This Catalyst Could Trigger Chainlink To Jump Further, According to Blockchain Analytics Firm Santiment

Crypto analytics agency Santiment says one metric is suggesting that decentralized oracle community Chainlink (LINK) may have extra upside potential.

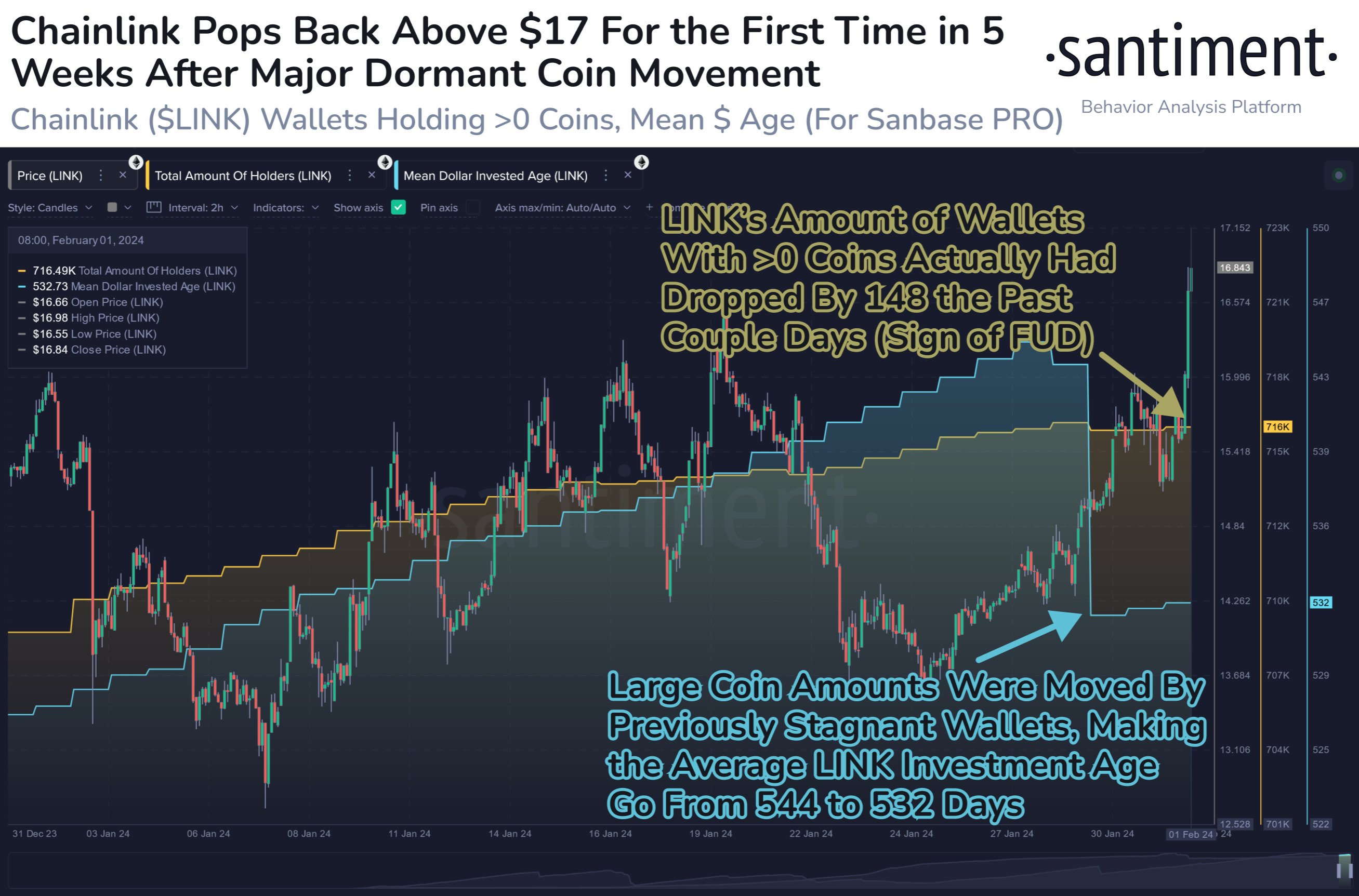

In a brand new thread on the social media platform X, the market intelligence platform says that Chainlink’s rally might proceed at the same time as LINK wallets see a sudden decline.

In accordance with Santiment, an abrupt pockets decline is usually an indication of a market capitulation as a result of concern, uncertainty and doubt (FUD) that may point out a rise in costs may quickly comply with.

“Chainlink has jumped forward of the altcoin pack after some beforehand dormant wallets created the best age consumed spike (5.38 billion, calculated by multiplying cash moved by the quantity of days these cash had been dormant). This inflow of LINK again into the community’s circulation has doubtless contributed to the worth soar.

Moreover, the community had seen minor liquidations of wallets, which is commonly an indication of FUD that may contribute to additional worth rises.”

LINK is buying and selling for $18.76 at time of writing, up almost 12% within the final 24 hours.

