This Ethereum ‘weakness’ may keep ETH below $3,100

- Knowledge confirmed that ETH’s underwhelming efficiency has restricted cash circulate out there.

- Outdated cash have been shifting, indicating that promoting strain may proceed.

Ethereum [ETH] is challenged with replicating its efficiency within the final bull market, in keeping with a current report. Put collectively by 10x Analysis, the report acknowledged that the challenge’s fundamentals have weakened.

In consequence, Ethereum is stopping cash from flowing into the market at a quicker charge. For these unfamiliar, 10x Analysis is a crypto institutional analysis platform.

Based on them, ETH drove the 2020/2021 bull cycle. Nevertheless, the truth that the altcoin has been lagging restricts the market from reaching its full potential.

Is ETH dragging BTC and others again?

The agency additionally added that it anticipated Ethereum to drive adoption, nevertheless it has failed to take action. It doesn’t finish there. The report additionally talked about that the correlation with Bitcoin [BTC] has additionally hindered BTC, noting that,

“Surprisingly, BTC and ETH stay extremely correlated, with an R-square of 95%. Ethereum’s weak fundamentals have gotten a roadblock for Bitcoin as they stop broad fiat influx into the crypto ecosystem.”

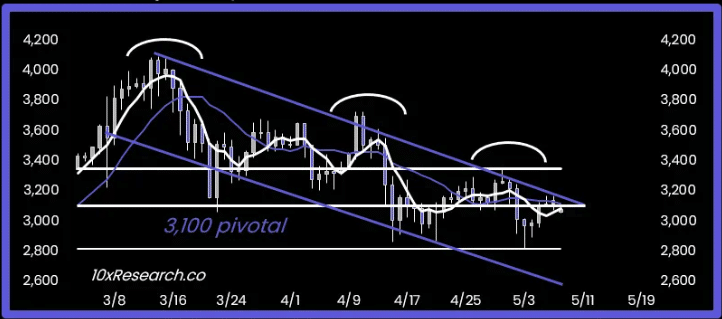

ETH’s value at press time was $3,128. And in keeping with 10x Analysis, the $3,100 area was a vital spot for the cryptocurrency.

Supply: 10x Analysis

Nevertheless, the chart shared by the platform urged that the value might lower and hit $2,600 if care will not be taken. When AMBCrypto checked the validity of this conclusion, we discovered some stable grounds for it.

