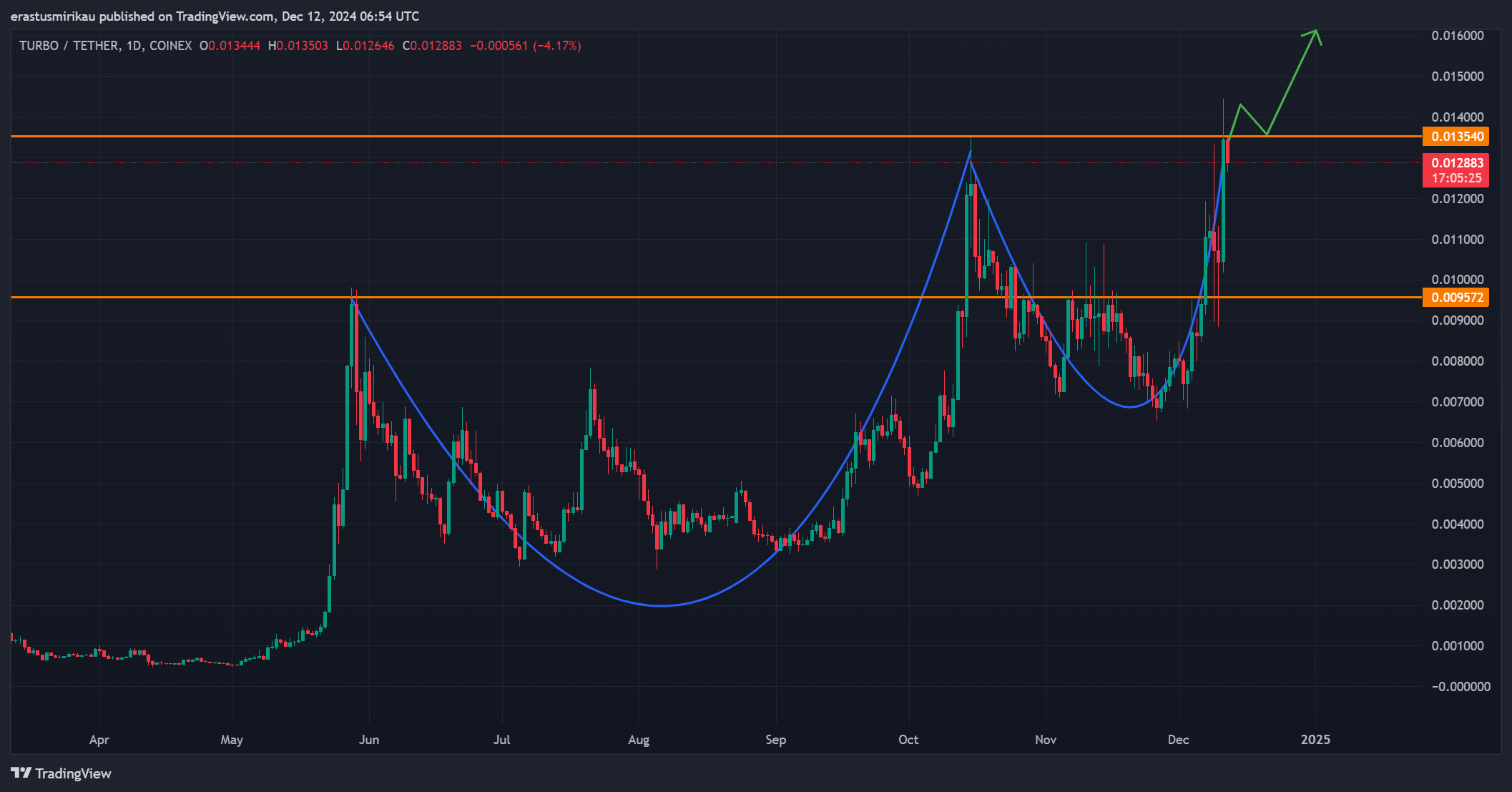

Turbo price prediction: Will it soar past $0.016 or fall below $0.0100 next?

- Turbo varieties a bullish cup and deal with sample, aiming for $0.016 if $0.0135 breaks.

- Rising open curiosity and robust on-chain exercise point out bullish momentum regardless of volatility dangers.

Turbo [TURBO] has skilled a outstanding surge, climbing 18% within the final 24 hours, capturing vital consideration from merchants. At press time, Turbo was buying and selling at $0.01302.

