HSBC to bring tokenized deposits to US and UAE as stablecoin race heats up

World megabank HSBC is doubling down on tokenization over stablecoins as world banks rush to maintain tempo within the stablecoin race.

HSBC Holdings will begin providing tokenized deposits to its company purchasers within the US and the United Arab Emirates within the first half of 2026, in accordance with a Bloomberg report on Tuesday.

The Tokenized Deposit Service (TDS) by HSBC permits purchasers to ship cash domestically and overseas in seconds across the clock, stated Manish Kohli, HSBC’s world head of funds options.

“The subject of tokenization, stablecoins, digital cash and digital currencies has clearly gathered a lot momentum. We’re making large bets on this area,” Kohli stated.

Tokenized deposits versus stablecoins

Tokenized deposits are digital representations of financial institution deposits issued on a blockchain by regulated banks, permitting for immediate 24/7 transfers and programmable funds.

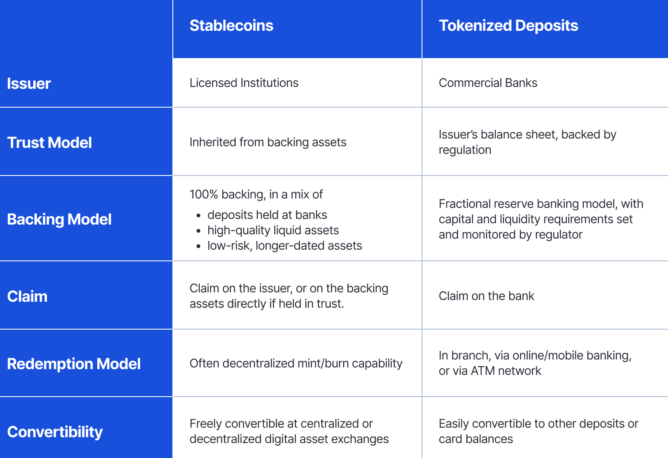

Not like stablecoins, which are sometimes linked to fiat currencies just like the US greenback and backed by property like authorities debt, deposit tokens are created utilizing the issuer’s stability sheet.

Whereas stablecoin issuers like Circle are usually not allowed to pay yields on stablecoin holdings by customers, tokenized deposits provide curiosity payouts amongst their key options.

Stablecoins versus tokenized deposits: Supply: Fireblocks

In line with Kohli, HSBC plans to increase the use instances of tokenized deposits in programmable funds and autonomous treasuries, or programs that deploy automation and AI to independently handle money and liquidity danger.

“Practically each giant firm that now we have a dialog with, we’re seeing a giant theme round treasury transformation,” the HSBC govt stated.

HSBC stablecoin launch not dominated out

The product’s enlargement within the US and UAE is the newest by HSBC, following its debut of the providing in Hong Kong in Might, with Ant Worldwide turning into the primary consumer to make the most of the TDS answer.

The financial institution has since expanded the providing in a number of markets, together with Singapore, the UK and Luxembourg.

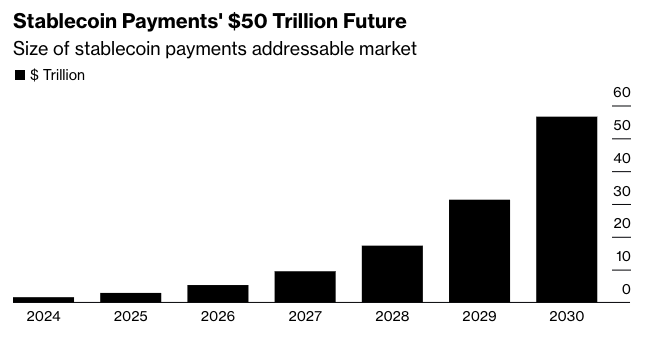

Supply: Bloomberg Intelligence

HSBC’s alternative to maneuver ahead with tokenized deposits comes amid main banks like JPMorgan doubling down on the expertise.

Associated: How TradFi banks are advancing new stablecoin fashions

On Nov. 12, JPMorgan rolled out the JPM Coin, a deposit token representing US greenback deposits on the financial institution. The corporate opposed the token to conventional stablecoins, with JPMorgan’s blockchain govt Naveen Mallela highlighting that deposit tokens function inside conventional banking frameworks.

Whereas pushing tokenized deposits, HSBC doesn’t rule out the potential issuance of a stablecoin.

“It’s one thing that we’d proceed to judge,” Kohli stated, including: “There are some things that must occur, which is the authorized framework must be clearer.”

Journal: Saylor denies Bitcoin sell-off, XRP ETF debut tops chart: Hodler’s Digest, Nov. 9 – 15