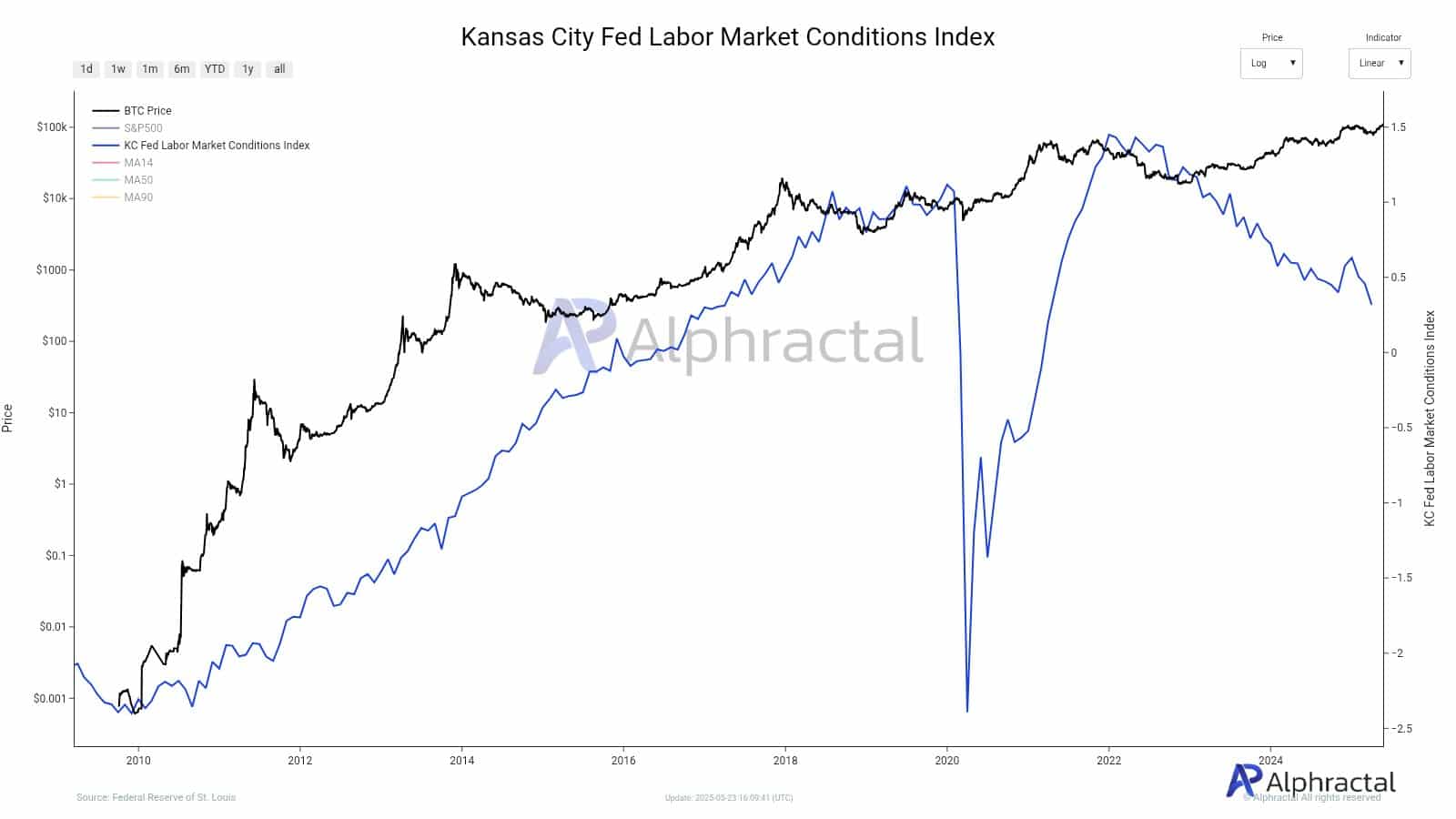

Bitcoin gains as U.S. labor market weakens: BTC as a safe haven, confirmed?

- Bitcoin gained traction as a macro hedge, supported by surging ETF inflows amid broader investor rotation.

- Kansas Metropolis Fed LMCI declined for a second month, reinforcing rising recession dangers throughout the U.S. economic system.

The American economic system could also be steering into turbulent waters.

The Kansas Metropolis Federal Reserve’s Labor Market Situations Indicators (LMCI) fell for the second successive month, showing much more weak point within the job market.

The autumn is the most recent of a collection of warning indicators that predict the chance of a looming recession.

Whereas the normal markets begin to buckle below the load, Bitcoin [BTC] could also be within the acquire. The latest figures present a growth in BTC ETF inflows, which signifies rising investor demand.

Is the digital coin’s “secure haven” standing then the principal driver behind its subsequent bull run? Let’s discover out!

Labor market flashing purple once more

The LMCI is a complete gauge of U.S. labor market momentum and exercise.

Falling LMCI usually factors to falling job creation, slowing wages, or much less aggressive hiring practices. This additional decline helps the view that labor situations are deteriorating extra aggressively than anticipated.

Economists intently monitor the LMCI because it usually strikes earlier than general macroeconomic indicators.

