How to Start Shorting Crypto as a Beginner

When the crypto market turns bearish, most merchants panic… however brief sellers see a possibility. Shorting allows you to make good points whereas cash crash, turning volatility into a bonus. This newbie’s information explains how shorting crypto works, the way to handle the dangers, and the way to use it well when the pattern is in opposition to you.

What Is Shorting in Crypto?

Shorting in crypto, or brief promoting, is a buying and selling methodology that permits you to revenue when the value of a digital asset goes down. In easy phrases, you promote a cryptocurrency you don’t really personal after which purchase it again later—ideally at a lower cost.

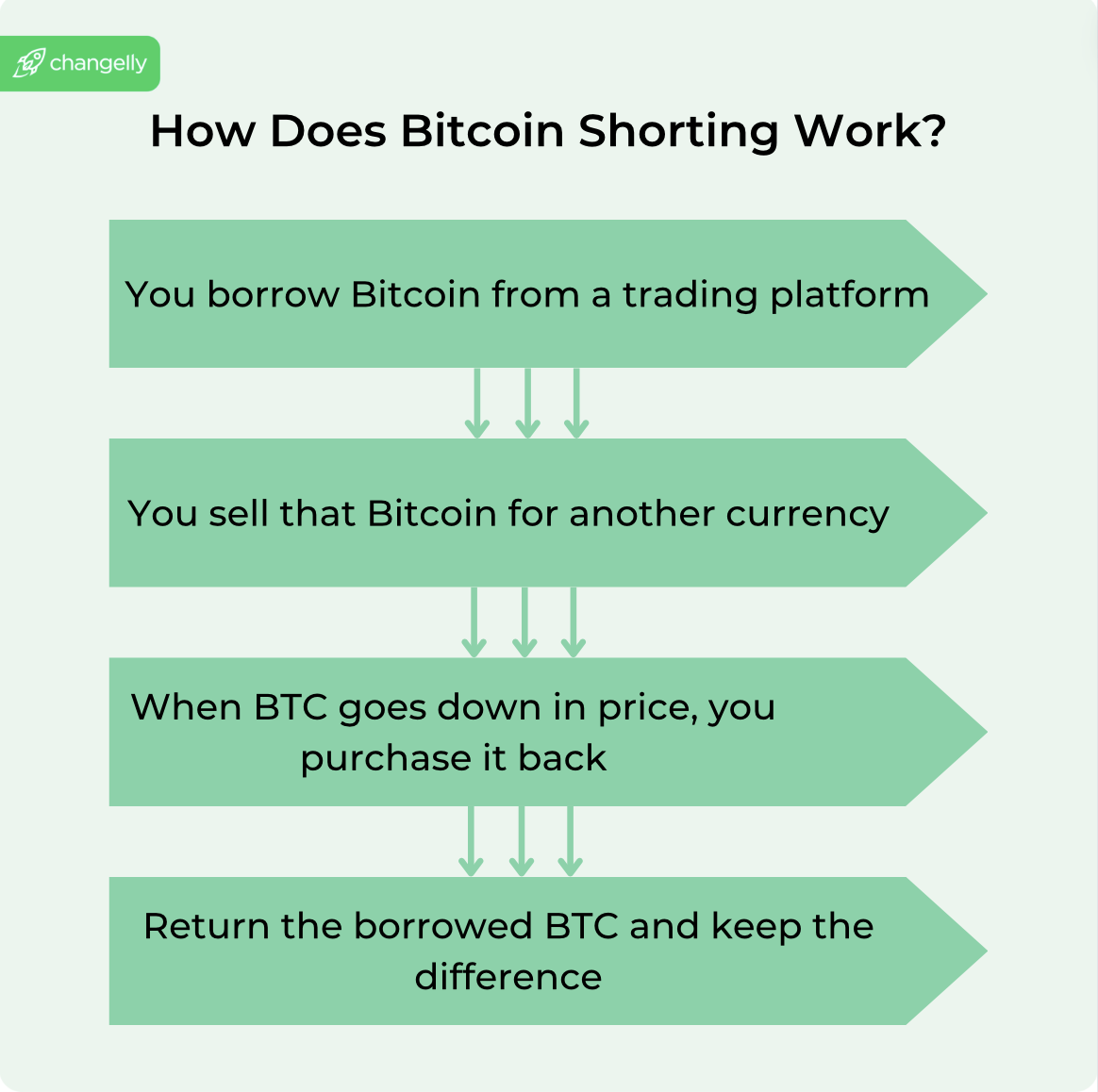

Right here’s the essential clarification of the method:

- You borrow a cryptocurrency (for instance, Bitcoin) from an change or dealer.

