Understanding the impact of BNB’s Open Interest cooling off lately

- Futures Open Curiosity retreated from the $1 billion milestone

- Liquidation patterns hinted at balanced market sentiment

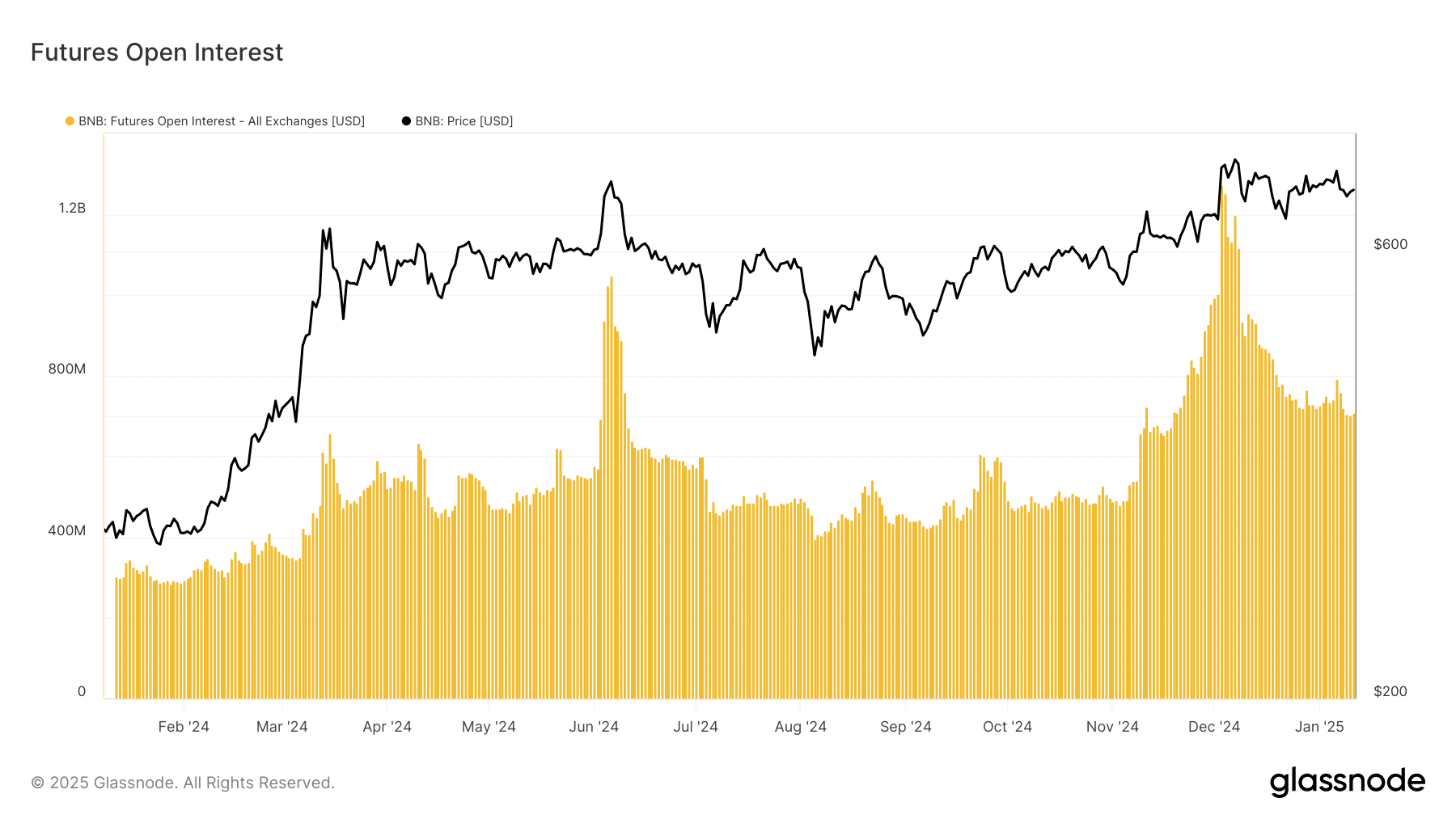

The derivatives panorama for Binance Coin (BNB) highlighted vital shifts in market positioning, with Futures open curiosity retreating from December’s $1 billion milestone. With institutional gamers recalibrating their positions, the market construction revealed attention-grabbing patterns value analyzing at press time.

