Theta surges 24% in 24 hours, hits 8-month high: Is $3.3 ahead?

- Theta has surged by 158.86% over the previous month.

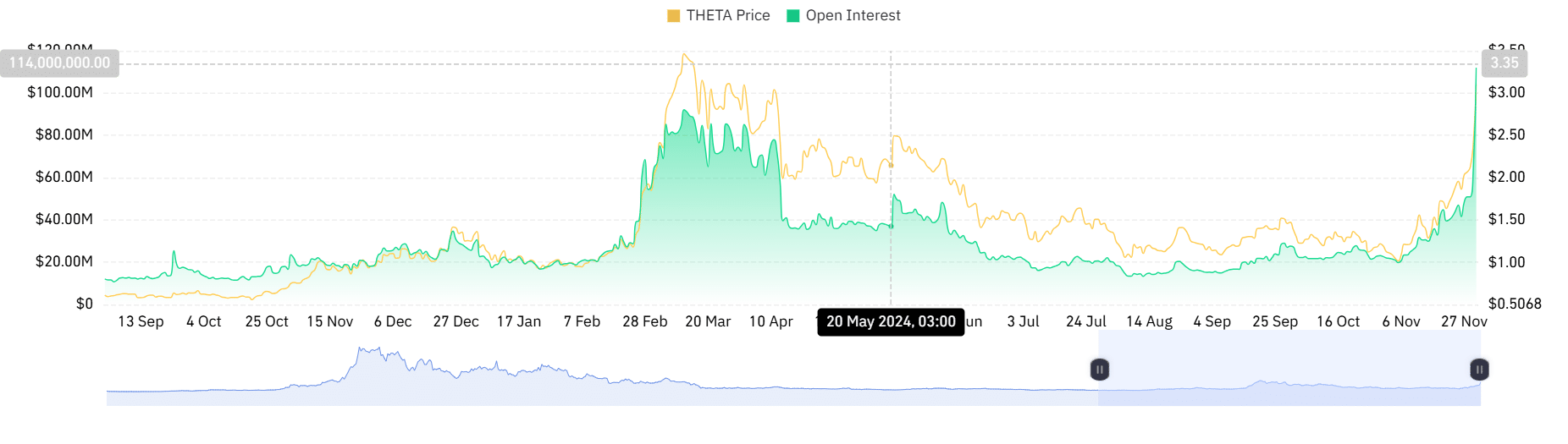

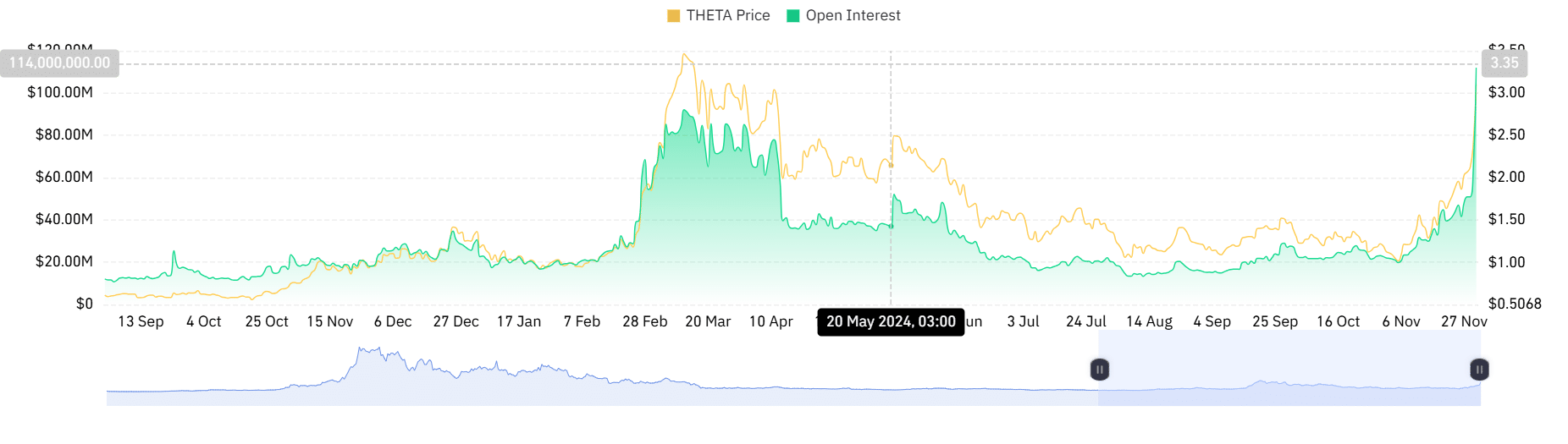

- The Futures Open Curiosity spiked over the previous 24 hours to a brand new ATH of $111.9 million.

Over the previous month, the Theta Community [THETA] has skilled a sustained uptrend. Since hitting a low of $1.25 earlier final month, the altcoin has surged to an 8-month of $3.1.

As of this writing, THETA was buying and selling at $2.8. This marked a 24.67% improve over the previous 24 hours. Equally, the altcoin has spiked on weekly and month-to-month charts, mountain climbing by 45.62% and 158.86% respectively.

However regardless of the latest value pump, THETA stays 81.91% beneath its ATH of $15.90. Nevertheless, the present market situation factors in the direction of rising demand and optimistic sentiment.

What THETA’s charts say

In accordance with AMBCrypto’s evaluation, THETA was experiencing sturdy demand and bullish sentiment at press time.

