Trump’s Bitcoin Reserve: Reasons why this can and cannot ignite crypto rally

- Chart patterns recommend that if the current govt order—anticipated to make BTC rally—follows previous developments, a decline is probably going.

- For now, buyers—U.S. retail and conventional establishments—have been promoting the asset because it fails to spark optimism out there.

Previously 24 hours, Bitcoin’s [BTC] motion hasn’t aligned with market expectations, significantly with the chief order bringing a strategic BTC reserve to life.

Over this era, the asset has dropped by 4.05%, interrupting final week’s 10% surge in BTC’s efficiency. Excessive dealer skepticism at the moment dominates market sentiment, contributing to BTC’s underwhelming efficiency.

Trump’s previous affect on Bitcoin is fading

President Donald Trump beforehand influenced BTC’s value positively, however this impact is diminishing as investor skepticism will increase.

After his 2024 U.S. presidential election victory, BTC surged from $66,780 to $109,350, marking a 63.75% enhance. Since then, BTC has struggled to ship further rally alternatives, reflecting a shift in market dynamics and sentiment.

Supply: TradingView

After Trump introduced a Presidential Working Group on January 23 to create a BTC regulatory framework, the asset fell 27.08%.

This decline is uncommon for such a part and displays rising investor skepticism, probably maintaining many on the sidelines. If BTC mirrors buying and selling patterns seen after earlier govt orders, it might drop one other 33% to the $58,000 vary.

What’s driving the decline?

Bitcoin’s current decline stems from skepticism amongst U.S. retail and institutional buyers, usually anticipated to behave as main consumers.

This skepticism persists regardless of the institution of a strategic Bitcoin reserve tied to their nation. The Coinbase Premium Index, which displays retail investor exercise, confirms that retail buyers are promoting as a substitute of shopping for.

The index stays in a traditionally bearish vary, recording a damaging 0.01, generally acknowledged as a promoting indicator.