The traction stops, locations the value in peril

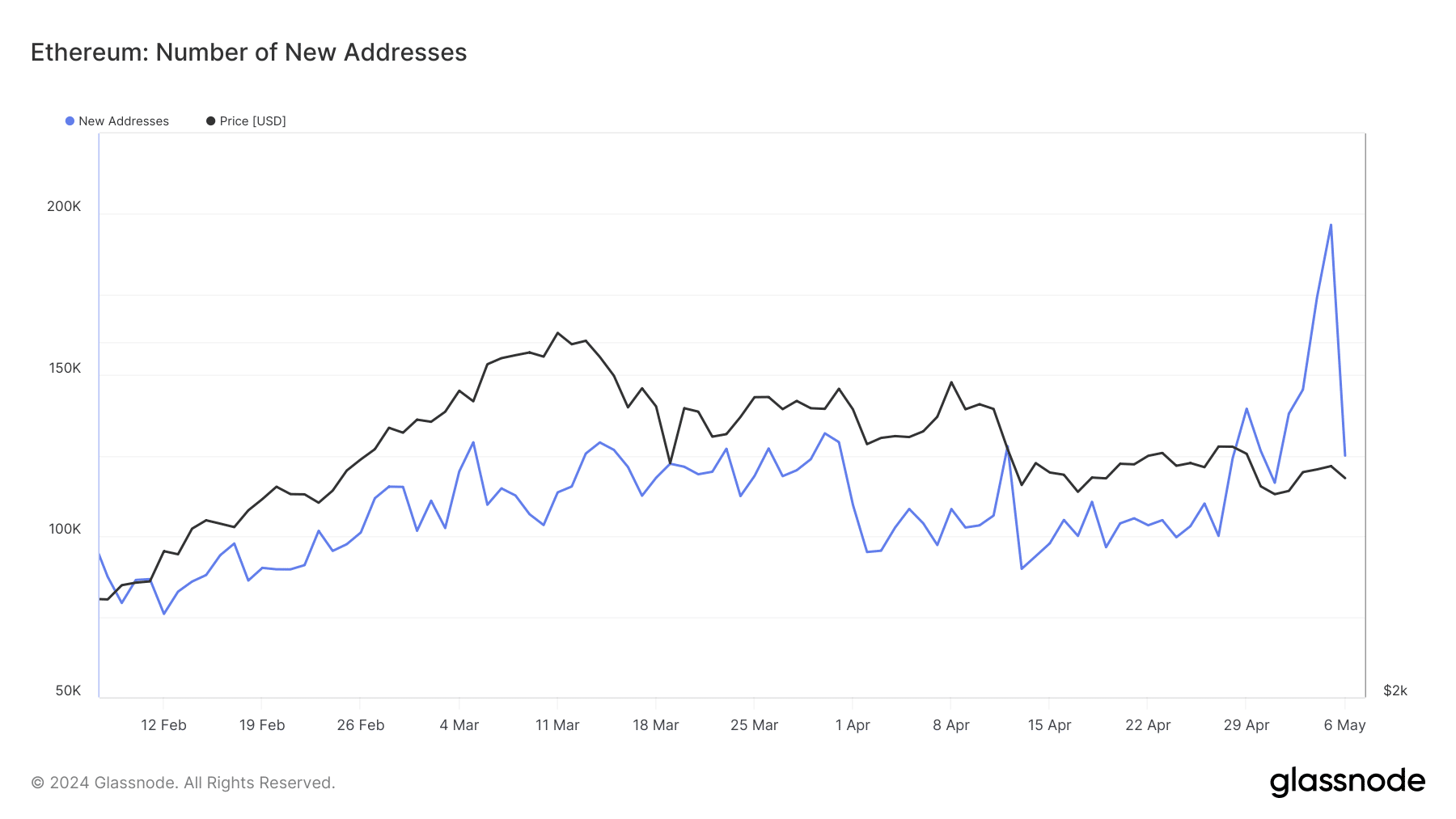

First off, we thought-about Ethereum’s variety of new addresses. Based on data obtained from Glassnode, the variety of Ethereum new addresses jumped to 196,620 on the fifth of Might.

This metric tracks the variety of distinctive addresses that participated in a transaction for the primary time. Nevertheless, at press time, that quantity had plunged to 125,008.

The shortcoming to maintain this progress places Ethereum in a dicey place. The identical goes for the value of ETH.

Ought to the variety of these addresses proceed to fall, then ETH could possibly be in a pole place for a slide beneath $3,100 as predicted.

Supply: Glassnode

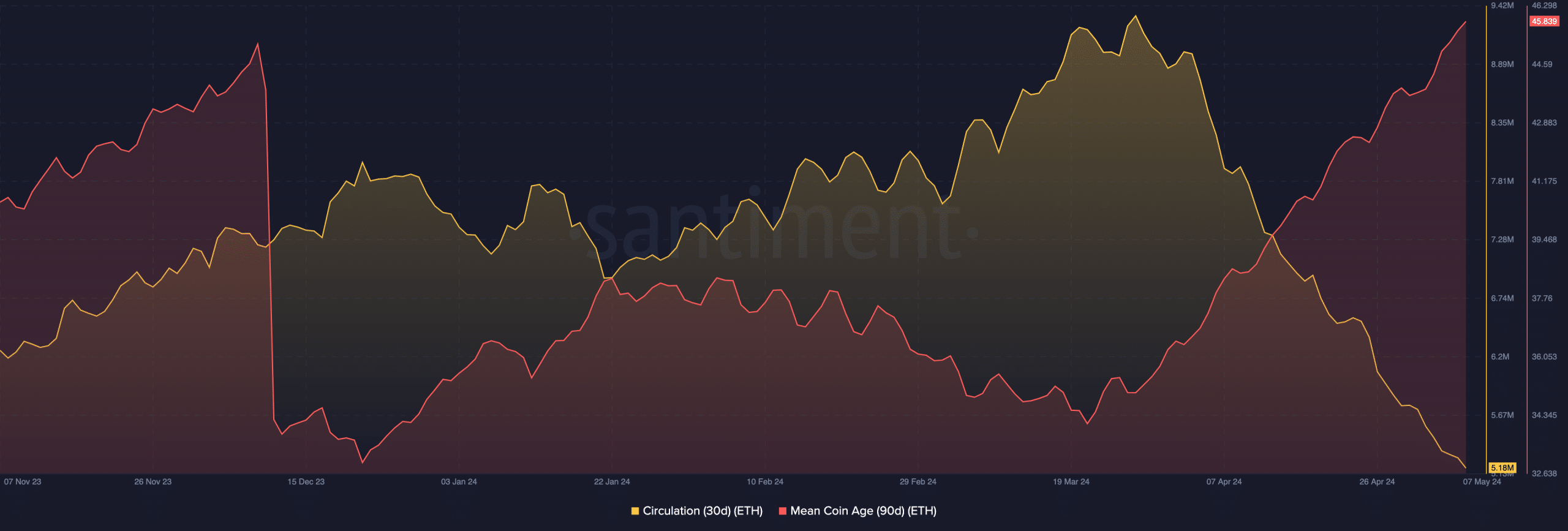

In the meantime, ETH’s one-day circulation has been reducing since March. This suggests that fewer cash have been engaged in transactions since then.

Sometimes, this could possibly be an indication of decreasing demand for the cryptocurrency. Nevertheless, it additionally exhibits that the variety of ETH put aside for promoting could possibly be low.

One other metric we checked out was the Imply Coin Age (MCA). Low values of the MCA point out accumulation, and this might foreshadow increased costs sooner or later.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

Nevertheless, the 90-day MCA on Ethereum’s community skyrocketed to 45.83. This enhance implies that long-term holders of the cryptocurrency are shifting their cash.

Supply: Santiment

Actions like this recommend a possible to promote. As such, ETH’s restoration may stay on the sidelines as the value may proceed to battle.