TRUMP’s trading volume conquers both CEXs and DEXs

Simply 4 quick days after its launch, TRUMP has turn into some of the actively traded cash throughout each centralized and decentralized exchanges. With its excessive liquidity and buying and selling quantity, it has positioned itself on the forefront of the market, banking on the controversy and memecoin frenzy that has swept the crypto business.

Centralized exchanges, the liquidity powerhouses for TRUMP

TRUMP established a powerful foothold on centralized exchanges, significantly on Binance. Due to the alternate’s recognition and ease of entry, the TRUMP/USDT buying and selling pair has turn into the third-largest market by quantity. Over the previous 24 hours, this pair recorded a staggering $3.11 billion in buying and selling quantity, accounting for over 9% of Binance’s complete exercise. That is no small feat, particularly contemplating the dominance of Bitcoin pairs like BTC/USDT and BTC/FUSD.

Spot Markets on Binance

| # | Coin | Pair | Worth | Unfold | +2% Depth | -2% Depth | 24h Quantity | Quantity % |

|---|---|---|---|---|---|---|---|---|

| 1 | Bitcoin | BTC/FDUSD | $104,884 | 0.02% | $7,354,256 | $7,309,560 | $4,295,024,880 | 13.05% |

| 2 | Bitcoin | BTC/USDT | $105,002 | 0.01% | $18,743,946 | $16,556,980 | $3,716,523,983 | 11.29% |

| 3 | Official Trump | TRUMP/USDT | $41.89 | 0.02% | $3,398,908 | $2,783,969 | $3,182,733,823 | 9.67% |

| 4 | USDC | USDC/USDT | $0.9993 | 0.02% | $67,174,976 | $69,943,077 | $2,166,704,864 | 6.58% |

| 5 | Dogecoin | DOGE/USDT | $0.3642 | 0.01% | $4,862,941 | $5,513,991 | $1,569,533,994 | 4.77% |

Knowledge from CoinMarketCap confirmed that the TRUMP/USDT pair boasts a excessive liquidity rating of 753, making it one of many deeper markets for merchants. Liquidity, measured as the power to execute giant trades with minimal value affect, is vital for any asset. This rating ensures merchants can rapidly enter and exit positions, as there’s ample depth to keep away from main value slippage. That is significantly important given TRUMP’s value volatility, which had a each day vary of $35.10 to $48.33.

Different centralized exchanges additionally noticed excessive TRUMP buying and selling exercise. Bybit’s TRUMP/USDT pair recorded $734 million in 24-hour quantity, whereas OKX adopted carefully with $1.27 billion. Coinbase, whereas trailing when it comes to quantity, nonetheless captured a big $262 million.

TRUMP Markets on CEXs

| # | Change | Pair | Worth | +2% Depth | -2% Depth | Quantity (24h) |

|---|---|---|---|---|---|---|

| 1 | Binance | TRUMP/USDT | $41.23 | $2,568,185 | $4,221,125 | $3,111,811,929 |

| 2 | Binance | TRUMP/USDC | $41.26 | $657,763 | $703,201 | $266,295,962 |

| 3 | Bybit | TRUMP/USDT | $41.39 | $404,707 | $441,133 | $734,040,401 |

| 4 | Coinbase Change | TRUMP/USD | $41.27 | $497,527 | $555,746 | $262,561,595 |

| 5 | OKX | TRUMP/USDT | $41.23 | $1,037,301 | $1,316,932 | $1,278,445,578 |

Decentralized exchanges, a rising challenger for quantity

Whereas centralized exchanges appear to get extra consideration, TRUMP has dominated exercise on decentralized platforms, significantly the Solana-based Meteora and Raydium.

TRUMP Markets on DEXs

| # | Change | Pair | Worth | Quantity (24h) | Liquidity rating |

|---|---|---|---|---|---|

| 1 | Meteora VD | TRUMP/USDC | $42.16 | $412,628,583 | 852 |

| 2 | Raydium (CLMM) | TRUMP/SOL | $41.61 | $531,658,687 | 670 |

| 3 | Raydium (CPMM) | TRUMP/SOL | $41.73 | $51,362,794 | 615 |

| 4 | Orca | TRUMP/USDC | $41.85 | $177,799,794 | 542 |

| 5 | Raydium | TRUMP/SOL | $41.99 | $12,518,161 | 435 |

The TRUMP/USDC pair on Meteora stands out, with $589.9 million in 24-hour quantity and a liquidity rating of 852—surpassing Binance’s liquidity for a similar asset. This makes Meteora some of the liquid markets for TRUMP.

The TRUMP/SOL pair on Raydium is one other key market, with $435.9 million in each day quantity and a Price/TVL ratio of 4.96%. This metric signifies a extremely energetic buying and selling surroundings, with charges producing practically 5 p.c of the liquidity within the pool. Whereas its liquidity rating of 670 trails that of Meteora’s TRUMP/USDC pair, Raydium’s exercise reveals the energy of the Solana ecosystem in facilitating high-frequency buying and selling with SOL pairs.

TRUMP pairs have additionally taken over most of Meteora’s exercise. TRUMP and MELANIA pairs account for 5 of Meteora’s high 10 buying and selling pairs, displaying that the alternate has been taken over by a speculative growth surrounding the controversial memecoins. As an illustration, the Melania/USDC pair on Meteora has a Price/TVL ratio of a rare 57.51%, reflecting extraordinarily excessive turnover regardless of decrease liquidity in comparison with TRUMP.

