Toncoin: Can TON extend its 20% surge and break past $7?

- The momentum of Toncoin remained bullish however has weakened in comparison with the earlier week.

- Sustained demand was seen in latest weeks, but it surely won’t be sufficient to interrupt the $7.3 and $8.3 resistance zones.

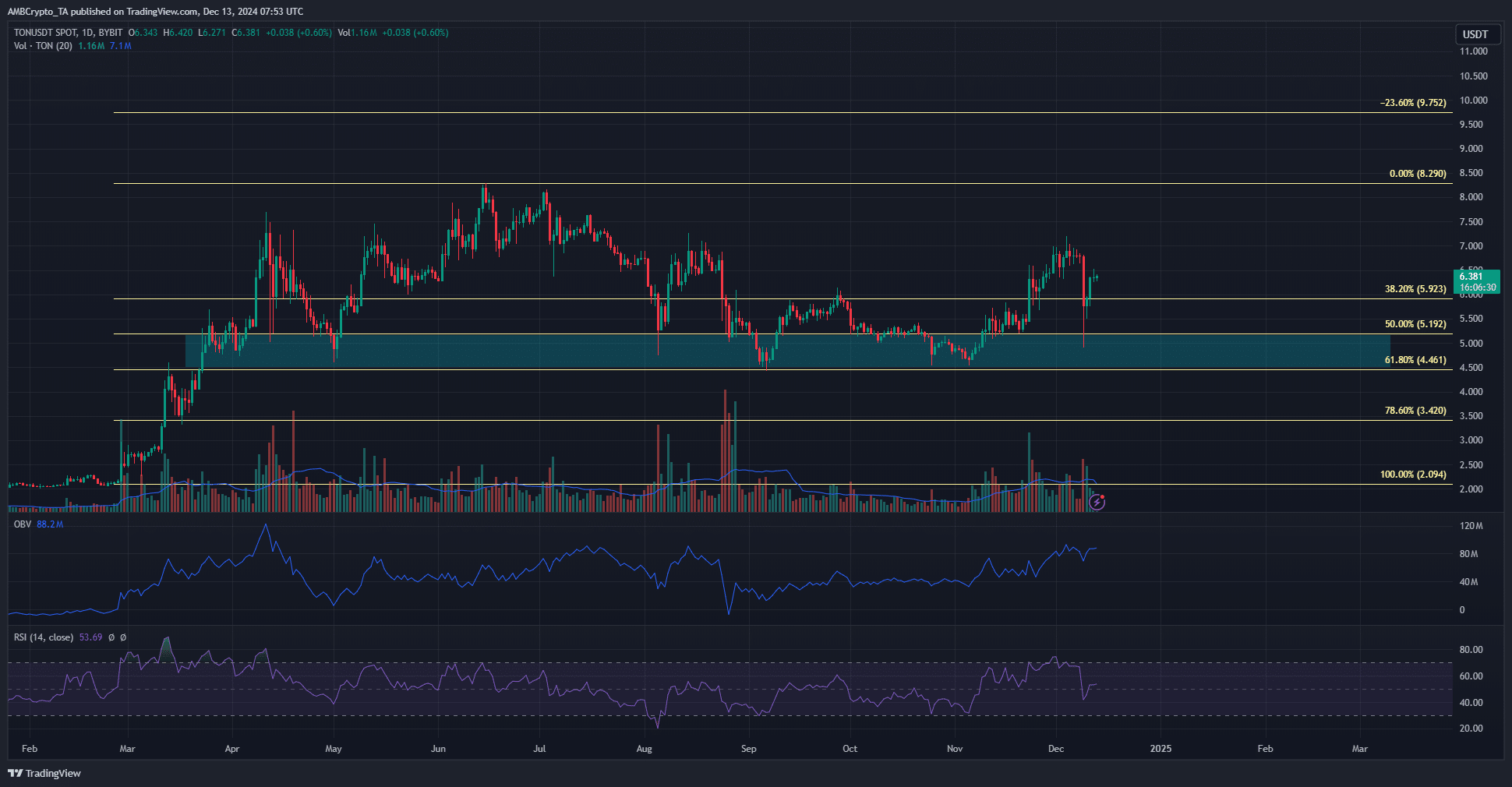

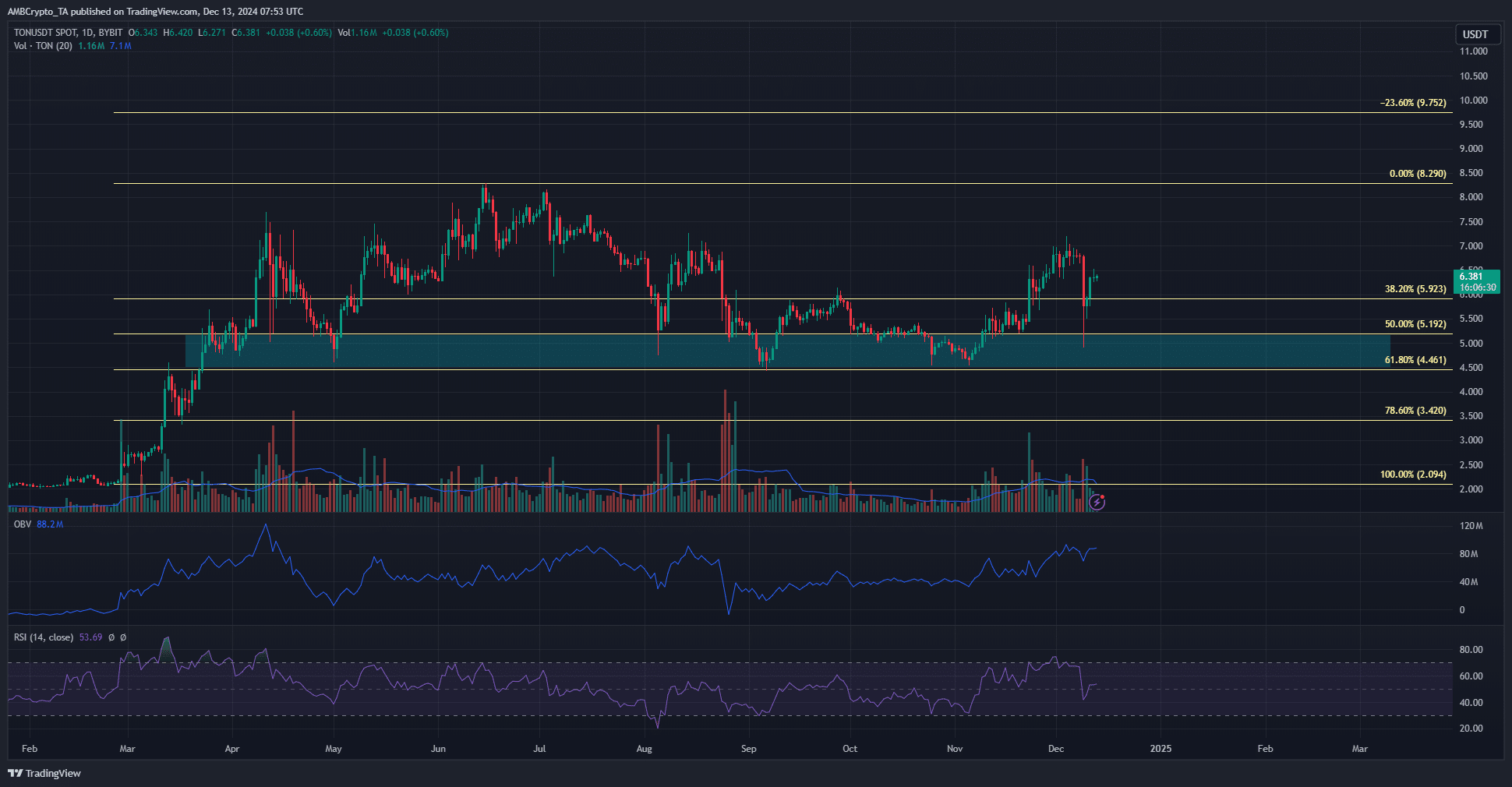

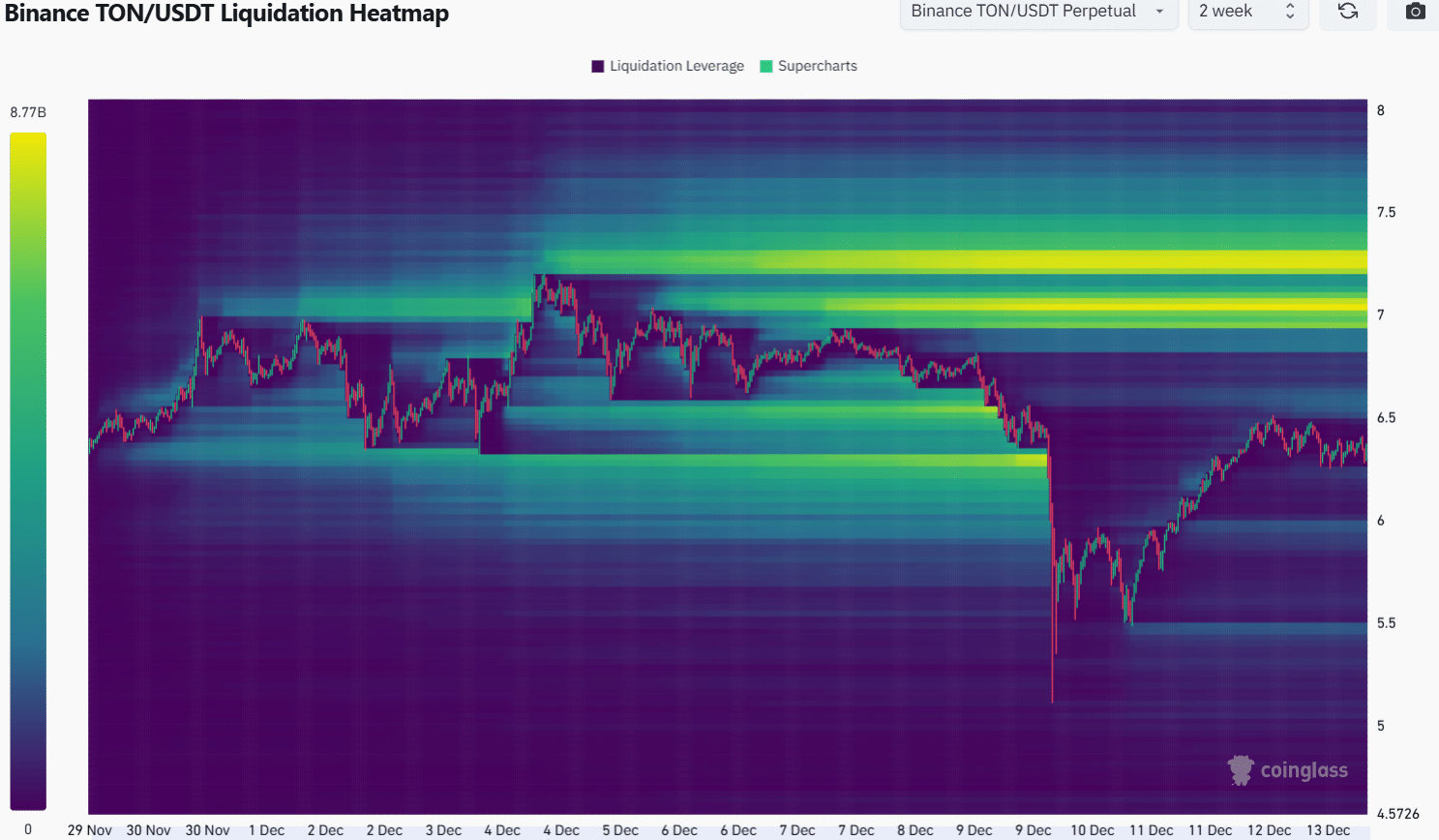

Toncoin [TON] was up almost 20% after the swift drop to $5.3 on Monday the ninth of December. This dip diverse throughout exchanges, reaching $5.3 on Binance however $4.91 on Bybit. Liquidation cascade’s backside apart, the restoration has been outstanding on the decrease timeframes.

Bitcoin [BTC] has but to transform the $101k-$103k zone for help. Nevertheless, the altcoin market cap has been in a robust uptrend since November. After the big reset on Monday, additional features could be anticipated.

Toncoin finds help across the $5 demand zone

Supply: TON/USDT on TradingView

The $5.9 stage, which served as resistance in September and November, has been flipped to help. The volatility on Monday threatened to interrupt it, however the bulls have recovered since then.

This was mirrored by the OBV’s uptrend over the previous month. Though substantial promoting was current earlier this week, the uptrend remained uninterrupted.

A priority for TON bulls was the efficiency over the previous 12–14 weeks. Whereas the $4.5-$5 demand zone has been stoutly defended, the $6.9-$7.1 resistance zone has not been breached. Heavier demand for Toncoin could be essential to push the asset on a long-term uptrend and towards new all-time highs.