- You promote it on the present market worth.

- When the value drops, you purchase it again and return the borrowed quantity.

- The distinction between your promote worth and purchase worth turns into your revenue.

Similar to in conventional markets, shorting in crypto means betting that an asset’s worth will decline. As an example, think about you anticipate Bitcoin’s worth to fall quickly. You borrow 1 BTC from an change and promote it for $60,000. Every week later, Bitcoin drops to $40,000. You purchase again 1 BTC for $40,000, return it, and hold the $20,000 distinction as revenue.

That’s the essence of shorting: incomes from a market downturn as a substitute of a rally.

Learn extra: Crypto Buying and selling 101.

Why Merchants Quick Bitcoin and Altcoins

Merchants brief Bitcoin and altcoins to reap the benefits of falling costs or to handle danger throughout unstable market circumstances. In a market the place costs can swing dramatically inside hours, shorting turns into a software not only for hypothesis but in addition for defense.

Some merchants brief crypto to revenue from downturns. In the event that they consider a coin is overvalued or a correction is due, they open brief positions to capitalize on the decline. Others use shorting as a hedging technique, offsetting potential losses from long-term holdings when the market turns bearish.

Shorting additionally performs a job in market effectivity. It helps stability excessive optimism by permitting merchants to specific damaging sentiment, which might stabilize costs and scale back bubbles. Briefly, merchants brief Bitcoin and altcoins to generate income when costs drop, shield their portfolios from draw back danger, and preserve flexibility regardless of which means the market strikes.

When Does Shorting Crypto Make Sense?

Shorting crypto is most sensible throughout clear downtrends or when a correction appears possible after speedy worth good points. It may also be helpful round main information occasions or financial shifts that might set off sell-offs. In calm or bullish markets, nonetheless, shorting normally carries extra danger than reward.

Keep Protected within the Crypto World

Discover ways to spot scams and shield your crypto with our free guidelines.

What Are the Elements to Think about for Quick Promoting?

Quick promoting Bitcoin and different cryptocurrencies will be worthwhile, however it carries important dangers. Earlier than deciding if it’s best for you, ask your self the next questions:

Are you able to deal with volatility?

Crypto markets are extremely unpredictable and unstable. Costs can transfer sharply inside minutes. Be trustworthy about whether or not you’ll be able to deal with the monetary and emotional stress of sudden swings.

Do you’ve a danger administration plan?

A strong technique ought to embody stop-loss and take-profit ranges to guard your capital. At all times plan your exits earlier than getting into a commerce.

Learn extra: Danger Administration in Crypto Buying and selling.

Do you utilize technical evaluation?

Indicators like RSI, MACD, and transferring averages assist determine overbought or oversold circumstances. They’re important instruments for timing brief entries.

Are you snug with leverage?

Leverage allows you to management a bigger place with borrowed funds, however it additionally magnifies losses. Solely use leverage should you absolutely perceive the dangers.

Do you keep knowledgeable concerning the market?

Crypto costs react rapidly to information, rules, and sentiment shifts. Sustain with developments that might impression your brief positions.

Have you ever accounted for charges and borrowing prices?

Shorting usually entails curiosity, funding charges, and buying and selling charges. At all times embody these in your revenue calculations.

Do you perceive the authorized surroundings?

Quick promoting guidelines and spinoff rules differ by nation. Examine what’s allowed in your jurisdiction earlier than buying and selling.

How Shorting Works in Crypto

Briefly (no pun supposed): You borrow → promote excessive → await a dip → purchase low → return the asset → and hold the revenue.

That’s the essential stream of how shorting works in crypto—easy in idea, however dangerous in observe, particularly in fast-moving markets. Right here is identical course of in somewhat bit extra element.

Step 1: Borrow the Cryptocurrency

To begin shorting, you borrow a cryptocurrency from an change or dealer. This normally occurs via a futures or margin buying and selling account, the place the platform lends you the asset in change for collateral. The borrowed cash stay on mortgage till you shut your place.

