Top Crypto Analyst Predicts ‘Decent Bounce’ for AI Altcoin, Updates Outlook on Bitcoin, Chainlink and Jupiter

A broadly adopted crypto analyst believes that one synthetic intelligence (AI) altcoin undertaking is gearing up for a transfer to the upside.

The analyst pseudonymously often called The Movement Horse tells his 199,800 followers on the social media platform X that the decentralized synthetic intelligence platform for purposes Fetch.ai (FET) seems able to rally based mostly on rising open curiosity (OI) and buying and selling quantity.

OI is a metric that tracks the quantity of a crypto asset’s open leveraged lengthy and brief positions.

In keeping with the analyst, FET bulls are aggressively taking over the provision coming into the market utilizing leveraged lengthy positions.

“FET could be an honest bounce from right here. OI up on vendor absorption, excessive quantity into January lows with a fairly skewed bid/ask.”

his chart, FET is on the verge of presumably flipping the $0.56 stage into assist.

FET is buying and selling for $0.566 at time of writing, up greater than 4% within the final 24 hours.

Subsequent up, the dealer suggests that Bitcoin’s (BTC) halving occasion in April could also be extra bullish than prior occasions as a result of now BlackRock, the monetary large with about $9 trillion in property beneath administration (AUM), will seemingly promote it round their just lately launched spot BTC exchange-traded fund (ETF).

“This Bitcoin halving is totally different from every other as a result of it’s the first time a trillion greenback asset supervisor will probably be advertising and marketing it.”

Bitcoin is buying and selling for $43,167 at time of writing, up barely within the final 24 hours.

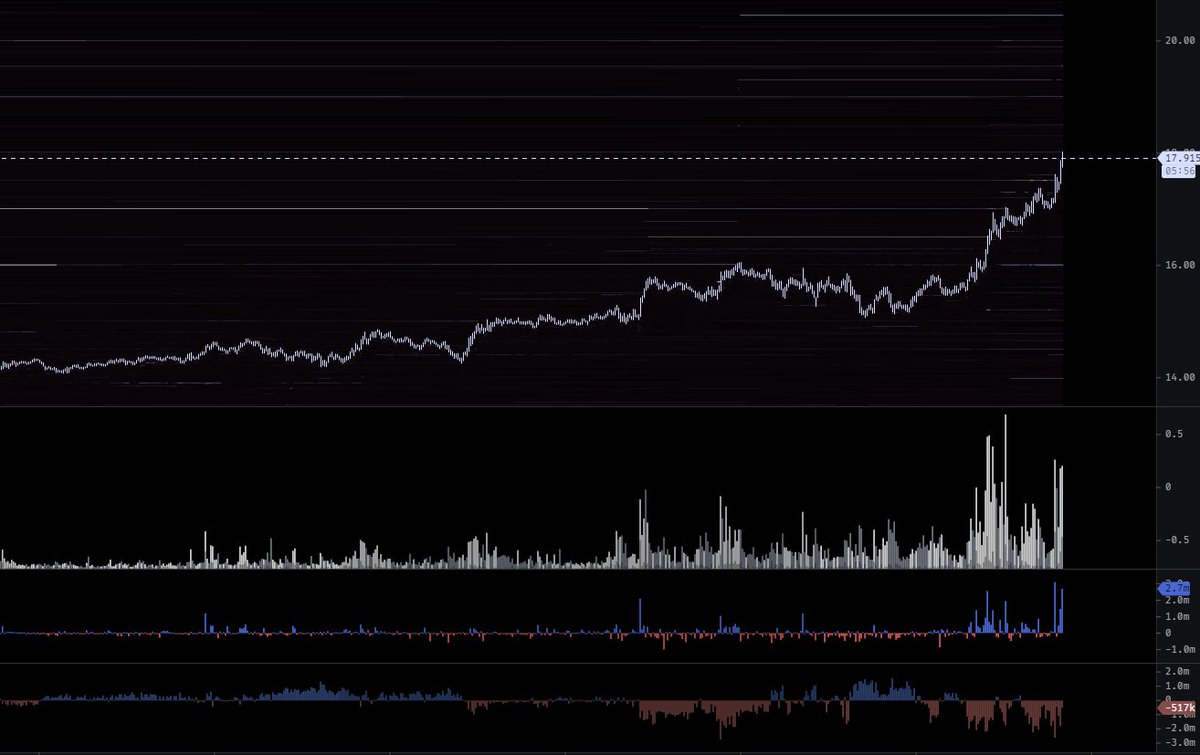

Subsequent on deck, the dealer says that the decentralized oracle supplier Chainlink (LINK) seems to stay in an uptrend because the token runs up towards the $18 resistance stage.

“Spectacular continuation kind transfer. I believe I closed my LINK bag too early.”

LINK is buying and selling for $17.83 at time of writing, down barely within the final 24 hours.

Lastly, the dealer is popping bullish on the Solana-based decentralized trade (DEX) aggregator Jupiter (JUP).

“Beginning to a purchase a little bit JUP. Mindshare is excessive and I believe negativity off the airdrop mechanics finally ends up creating an imbalanced public sale. Airdrop performs within the brief time period are fairly predictable…

VWAP (volume-weighted common value) is your buddy particularly in newly simply listed alts. JUP VWAP is already anchored from a catalyst which makes it very helpful. No matter what occurs long run, you understand that is going to supply a very good lengthy setup quickly.”

Merchants use the VWAP to assist them decide whether or not an asset is buying and selling underbought or overbought based mostly on its intraday value motion.

Jupiter is buying and selling for $0.579 at time of writing, down greater than 3% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Fortis Design/VECTORY_NT/PurpleRender