$4B Increase In Bitcoin Open Interest Fueled By Whale Transfers To Exchanges – Details

Bitcoin confronted renewed volatility after a minor pullback interrupted two weeks of tight consolidation slightly below its all-time excessive of $123,000. The value briefly dipped close to the $115,000 assist degree however has already begun to recuperate, signaling that bullish momentum stays intact regardless of current promoting strain. Market members seem like reacting calmly, with sturdy demand rapidly absorbing the dip.

Associated Studying

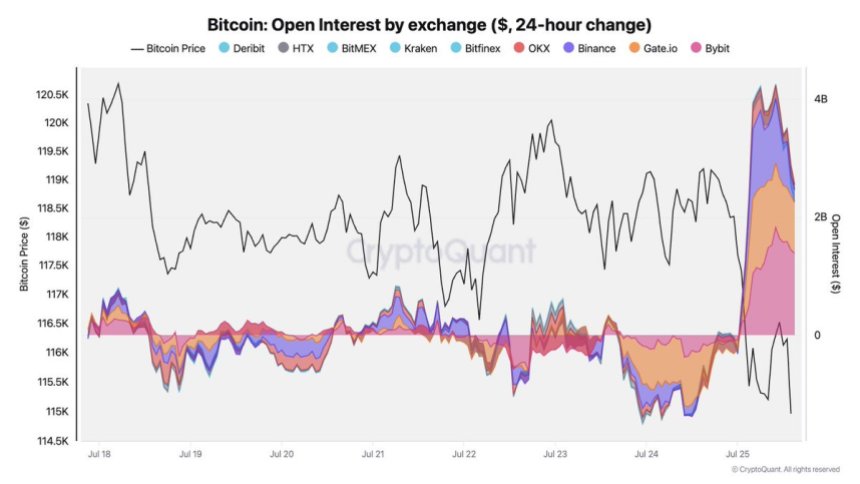

In keeping with recent information from CryptoQuant, at this time’s value motion coincides with a major enhance in open curiosity throughout main exchanges. Binance, Bybit, and Gate all recorded sharp spikes in open curiosity throughout the final 24 hours, suggesting that merchants are positioning aggressively. Notably, these exchanges have been among the many recipients of huge Bitcoin transfers earlier within the day, possible tied to institutional or whale exercise.

This alignment of value restoration and rising open curiosity hints at a shift in sentiment. Quick-term merchants are re-entering the market, whereas bulls seem able to defend key ranges. As volatility picks up, Bitcoin’s capability to carry and reclaim current assist will decide whether or not it resumes its upward march or stays range-bound. The approaching days may very well be essential for setting the tone of the subsequent leg in Bitcoin’s value motion.

Rising Open Curiosity Indicators Rising Volatility

In keeping with Julio Moreno, CryptoQuant’s head of analysis, over the past 24 hours, open interest surged by roughly $4 billion, indicating that leveraged positions—significantly shorts—have entered the market in massive numbers. This spike coincided with important Bitcoin transfers to main exchanges like Binance and Bybit, which acquired a considerable portion of at this time’s large-volume transactions.

These developments counsel elevated speculative exercise as merchants anticipate additional value motion. The influx of cash to exchanges, mixed with rising open curiosity, usually indicators upcoming volatility. Quick sellers seem like betting on continued draw back, however with Bitcoin already recovering from its current $115,000 dip, this might result in a brief squeeze if momentum shifts again in favor of the bulls.

This market shift comes as Ethereum and altcoins present notable energy. Since Could, Ethereum has constantly outperformed Bitcoin, aided by institutional accumulation and clearer regulatory indicators within the US. As ETH leads the altcoin rally, buyers are watching intently to see whether or not capital rotation from BTC into altcoins continues.

Associated Studying

Bitcoin Holds Key Help After Minor Pullback

The each day Bitcoin chart exhibits that BTC stays in a bullish construction regardless of current volatility. After briefly consolidating close to the $122,000 resistance zone and reaching an all-time excessive simply above that degree, the worth retraced towards the $115,700–$117,000 assist band. This zone, marked by the horizontal yellow vary, additionally aligns intently with the 50-day easy shifting common (SMA), presently at $117,593.23, reinforcing its position as a powerful technical assist.

The general uptrend that began in early Could stays intact, with increased highs and better lows clearly seen on the chart. Notably, BTC continues to commerce effectively above the 100-day (inexperienced) and 200-day (crimson) SMAs, which sit at $112,547.95 and $109,436.38, respectively. These ranges function deeper assist zones if promoting strain intensifies.

Quantity has elevated barely on crimson candles, indicating some promote strain, however there isn’t a signal of panic. So long as BTC holds above the $115,700 degree, bulls keep the benefit. A breakout above $122,000 would sign pattern continuation and will open the trail to new highs.

Featured picture from Dall-E, chart from TradingView