Subsequently, the important thing query stays: will Turbo break via the crucial resistance at $0.0135 and soar to $0.016, or will it retrace to check assist at $0.0095? With the present momentum and rising hypothesis, the subsequent transfer might be decisive.

Is turbo gearing up for a breakout?

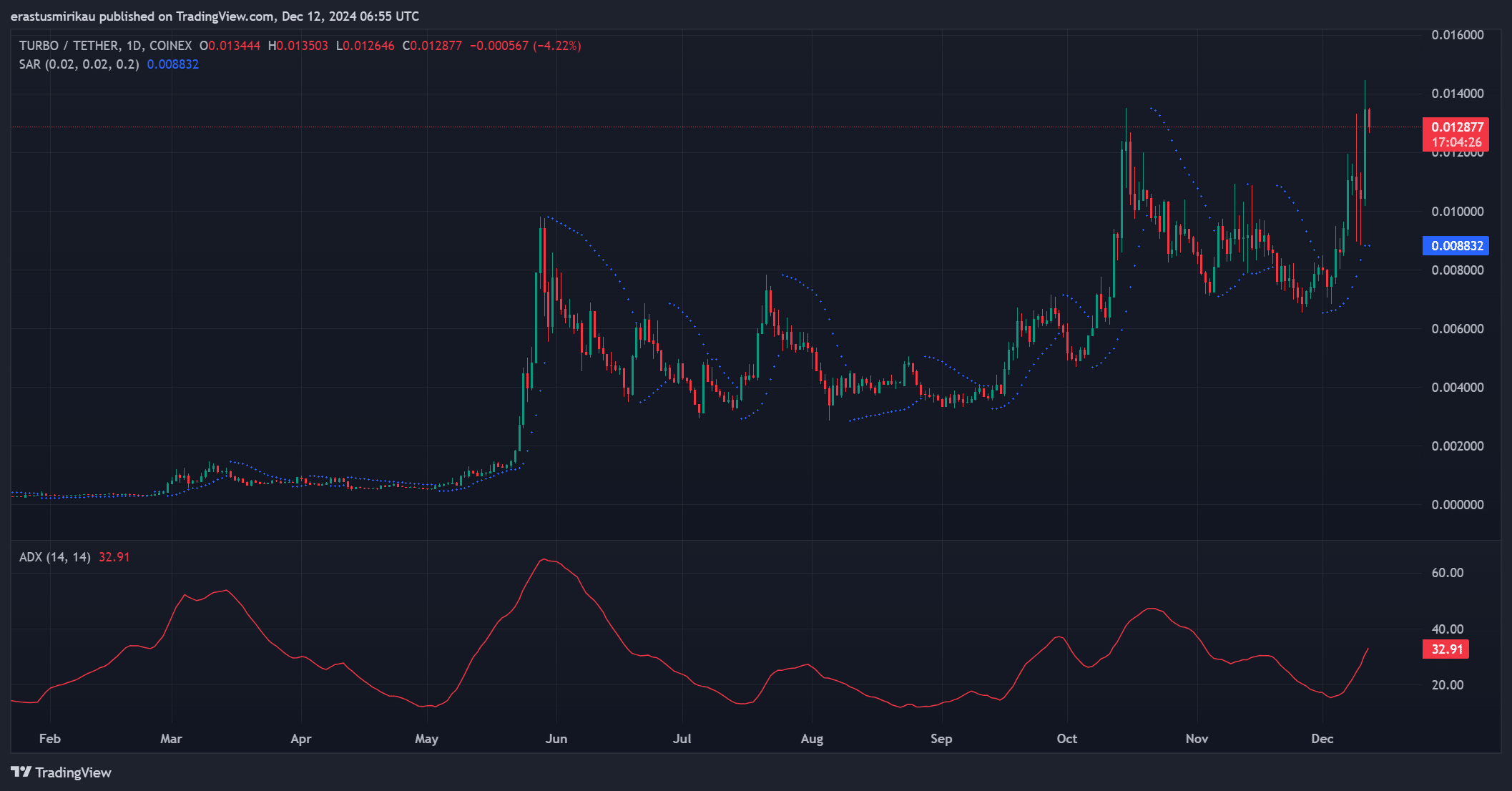

The each day chart highlights a cup and deal with sample, a bullish construction that alerts a possible breakout. Turbo has already surged previous the $0.0095 assist degree, reflecting robust purchaser confidence and growing demand.

Nevertheless, the $0.0135 resistance stays a big problem. Breaking this degree may open the door for a rally towards $0.016, which represents the subsequent key psychological and technical goal.

