The Inside Scoop On The Massive $500 Million Weekly Flight

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has seen a major exodus from centralized exchanges in current weeks, with knowledge suggesting a rising desire for holding the asset outdoors of buying and selling platforms.

On the time of writing, ETH was trading at $2,289, down 0.7% within the final 24 hours, however managed to achieve 1.6% within the final week, knowledge from Coingecko reveals.

Ethereum Outflow Hits $1.2 Billion

Based on blockchain analytics agency IntoTheBlock, a staggering $500 million price of ETH exited exchanges final week, contributing to a complete outflow of $1.2 billion for your complete month of January. This represents a significant shift in comparison with earlier months, elevating questions concerning the motivations behind this pattern.

$500M in $ETH was withdrawn from CEXs this week, including to a complete of over $1.2B in outflows within the final month pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

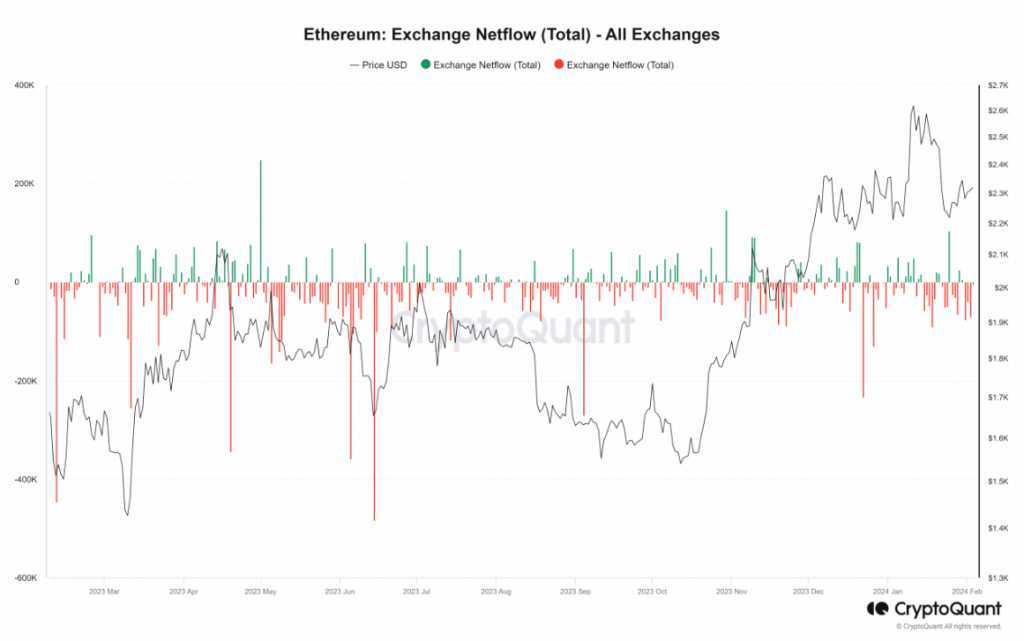

CryptoQuant knowledge paints a fair starker image, showcasing a dominant sample of outflows for the reason that starting of January. The chart reveals a persistent decline in change holdings, with the final influx recorded on January thirtieth. On the time of writing, the outflow continues unabated, with over 3,000 ETH leaving exchanges each hour.

Nevertheless, the influence on general change provide will not be totally uniform. Whereas the overall quantity of ETH held on exchanges initially elevated in January, reaching round 10.7 million by mid-month, it subsequently dipped to 10.3 million by January twenty eighth. At the moment, the provision has resumed an upward pattern, sitting at round 10.6 million.

Binance ETH Exodus: Traders’ Strategic Strikes

Apparently, the historic stability of ETH on Binance, the world’s largest cryptocurrency change, tells a distinct story. Regardless of the general uptick in change holdings, Binance has witnessed a constant decline in its ETH stability all through January. From a peak of over 3.9 million ETH on January twenty third, the stability has shrunk to round 3.7 million, indicating that customers are actively withdrawing their Ethereum from the platform.

Ethereum at present buying and selling at $2,288.5 on the each day chart: TradingView.com

Whereas the precise causes behind this pattern stay unclear, a number of attainable interpretations emerge:

- Elevated Investor Confidence: Transferring ETH off exchanges might sign a rising sentiment amongst buyers to carry the asset for the long run, doubtlessly pushed by confidence in its future potential. Moreover, some buyers is perhaps transferring their ETH to DeFi platforms for staking or yield farming alternatives.

- Market Uncertainty: The current outflows might additionally replicate broader issues about market volatility or potential regulatory modifications, prompting buyers to hunt safer storage for his or her holdings.

- Binance-Particular Dynamics: The decline on Binance is perhaps because of elements particular to the change, corresponding to person preferences for different platforms or modifications in its buying and selling charges or insurance policies.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site totally at your personal threat.