These Bitcoin holders briefly experienced pain – Here’s what happened

- Bitcoin’s LTH-SOPR lately fell below 1.

- This confirmed that the coin’s long-term holders briefly offered at a loss.

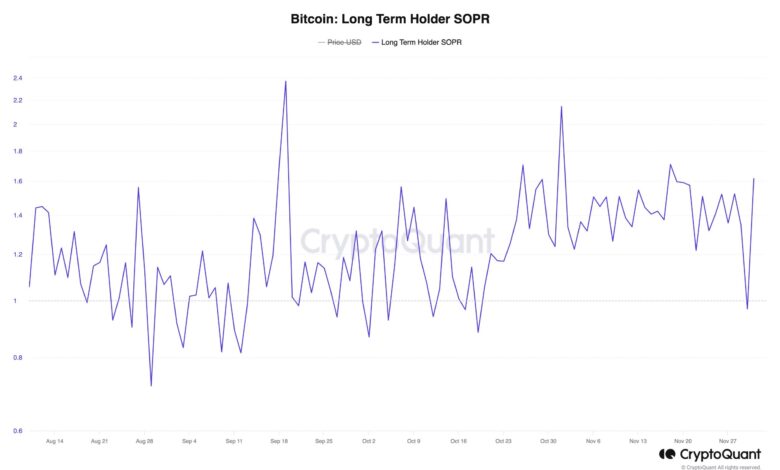

Bitcoin’s [BTC] Spent Output Revenue Ratio (SOPR) for its long-term holders (LTH) lately slipped beneath 1. This indicated that this cohort of buyers briefly offered their holdings at a loss.

Lengthy-Time period Holder Spent Output Revenue Ratio (LTH-SOPR) is a metric used to gauge the profitability of long-term holders of a crypto asset. It presents insights into whether or not buyers who’ve held a selected asset for over twelve months are in a worthwhile place or in any other case.

When this metric returns a price above 1, it signifies that BTC long-term holders, on common, are promoting their cash at a revenue. Conversely, when it falls beneath 1, it means that these holders are promoting at a loss.

The small print

AMBCrypto discovered that on thirtieth November, the LTH-SOPR fell to 0.96. It then reclaimed its place above the zero line.

At press time, this metric stood at 1.61. This advised that that buyers who’ve held BTC for over 12 months have been again to buying and selling at a revenue.

As for the coin’s short-term holders, in a latest report, pseudonymous CryptoQuant analyst Crypto Hell famous that their SOPR can also be “dipping near 1.”

“On this consolidated value scenario, tons of merchants push themselves into spot or spinoff markets. If their evaluation goes unsuitable, it’s losses. That might drop the STH-SOPR ratio, indicating short-term merchants promoting at a loss.”

In keeping with the analyst, a constant decline within the SOPR of the 2 lessons of buyers usually ends in a decline in BTC’s value.

“Looks like if we take a look at each ratios the place they’re okay with promoting at a loss, it hints at a correction in the direction of $33,000,” the analyst opined.

Value at 18-months excessive

Through the buying and selling session on 1st December, BTC’s value rallied above $38,000 for the primary time since Might 2022. At press time, the main cryptocurrency exchanged palms at $38,800, based on knowledge from CoinMarketCap.

The sudden value hike above $38,000 resulted within the liquidations of some brief positions on the coin’s futures market.

Learn Bitcoin’s [BTC] Price Prediction 2023-24

Liquidation knowledge assessed by AMBCrypto confirmed that inside the final 24 hours, brief positions value $24 million have been liquidated.

With vital bullish sentiments current within the BTC market, its open curiosity has climbed by 8%, based on knowledge from Coinglass.