Per Santiment’s knowledge, the Weighted Sentiment spiked to 0.7 from a low of -0.1. This advised that the majority traders have been positively inclined, in comparison with these with unfavorable sentiment.

When optimistic sentiment is increased, it implies that the majority traders are betting on costs to rise.

Supply: Santiment

Moreover, AMBCrypto’s commentary of elevated demand was evidenced by the rising buying and selling actions. As such, over the previous 24 hours, buying and selling quantity has spiked by 442% to $682.33 million.

Supply: Coinglass

This demand is proven by the rising Open Curiosity. Over the previous 24 hours, Futures Open Curiosity has spiked to hit a brand new all-time excessive of $111.99 million.

Such a surge in Open Curiosity means that traders are actively opening new positions whereas present ones maintain their trades.

Supply: Coinglass

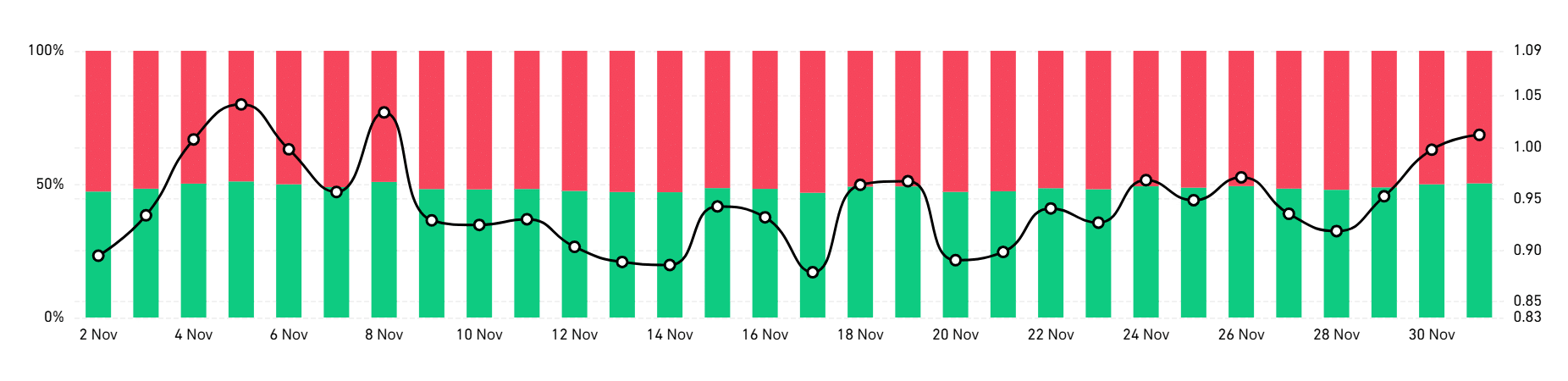

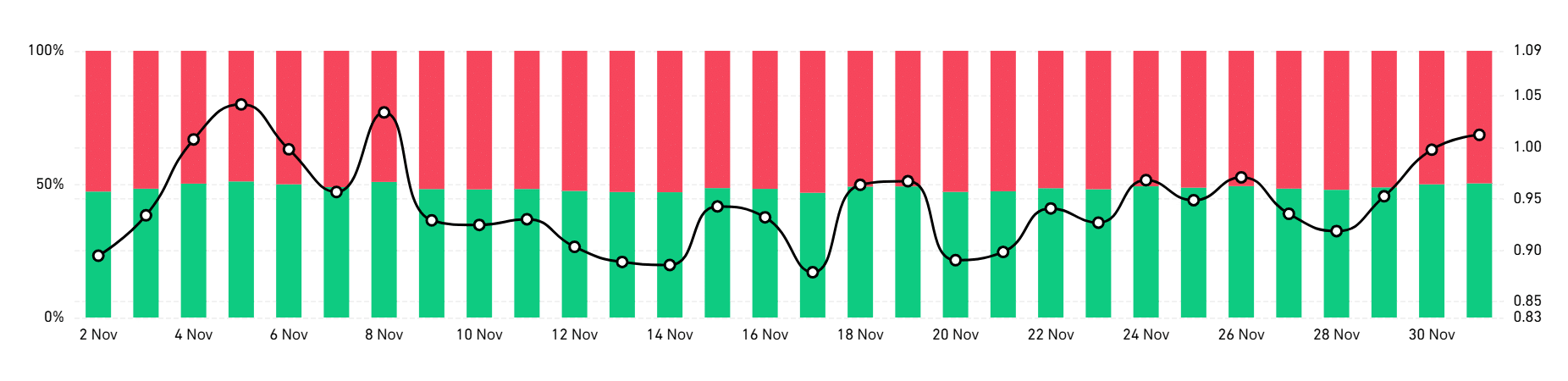

Considerably, these open positions are largely lengthy, in response to Coinglass. THETA’s Lengthy/Quick Ratio exhibits that lengthy place holders have been dominating the market.

This implied that the majority merchants have been betting on costs to rise.

Supply: TradingView

This bullishness is prevalent amongst patrons, as evidenced by THETA’s Advance Decline Ratio (ADR), which had elevated to 1.9. So, patrons have been dominant, which pushed costs to make extra good points.

This dominance amongst patrons has created a robust upward momentum, as evidenced by a rising RVGI.

Learn Theta Community’s [THETA] Value Prediction 2024–2025

What’s the subsequent transfer?

Merely put, THETA was experiencing a robust upward momentum at press time. As such, patrons have dominated the market, making a sustained bullish wave.

With the prevailing market situations, THETA may discover the subsequent vital resistance round $3.3. Subsequently, a market correction will see the altcoin retrace to $2.6.