U.S. regulators shun spot Ethereum ETFs: What about ETH’s price?

- Expectations for an Ethereum spot ETF has gotten considerably low locally.

- Ethereum’s market efficiency continues to lag behind nearly all of its friends.

Gary Gensler’s SEC is thought for enjoying energy video games with the cryptocurrency business, like taking their time to approve any form of software for crypto merchandise.

They eased up a bit this 12 months with the approval of 11 spot Bitcoin [BTC] ETFs.

Ethereum Spot ETF, when?

Now, all eyes have turned to Bitcoin’s rapid sibling, Ethereum [ETH]. Functions have been filed fairly a while in the past for what the neighborhood sees as Gensler’s solely most well-liked crypto to have its personal spot ETF.

None has been accepted, and the SEC has been noticeably quiet about all of it. Only a few days in the past, Grayscale withdrew their software for the ETH ETF., and didn’t reveal their causes for it both.

The dearth of engagement from the SEC with purposes from ETF issuers plus Grayscale’s withdrawal have fueled hypothesis locally that approval will not be on the horizon.

This sentiment is mirrored available in the market, with outflows totaling $14 million final week, in line with data by CoinShares.

Moreover, ARK Make investments and 21Shares have revised their proposal for a spot Ethereum ETF, eradicating plans to have interaction in staking.

Within the newest filing, submitted on Friday, the earlier clause that allowed 21Shares to stake a portion of the fund’s belongings by third-party suppliers was omitted.

Bloomberg ETF analyst Eric Balchunas mentioned that this replace may very well be an try and refine the appliance based mostly on potential suggestions from the US Securities and Trade Fee (SEC)/

Nevertheless, there have been no official statements.

Balchunas additionally proposed that this modification is perhaps a technique to attenuate the main points the SEC may use to probably deny the appliance.

Ethereum’s market actions

Turning our consideration to Ethereum’s market, the second-largest cryptocurrency on the planet will not be having a superb time in the intervening time.

Although all the opposite cryptos within the prime ten have seen modest rises up to now twenty-four hours, Ether hardly budged. At press time, it’s nonetheless means under its essential assist degree of $3,000.

Knowledge from Santiment reveals that there’s a lot of bearishness amongst Ethereum merchants.

Buying and selling volumes have gone down, liquidations are low, however not as a result of buyers are staying put, however doubtless as a result of they’re bored.

In contrast to Bitcoin, Ethereum hasn’t made any form of main worth actions this 12 months. And the bulls are actually unimpressed.

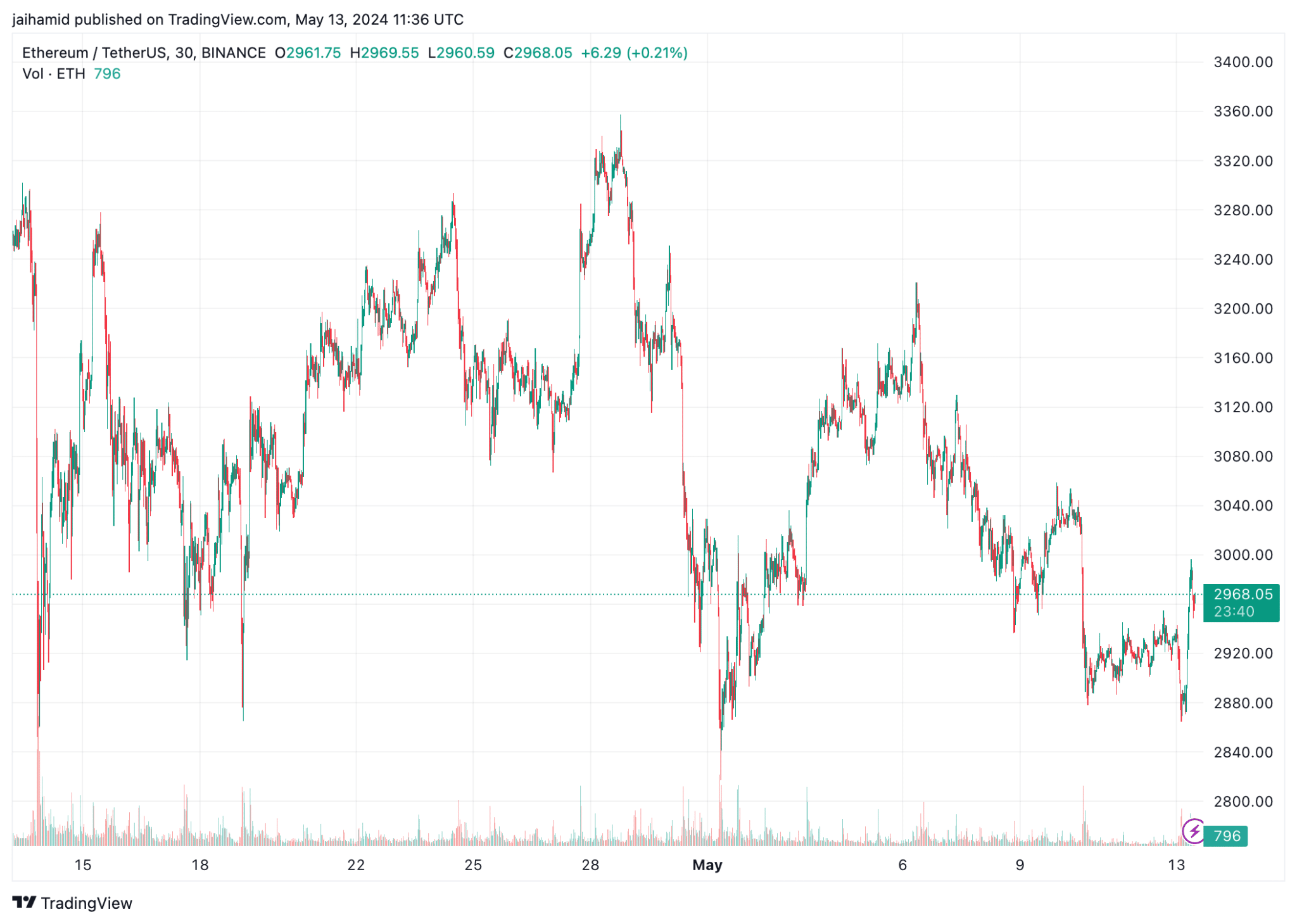

AMBCrypto took a have a look at the ETH/USDt pair on TradingView and found excessive volatility with a number of ups and downs.

The best peak approaches the $3,340 degree, indicating robust shopping for curiosity, whereas the bottom nears $2,840, the place promoting strain intensifies.

Supply: TradingView

The value repeatedly examined assist round $2,900 this previous month, as indicated by a number of touches on this line however with out really breaking it, displaying resilience at this degree.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Lately, the worth reveals a slight upward motion round $2,968, suggesting a tentative restoration or consolidation part. However nonetheless, it failed. Ethereum was value $2,958 at press time.

Given this context, the short-term prediction for Ethereum would lean in direction of a continuation of bearish tendencies.