This Bitcoin ratio is close to its 2021 ATH and why it matters?

- The BTC/Gold correlation remained weak at press time.

- Bitcoin surpassed Gold in traders’ portfolio allocation when adjusted for volatility.

Bitcoin’s [BTC] proponents have lengthy pitched it as a world retailer of worth, assuring traders assured returns over a while, no matter the state of the broader monetary market.

Properly, 2024 could be the 12 months that dramatically strengthens this narrative.

Digital Gold vs. Actual Gold

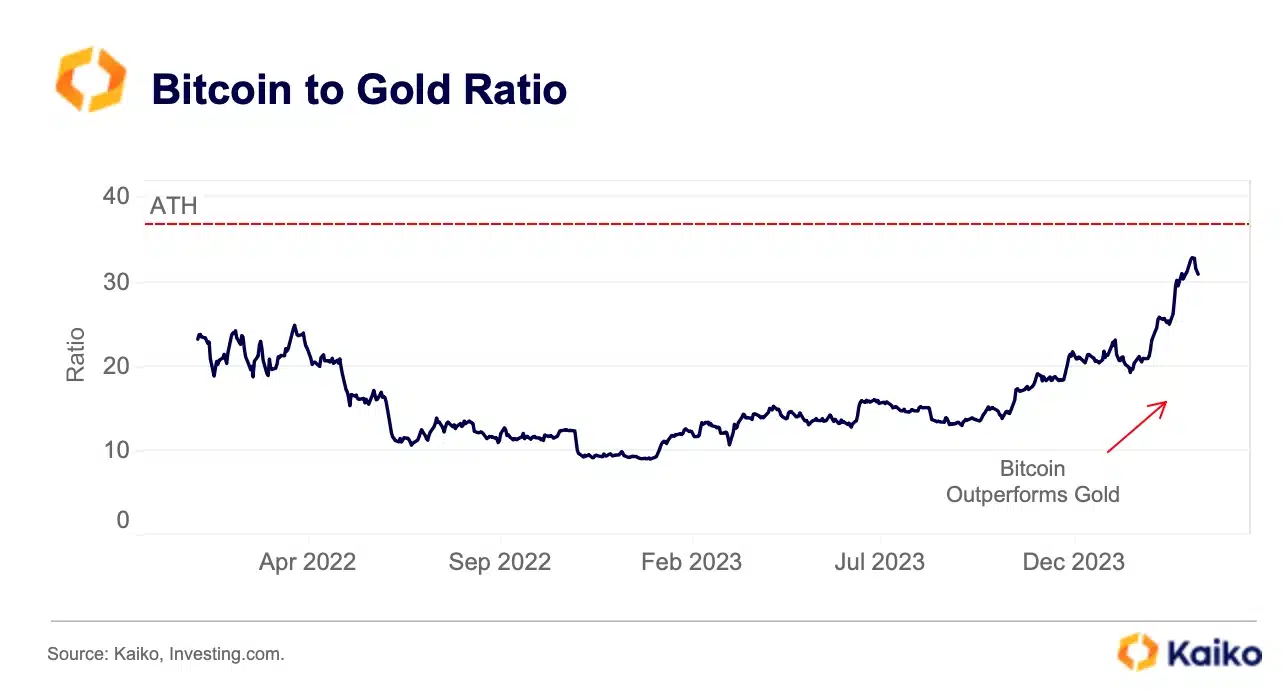

The Bitcoin to Gold ratio has risen sharply because the begin of the 12 months, and was transferring nearer to the all-time excessive (ATH) clocked in the course of the peak 2021 bull market, based on crypto market information supplier Kaiko.

The ratio, which measures the relative efficiency of the 2 property, underlined that the “Digital Gold” outperformed its real-world counterpart.

Supply: Kaiko

The world’s largest cryptocurrency has been bolstered by the launch of spot exchange-traded funds (ETFs) within the U.S. this 12 months.

In response to AMBCrypto’s evaluation of SoSo Value information, inflows into spot ETFs have hit $12 billion since their itemizing in January.