Supply: CryptoQuant

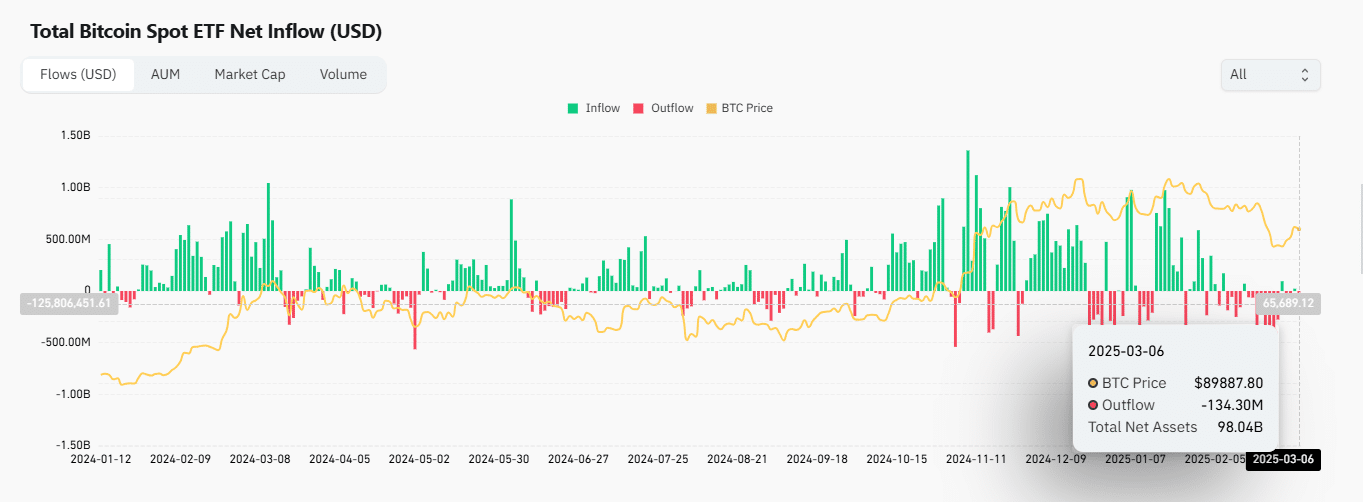

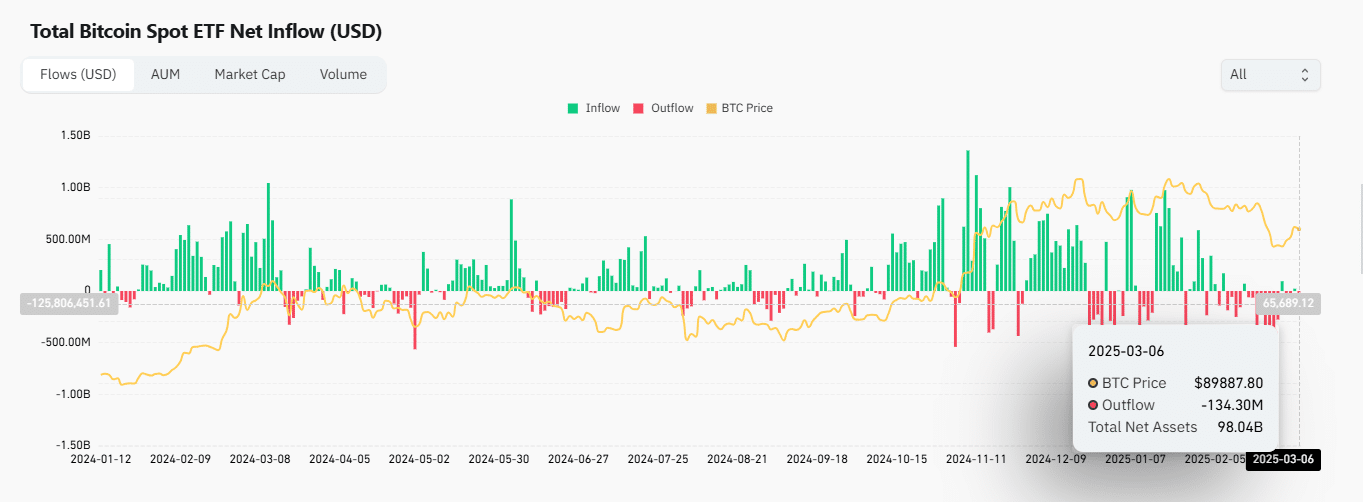

In the meantime, BTC Alternate-Traded Fund (ETF) netflow knowledge reveals that institutional buyers are additionally promoting within the present market atmosphere.

Throughout the final day, the trade netflow turned damaging as institutional holders bought $134 million value of BTC. That is stunning, as profit-driven buyers would usually view BTC’s $88,200 value, at press time, as a shopping for alternative throughout vital occasions.

Nevertheless, opposite to expectations, they’re opting to promote, additional contributing to bearish market exercise.

Supply: Coinglass

Bulls stay, however with low momentum

Some market segments stay bullish, however momentum seems weak.

Within the derivatives market, the Funding Charge signifies a barely bullish bias, monitoring whether or not longs or shorts pay place premiums.

On the time of writing, it was at 0.011. This means that consumers are paying premiums, anticipating a value enhance. Nevertheless, enthusiasm appears to be waning.

The Funding Charge stands barely above the bearish threshold (under 0) and has dropped from the day gone by’s excessive of 0.0042.

