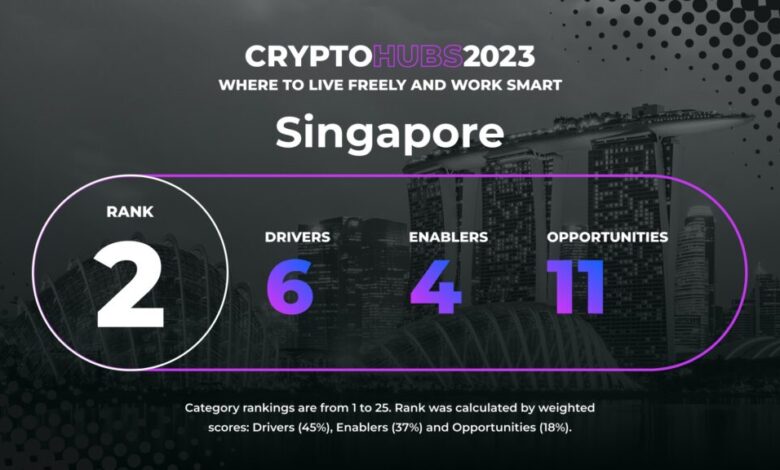

Singapore: A big base in Asia ready to restart[Crypto Hub 2023]2nd place | CoinDesk JAPAN | CoinDesk Japan

With the crypto business rightfully dubbed the “Wild West,” crypto founders are on the lookout for predictability and readability when on the lookout for a spot to include. They have an inclination to favor regulation.

That’s the reason Singapore, a regulated and effectively ruled city-state, has the headquarters and satellite tv for pc workplaces of among the greatest names within the cryptocurrency business, equivalent to Binance, Coinbase and Crypto.com. workplace is situated.

However with the spectacular bankruptcies of homegrown darlings Terraform Labs and Three Arrows Capital, the ecosystem entered a “crypto winter.” Singapore’s crypto neighborhood is now beginning to heal its wounds and look to the longer term.

Highly effective Crypto Hub

Singapore’s status continues to be alive and nicely. In a CoinDesk survey of about 30 globe-trotting crypto professionals this spring, it obtained essentially the most votes as the very best crypto hub. Nicknamed the Pink Dot, Singapore ranks highest on the planet for digital infrastructure (Digital Evolution Index by Tufts College’s Fletcher Faculty), second within the World Financial institution’s Ease of Doing Enterprise Index, and has a powerful cryptocurrency. It has every thing you want for a hub.

In accordance with the 2023 World Monetary Facilities Index, Singapore is essentially the most aggressive fintech hub within the Asia-Pacific area, forward of Hong Kong, in addition to a regulatory pioneer within the crypto business. The Financial Authority of Singapore (MAS) has handed the Cost Providers Licensing Act in 2020.

“Singapore was the primary nation within the area to have a strong framework for digital asset licensing in place, leading to a rush of firms to use for licenses,” mentioned Institutional Digital Belongings. mentioned Pamela Lee, head of APAC gross sales at buying and selling know-how developer Talos.

Prakash Somosundram, founding father of Enjinstarter, a blockchain-based crowdfunding platform for early-stage crypto tasks, mentioned he has been “entrance row on the Singapore crypto scene” since 2015. “I’ve seen it,” he says.

“From a regulatory perspective, the early days of crypto have been very pro-crypto, which is why many crypto influencers moved their capital right here,” Somosandram mentioned. He additionally identified that the absence of capital beneficial properties tax “is a perfect place for the crypto rich to return.”

“Crypto Island”

Extremely educated expertise and arranged fintech know-how make for a powerful mixture for Singapore. Early ICOs (preliminary coin choices) embody Singapore startups equivalent to cryptocurrency cost platform TenX, which raised $43 million in simply seven minutes in 2017. was included.

In the identical 12 months, Singapore raised $1.5 billion in ICO funding, surpassing the US with $1.2 billion. For a rustic in regards to the measurement of New York Metropolis with solely two-thirds of the inhabitants, the numbers are staggering.

Till the present “cryptocurrency winter” arrived, Singapore had attracted a lineage that may very well be described as a stereotype of the tradition and life-style of cryptocurrency celebrities. That world was centered across the prosperous Sentosa Island, which Somosundrum known as “Crypto Island.”