Please be aware that to open a leveraged brief, it’s essential to deposit collateral, additionally referred to as the preliminary margin. It acts as a safety deposit to cowl potential losses. The change will observe your margin stability all through the commerce to make sure you can meet obligations if the market strikes in opposition to you.

Step 2: Promote the Cash on the Present Value

As soon as borrowed, you promote the cryptocurrency on the present market worth. This converts your place into money or stablecoins. For instance, if Bitcoin trades at $100,000, you promote the 1 BTC you borrowed for that quantity, anticipating the value to say no quickly.

Step 3: Anticipate the Value to Drop

After promoting, you await the market to maneuver in your favor. In case your prediction is appropriate and the asset’s worth falls, your brief place turns into worthwhile. Throughout this time, merchants usually monitor technical indicators—like RSI, MACD, and transferring averages—to gauge momentum and potential reversals.

Step 4: Purchase Again the Cash at a Decrease Value

When the value drops to your goal stage (for instance, from $60,000 to $40,000) you purchase again the identical quantity of crypto you initially bought. This step closes your place and locks within the worth distinction as potential revenue.

Step 5: Return the Cash and Maintain the Revenue

Lastly, you come the borrowed cryptocurrency to the change or lender. The revenue equals the distinction between your promoting and shopping for costs, minus any charges, funding charges, or curiosity charged on the borrowed funds.

Methods to Quick Crypto: Full Breakdown

There’s multiple method to guess in opposition to the market in crypto. Some merchants favor direct strategies like margin or futures buying and selling, whereas others use contracts or prediction platforms to revenue from falling costs with out holding the cash themselves. Every methodology works a bit in a different way, with its personal mixture of danger, complexity, and reward potential.

Shorting with Margin Buying and selling

One of many best methods to brief Bitcoin, the margin buying and selling technique permits you to use leverage, that means you’ll be able to borrow extra money from the change than you’ve deposited in your account. Whereas this opens up doorways for larger earnings, it’s naturally riskier, too—your place might shut prior to you anticipated should you’re partaking in leveraged shorting.

Learn extra: Margin Buying and selling in Crypto

There are two predominant methods to handle margin: cross margin and remoted margin. With cross margin, all obtainable funds in your account again each open place, spreading each danger and collateral throughout trades. In distinction, remoted margin retains collateral locked to at least one place solely—defending the remainder of your account if that commerce fails. Newcomers usually favor remoted margin as a result of it limits potential losses to a single commerce.

Shorting with Futures and Perpetual Contracts

Similar to different belongings, Bitcoin has a futures market. In a futures commerce, you primarily agree to purchase crypto on-line—in our case, BTC—on the situation that it is going to be bought later at a predetermined worth. This settlement is known as a futures contract.

Nevertheless, it’s additionally potential to promote futures contracts. On this case, you’ll be capable of profit from the asset’s worth dropping, in contrast to when shopping for the contracts.

Shorting with Binary Choices

Binary choices buying and selling permits you to guess on “sure or no” situations. This monetary product offers consumers with the choice however not the duty to finish the deal. You mainly guess on whether or not an asset’s worth will go up or down. To brief promote crypto utilizing this methodology, you buy put choices.

Binary choices buying and selling affords nice flexibility and higher-than-usual leverage. We might advise in opposition to partaking in it except you’re an professional dealer.

Shorting with CFDs (Contract for Distinction)

Contracts for distinction, or CFDs, let merchants speculate on crypto worth actions with out proudly owning the asset itself. Whenever you open a CFD brief place, you’re agreeing to pay the distinction between the opening and shutting worth of the commerce. If the value drops, you revenue from the decline, and if it rises, you incur a loss.

CFDs are broadly used on conventional buying and selling platforms and are in style for shorting crypto as a result of they’re easy to execute and don’t require direct borrowing. Nevertheless, they usually contain in a single day financing charges and are usually not obtainable in all jurisdictions, together with the US.

Shorting with Prediction Markets

Prediction markets are just like sports activities betting companies. Such platforms haven’t been round within the crypto trade for a very long time, however they current a great way to brief Bitcoin. They permit you to make a wager on a selected end result, similar to “Bitcoin goes to fall by 10% subsequent week.” If anyone takes you up on the guess, you can also make fairly a hefty revenue.