If the indicator is shifting down, it may very well be an indication that the Federal Reserve’s tight rate of interest coverage is beginning to chew deeper into the actual economic system.

Supply: Alphractal

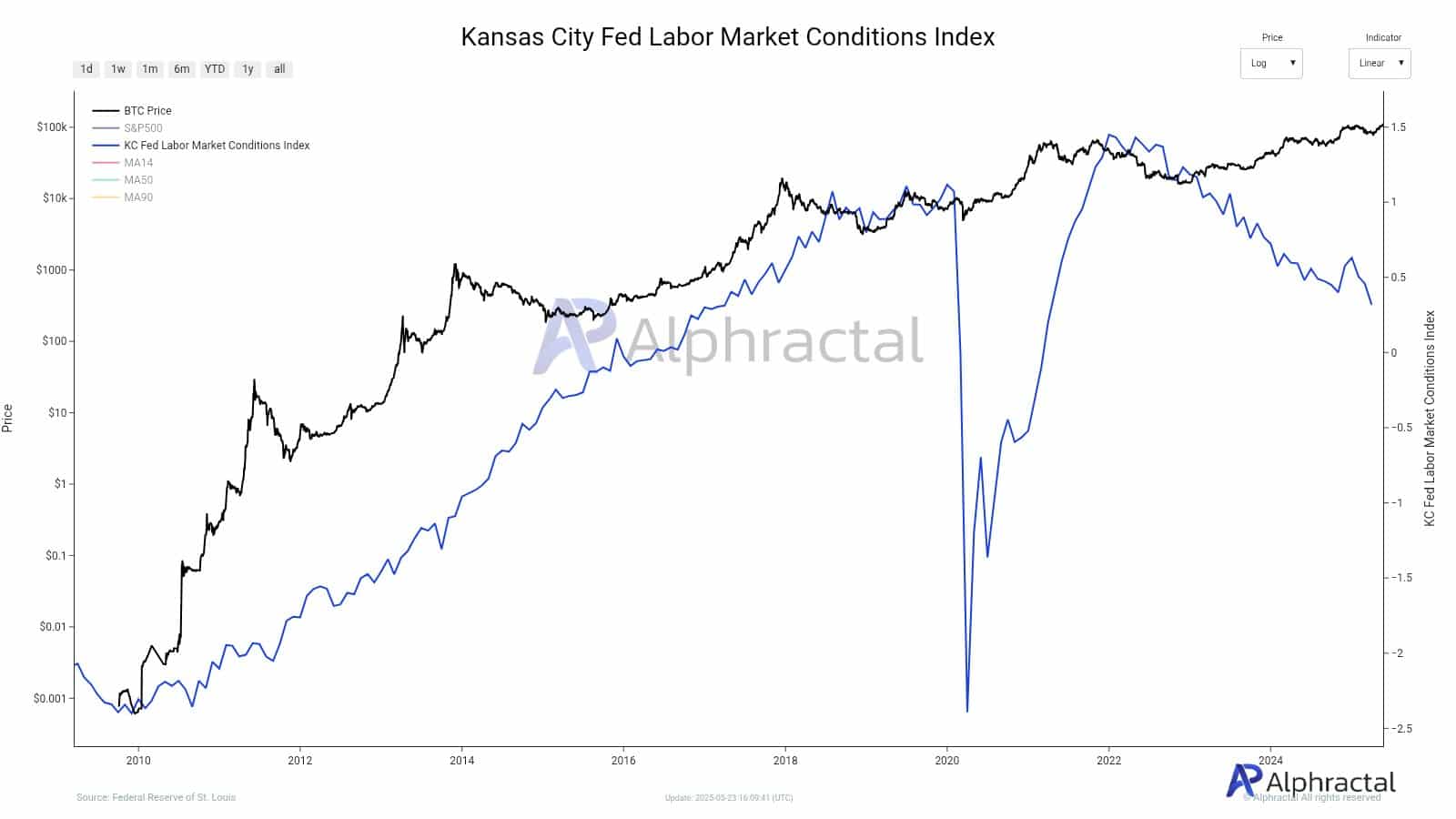

An indication of buyers portfolio rotation

Within the meantime, Bitcoin seems to be gaining from this volatility.

Current figures for BTC ETF confirmed a steep rise in inflows, with institutional cash flowing into the asset more and more.

This can be a signal of a noticeable change in investor sentiment, from conventional equities to digital belongings like Bitcoin.

Greater than only a short-term hedge, Bitcoin’s positioning as “digital gold” is getting renewed validation.

Throughout occasions of financial disaster, buyers search refuge in securities which are scarce in provide, liquid and decentralized.

BTC suits right here and has more and more discovered use as a car for diversification throughout occasions of macroeconomic stress.

Supply: BitBO

Recession narrative fuels Bitcoin’s demand story

In fact, if labor metrics proceed to droop and macro threat grows, investor urge for food for Bitcoin may speed up.

We’ve seen this playbook earlier than—shrinking job markets typically result in hypothesis about Fed charge cuts.

If that chatter grows louder, threat belongings like BTC might catch a recent bid, particularly as capital rotates out of equities and into non-correlated digital belongings.

With inflows into BTC ETFs selecting up pace, the market could also be witnessing the preliminary levels of a extra international threat rebalancing.