Tether $1 Billion Boost Fuels Tron Surge: $0.40 In The Crosshairs

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Tron (TRX) is retaining its place after a tumultuous weekend within the basic crypto area. The token stays near $0.24, recording a negligible decline of solely 0.91% during the last day. Whilst there may be tame value motion, analysts are in shut statement on the lookout for indications of a possible breakout, with $0.40 now making an look.

Associated Studying

Value Caught Between Main Ranges

TRX has been consolidating between $0.21 and $0.2551. The sideways value motion has gone on for a number of weeks, after plummeting from $0.45 all the best way to $0.21 on the finish of final yr. The token seems to be steadying because the fall. At current, the consumers are exhibiting resilience on the $0.24 mark, which coincides with the 50-day Exponential Transferring Common (EMA).

Three of the numerous EMAs — the 50-day, 100-day, and 200-day — are additionally in a bullish alignment, which additional helps the notion that the token might be positioning for a robust transfer upward. The longer TRX stays above these assist strains, the larger the percentages are that it’ll escape of this vary.

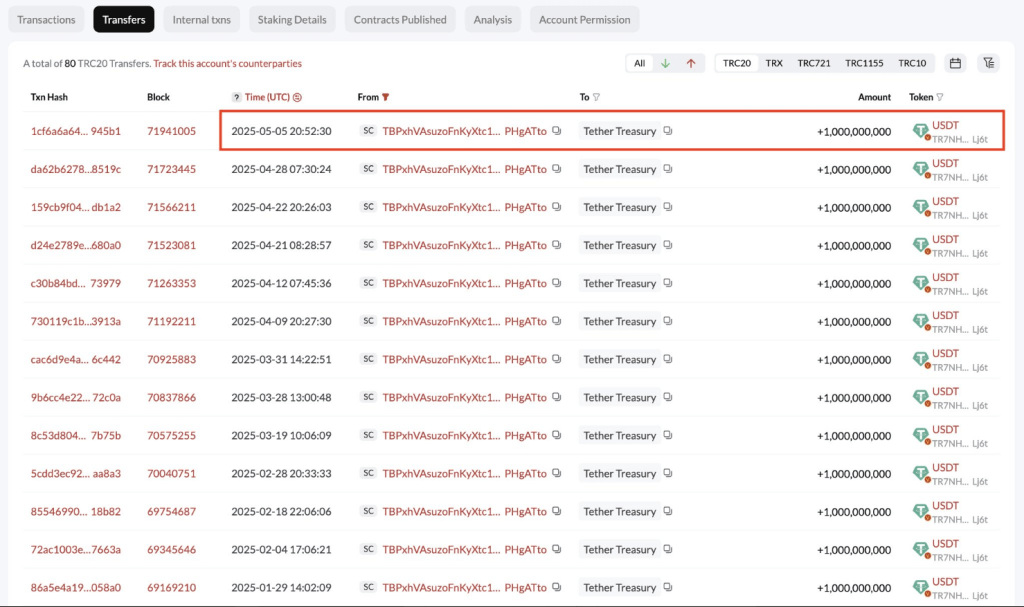

Tether minted an extra 1B $USDT on Tron ~4 hours in the past!

Since April 28 (8 days in the past), #Tether has minted 4B $USDT on each #Ethereum and #Tron.

Comply with @spotonchain for extra updates now! https://t.co/SeKwCj1byN pic.twitter.com/xxPA6IosmB

— Spot On Chain (@spotonchain) May 6, 2025

Momentum Indicators Counsel Rising Energy

From a technical perspective, the Transferring Common Convergence Divergence (MACD) is indicating a attainable change. The MACD and sign line are transferring shut to one another within the constructive space. This usually signifies rising momentum.

If buy quantity units in, analysts predict TRX will breach the $0.2551 ceiling and transfer in direction of $0.28, which is the place the 23.6% stage lies on a trend-based Fibonacci retracement. If issues proceed to construct steam from there, TRX will transfer as excessive because the 50% Fibonacci stage at $0.39 — just under the much-hyped $0.40 stage.

1 Billion USDT Minted On Tron

Help for the bullish argument can be rising from inside the Tron ecosystem. Tether has created an additional $1 billion USDT on the Tron blockchain. Tether has created 4 billion USDT on Ethereum and Tron mixed since April 28.

TRX value up within the final week. Supply: Coingecko

New minting of USDT tends to point elevated market exercise. As these tokens are utilized for buying and selling, swapping, and transferring capital, further USDT on Tron may translate to larger demand for TRX. It’s not sure, however it’s a signal to contemplate.

Associated Studying

Chain income:👇$SOL 41.72%$TRX 24.56$ETH 16.4%$BTC 7.4% pic.twitter.com/kvVcvpkJT8

— Ted (@TedPillows) May 5, 2025

Tron Exercise Surpasses Ethereum In Income

In accordance with statistics reported by analyst Ted Pillows, Tron’s portion of the general community financial worth is almost 25%. Solana alone can be nearing 42%. But in a shocking flip, Tron’s income chain is now larger than Ethereum‘s at 16% of whole community income.

In accordance with TronScan, the variety of whole accounts on the community can be rising. As of now, there are greater than 304 million accounts. The overall worth locked (TVL) throughout Tron’s platforms has crossed the $20 billion mark.

Whether or not TRX reaches $0.40 anytime quickly could have one thing to do with the way it acts across the $0.25 resistance stage. For the time being, value motion, technical indications, and ecosystem exercise all look like pointing in the identical path.

Featured picture from Gemini Imagen, chart from TradingView