Markets on Meteora

| # | Foreign money | Pair | Worth USD | 24h Change | 24h Txns | 24h Quantity | Liquidity |

|---|---|---|---|---|---|---|---|

| 1 | OFFICIAL TRUMP | TRUMP/SOL | $41.70 | ↑ 9.75% | 66,356 | $154,616,927.42 | $2,567,151.83 |

| 2 | Official Musk Meme | MUSK/SOL | $0.1705 | ↓ 32.89% | 65,277 | $121,740.12 | $48,471.82 |

| 3 | Solana | SOL/USDC | $253.37 | ↑ 5.78% | 54,236 | $125,501,649.62 | $1,727,724.14 |

| 4 | OFFICIAL TRUMP | TRUMP/SOL | $41.62 | ↑ 9.70% | 41,773 | $165,098,976.66 | $8,607,089.35 |

| 5 | Solana | SOL/USDC | $253.08 | ↑ 6.11% | 41,327 | $3,728,722.70 | $296,165.48 |

| 6 | Official Melania Meme | MELANIA/SOL | $3.92 | ↓ 7.81% | 34,797 | $42,891,832.19 | $2,565,248.35 |

| 7 | Solana | SOL/USDC | $253.25 | ↑ 5.66% | 34,584 | $4,095,137.59 | $246,651.57 |

| 8 | OFFICIAL TRUMP | TRUMP/USDC | $42.07 | ↑ 10.25% | 34,254 | $520,667,907.17 | $718,025,470.87 |

| 9 | OFFICIAL TRUMP | TRUMP/SOL | $41.53 | ↑ 9.10% | 27,893 | $37,321,534.26 | $388,240.19 |

| 10 | Solana | SOL/USDC | $253.83 | ↑ 5.76% | 27,841 | $11,909,068.08 | $620,288.86 |

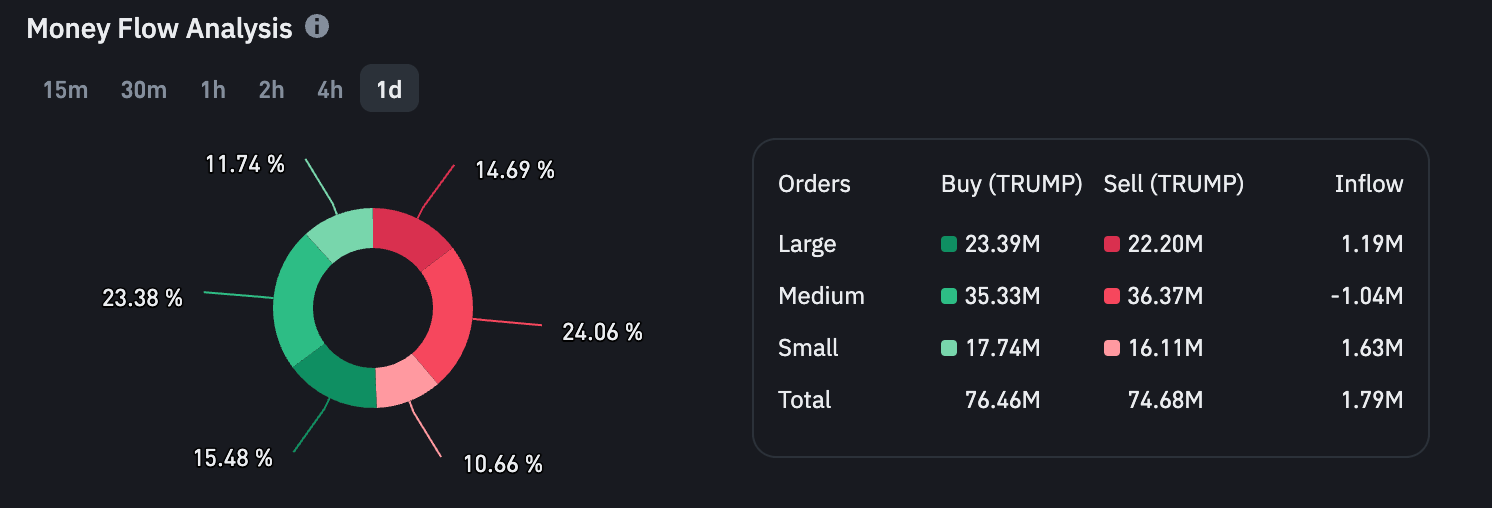

TRUMP’s efficiency throughout centralized and decentralized exchanges highlights two key tendencies. First, centralized exchanges like Binance stay liquidity powerhouses, providing stability and excessive buying and selling volumes that cater to institutional and high-net-worth merchants. Second, decentralized exchanges are rapidly closing the hole, with platforms like Meteora offering liquidity scores and buying and selling environments that rival or surpass their centralized counterparts.

The coin’s speculative enchantment is obvious in each ecosystems. Excessive buying and selling volumes and value volatility on centralized exchanges draw short-term merchants on the lookout for fast positive factors. On decentralized platforms, the emergence of high-turnover pairs like TRUMP/USDC and TRUMP/SOL signifies sturdy exercise from customers preferring the high-risk, high-reward buying and selling surroundings of DEXs.

The submit TRUMP’s buying and selling quantity conquers each CEXs and DEXs appeared first on CryptoSlate.