Tech giant to launch crypto wallet, fintech L1s will bomb: Dragonfly exec.

A Huge Tech firm will combine a crypto pockets in 2026, and extra Fortune 100 corporations will begin their very own blockchains, crypto VC agency Dragonfly’s managing accomplice Haseeb Qureshi has predicted.

He additionally tipped that fintechs launching L1s to compete with public chains like Ethereum and Solana will fail to draw sufficient customers.

In a publish to X on Monday, Qureshi stated a lot of the Fortune 100 adoption is prone to come from the banking and fintech sectors, with many leveraging the Avalanche blockchain and present crypto toolkits like OP stack, Orbit, and ZK Stack. The setup would allow these networks to extra non-public and permissioned whereas remaining related to a public blockchain.

Supply: Haseeb Qureshi

Various Fortune 100 corporations within the monetary providers business have already constructed non-public blockchains, together with JPMorgan, Financial institution of America, Goldman Sachs, and IBM — although many of those options are nonetheless within the testing section or have solely been utilized in restricted methods.

Earlier this month, crypto funding agency Galaxy Digital predicted at the least one Fortune 500 financial institution, cloud supplier, or eCommerce platform would launch a layer 1 blockchain that settles greater than $1 billion of actual financial exercise in 2026 and construct a bridge for decentralized finance entry.

Qureshi additionally believes one of many Huge Tech corporations that dominate on-line life — probably Google, Meta, or Apple — will launch or purchase a crypto pockets in 2026 — a transfer that has the potential to onboard billions of customers into crypto.

Public fintech chains received’t threaten Ethereum’s dominance

Nonetheless, Qureshi isn’t bullish on new L1 blockchains constructed by fintech corporations — arguing that they received’t entice adequate customers or seize sufficient community exercise to problem crypto-native networks like Ethereum and Solana.

“Regardless of the thrill across the current crop of fintech chains, their metrics will underwhelm.” Day by day energetic addresses, stablecoin flows, and RWAs—Tempo, Arc, and Robinhood Chain will underdeliver, whereas Ethereum and Solana will overdeliver.”

“Finest builders will proceed to construct on impartial infra chains,” Qureshi added.

Bitcoin to prime $150K however lose market share

With regards to value forecasts, the Dragonfly govt expects Bitcoin to commerce above $150,000 by the top of 2026, however suggestions that Bitcoin dominance will fall.

Galaxy Digital took a tough cross on making a stable prediction and stated 2026 can be “too chaotic” to even guess, as the worth may vary wherever between $50,000 and $250,000 by the top of subsequent 12 months.

In the meantime, Qureshi expects the $312 billion stablecoin market to develop by 60% in 2026, with the present market chief Tether (USDT) seeing its dominance drop from 60% to 55%.

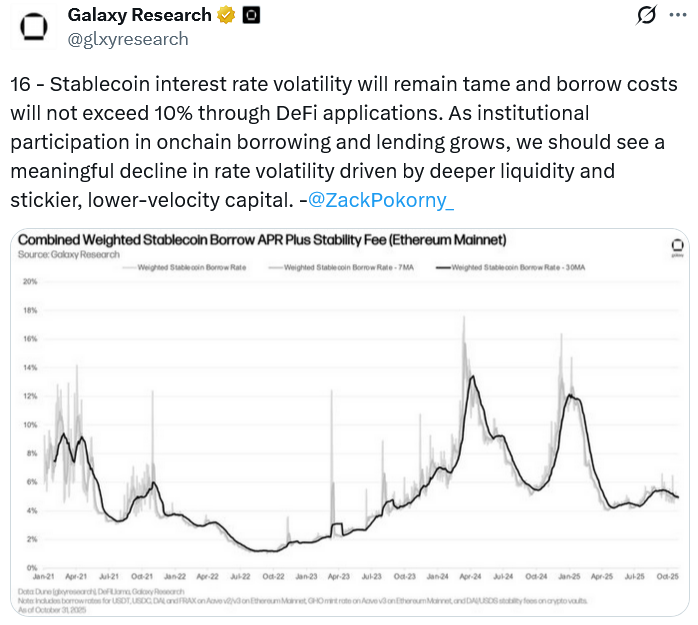

Supply: Galaxy Digital

Qureshi bullish on prediction markets, however not AI in crypto

Prediction markets will proceed to growth subsequent 12 months, however AI received’t discover a use case in crypto past safety, Qureshi stated.

“AI brokers will nonetheless not be ‘paying one another’ or spending any significant cash in 2026,” Qureshi stated, whereas additionally predicting that no efficient answer will emerge to curb spambot proliferation on social platforms.