Uniswap nears critical support: UNI’s $10 rebound depends on…

- UNI’s giant transactions have surged by 44% during the last 24 hours, reflecting rising confidence amongst high-net-worth traders.

- The altcoin’s value was obeying a key trendline help that would spearhead a rally to $10 if the bulls maintain robust.

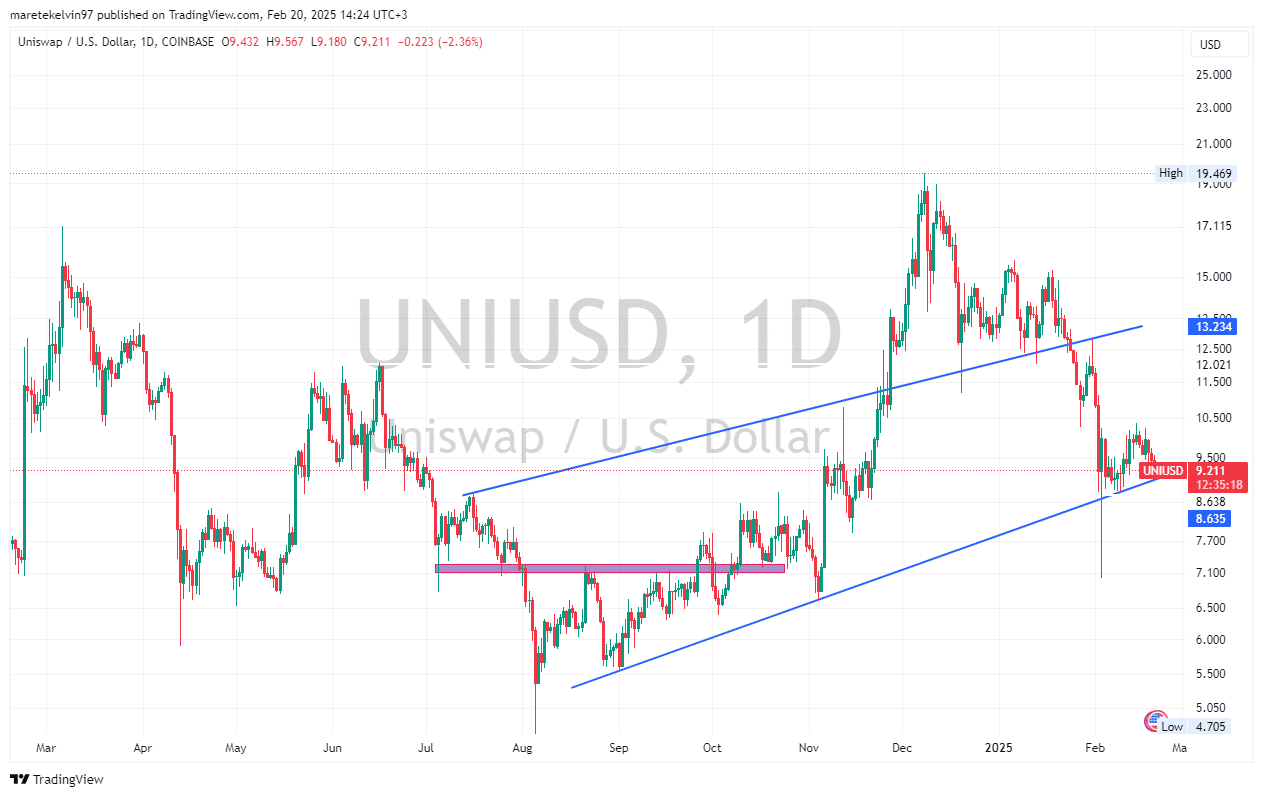

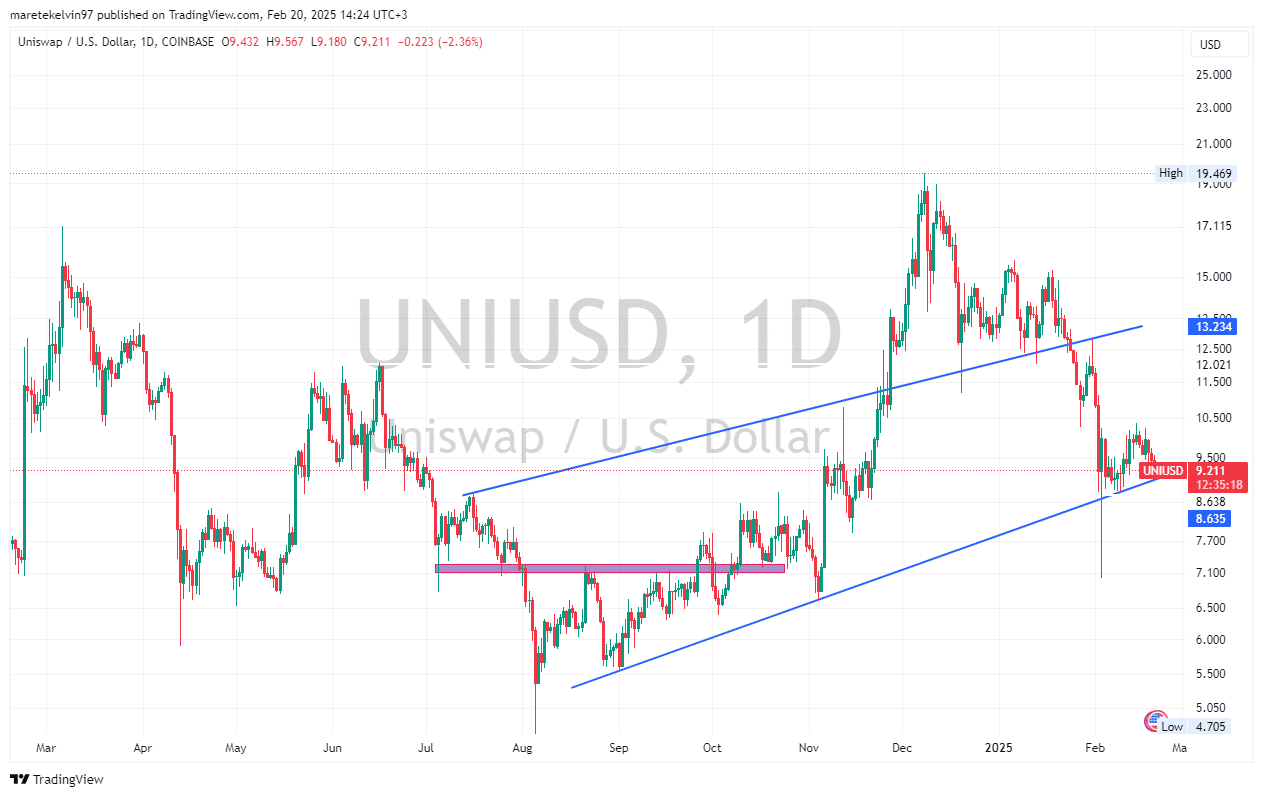

Uniswap [UNI] is stumbling on the sting of a make-or-break situation. The decentralized change token is quickly closing in on a really important trendline help stage after a ten% value decline as seen on the every day chart.

With whale exercise on the rise and promoting strain easing off, the crypto group is stuffed with anticipation. May this help stage act as a launchpad for UNI to regain $10 and above?

UNI whales make strikes and retail exercise shrinks

The latest on-chain exercise creates an attention-grabbing image of market conduct in the direction of UNI.

At press time, the full variety of cash transferred to exchanges had shrunk by 74.73% during the last 24 hours, reflecting a dramatic decline in retail exercise.

Supply: CryptoQuant

Nonetheless, the decline in retail transactions is slowly being whipped out by a 44% surge in large-volume transactions, a positive indication that the whales are asserting themselves to take lengthy positions quickly.

The rise in whale exercise sometimes precedes important value motion. As high-net-worth traders accumulate UNI close to key help ranges, their actions mirror religion in a possible reversal.

In the meantime, the discount in promoting strain provides to the optimism. With fewer sellers available in the market, the surroundings is conducive for consumers to take management.

Make-or-break second for Uniswap

All market members at the moment are watching UNI’s trendline help, a major stage that has traditionally sparked value recoveries. If the altcoin holds this stage, it might ignite shopping for exercise, propelling UNI towards the psychologically important $10 mark.

Nonetheless, breaking previous this resistance might open the floodgates for additional positive factors.

Supply: TradingView