Dangers of Shorting Cryptocurrency

Whenever you brief, you’re betting in opposition to the underlying asset, hoping its worth will fall. But when the market strikes upwards as a substitute, your losses can develop quick, particularly in a market identified for excessive worth volatility. Add leverage, change dangers, and unpredictable information occasions, and shorting turns into a technique that calls for strict self-discipline and consciousness.

Liquidation Defined

Liquidation occurs when the worth of your collateral drops too low to cowl your open brief place. The purpose at which this happens is known as the liquidation worth. Exchanges use a mark worth—a good worth derived from the common of main markets—to determine when a liquidation ought to set off, serving to stop unfair closures attributable to short-term worth spikes. The mark worth is normally based mostly on an index worth, which tracks real-time knowledge from a number of exchanges to replicate the asset’s true market worth.

In leveraged buying and selling, exchanges robotically shut your commerce to forestall additional losses. For instance, if Bitcoin’s worth jumps sharply after you brief it, your place may be liquidated at the next worth, leaving you with nothing however the lack of your margin. Understanding how liquidation thresholds work is essential to managing danger.

Margin Calls and How They Work

Exchanges use a upkeep margin requirement to outline the minimal stability it’s essential to hold to carry an open place. When your account worth drops under that threshold, you’ll obtain a margin name. In the event you don’t add extra collateral, the platform can shut your commerce robotically to forestall additional losses.

A margin name is a warning that your account now not holds sufficient collateral to assist your commerce. When this occurs, the change asks you to deposit extra funds to maintain your brief place open. In the event you don’t prime up your margin in time, the platform might liquidate your belongings robotically. Staying above the required margin stage is crucial to keep away from compelled losses throughout sudden market strikes.

How Leverage Multiplies Danger

Leverage permits merchants to borrow funds and management positions bigger than their preliminary deposit. Whereas this boosts potential earnings, it additionally amplifies losses. A small worth improve within the underlying asset can erase your margin fully. As an example, with 10x leverage, a ten% transfer in opposition to you ends in a complete loss. Newcomers ought to use minimal or no leverage till they absolutely perceive the way it impacts brief trades.

Learn extra: Crypto Leverage Buying and selling

Market Volatility and Information Occasions

Crypto markets are famously unpredictable. Information about rules, change hacks, ETF approvals, or perhaps a single tweet can ship costs hovering or crashing inside minutes. As a result of shorting depends on worth route, surprising occasions can rapidly flip a worthwhile commerce into a serious loss. At all times set stop-loss orders and keep alert to market-moving headlines.

Quick Squeeze

A brief squeeze occurs when closely shorted belongings out of the blue rise in worth, forcing merchants to shut positions by shopping for again the asset. This rush to cowl drives the value even larger, amplifying losses for remaining shorts. In crypto, squeezes usually happen throughout sudden rallies or low-liquidity durations, making danger management and stop-loss orders much more vital.

Alternate Danger (Hacks, Outages, Rules)

Even should you predict the market accurately, exterior dangers can derail your commerce. Exchanges can undergo hacks, technical outages, or sudden regulatory actions that freeze accounts or liquidate positions. To cut back this danger, commerce solely on respected platforms with robust safety, clear insurance policies, and a strong observe file. Maintaining funds on the change for the shortest time potential additionally limits publicity.

Finest Shorting Methods for Newcomers

Shorting will be intimidating at first, however just a few easy methods could make it safer and extra manageable. The objective is to manage danger, commerce with the pattern, and keep disciplined—particularly in unstable markets.

- Begin small with low leverage. Use minimal leverage (1–3x) and small positions till you’re assured with brief setups.

- Commerce with the pattern. Give attention to belongings already exhibiting clear downwards momentum as a substitute of attempting to catch the highest.

- Anticipate affirmation. Enter solely after bearish indicators, like a break under assist or rejection at resistance.

- Set stop-loss and take-profit ranges. When getting into a brief, you should utilize a restrict order to set the precise worth the place you wish to promote. This helps you keep away from getting into at a worse worth throughout unstable market strikes. At all times plan exits upfront to guard your capital and lock in good points.*

- Watch funding charges and charges. Borrowing prices and perpetual funding can scale back earnings; issue them into each commerce.

- Keep away from main information occasions. Sudden headlines can set off sharp reversals that wipe out brief positions.