On the each day chart, the RSI was at 53. The momentum has slowed down from the place it was per week in the past however remained on the bullish aspect.

Quick-term rally focusing on $7 in sight

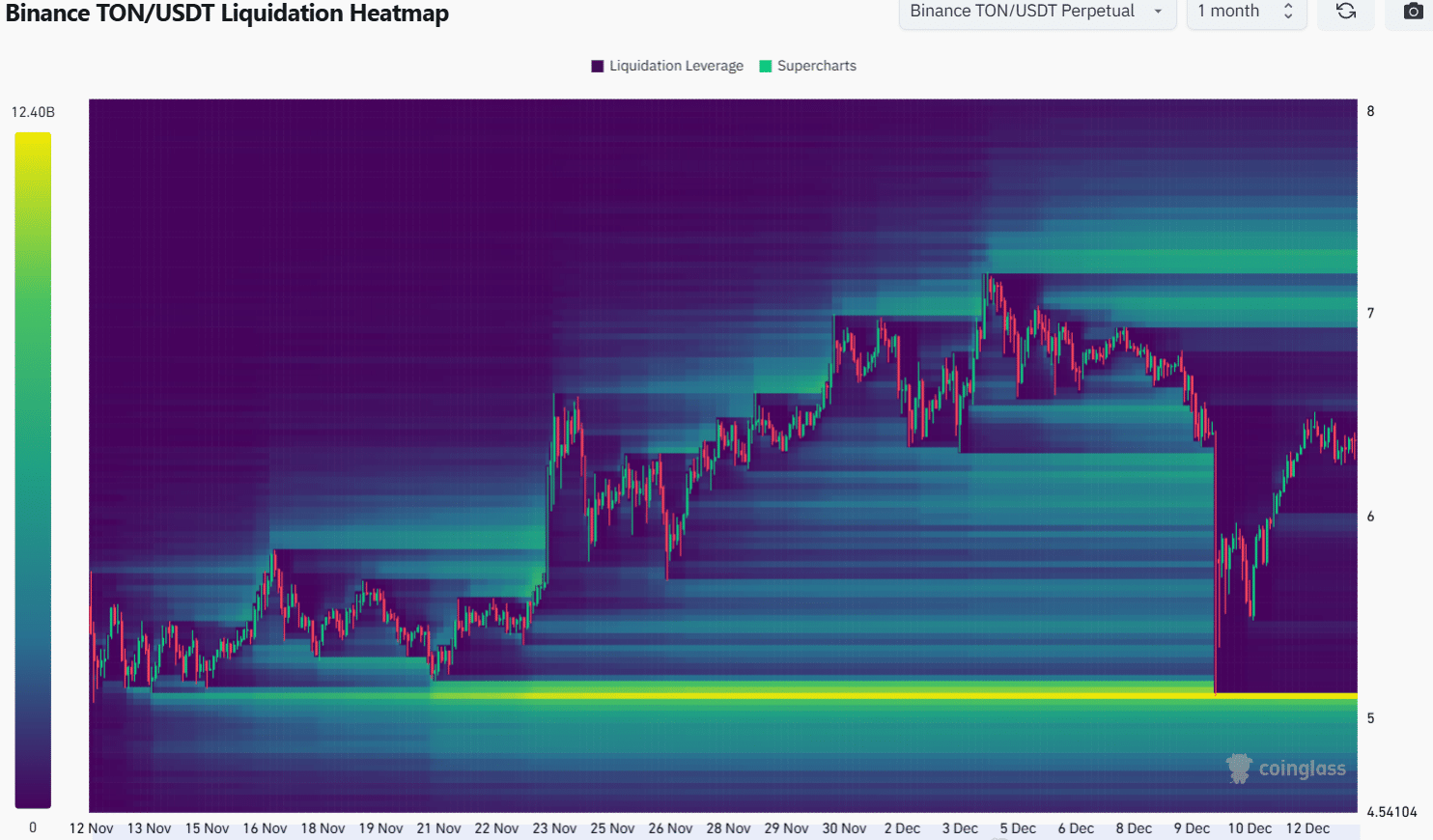

The previous month’s liquidation heatmap highlighted the excessive focus of liquidation ranges round $5.05-$5.15. It was examined on Monday and the costs have since rebounded. The liquidity pocket round $5 was nonetheless current.

A Bitcoin worth drop under $98.6k might feed any short-term bearish sentiment out there and will drive TON decrease as effectively.

