U.S. government moves $8M in Bitcoin – Are major crypto shifts coming?

- The U.S. authorities transferred $8.46M value of Bitcoin from Sae-Heng Confiscated Funds.

- The aftermath of the massive switch was mirrored within the quick time-frame, however the long-term sentiments stay bullish.

The U.S. authorities has as soon as once more transferred an enormous quantity of confiscated Bitcoin [BTC], producing hypothesis within the crypto world.

In accordance with a latest tweet from a renown analyst, $8.46 million value of BTC was transferred from Sae-Heng Confiscated Funds. Notably, the funds have been transferred to 2 completely different wallets.

Traditionally, high-value BTC transactions by governments have prompted short-term worth fluctuations. Whereas such transactions mirror liquidation plans, direct affirmation of any outright promoting has not been noticed but.

Nevertheless, the metrics stay unstable because the market reacts to the transaction.

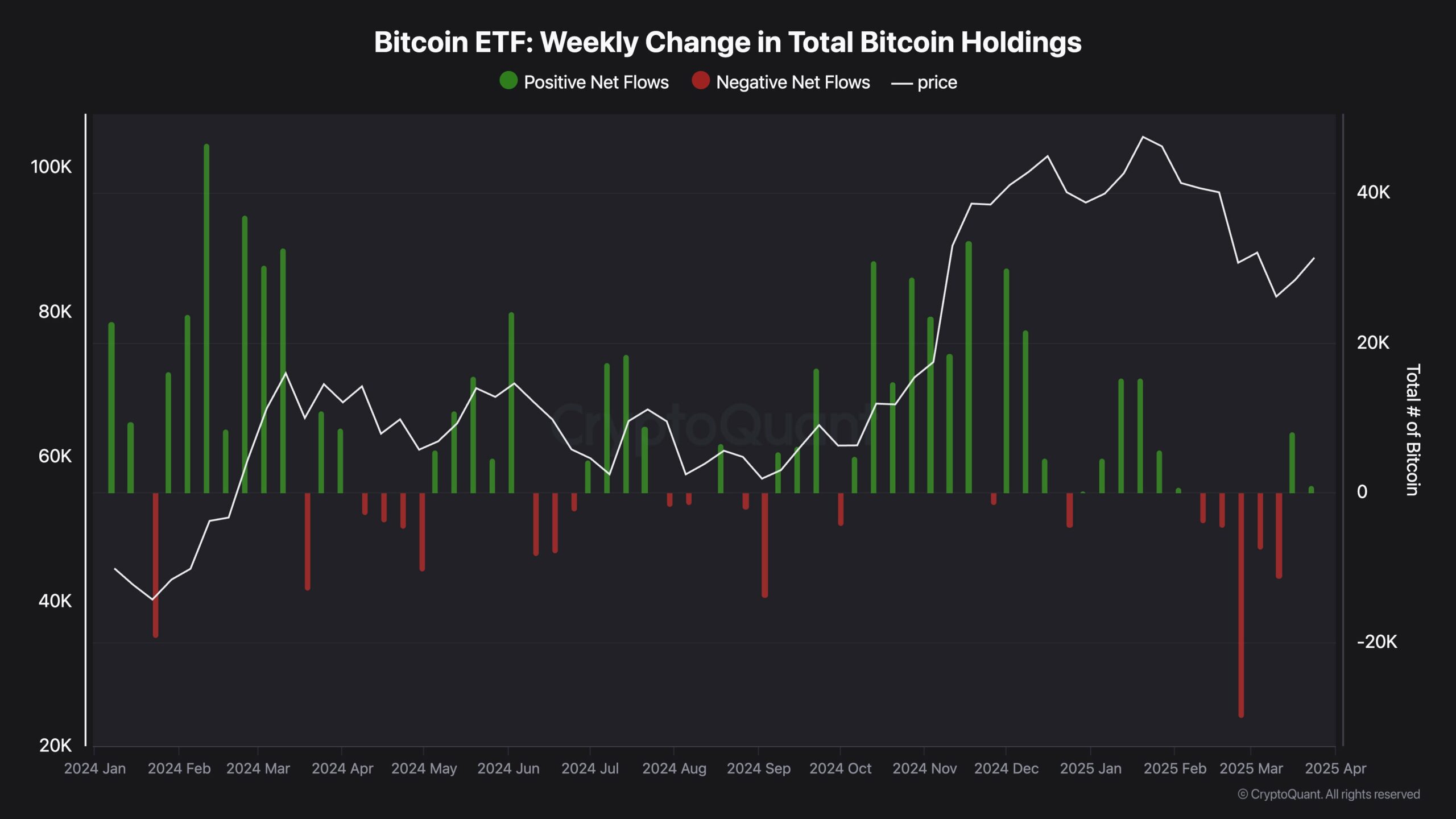

Bitcoin ETFs at a crossroad

Bitcoin Trade-Traded Funds (ETFs) are at a turning level. AMBCrypto’s evaluation of CryptoQuant knowledge exhibits document weekly outflows as establishments alter their portfolios.