Alternatively, failure to surpass $0.0135 might result in a pullback, with $0.0095 serving as instant assist and a crucial fallback degree. Subsequently, the worth motion over the subsequent few classes will likely be essential in figuring out Turbo’s trajectory.

Supply: TradingView

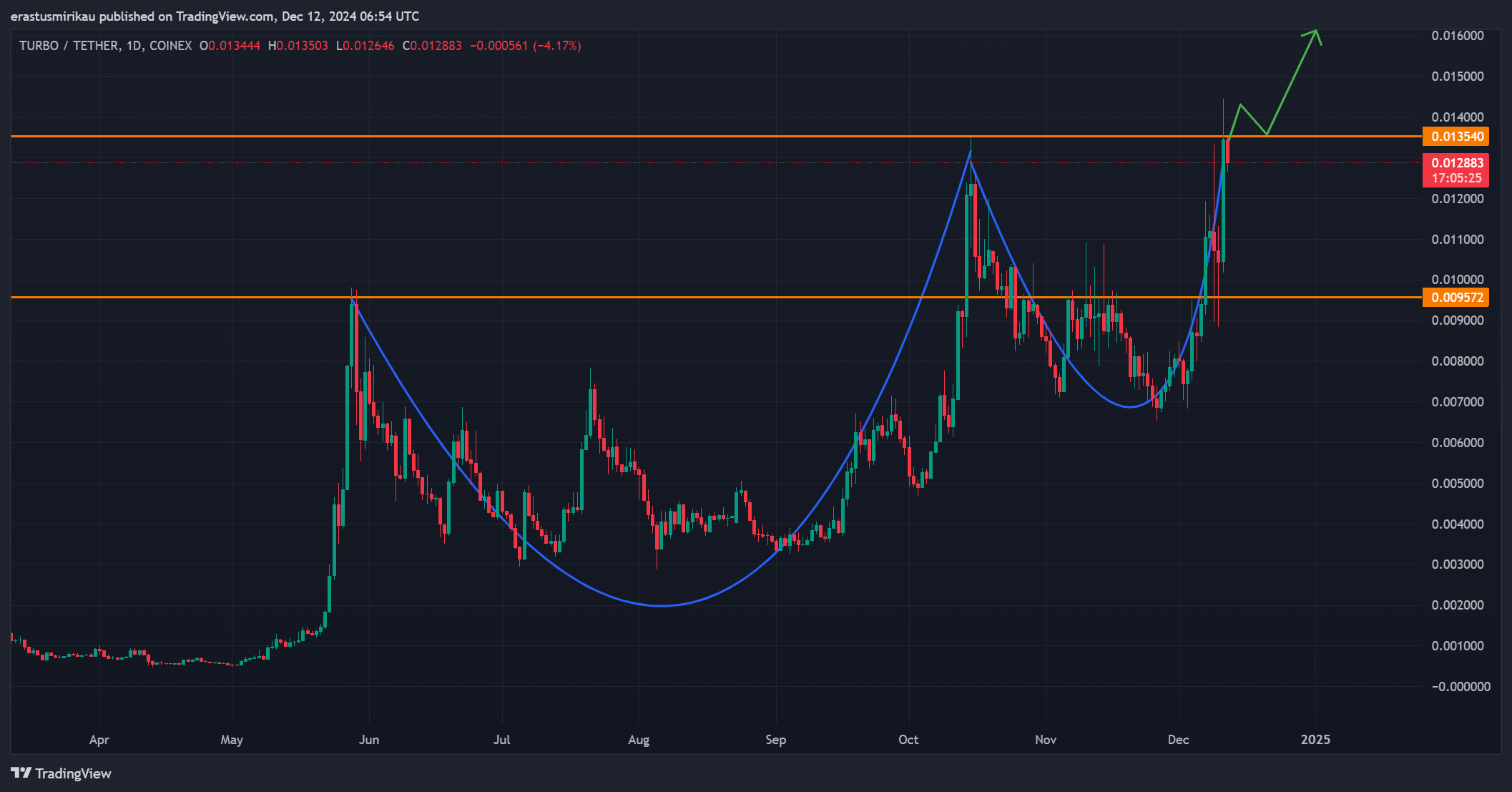

What do the technical indicators say?

The Parabolic SAR confirms the continuation of the bullish development, with the dotted markers remaining under the worth. This means sustained upward momentum, which helps the probability of additional beneficial properties.

