TradFi giant and FTSE-listed IG launches retail crypto trading in UK with Uphold tomorrow

IG Group will enable retail traders in the UK to commerce 38 cryptocurrencies on its multi-asset platform from Tuesday, June 3, changing into the primary London-listed dealer to supply spot tokens.

The agency’s integration depends on a partnership with digital-asset trade Uphold, which is able to present custody and execution providers. The Monetary Providers Compensation Scheme doesn’t cowl property held with Uphold, and buying and selling will likely be restricted to totally paid positions with no leverage.

“Buyer demand is reaching a tipping level,” IG U.Ok. managing director Michael Healy advised The Times, including that conventional account holders need direct publicity to bitcoin, ether, and a rising checklist of altcoins, together with Solana, Dogecoin, and the meme token DogWifhat.

The launch comes 5 weeks after the Treasury printed a draft rulebook geared toward bringing crypto below present market abuse, shopper safety, and capital regimes. Chancellor Rachel Reeves stated the framework would “increase investor confidence,” in line with an April 29 press launch on gov. UK.

Regulatory readability is colliding with a pointy rise in public participation. A Monetary Conduct Authority survey launched in August 2024 discovered that 12 p.c of U.Ok. adults, roughly seven million individuals, already personal digital property, up from 4.4 p.c in 2021. Consciousness stands at 93 p.c, the watchdog famous in its 2024 research briefing.

Brokerages are shifting shortly to fulfill that demand. Revolut and eToro have lengthy supplied retail crypto channels, whereas Coinbase operates exterior the standard brokerage mannequin. By securing a seat inside a spread-bet and equities platform, IG goals to lock in shoppers who may in any other case transfer funds to challenger apps.

The choice to outsource custody displays a wider pattern amongst established monetary corporations that wish to add digital property with out constructing pockets infrastructure in-house. As trade guide GoodMoneyGuide observed when first flagging the tie-up, such preparations let brokers management market danger and time-to-market whereas the Monetary Conduct Authority finalises technical safeguarding guidelines here.

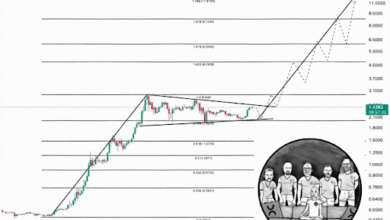

Crypto markets have retained momentum forward of the product rollout. Whole capitalisation stood close to $3.3 trillion on June 2, with Bitcoin secure round $105,000. Deeper liquidity and tighter regulation are encouraging mainstream brokers to deal with tokens as one other asset class fairly than an unique facet wager.

IG’s transfer nonetheless carries questions. Purchasers should take up value swings with out leverage however will shoulder the complete tax burden on beneficial properties, and the dealer should clearly flag the absence of deposit safety. The Monetary Conduct Authority can be refining capital and safeguarding thresholds for corporations holding consumer crypto, that means future changes could possibly be required.

Even so, the step indicators that digital property have crossed an institutional line within the UK. With coverage guardrails rising and thousands and thousands of Britons already holding tokens, 2025 is shaping up because the yr crypto settles contained in the Metropolis’s regulated perimeter.