Supply: CryptoQuant

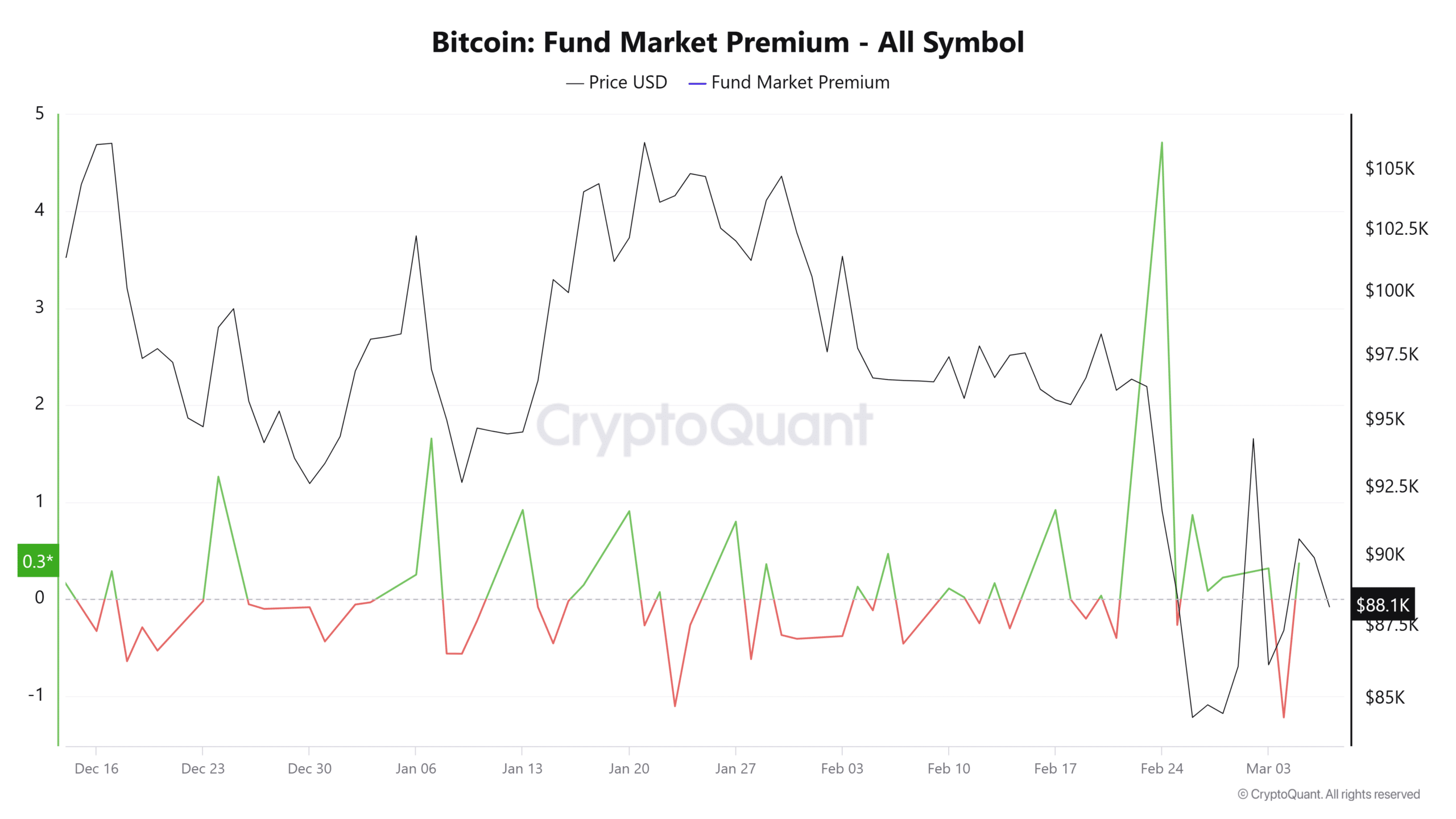

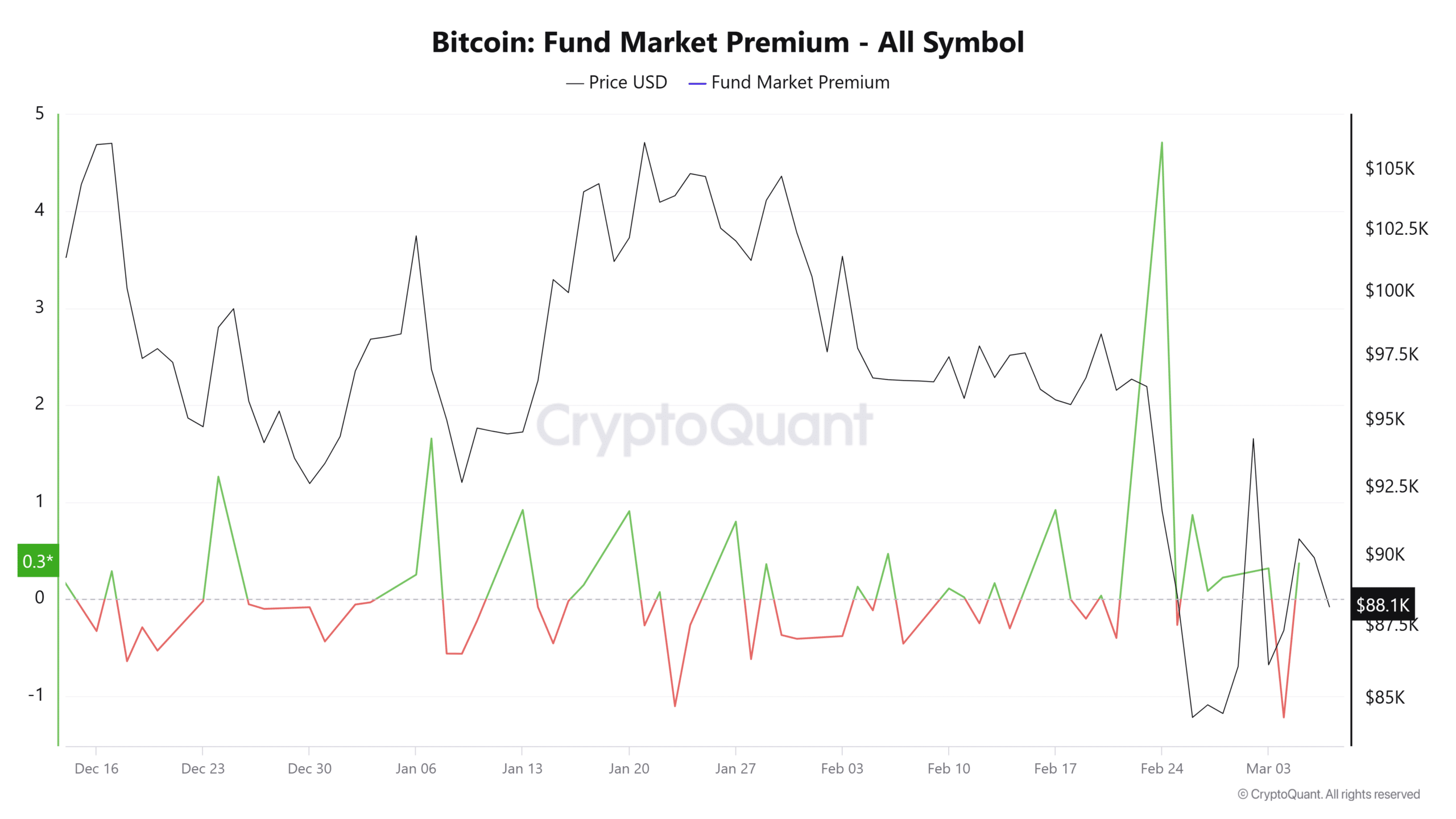

Equally, the Fund Market Premium reveals that crypto funding funds like GBTC are shopping for, though their tempo stays gradual.

At the moment, the metric stands at 0.3, barely above the impartial and bearish zone, signaling cautious investor habits.

If the derivatives market and crypto funding funds flip bearish, Bitcoin’s value might expertise additional declines from its present stage.