Trader Says Ethereum-Based Altcoin Looking Massively Bullish, Updates Outlook on Polygon, Chainlink and XRP

Cryptocurrency analyst and dealer Ali Martinez is saying {that a} main Ethereum (ETH)-based decentralized trade could possibly be on the cusp of constructing a big upside transfer.

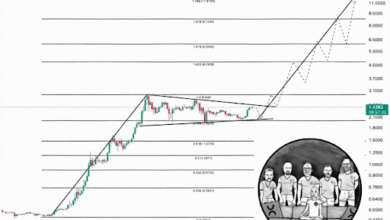

Martinez tells his 33,200 followers on the social media platform X that Uniswap (UNI) “seems to be breaking out” on the weekly chart after invalidating a descending triangle.

A descending triangle is usually thought-about a bearish continuation sample.

In line with Martinez, if Uniswap prints a “sustained shut” above the value of $5.70, UNI may soar towards $10, a acquire of round 62% from the present worth.

Uniswap is buying and selling at $6.18 at time of writing.

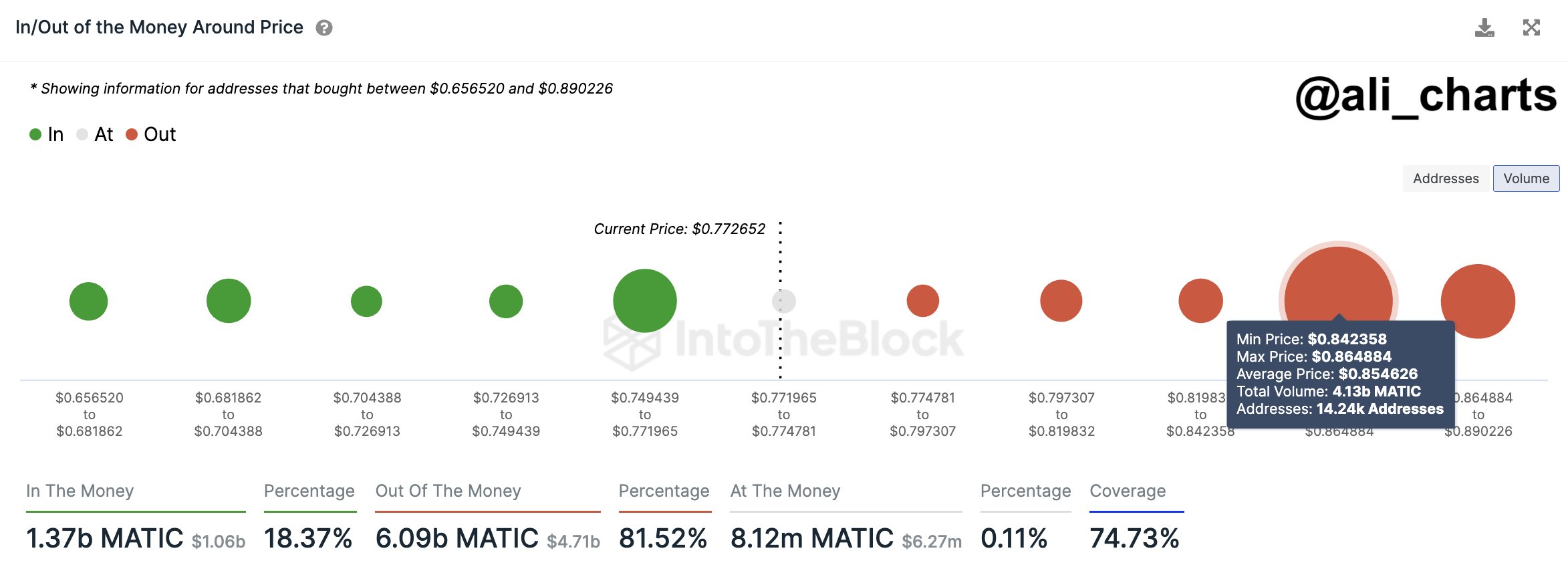

Turning to Polygon (MATIC), Martinez says that the Ethereum scaling resolution may witness a sell-off if it fails to interrupt above a vital worth stage.