The hovering demand despatched Bitcoin previous its ATH earlier this month, and greater than 50% increased because the begin of the 12 months.

However, the yellow steel may simply grow 4.71% year-to-date (YTD), though it additionally hit its peak of $2,179 per ounce not too long ago.

Furthermore, in contrast to Bitcoin, physically-backed Gold ETFs have witnessed web outflows of late, as per World Gold Council.

Is Bitcoin changing Gold in portfolios?

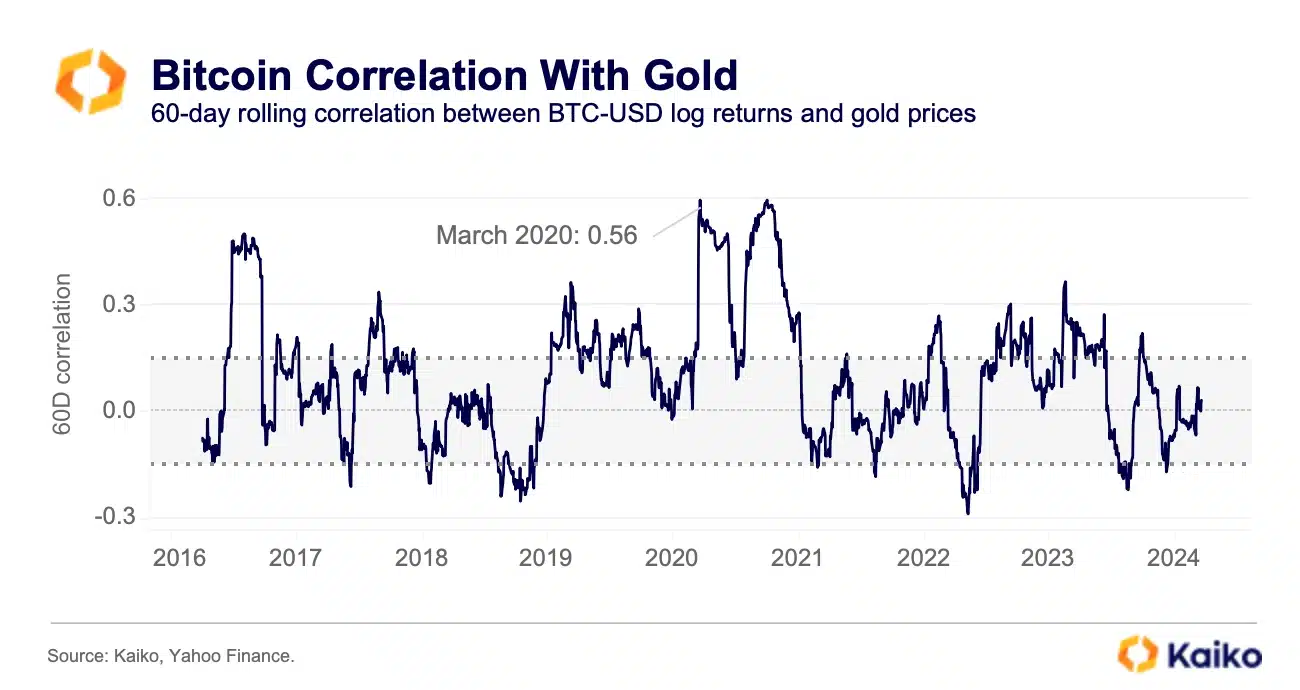

Kaiko additional highlighted the dearth of a mutual relationship between the 2 asset courses.

The 60-day BTC/Gold correlation oscillated between a constructive 0.15 and a damaging 0.15 for many of the final decade. This implied that components affecting the demand for the 2 diverse considerably.

If the correlation stays weak, Bitcoin spot ETFs may emerge as a viable different to Gold investments.

Supply: Kaiko

Learn Bitcoin’s [BTC] Value Prediction 2024-25

JPMorgan analyst Nikolaos Panigirtzoglou not too long ago acknowledged that Bitcoin has already surpassed Gold in traders’ portfolio allocation when adjusted for volatility.

This recommended a possible rotation of capital from Gold to Bitcoin.