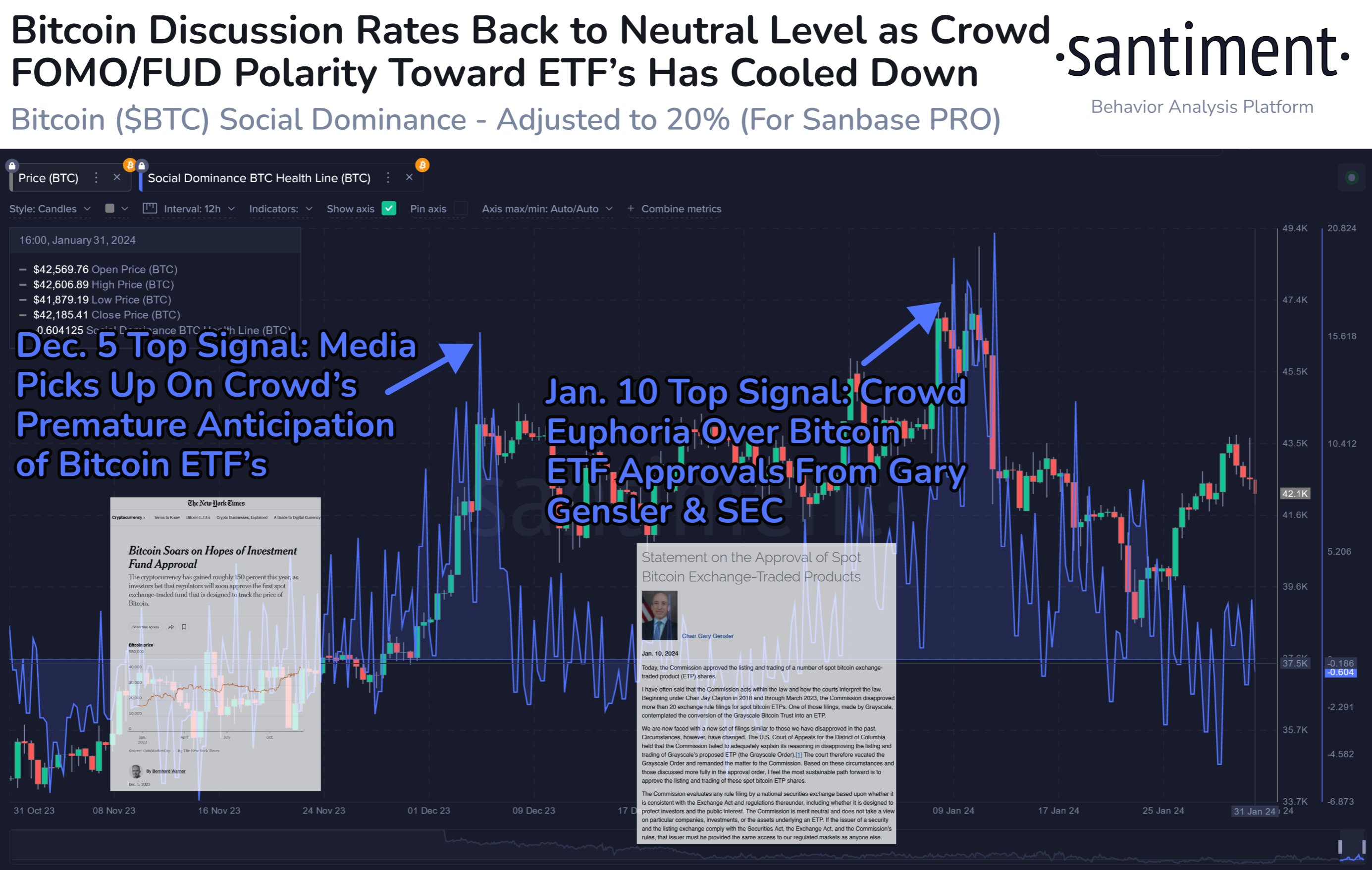

Subsequent up, Santiment says that the social dominance indicator, which tracks crypto discussions on social media platforms, might flip bearish for Bitcoin (BTC) this week and bullish for altcoins.

“Traditionally, a excessive ratio of crowd discussions towards Bitcoin is an indication of concern. Nonetheless, since mid-2023, the euphoria and optimism surrounding the ETFs (exchange-traded funds) has flipped excessive BTC discussions right into a greed indicator as a result of (arguably) unrealistic expectations for markets.

Three weeks for the reason that SEC (U.S. Securities and Change Fee) authorised the Bitcoin ETFs, it seems that this indicator has lastly normalized.

Excessive altcoin discussions might push the ratio of BTC discussions right into a bearish ‘unhealthy’ space in the event that they outperform the #1 market cap asset throughout this primary week of February. In contrast to the final two Bitcoin social dominance spikes that foreshadowed predictable tops, a unfavorable spike means the asset is being ignored as soon as once more in favor of the gang greedily over-leveraging portfolios towards alts as soon as once more.”

Bitcoin is buying and selling for $43,140 at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/Tithi Luadthong