Fidelity’s Timmer: Bitcoin wallet growth stalls – A warning for crypto adoption?

- Bitcoin rebounds to $88K after a significant droop, however pockets progress stays stagnant.

- Constancy analysts query Bitcoin’s risk-adjusted returns in comparison with the S&P 500.

Bitcoin [BTC] is regaining its bullish momentum after a big downturn that noticed its value plummet to a low of $78K following a peak of $109K.

Because the main cryptocurrency makes a powerful restoration, issues stay about its underlying community progress.

Jurrien Timmer weighs in

Jurrien Timmer, Director of World Macro at Constancy Investments, pointed out that BTC’s pockets depend has proven minimal enlargement over the previous yr.

This raises questions on whether or not the most recent value surge is fueled by natural adoption or short-term market hypothesis.

Timmer attributes Bitcoin’s stagnant pockets progress to the approval of U.S.-based spot exchange-traded funds (ETFs) and MicroStrategy’s aggressive accumulation technique.

He explains that institutional patrons, in contrast to retail traders, require just a few wallets to handle substantial holdings, limiting the obvious enlargement of the community.

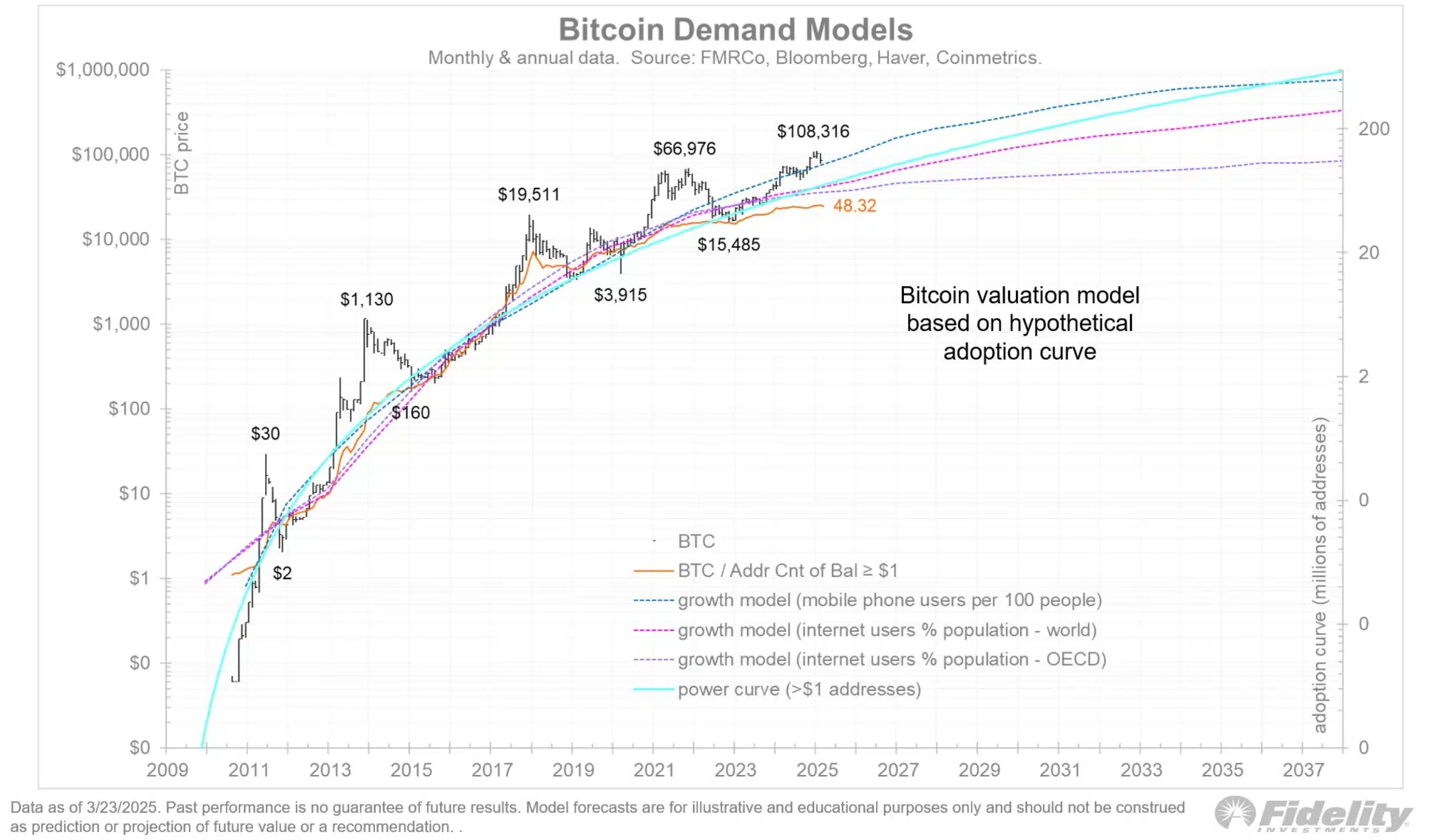

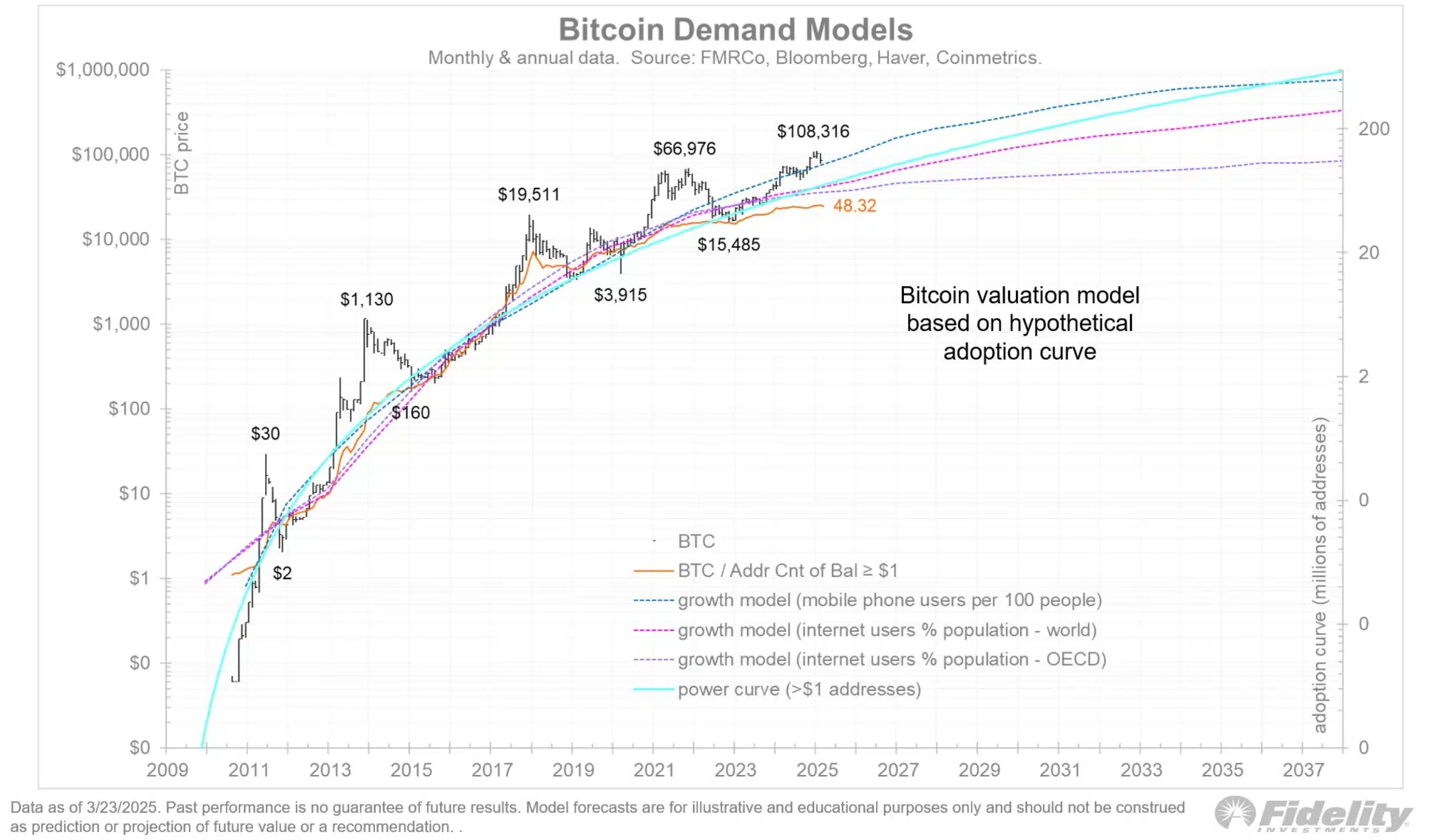

Regardless of this, Timmer stays assured in BTC’s long-term trajectory, noting that its adoption follows the S-curve seen in different exponential applied sciences.

The ability regulation mannequin

Moreover, Bitcoin’s valuation adheres to the facility regulation mannequin, the place its worth will increase as extra members have interaction with the community, reinforcing its long-term potential.

Taking to X, Timer added,

