There’s WAY less Bitcoin available than you’d think. Here’s why that’s a very good thing…

TL;DR

-

We beat you over the top with this equation, loads, however it bears repeating – as a result of it is the principle motive Bitcoin goes up over time: Lowered provide + elevated demand = elevated worth.

-

We’ve 19.51M BTC in existence, 14.85M of that are both being held long run, or misplaced eternally…That leaves us with 4.66M BTC (~$124B price) available for purchase and commerce.

-

If the oldsters at BlackRock have been to get their Bitcoin ETF authorized, and allotted simply 1.25% of their complete property below administration to the ETF (property which complete ~$10 trillion)…There would actually be no extra Bitcoin out there to buy.

Full Story

We beat you over the top with this equation, loads, however it bears repeating – as a result of it is the principle motive Bitcoin goes up over time:

Lowered provide + elevated demand = elevated worth.

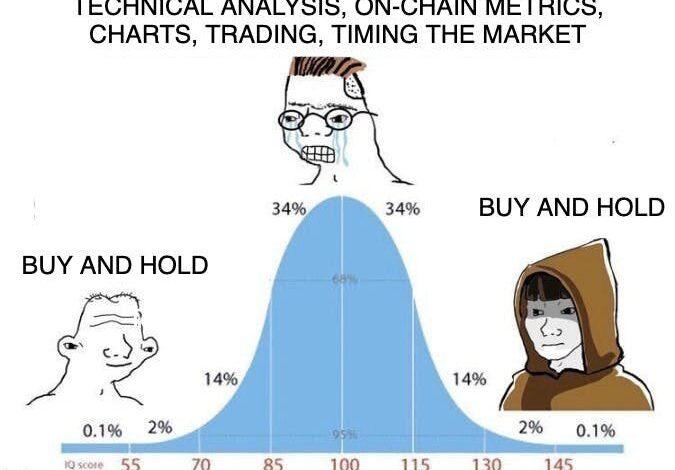

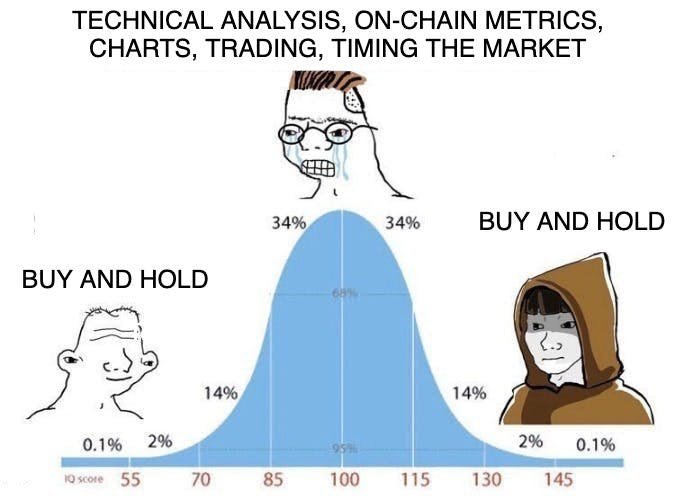

Certain, it is easy. Stupidly easy. However idiocy and genius are sometimes one-and-the-same in crypto (see header picture ☝️).

What we wish to speak about right this moment is the primary a part of that equation, the bit about ‘lowered provide.’

As a result of proper now, the next is true:

19.51M BTC are in existence.

14.85M of these are owned by long-term holders (aka of us which have held their BTC for 155 days or extra).

And in line with Chainalysis – 5.25M BTC of that 14.85M BTC that are not ‘long-term holds,’ as a lot as they’ve been ‘misplaced eternally.’

So. We’ve 19.51M BTC in existence, 14.85M of that are both being held long run, or misplaced eternally…

That leaves us with 4.66M BTC (~$124B price) available for purchase and commerce.

That ain’t a lot!

And it means Bitcoin goes to be far more delicate to any will increase in demand than you would possibly suppose.

All we want now could be an uptick in demand…which is probably not far off. For instance:

If the oldsters at BlackRock have been to get their Bitcoin ETF authorized, and allotted simply 1.25% of their complete property below administration to the ETF (property which complete ~$10 trillion)…

There would actually be no extra Bitcoin out there to buy.

And because the principle goes: lowered provide + elevated demand = elevated worth.

Very thrilling!