THIS Ethereum metric just hit its 2016 levels; history tell us ETH’s price will…

- Ethereum alternate reserves just lately dipped to a important low level

- Key indicators appeared to level in direction of a possible short-term bounce at key stage

Ethereum bears have maintained their dominance for the final 3 months, however how for much longer can they stick with it? Effectively, latest knowledge suggests potential accumulation as ETH flows out of exchanges, highlighting the state of demand at decrease costs.

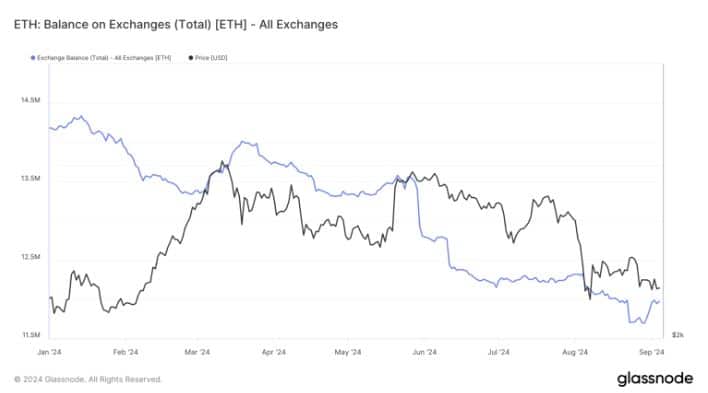

In accordance with Glassnode, Ethereum has been flowing out of exchanges. Much more noteworthy is the latest ETH reserve lows which just lately retested ranges beforehand seen in 2016. Low alternate reserves could have contributed to ETH’s sturdy worth motion within the following 12 months (2017). Therefore, the query – Can historical past repeat itself?

Supply: Glassnode

A historic evaluation of Ethereum in 2016 revealed that it did expertise some headwinds. ETH’s worth peaked at $18.36 in June 2016, earlier than dropping under $12 in September of the identical 12 months. It even fell to as little as $7.14 by December of the identical 12 months, earlier than embarking on an epic rally in 2017.

If Ethereum pursues an identical path in 2024, then it would level to the chance that 2025 could deliver forth a powerful rally. The truth that ETH has been flowing out of exchanges confirms the presence of sturdy demand at discounted costs. Moreover, the tempo of ETH flows has additionally been rising.

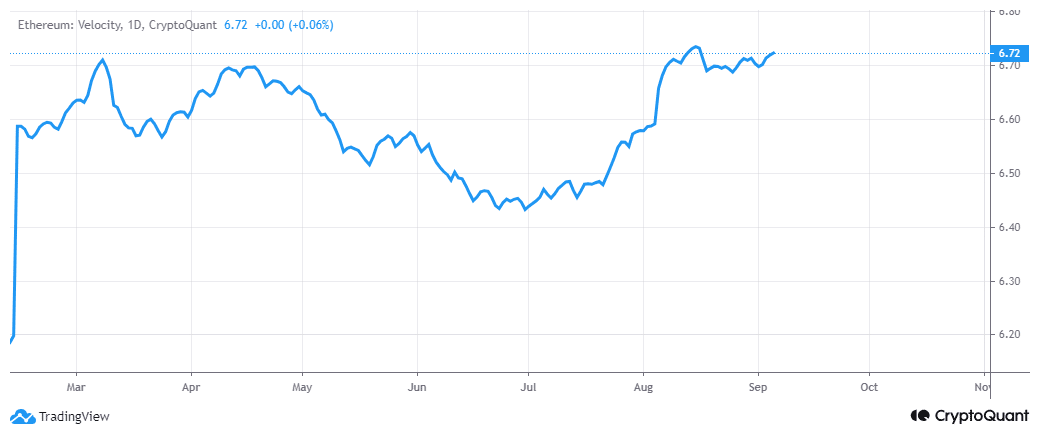

Supply: CryptoQuant

Ethereum’s velocity has been trending upwards since July. A brief-term bullish pivot could possibly be within the making if this development continues, coupled with sturdy demand.

Nevertheless, on-chain exercise revealed that demand is but to succeed in an inflection level the place it should outweigh provide.

Can Ethereum’s demand push for a pivot?

