These Bitcoin metrics signal potential bull run as…

- Bitcoin’s Realized Cap stabilizes and reveals optimistic indicators, probably driving a bull run.

- BTC miners take pleasure in worthwhile returns whereas the cryptocurrency’s value experiences a slight loss in current buying and selling.

Bitcoin’s value has been on a rollercoaster experience recently, displaying indicators of volatility over the previous few months. Nevertheless, amidst these fluctuations, there have been some encouraging developments to notice.

Latest information prompt that BTC was experiencing a optimistic shift in one in all its essential metrics. This enchancment may probably play a major position in driving its bull run.

Bitcoin Realized Cap flashes optimistic

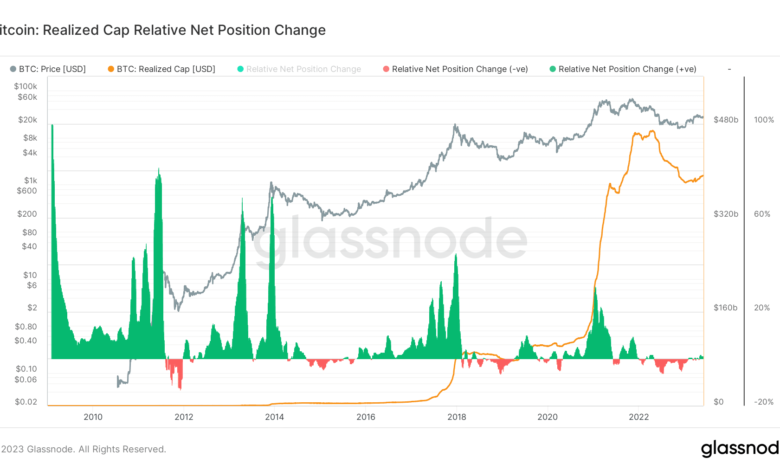

The Bitcoin Realized Cap, a vital metric in on-chain evaluation, holds important significance because it serves because the on-chain counterpart to Market Cap. It evaluates the worth of every coin in circulation primarily based on its final on-chain motion.

After experiencing a notable outflow of capital, the Bitcoin Realized Cap has now stabilized and is beginning to witness a web influx of capital as soon as once more.

Supply: Glassnode

Nevertheless, in comparison with earlier bull market situations, this pattern was nonetheless in its early phases, each when it comes to length and magnitude, as indicated by the current Glassnode chart. Analyzing the Web Place Change of the realized BTC market cap revealed that it was presently optimistic however fading.

As of this writing, the Relative Web Place change stood at roughly 1.19%. Furthermore, the Realized Cap remained constant at over $391.7 million for the previous month.

P.c Provide in revenue sees an uptrend

Because the Realized Cap confirmed optimistic developments after over a yr of being under it, the Bitcoin P.c Provide in Revenue additionally skilled some upward motion.

Analyzing the chart primarily based on Glassnode information, this metric initiated an upward pattern initially of the yr, reversing the decline noticed within the earlier yr.

As of this writing, the P.c Provide in Revenue stood at over 68.4% primarily based on the present spot value.

Supply: Glassnode

Whereas this signified a considerable revenue stage, it was nonetheless decrease than the degrees reached through the earlier yr earlier than the decline occurred.

BTC miners take pleasure in worthwhile returns

Bitcoin miners have been experiencing a good pattern in current weeks, having fun with optimistic momentum. Regardless of the prevailing market situations, Bitcoin miners have managed to keep up profitability.

In response to a current Glassnode chart, they collectively generated a noteworthy income of $24.1 million, which included earnings from the Block Subsidy and Transaction Charges. Contemplating an estimated manufacturing value of $19.1 million, this translated to a web revenue exceeding $5 million.

Supply: Glassnode

Given the sustained progress in transactions on the Bitcoin community and an upward trajectory in value, there was potential for the revenue margin to increase additional.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Bitcoin Every day timeframe chart

Following a modest upward motion in Bitcoin’s value in direction of the top of buying and selling on June 2nd, the cryptocurrency started the present buying and selling interval with a slight loss. As of this writing, it was buying and selling at roughly $27,220, reflecting a minor lower of lower than 1%.

The amount indicator indicated an absence of serious exercise in BTC’s motion, suggesting a comparatively quiet market.

Moreover, BTC was trapped in a bearish pattern, as indicated by its Relative Power Index (RSI) line, which remained under the impartial line.

Supply: TradingView