U.S. to sell $117M in seized Bitcoin – Should you be concerned?

- The U.S. publicizes the sale of round $117 million price of Bitcoin.

- BTC sees extra alternate inflows as the value makes an attempt to stabilize at $40,000.

Latest headlines have been dominated by the Bitcoin [BTC] spot ETF flows, notably the GBTC circulation, which has garnered elevated consideration amid fluctuations in BTC’s worth. The U.S. authorities’s newest motion has additional raised issues, prompting hypothesis about its potential impression on the circulation and worth of BTC.

U.S. sell-off seized Bitcoin

As per an online notice, the U.S. Division of Justice has declared its intention to promote a portion of Bitcoin obtained from the authorized case in opposition to Ryan Farace and his father Joseph Farace.

The costs in opposition to them included cash laundering conspiracy.

The Justice Division reported the profitable restoration of over 2,933 BTC from the Farace household. The asset is presently valued at about $117 million, although it was valued at round $133.5 million when the forfeiture discover was launched on tenth January.

Ryan Farace was convicted in 2018 for the manufacturing and sale of Xanax tablets on darkish net platforms comparable to Silk Highway.

Whereas this isn’t the primary time the U.S. has confiscated and bought Bitcoin, the present state of BTC costs has elevated curiosity within the current announcement by the U.S. company.

Influx dominates Bitcoin’s netflow

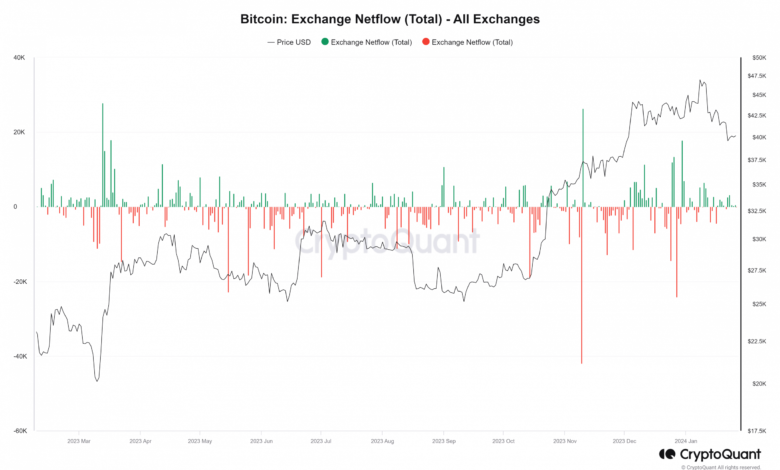

The current announcement prompted elevated consideration, notably when analyzing the netflow of Bitcoin on exchanges.

Based on knowledge from CryptoQuant, there was a notable improve in inflows in comparison with outflows in current days.

Basically, extra BTC has been directed to exchanges for promoting functions. This dynamic implies a possible impression on the value, with provide surpassing demand.

Supply: CryptoQuant

Though the each day influx has not been notably excessive, the cumulative numbers have been important.

As of this writing, there was a short lived pause within the development, proven by a slight outflow. Notably, the U.S. announcement coincided with a steady outflow from Grayscale Bitcoin.

BTC’s try at restoration continues

An examination of the each day timeframe chart for Bitcoin confirmed current makes an attempt at restoration over the previous few days. Nonetheless, this restoration has not demonstrated important energy but, with BTC fluctuating out and in of the $40,000 worth vary.

On the time of this report, it was buying and selling at round $40,000, reflecting a rise of lower than 1%.

Moreover, the decline has pushed it under the impartial line on the Relative Power Index (RSI), and it’s at the moment under 40.

Supply: Buying and selling View

Learn Bitcoin (BTC) Worth Prediction 2024-25

Moreover, its brief shifting common (yellow line), initially performing as help, has now grow to be a resistance degree at round $43,000.

The prevailing sentiment is that after the outflow stabilizes, the value of Bitcoin is predicted to search out stability.