Sentosa is the one place in Singapore the place foreigners can personal actual property and is flooded with rich expats. Sentosa residents embody Binance founder and CEO Chengpeng Zhao and cryptocurrency thought chief and American investor Balaji Srinivasan. Crypto-related meetups, conferences and occasions have been held at villas and yachts, Somosandram recalled.

Various island

However Zhao and Balaji left Singapore comparatively early. Zhuling Chen, founder and CEO of staking entry startup RockX, his second crypto startup in Singapore, shares his views on the native crypto neighborhood. mentioned it was clearly not a luxurious island for high-profile billionaires.

Chen mentioned the neighborhood is racially and gender-diverse, and the crypto ecosystem is diversifying. Along with ICOs, “Singapore can also be one of many earliest international locations the place the Ethereum neighborhood was fashioned,” based on Chen. “If you go to NEAR or Solana meetups, you see several types of individuals. Robust fan bases” exist in varied token tasks, Chen mentioned.

Singapore’s residents come from all around the world, with round 30% of the inhabitants being non-citizens, or foreigners. “Singapore has been a fintech hub for a few years, attracting expertise from throughout the Asia-Pacific area,” Cheng mentioned, including, “It’s a fairly engaging place to seek out high expertise.” In reality, Cheng’s firm has 40 employees from eight completely different nationalities.

“We don’t need to be seen as crypto bros (self-righteous and conceited crypto males),” mentioned Lee, who’s a member of the Singapore Blockchain Affiliation’s Ladies in Blockchain Committee. says Mr.

“I feel that’s not what Singapore actually needs to construct. What we wish is a fintech hub with a extremely revolutionary surroundings for individuals to work collectively and develop collectively.”

A cautious stance and concern of leaving Singapore

As Singapore returns to its roots, each MAS and crypto traders are a bit extra cautious than earlier than. Temasek Holdings, a government-backed conglomerate and enterprise capital agency, has reportedly written off $200 million in losses as a result of FTX chapter.

Whereas Singapore has maintained its dedication when it comes to selling blockchain, Cheng mentioned banks have taken stricter measures, together with paying extra consideration to know-your-customer (KYC) and anti-money laundering (AML) measures. I settle for that it’s evolving.

Such a cautious stance could transfer crypto-wealthy to Dubai and Hong Kong, the place crypto-friendly rules are attracting company and VC capital, Somosandram mentioned.

Somosandram himself mentioned he has moved Engine Starter’s tokens from an offshore entity to Dubai and is making use of for a license for the primary section of the startup.

“We’re being overtaken by Hong Kong and Dubai,” Somosandram mentioned. Cheng and Lee say Singapore will not be being overwhelmed by hotspots like Dubai and Hong Kong.

“Singapore is a cushty place, so it isn’t really easy to maneuver your entire enterprise that we now have arrange right here to Hong Kong,” Lee mentioned. “I might fairly keep in Singapore and arrange a small workplace elsewhere,” he continued.

In any case, Singapore is in a significantly better place than New York Metropolis, the world’s high monetary hub, in relation to crypto regulation. The Winklevoss brothers, co-founders of cryptocurrency alternate Gemini, introduced in June that they might broaden their Singapore footprint to greater than 100 individuals. By the way in which, the corporate at present has 500 staff worldwide.

“Our Singapore workplace will act as a hub for our wider APAC enterprise. We imagine APAC can be a serious driver of crypto and Gemini’s subsequent progress,” Gemini mentioned in a weblog publish. .

|Translation and enhancing: Akiko Yamaguchi, Takayuki Masuda

|Picture: Wirestock Creators / Shutterstock.com

|Unique: Singapore: The Heart of Asian Crypto Wealth Is Prepared for a Reset

rn","creator":{"@kind":"Individual","title":"Damien Martin","url":"https://ourbitcoinnews.com/creator/damien-martin/","sameAs":["https://www.linkedin.com/in/damien-martin-231789227/"]},"articleSection":["News"],"picture":{"@kind":"ImageObject","url":"https://recordsdata.ourbitcoinnews.com/wp-content/uploads/2023/07/03032516/shutterstock_2158477643.jpg","width":1200,"top":798},"writer":{"@kind":"Group","title":"","url":"https://ourbitcoinnews.com","brand":{"@kind":"ImageObject","url":""},"sameAs":["#","https://twitter.com/CryptoObn","https://ourbitcoinnews.com/feed/"]}}

Source link