Derivatives market indicators blended sentiment

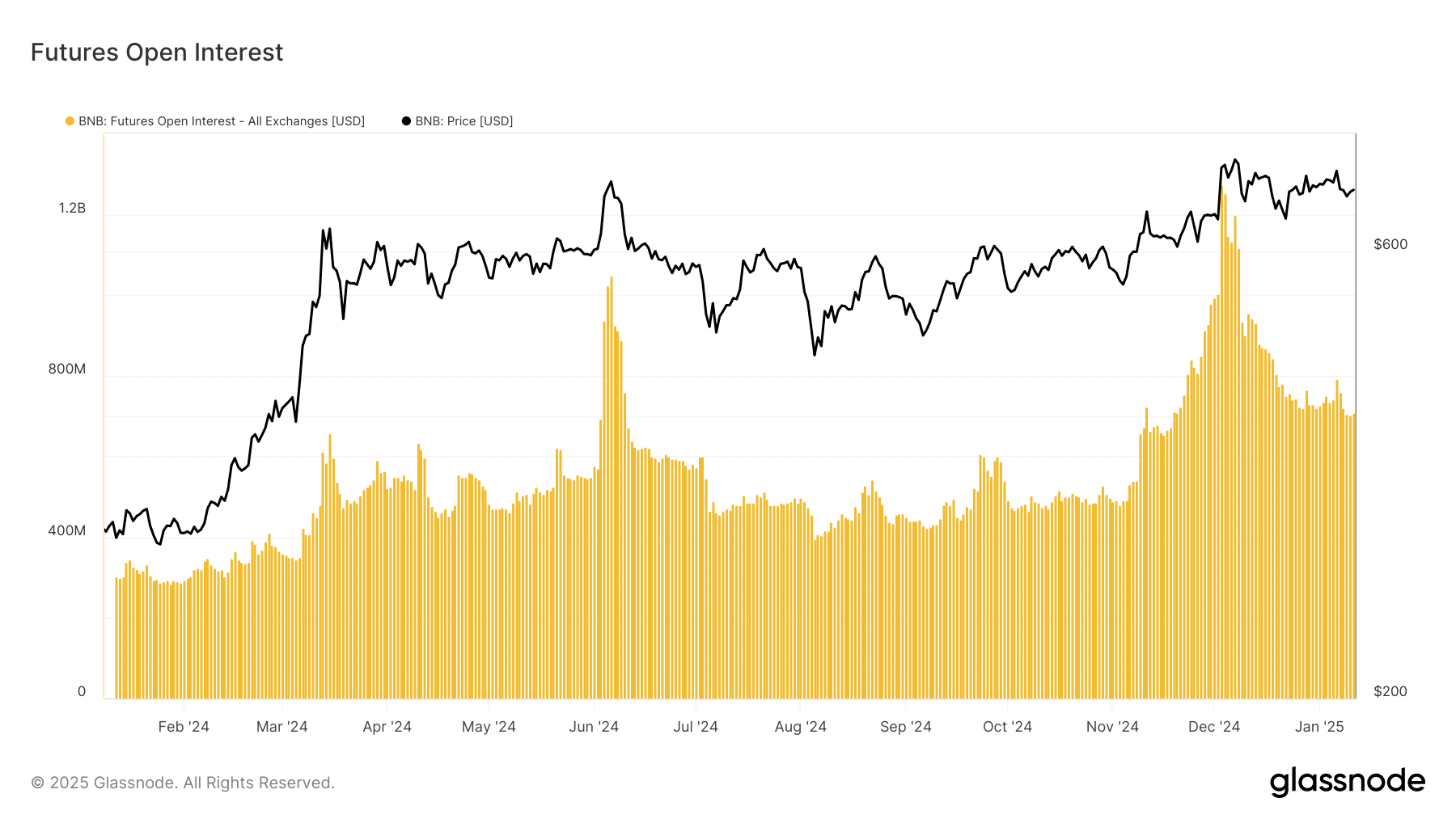

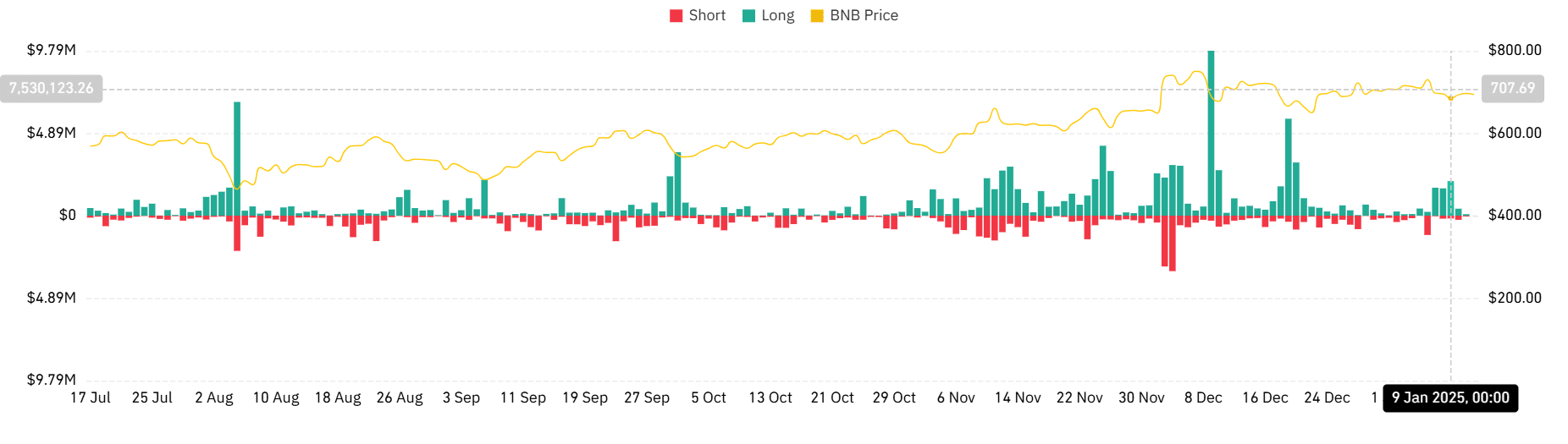

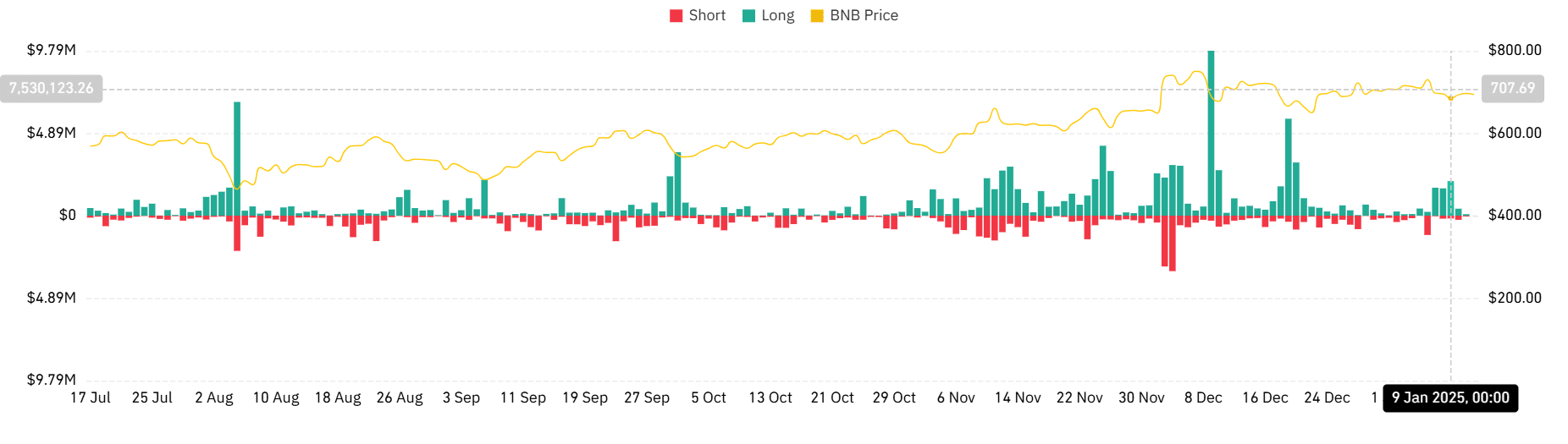

Based on Glassnode, BNB’s Futures open interest tapered off after hitting peak ranges, with a marked decline in complete worth locked in Futures contracts. Whereas lengthy liquidations dominated in December, hitting $9.79 million at their peak, current weeks have seen extra balanced liquidation patterns between longs and shorts – An indication of a impartial market place.