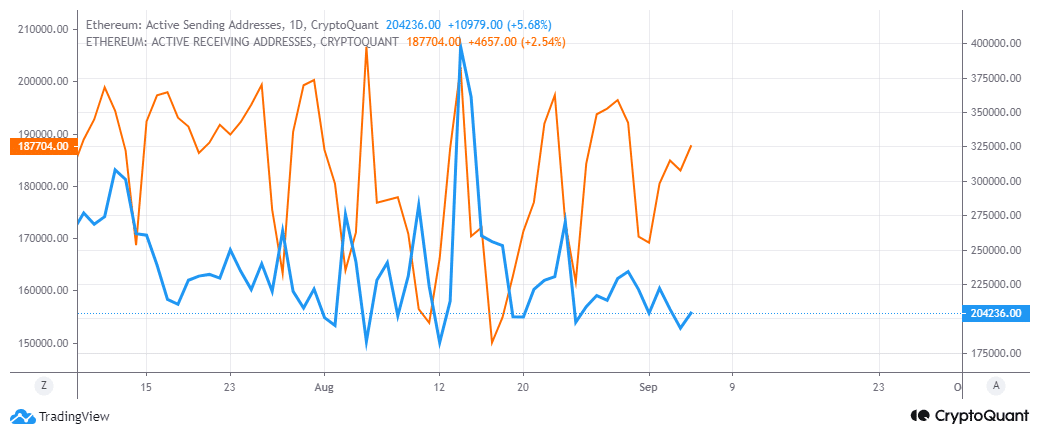

In accordance with Ethereum’s handle knowledge, ETH addresses have been seeing extra outflows than inflows. There have been 204,000 energetic sending addresses versus virtually 188,000 receiving addresses, on the time of writing.

Supply: CryptoQuant

Nonetheless, energetic addresses knowledge additionally revealed one other fascinating remark.

Within the final 2 weeks or so, energetic receiving addresses have been rising, whereas energetic sending addresses have been declining. This remark might sign a shift within the provide and demand dynamics. Furthermore, this could possibly be because of ETH’s prevailing worth stage.

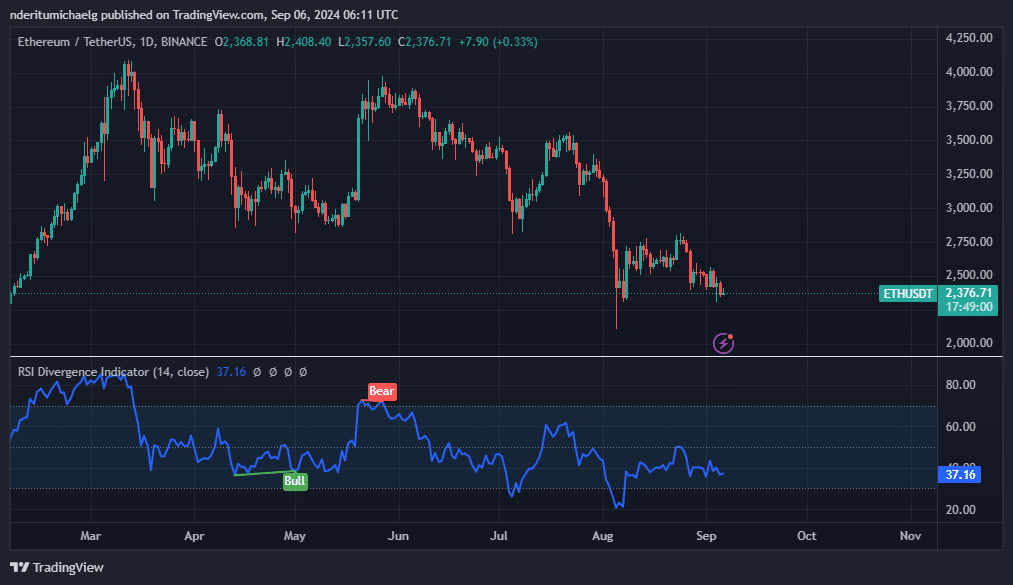

ETH’s newest draw back pushed the value right into a noteworthy help stage close to the $2,333 worth vary. This can be an indication that there are rising expectations of a pivot across the identical worth vary. Particularly as bears ease off their assault.

Supply: TradingView

Regardless of these observations, nevertheless, the 1-day chart signaled that the bulls are but to come back out swinging.

In addition to, the RSI indicated that the general development will stay in favor of the bears, with room for extra potential draw back too. Presumably in direction of the bottom worth ranges seen in August.