*A market order, alternatively, executes immediately at the perfect obtainable worth. It’s quicker however can expose you to larger prices throughout sudden worth swings. The distinction between the value you anticipate and the value you really get is known as slippage. It tends to extend in low-liquidity or fast-moving markets.

Widespread Errors to Keep away from

Shorting within the cryptocurrency market will be rewarding, however small errors can result in large losses, particularly when buying and selling derivatives or utilizing leverage. Keep away from these widespread pitfalls to guard your capital and commerce smarter.

Utilizing Too A lot Leverage

Excessive leverage magnifies each good points and losses. A small transfer in opposition to your place can set off liquidation. Begin with low leverage and give attention to consistency, not fast wins.

Ignoring Cease-Loss Orders

Skipping stop-loss orders is among the quickest methods to empty an account. At all times set stops to outline danger and stop emotional decision-making throughout unstable swings.

Shorting in a Bull Market

Shorting in opposition to robust upwards momentum is dangerous. When buying and selling quantity and sentiment are bullish, costs can surge larger earlier than correcting, wiping out brief positions.

Selecting the Mistaken Platform

Not all exchanges deal with brief trades equally. Choose a platform with excessive liquidity, robust safety, and clear funding phrases to make sure clean execution and honest pricing.

Not Understanding Charges and Funding Charges

When shorting derivatives, prices add up: Borrowing charges, funding charges, and buying and selling commissions can eat into earnings. At all times calculate these bills earlier than opening an extended or brief place.

Authorized and Regulatory Concerns

Crypto regulation strikes quick, particularly now that authorities pay even nearer consideration to the market. There have been many efforts to make buying and selling safer and extra clear. Earlier than opening a brief, it’s price understanding which guidelines apply and the way they could have an effect on the place and what you’ll be able to commerce.

- Federal laws is advancing. The GENIUS Act provides the primary main US regulation regulating stablecoins, setting clear reserve-backing and audit requirements.

- Regulatory authorities are clarifying oversight. The Commodity Futures Trading Commission (CFTC) issued a “Request for Remark” on perpetual futures—a key spinoff automobile for shorting crypto.

- Trade participation should meet compliance requirements. Platforms providing buying and selling derivatives on digital belongings must contend with overlapping scrutiny from each the Securities and Alternate Fee (SEC) and CFTC, relying on asset classification.

- International and platform-specific guidelines matter. Prediction markets, margin buying and selling, and different fashions of shorting crypto could also be topic to native licensing, anti-fraud, and platform registration necessities.

So what must you do?

- Confirm that any change or dealer you utilize is licensed for derivatives in your jurisdiction.

- Perceive how your commerce (futures, perpetual, CFD) is regulated and what protections apply.

- Remember that regulatory modifications can have an effect on charges, eligible customers, or the very capability to open brief positions.

Last Ideas

Shorting crypto will be highly effective when used with self-discipline and clear danger controls. Begin small, learn the way completely different devices work, and deal with each commerce as an opportunity to grasp market habits. As you acquire expertise, you’ll see that profitable shorting isn’t nearly predicting a drop. It’s about studying momentum, managing leverage, and staying calm when the market turns.

FAQ

How a lot cash ought to I begin with when attempting my first brief commerce?

Begin small, with simply sufficient crypto to check your technique and handle danger comfortably. Many merchants start with an quantity they will afford to lose whereas studying how brief and lengthy positions react to Bitcoin worth swings.

Is it higher to brief Bitcoin or altcoins as a newbie?

Bitcoin is usually extra liquid and fewer unstable than most altcoins, making it simpler for freshmen to grasp how merchants guess on market tendencies. Altcoins can provide greater strikes but in addition carry larger danger.

Can I lose greater than I make investments when shorting crypto?

Sure. As a result of a coin’s worth can rise indefinitely, losses on a brief place are theoretically limitless. At all times use stop-loss orders and low leverage to manage potential draw back.

What indicators or indicators do merchants use to determine when to brief?

Merchants watch market tendencies and technical indicators similar to RSI, MACD, and transferring averages to identify overbought circumstances. These indicators assist them time entries when momentum exhibits a possible reversal in bitcoin worth or different belongings.

Learn extra: The Finest Indicators for Crypto Buying and selling

Disclaimer: Please be aware that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.