TRON and Ethereum Are Battling for the USDT Top Spot

- TRON is closing in on Ethereum’s USDT dominance because of low charges and powerful assist from main exchanges.

- Ethereum nonetheless attracts institutional curiosity, with rising every day energetic addresses and worthwhile whale exercise.

A number of years in the past, Ethereum might need been the principle residence for USDT. However now, the story is completely different. The battle has been heating up since 2021, and TRON, with out a lot fuss, is slowly catching up.

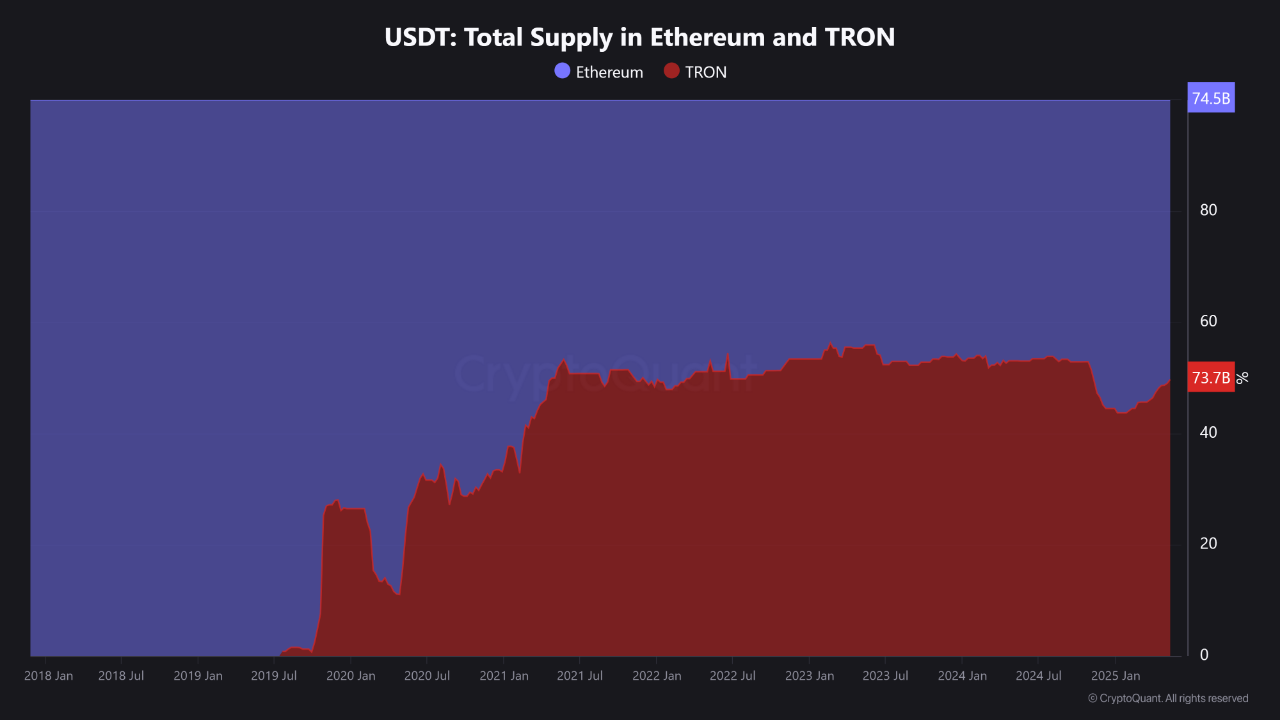

At present, in accordance with CryptoQuant, Ethereum continues to be barely forward with a complete USDT provide of round $74.5 billion. However TRON is carefully following at $73.7 billion. These numbers mirror how trade gamers are more and more involved about effectivity and pace.

Supply: CryptoQuant

Behind this shift, there are a number of issues that make TRON a brand new selection for many individuals. Ethereum’s fuel charges that may make your pocket scream are one of many triggers. However not solely that, large exchanges like Binance, OKX, and Bybit are additionally pushing for the usage of the TRC20 commonplace.

Even within the Asian market, TRON is more and more getting used for over-the-counter transactions. All these components make TRON not underestimated.

TRON is Getting Extra Mature, Ethereum is Nonetheless Charming

If we glance additional, Ethereum as soon as held virtually all management over USDT, particularly in 2019. However now? The proportions are virtually even—Ethereum is round 50.26% and TRON is 49.73%. It’s not nearly who’s greater, however who’s extra agile and environment friendly. Simply think about in the event you needed to switch a considerable amount of stablecoins, and the fuel payment was equal to a flowery dinner. You’d suppose twice, proper?

Moreover, TRON is not only about low prices. CNF beforehand reported that TRON has maintained a every day block manufacturing effectivity of 99.7%. This stability is necessary, particularly for a community that’s the spine of stablecoin transactions. Plus, their Tremendous Consultant (SR) system exhibits wholesome rotation, reflecting pretty aggressive governance.

However, Ethereum isn’t standing nonetheless. The most recent information exhibits a 15% improve in every day energetic addresses, breaking by way of 450,000. There was even one ETH whale that managed to show a $21 million loss right into a $21.7 million acquire. His whole asset worth now? $104.5 million. This type of exercise alerts that institutional curiosity in Ethereum has not died down—in truth, it’s even burning hotter.

Apparently, as we beforehand reported, Ethereum is presently buying and selling above its realized worth. Because of this many long-term holders—particularly Binance customers—are in a cushty place, aka worthwhile. Binance itself stays a significant liquidity hub for ETH, even throughout main portfolio shifts.

Nevertheless, TRON can also be displaying an fascinating sample. Regardless of the latest decline in new wallets and transactions, many analysts see it as an accumulation part. Slowing exercise doesn’t imply weakening, however moderately making ready for the subsequent surge.