Moreover, the ADX (Common Directional Index) reads 32.91, a powerful indication of a well-established development. Collectively, these indicators recommend that Turbo’s worth is extra prone to push greater than reverse.

Nevertheless, merchants ought to look ahead to any potential shifts in these alerts, as a lack of momentum may set off a correction.

Supply: TradingView

On-chain metrics reveal bullish demand

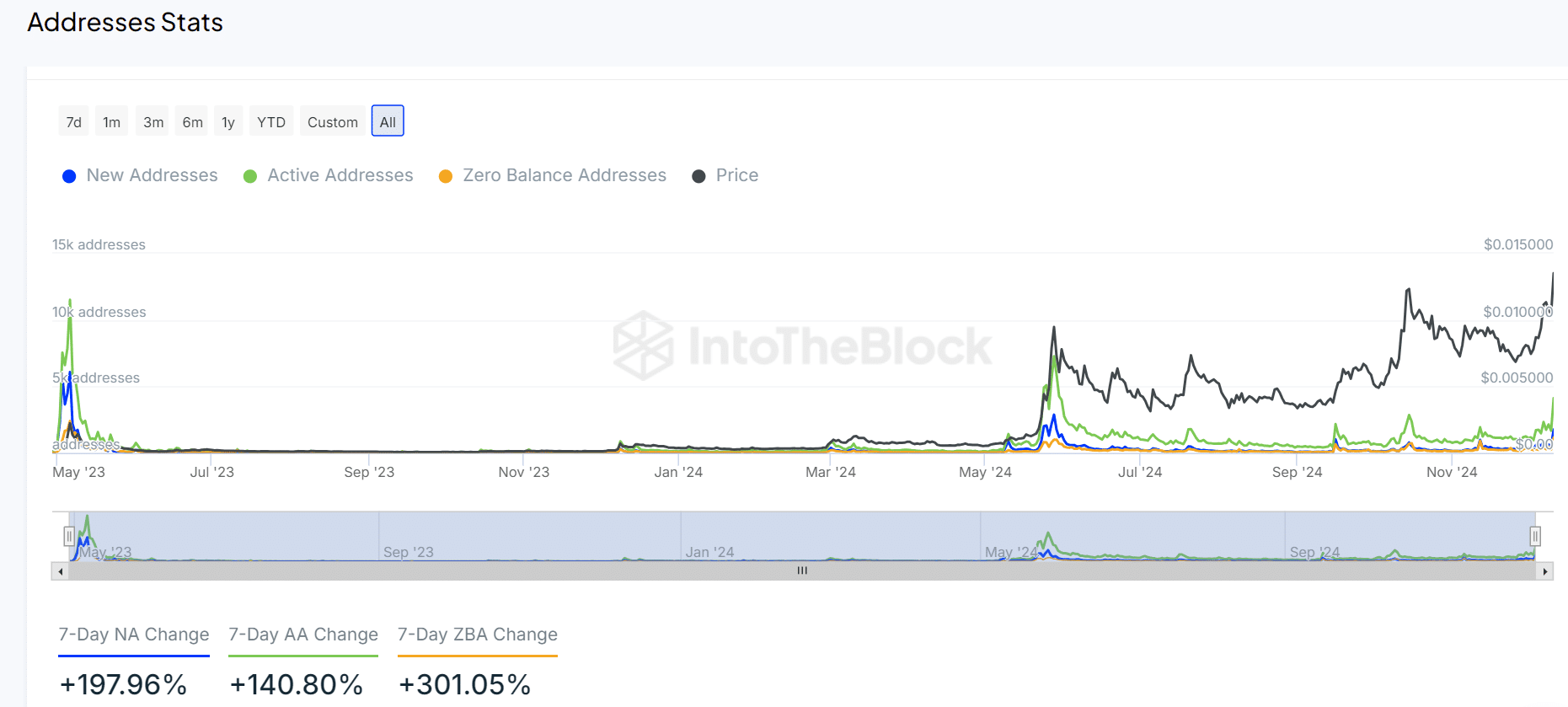

On-chain exercise additional helps the bullish outlook, with vital development in consumer engagement. New addresses have surged by 197.96%, whereas lively addresses have elevated by 140.80%, reflecting heightened curiosity in Turbo.

Furthermore, zero-balance addresses have risen by 301.05%, indicating the creation of recent wallets, probably pushed by hypothesis. These metrics show robust demand, aligning with the bullish worth motion and reinforcing the case for an upward transfer.

