This is how Bitcoin must perform to sustain its mining industry

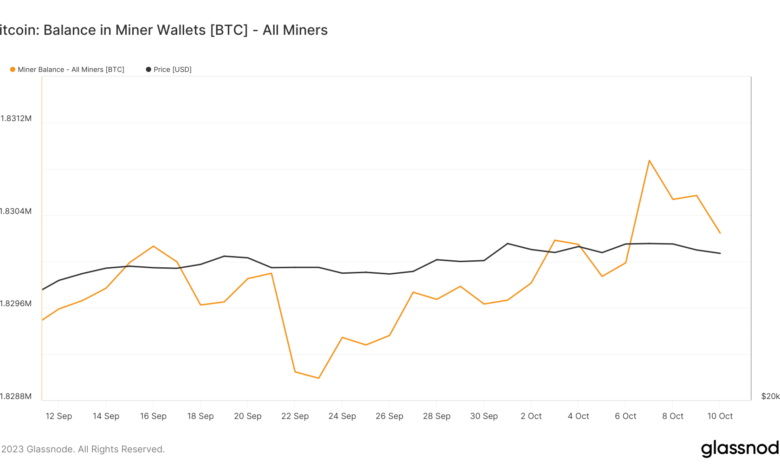

- Miners’ stability has gained upward momentum for the previous few weeks.

- BTC was down by over 2% within the final 24 hours, and some metrics appeared bearish.

The Bitcoin [BTC] mining sector has been witnessing immense progress over the previous couple of months. A doable purpose for the expansion might be the truth that miners had been really making a revenue.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Nonetheless, issues can change quickly as BTC is anticipating its subsequent halving, which is able to cut back miners’ rewards to half.

Bitcoin’s mining trade is rising forward of the halving

Notably, Coinwarz’s data revealed that BTC’s hashrate has surged significantly over the previous couple of months. At press time, BTC’s hashrate stood at 517.41 EH/s. Moreover, James V. Straten, a well-liked crypto researcher and information analyst, identified that BTC’s issue has additionally continued to develop.

With #Bitcoin issue persevering with to extend and hitting all-time highs, and a halving approaching in April.

The present all-in value to mine #BTC is roughly round $24,000.

By the halving, miners could also be beneath stress if #Bitcoin is beneath roughly $40,000 subsequent 12 months.

— James V. Straten (@jimmyvs24) October 10, 2023

The rationale behind this progress might be the earnings amassed by miners. The present all-in value to mine BTC is sort of $24,000, and at press time, BTC’s value remained above the $27,000 mark, revealing that miners had been making a revenue.

Actually, that is likely to be the rationale behind the sharp hike in miners’ stability as nicely, which mirrored their willingness to carry BTC.

Supply: Glassnode

Nonetheless, as BTC’s subsequent halving approaches, it turns into necessary for BTC to lift its value with the intention to preserve miners worthwhile. It’s because after the halving, miners’ reward will probably be diminished to halving.

Straten talked about within the tweet that by halving, miners could also be beneath stress if Bitcoin is beneath roughly $40,000 subsequent 12 months. Due to this fact, let’s check out BTC’s on-chain metrics to see whether or not BTC’s value can start its bull rally anytime quickly.

Will Bitcoin start a rally?

The aforementioned information steered that it was key for Bitcoin to lift its worth over the upcoming months to take care of its progress within the mining sector. Nonetheless, issues on the bottom didn’t counsel that BTC was about to provoke a bull rally.

Within the final 24 hours alone, BTC’s value dropped by greater than 2%. On the time of writing, it was trading at $27,039.44 with a market capitalization of over $527 billion.

Actually, CryptoQuant’s information revealed that the king of cryptos’ was really beneath promoting stress. This was illustrated by BTC’s Change Reserve, which has been growing over the previous couple of days.

Furthermore, its web deposits on exchanges had been additionally excessive in comparison with the final seven-day common, establishing the truth that BTC was beneath promoting stress on the time of writing.

Supply: CryptoQuant

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Nonetheless, nothing might be mentioned with the utmost certainty, as a couple of of the metrics had been bullish as nicely. For instance, BTC’s aSOPR was inexperienced on the time of writing. This meant that extra buyers had been promoting at a loss, which typically signifies a market backside.

Furthermore, Bitcoin’s Binary CDD was additionally within the inexperienced, suggesting that long-term holders’ confidence in BTC was excessive.

Supply: CryptoQuant