“Sadly, this can make it harder to trace the adoption curve going ahead.”

Supply: Jurrien Timmer/X

Including to the fray, Sina, co-founder at 21stCapital, famous,

“Good take. Pockets addresses are deviating from the decade-long pattern.”

Bitcoin vs. shares

Moreover, Chris Kuiper, director of analysis at Constancy Digital Belongings, additionally highlighted Bitcoin’s underwhelming efficiency in comparison with conventional markets over the previous 4 years.

Whereas Bitcoin has recorded a 17% compound annual progress charge (CAGR), the S&P 500 isn’t far behind at 13%.

Nevertheless, when factoring in risk-adjusted returns, BTC falls quick, as traders have confronted practically 4 occasions the volatility for under a touch greater return.

This additional raised issues about Bitcoin’s risk-reward profile, particularly for institutional traders searching for extra steady but aggressive funding alternatives.

Kuiper mentioned,

“So this explicit 4-year interval has thus far underperformed the earlier cycles. If we actually did peak earlier this yr, then this will likely be fairly the disappointing cycle.”

Kuiper acknowledges the potential for an prolonged market cycle, suggesting that BTC’s trajectory might not observe previous patterns rigidly.

Bitcoin’s present value motion

Buying and selling at $88,036.11 at press time after a 0.64% day by day improve, Bitcoin has additionally recorded a strong 4.90% weekly acquire, in keeping with CoinMarketCap.

Notably, its latest breakout above the $86,800 resistance on twenty fourth March indicators renewed bullish momentum.

Subsequently, as Bitcoin continues to navigate market fluctuations, traders stay watchful for indicators of a sustained rally or potential corrections within the coming weeks.