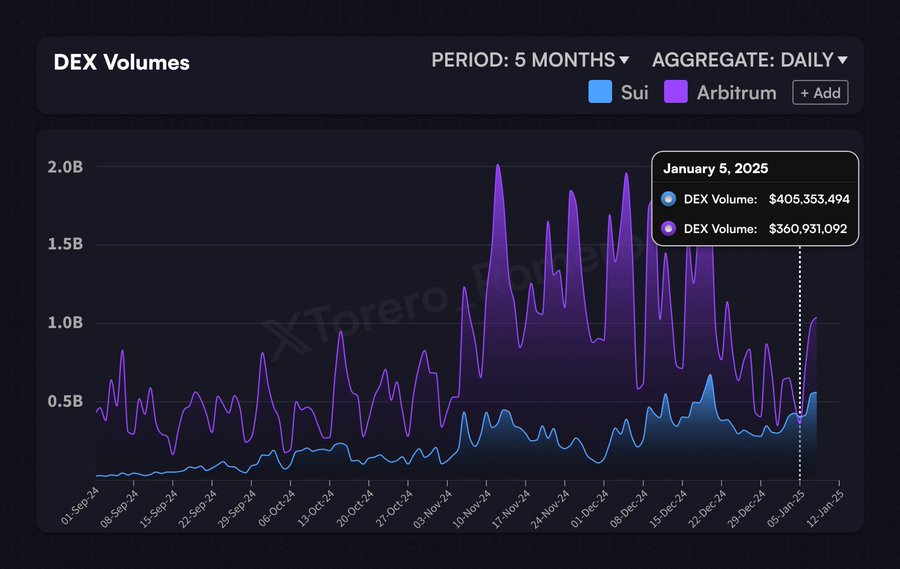

Understanding how SUI overtook Arbitrum and what’s next for the price

Why this flip issues for SUI

Supply: X

Surpassing Arbitrum in DEX volume marks a pivotal achievement for SUI. DEX quantity serves as a essential indicator of a community’s liquidity and person engagement, reflecting how actively members are using the protocol for buying and selling and different monetary actions.

This flip signifies SUI’s capacity to problem established gamers, probably attracting extra builders, liquidity suppliers, and traders to its ecosystem. The milestone can also be an indication og SUI’s scalability and utility, which may bolster market confidence. In flip, this might drive extra sustained adoption and token demand.

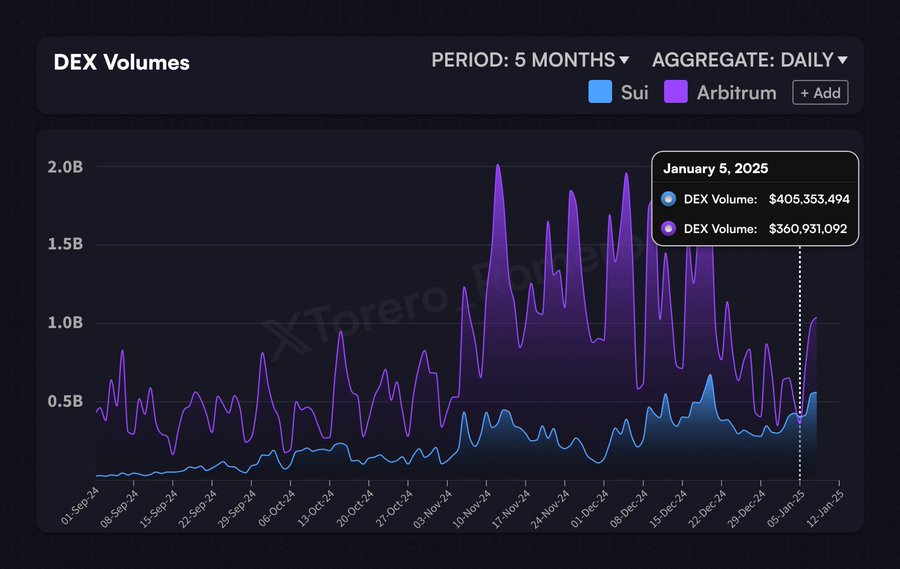

SUI – The no-trade zone

Based on Crypto analyst Ali Martinez, SUI’s worth has been oscillating between $4.86 and $4.61, forming a no-trade zone that merchants typically keep away from because of unsure directional bias.

This zone highlights market indecision, the place consumers and sellers fail to dominate. A break above $4.86 may sign a bullish breakout, whereas a detailed beneath $4.61 would possibly point out additional bearish momentum.

Supply: X

Merchants have been carefully monitoring this vary as a sustained shut exterior it may spark vital volatility, probably triggering a ten% transfer in both path. This makes the $4.86-$4.61 vary pivotal in figuring out SUI’s subsequent main development. For now, endurance is vital, because the market awaits a decisive transfer to verify its path and supply higher buying and selling alternatives.

Key eventualities – What may occur subsequent?

Is your portfolio inexperienced? Take a look at the SUI Revenue Calculator