Macroeconomic uncertainty has prompted risk-averse buyers to scale back BTC publicity and steadiness their holdings.

This shift has led to a decline in Bitcoin ETF holdings, signaling potential short-term volatility.

Establishments could also be hedging their crypto investments towards broader financial dangers, which might affect BTC’s worth actions within the weeks forward.

Supply: CryptoQuant

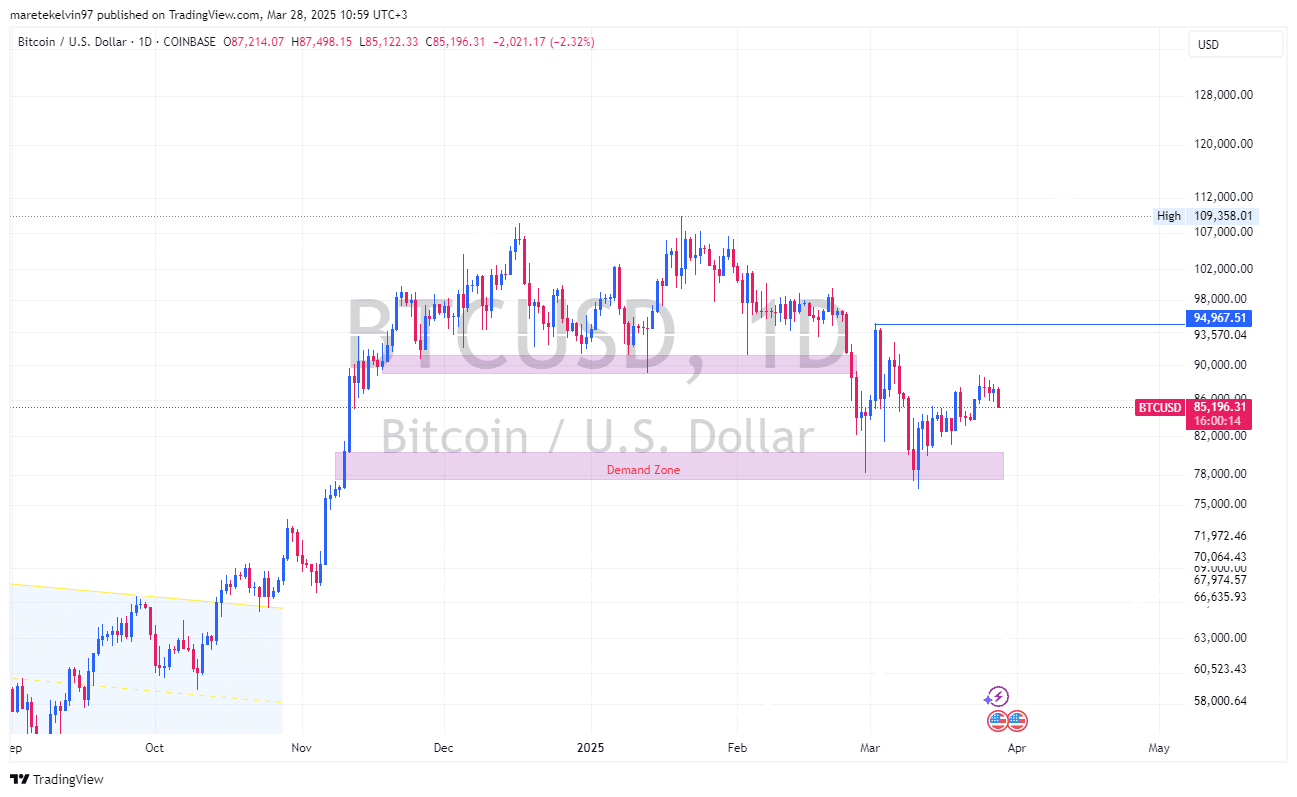

BTC costs tune to outflows and transfers

The affect of the latest Bitcoin motion is clear on the charts. Over the previous 24 hours alone, BTC costs have dropped by over 2%, at press time.

This decline is rubbing shoulders with ETF outflows and the U.S. authorities’s Bitcoin switch, which is regarding merchants.

Supply: TradingView

Regardless of the latest dip, Bitcoin’s general development stays bullish, pushed by robust fundamentals and growing adoption. BTC costs have proven resilience in latest months, sustaining their standing as a number one monetary asset.

Though short-term volatility persists, the long-term outlook for Bitcoin seems promising. As institutional buyers alter their methods, BTC’s worth habits is prone to stay influenced by macroeconomic elements.

Market consensus suggests a gentle development continuation except affected by vital exterior occasions. Individuals ought to monitor institutional flows and authorities actions involving Bitcoin to raised perceive worth path.