Supply: IntoTheBlock

Rising open curiosity alerts momentum

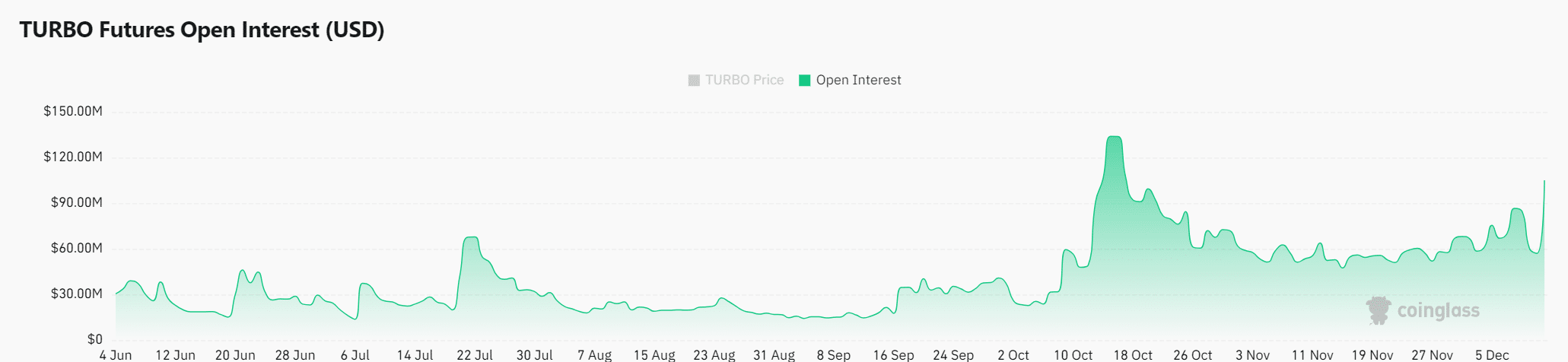

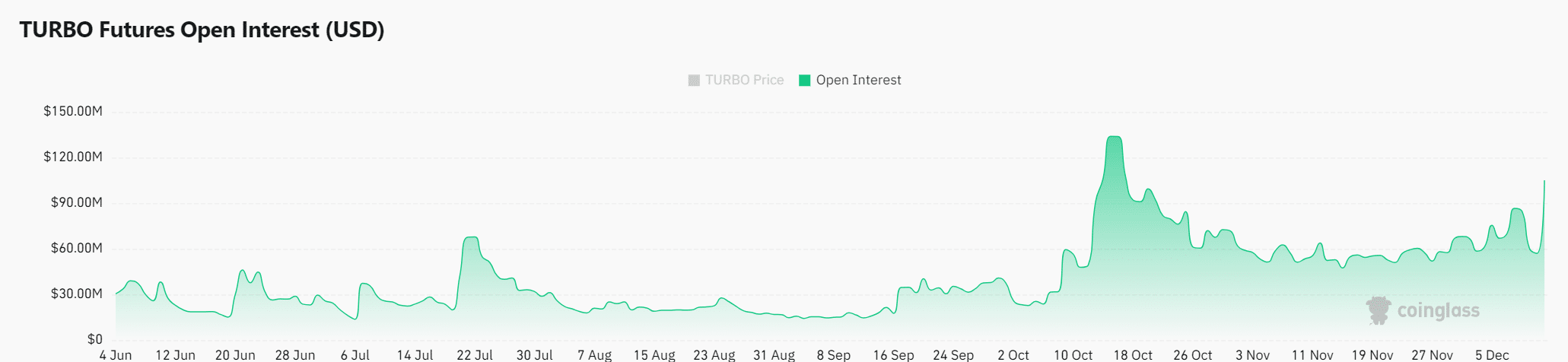

Open curiosity for Turbo has surged by 43.74%, reaching $91.50M. This sharp improve displays rising speculative exercise, which frequently precedes massive worth actions.

Whereas this strengthens the case for a breakout, it additionally introduces potential dangers if leveraged positions start to unwind. Subsequently, merchants ought to monitor market conduct intently, as heightened volatility is predicted.

Supply: Coinglass

Sensible or not, right here’s TURBO’s market cap in BTC’s phrases

Will turbo soar or stumble?

Turbo is extremely prone to break the $0.0135 resistance and goal $0.016 and past. Robust technical indicators, rising on-chain exercise, and surging open curiosity all level to sustained upward momentum.

Whereas a pullback to $0.0095 is feasible, the proof overwhelmingly helps a bullish breakout within the close to time period.