“MATIC has slipped under a vital provide zone, spanning $0.84 to $0.86. On this vary, 14,240 addresses maintain over 4.13 billion MATIC.

The longer the Polygon worth stays under this zone, the upper the chance that these holders may begin promoting to keep away from incurring important losses.”

MATIC is buying and selling at $0.772 at time of writing, properly under Martinez’s provide space.

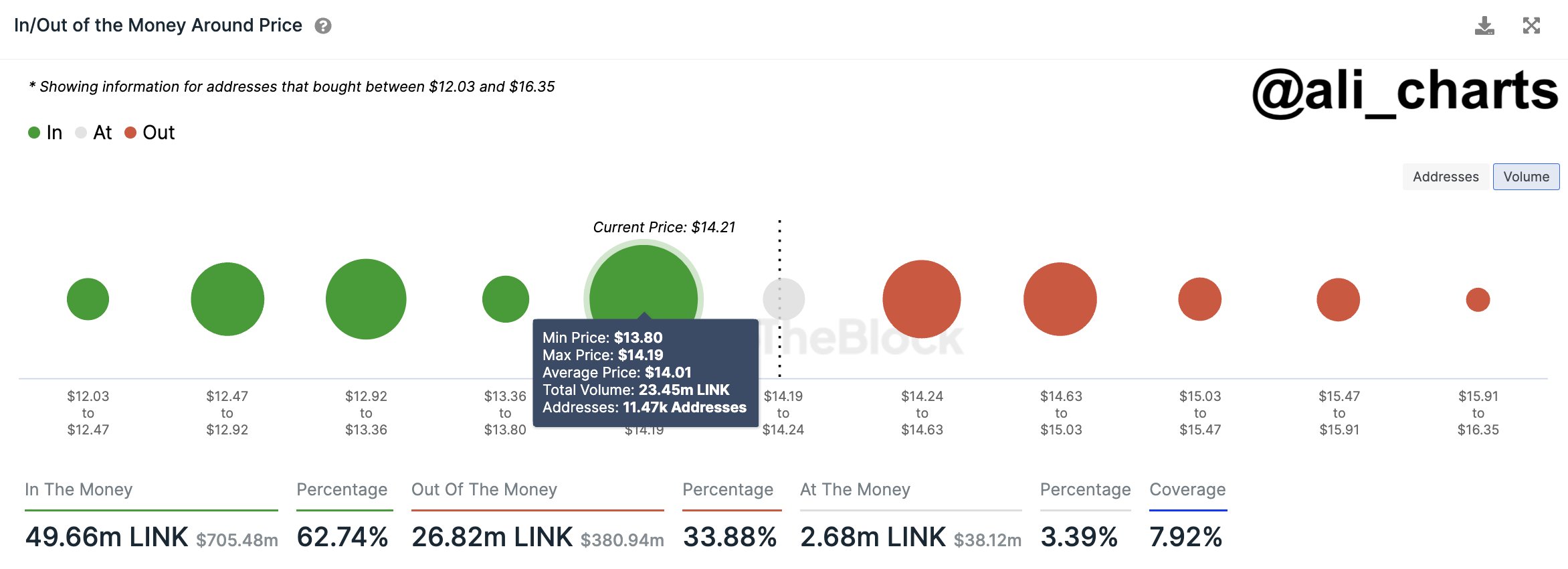

Subsequent up is the blockchain oracle Chainlink (LINK). The crypto analyst and dealer says that Chainlink may revisit and surpass the 2023 excessive of $16.62.

“Chainlink is in a key demand zone, ranging between $13.80 and $14.20. Right here, 11,470 wallets maintain a considerable 23.5 million LINK.

With minimal resistance forward and strong assist under, remaining above this zone may pave the way in which for LINK to climb to new yearly highs.”

Chainlink is buying and selling at $14.34 at time of writing.

Turning to XRP, Martinez says that the fifth-largest crypto asset by market cap may rally between $0.65 and $0.66 because it appears to be breaking out from the vary midpoint of a descending parallel channel.

In technical evaluation, descending parallel channels are sometimes thought-about bearish, however an asset should still rally to the highest of the construction’s vary as Martinez’s chart suggests.

XRP is buying and selling at $0.612 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Giovanni Cancemi/Natalia Siiatovskaia