Supply: Glassnode

Buying and selling volumes painted an attention-grabbing image, with sustained exercise regardless of the OI pullback. The ratio between long and short liquidations has normalized too, indicating decreased leverage within the system – A doubtlessly wholesome growth for BNB’s market construction.

Supply: Coinglass

BNB’s value motion holds regular, regardless of OI decline

BNB’s spot value has demonstrated outstanding resilience, regardless of the cooling derivatives market.

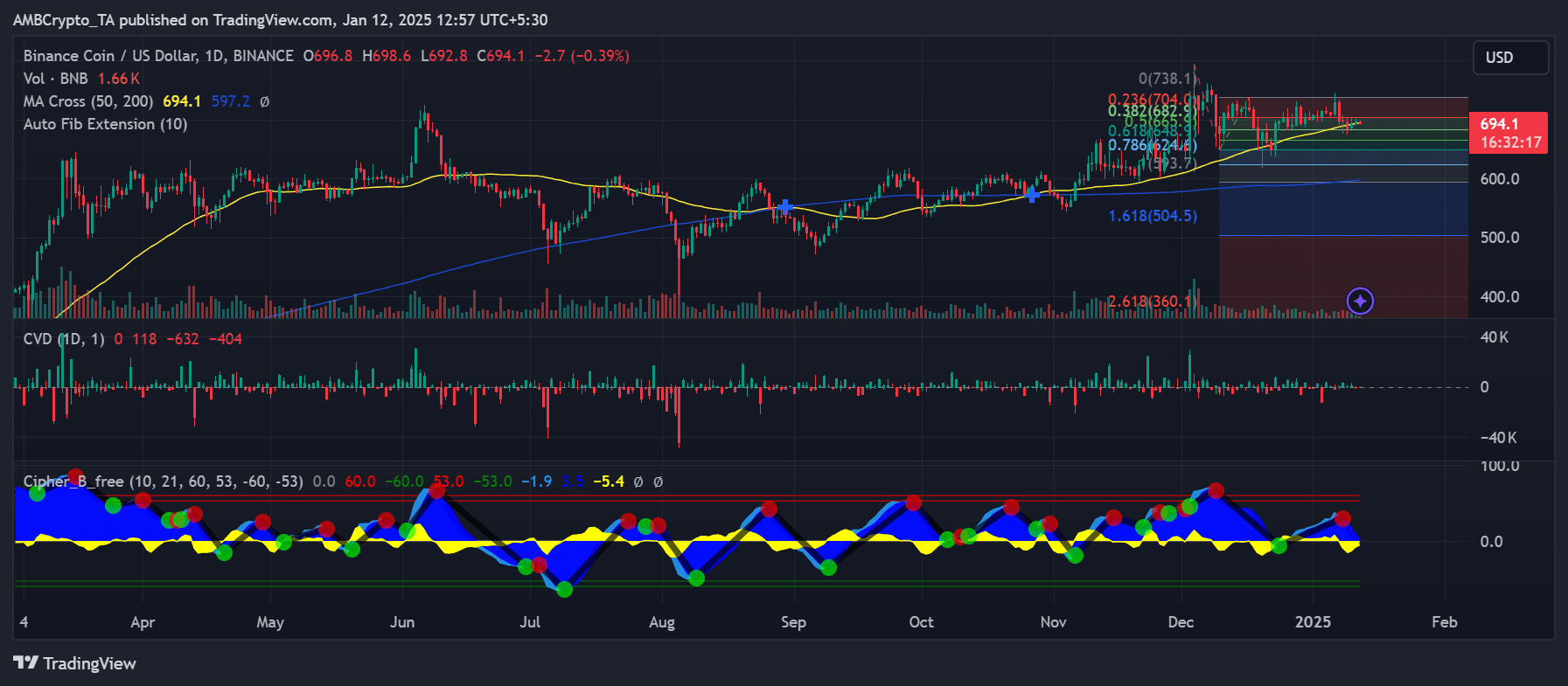

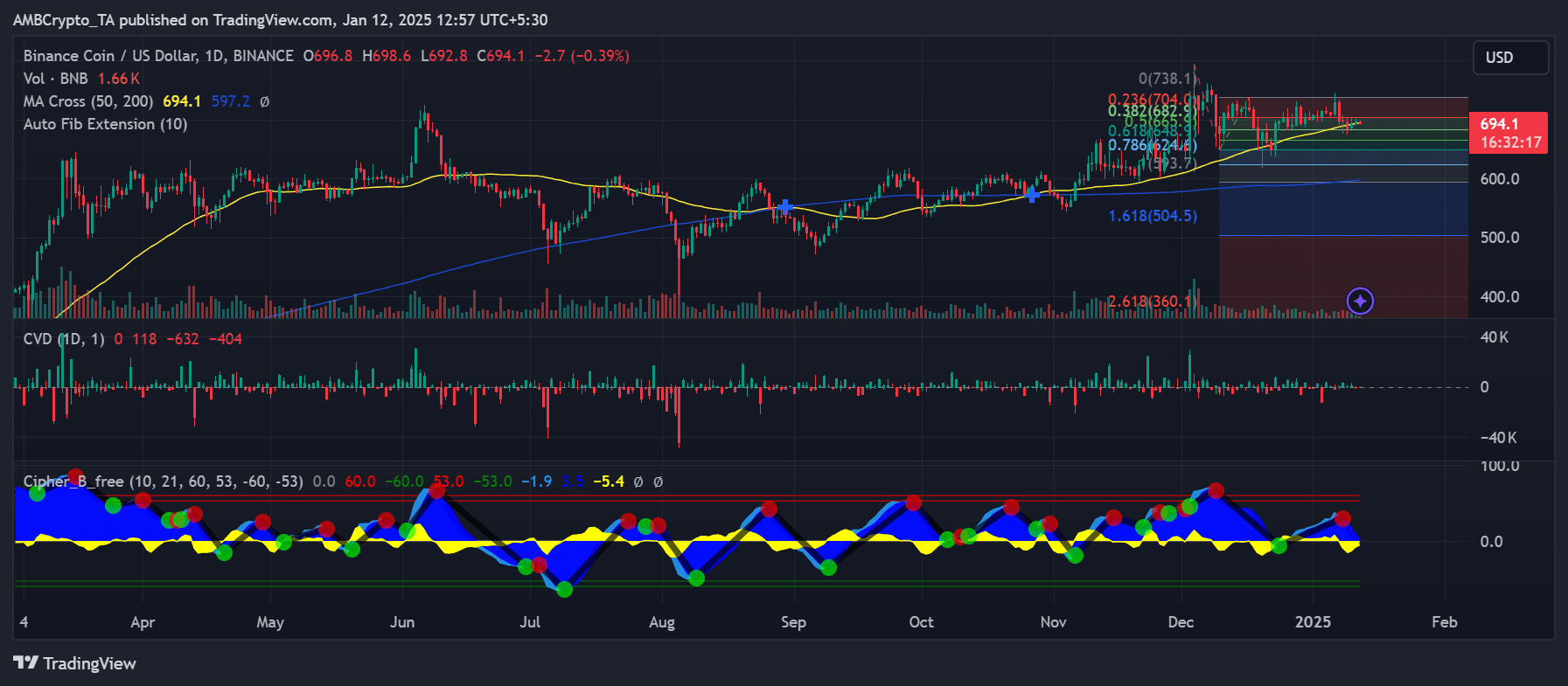

Buying and selling at $694.1 at press time, the token appeared to take care of its place above crucial shifting averages, with the 50-day MA at 694.1 crossing above the 200-day MA at 597.2. In doing so, it fashioned a golden cross sample on the charts.

Supply: TradingView

The Cumulative Quantity Delta (CVD) indicator revealed regular institutional accumulation too, although extra measured than December’s aggressive shopping for. This may be interpreted as an indication that good cash is constant to indicate curiosity, albeit with extra cautious positioning.

BNB market construction exhibits power

Fibonacci extension ranges highlighted key areas of curiosity, with the 0.786 retracements round $624.8 serving as sturdy assist. The altcoin’s newest value motion fashioned a sequence of upper lows, indicating underlying power regardless of the OI decline.

Additionally, BNB’s market construction has remained constructive above the $680 assist zone. The autumn in open curiosity, mixed with secure value motion, steered a possible shift from leveraged hypothesis to spot-driven value discovery – Sometimes a more healthy market dynamic.

– Learn Binance Coin (BNB) Value Prediction 2025-26

Whereas the billion-dollar OI milestone captured headlines in December, the present market positioning would possibly present a extra sustainable basis for BNB’s subsequent transfer. Merchants ought to monitor the convergence of spot and derivatives metrics for affirmation of a directional bias.