Assessing if Ethereum’s price is at risk of a 10% decline now

- 52.67% of prime merchants held quick positions, whereas 47.33% held lengthy positions

- A piece of whales seemed to be accumulating ETH too

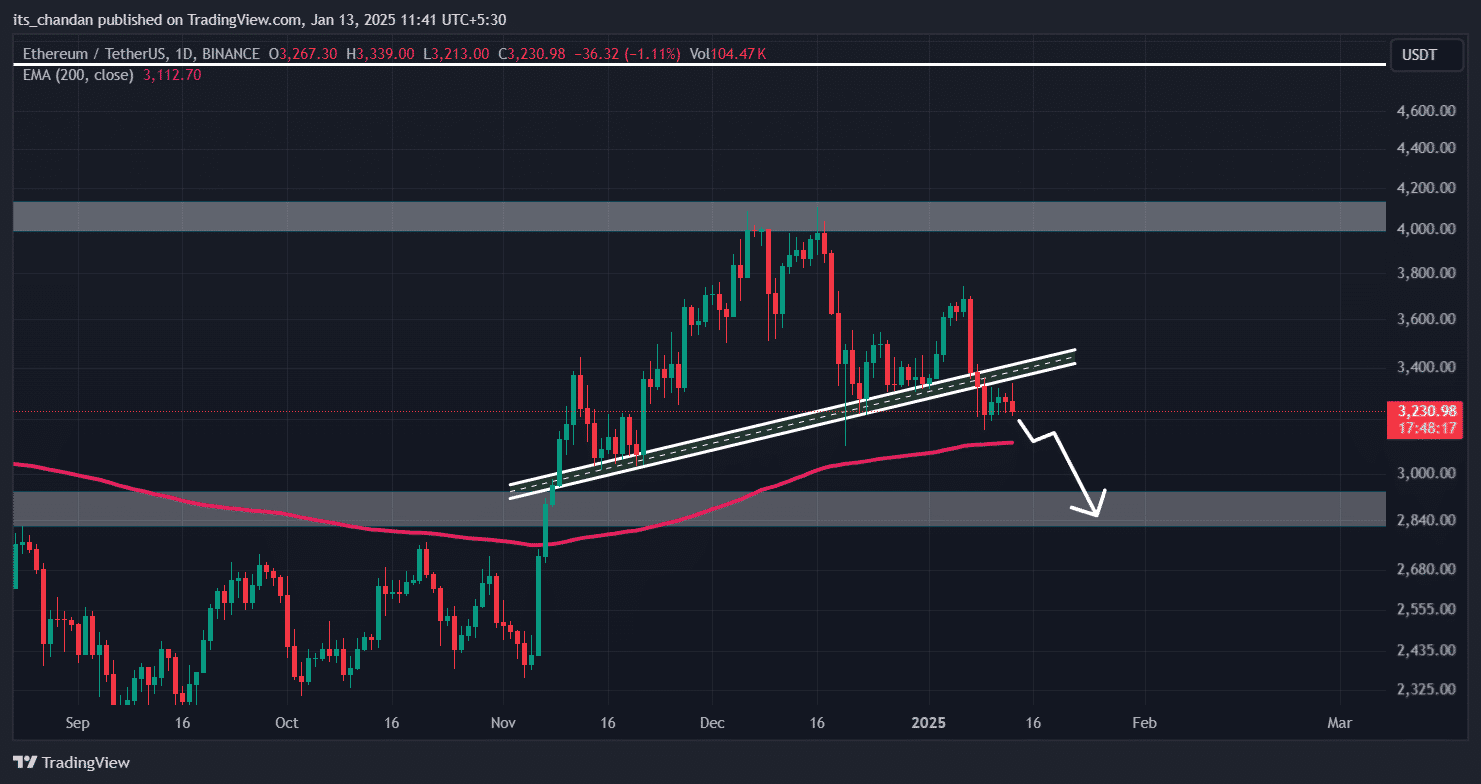

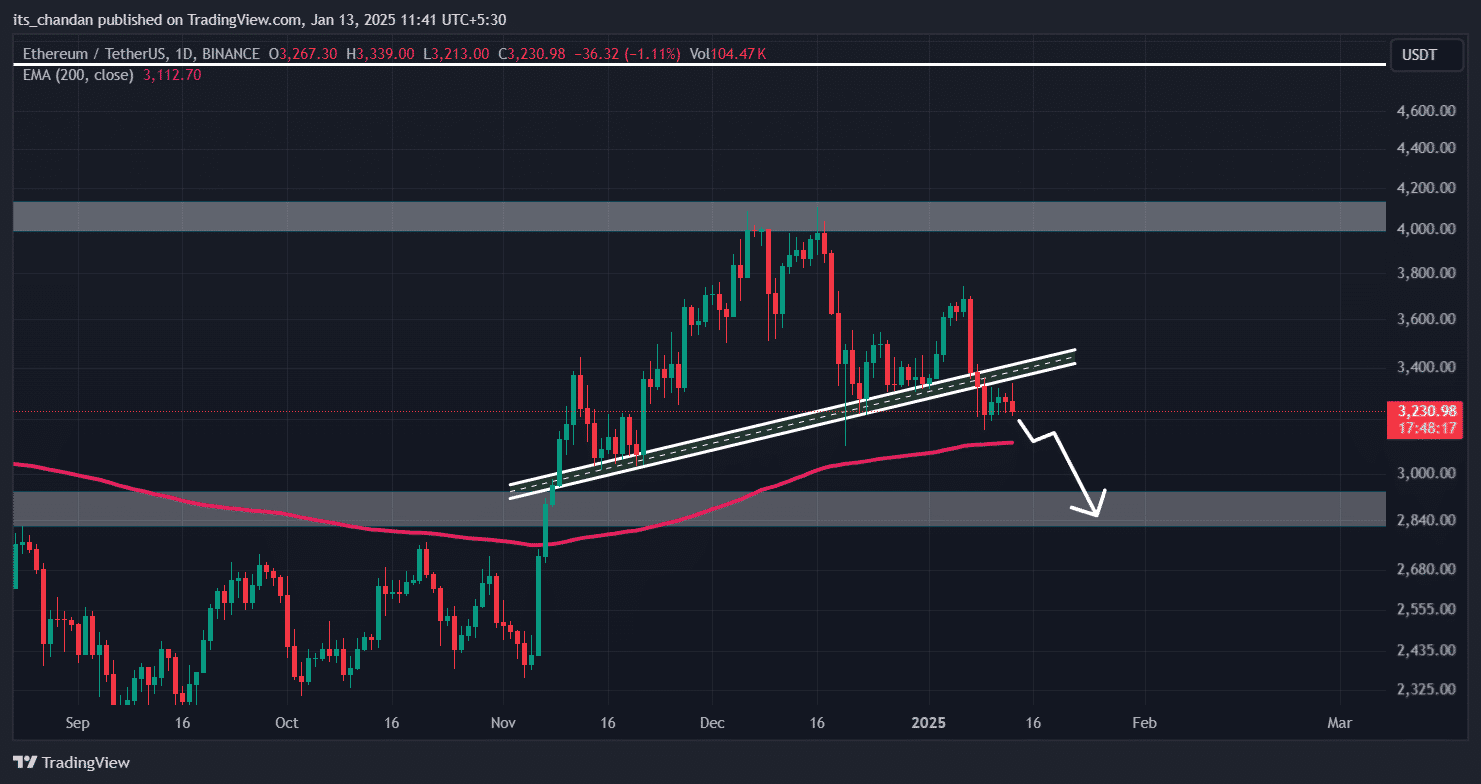

Ethereum (ETH), the second-largest cryptocurrency by market cap, gave the impression to be displaying indicators of a possible value decline after forming a bearish sample on the charts, at press time.

Ethereum’s (ETH) bearish outlook

Price noting, nonetheless, that elements of his bearish development usually are not solely evident in ETH, but additionally throughout main cryptocurrencies equivalent to Bitcoin (BTC), XRP, and Solana (SOL).

Since December 2024, ETH has been on a downtrend and has damaged down and efficiently retested its breakdown stage – Supporting the bearish sentiment.

Supply: ETH/USDT, TradingView

ETH value prediction

Primarily based on its latest value motion and historic momentum, if this sentiment stays unchanged, there’s a sturdy risk that ETH might drop by 10% to hit the $2,850-level sooner or later. Nonetheless, technical indicators nonetheless alluded to the potential of a value rebound.

On the every day timeframe, as an illustration, ETH’s Relative Power Index (RSI) was close to the oversold space – Hinting at a possible restoration. This, whereas the 200 Exponential Shifting Common (EMA) indicated that the asset was on an uptrend.

Merchants preserve a bearish bias

Regardless of the bullish outlook of those indicators, nonetheless, merchants stay hesitant to take lengthy positions, as reported by the on-chain analytics agency CoinGlass. At press time, ETH’s lengthy/quick ratio stood at 0.94, indicating sturdy bearish sentiment amongst merchants.

When assessed, 52.67% of prime merchants held quick positions, whereas 47.33% held lengthy positions.

Nonetheless, merchants’ positions have been rising considerably throughout this bearish interval. Particularly as ETH’s Open Curiosity elevated by 4.5% within the final 24 hours. These metrics indicated that intraday merchants are bearish, which might result in a possible value drop within the coming days.

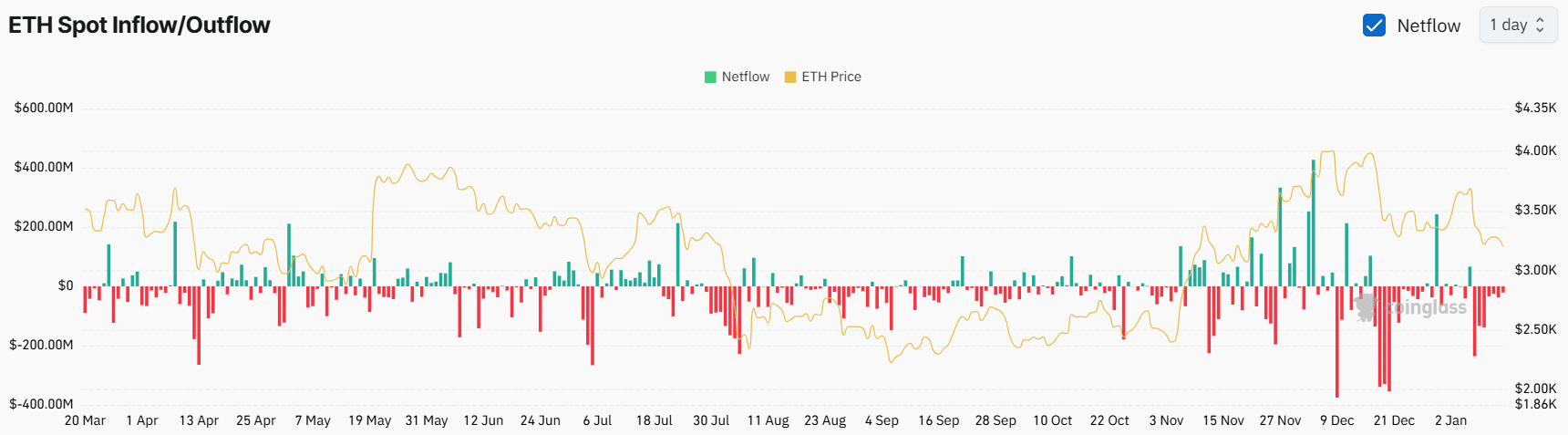

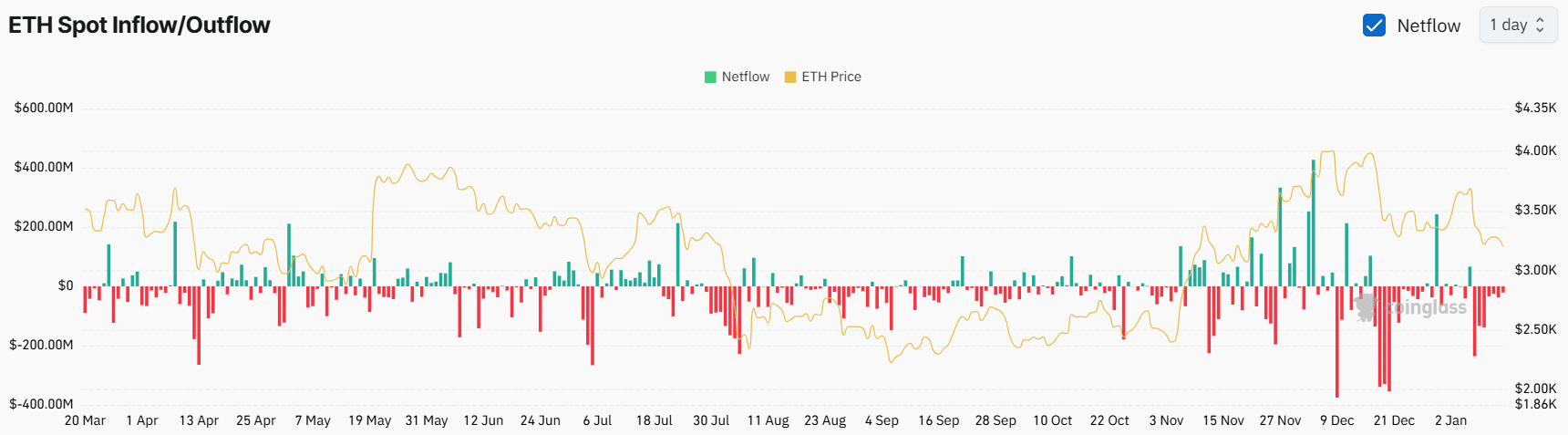

Whales’ latest exercise

Along with merchants, long-term holders and whales look like accumulating ETH too, as revealed by CoinGlass’s spot influx/outflow metric.

Supply: CoinGlass

The truth is, knowledge revealed that exchanges have seen outflows of over $21 million price of ETH within the final 24 hours, indicating potential accumulation that would create shopping for strain and a shopping for alternative.