Supply: Coinglass

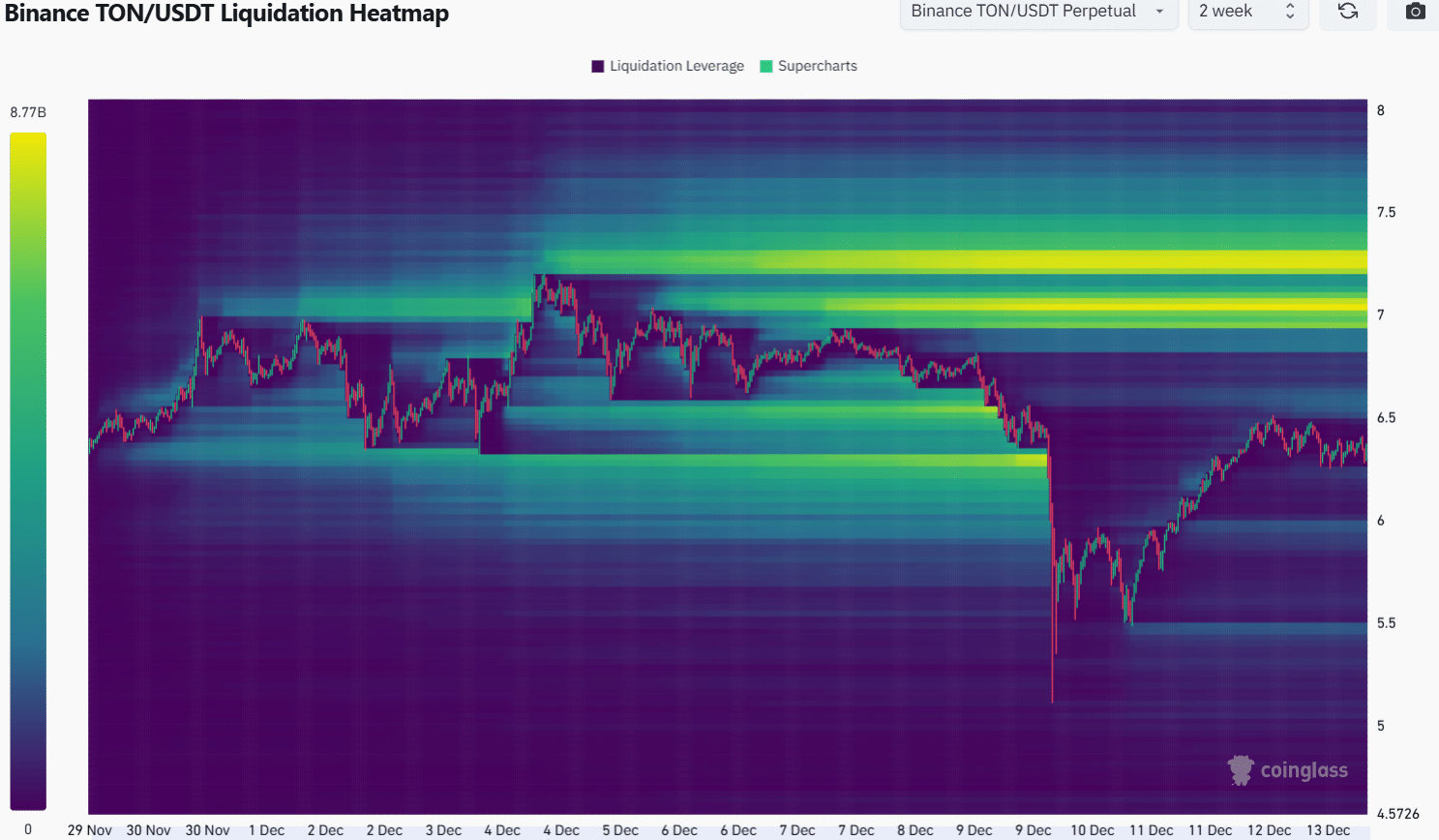

As issues stand, the drop to $5 appeared unlikely. This was due to the presence of a pocket of liquidity round $7, which was nearer to present market costs. The two-week liquidation heatmap highlighted the $7.05 and $7.3 areas as short-term bullish worth targets.

Is your portfolio inexperienced? Verify the Toncoin Revenue Calculator

Whether or not the Toncoin bulls will achieve breaking previous this resistance zone stays to be seen, however the short-term TON worth prediction is bullish.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion