UNI may recover well in Q3 only if these holders escape the profit trap

- Uniswap took a success in Q2 when it comes to quantity and right here’s how extreme the influence was.

- UNI’s promote strain prevails because it cools down from the latest upside.

Coinmarektcap simply launched its Q2 2023 report on trade efficiency. The report mirrored Uniswap’s efficiency throughout the identical interval however what does this imply for its efficiency in Q3?

Is your portfolio inexperienced? Take a look at the Uniswap Revenue Calculator

In accordance with the CMC report, most high exchanges on this planet registered a drop in quantity in Q2. Uniswap is probably going inside this class not solely as a result of it was the highest DEX by trade quantity but in addition as a result of the influence prolonged to DEXes. The latter reportedly registered a 24% decrease quantity in Q2 than in Q1.

CMC report reveals that Prime 20 exchanges noticed a big 36% drop in Q2 2023 spot commerce quantity, contributing $1.67 trillion; Binance stays dominant in H1 2023 with 59.99% spot buying and selling quantity share, steady in comparison with final 12 months; Q2 DEX quantity was $189 billion, 24% decrease than…

— Wu Blockchain (@WuBlockchain) July 11, 2023

The 24% drop represented an approximate drop of $60 billion from the earlier quarter. So, how did Uniswap honest when it comes to quantity throughout Q2?

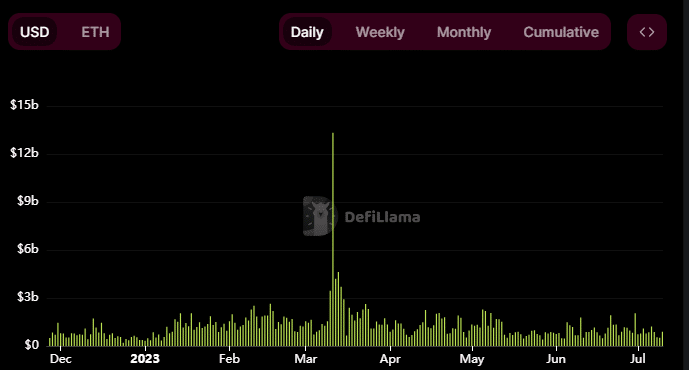

A take a look at Uniswap’s on-chain quantity revealed that it peaked in the direction of mid-March throughout which each day quantity soared over $13 billion. For perspective, the very best Uniswap quantity in Q2 was roughly $2.27 billion.

Supply: DeFiLlama

A significant cause for this drop could possibly be that we noticed the return of euphoria into the market in Q1 after a sluggish Q3 and This fall 2022. Nevertheless, the wave of shopping for strain slowed down in Q2 2023 because the market skilled some regulatory FUD.

Will issues prove in another way for Uniswap in Q3?

The market is off to begin in Q3, particularly with the latest talks of main corporations venturing into spot ETFs. As such, the following three months look promising particularly if these ETFs obtain regulatory approval.

Such an consequence may set a robust tempo for the rest of 2023. Uniswap would seemingly be among the many greatest beneficiaries. However what about its native token UNI? UNI has been cooling down for the final 10 days after beforehand delivering a 60% rally.

It has to this point tanked by 10% from its latest high to its $5.20 press time worth.

Supply: TradingView

UNI’s prospects will seemingly enhance if the market leans in favor of the bulls in Q3 and This fall. This wasn’t solely due to on-line demand however largely as a result of UNI has been buying and selling in tandem with the marketplace for probably the most half.

Moreover, on-chain evaluation revealed that some handle classes have been shopping for the latest dip. Nevertheless, whales had been nonetheless seen contributing to UNI’s ongoing promote strain.

Supply: Santiment

Learn Uniswap’s worth prediction for 2023/2024

Addresses holding between 1 million and 10 million UNI held 33.33% of UNI’s circulating provide. This implies they’re probably the most dominant whales and thus have probably the most influence available on the market. The most recent provide distribution information revealed that these whales had been taking income.