Uniswap price prediction – UNI traders, when should you take profits?

- Bullish expectations for Uniswap are excessive for this cycle

- Community metrics have been effectively underneath their 2021 highs, suggesting that additional development is feasible

Uniswap [UNI], at press time, appeared to exhibit sturdy bullish conviction. It has gained by 97% since 20 November, whereas additionally breaking a number of key resistance ranges on the best way. Its Open Curiosity climbed by 12% in 24 hours too – An indication of bullish sentiment.

Technical and on-chain metrics revealed that Uniswap is on a powerful uptrend now. And, extra positive aspects could be anticipated within the coming months. This, regardless of UNI nonetheless being 61% under its all-time excessive at $44.9 from Might 2021.

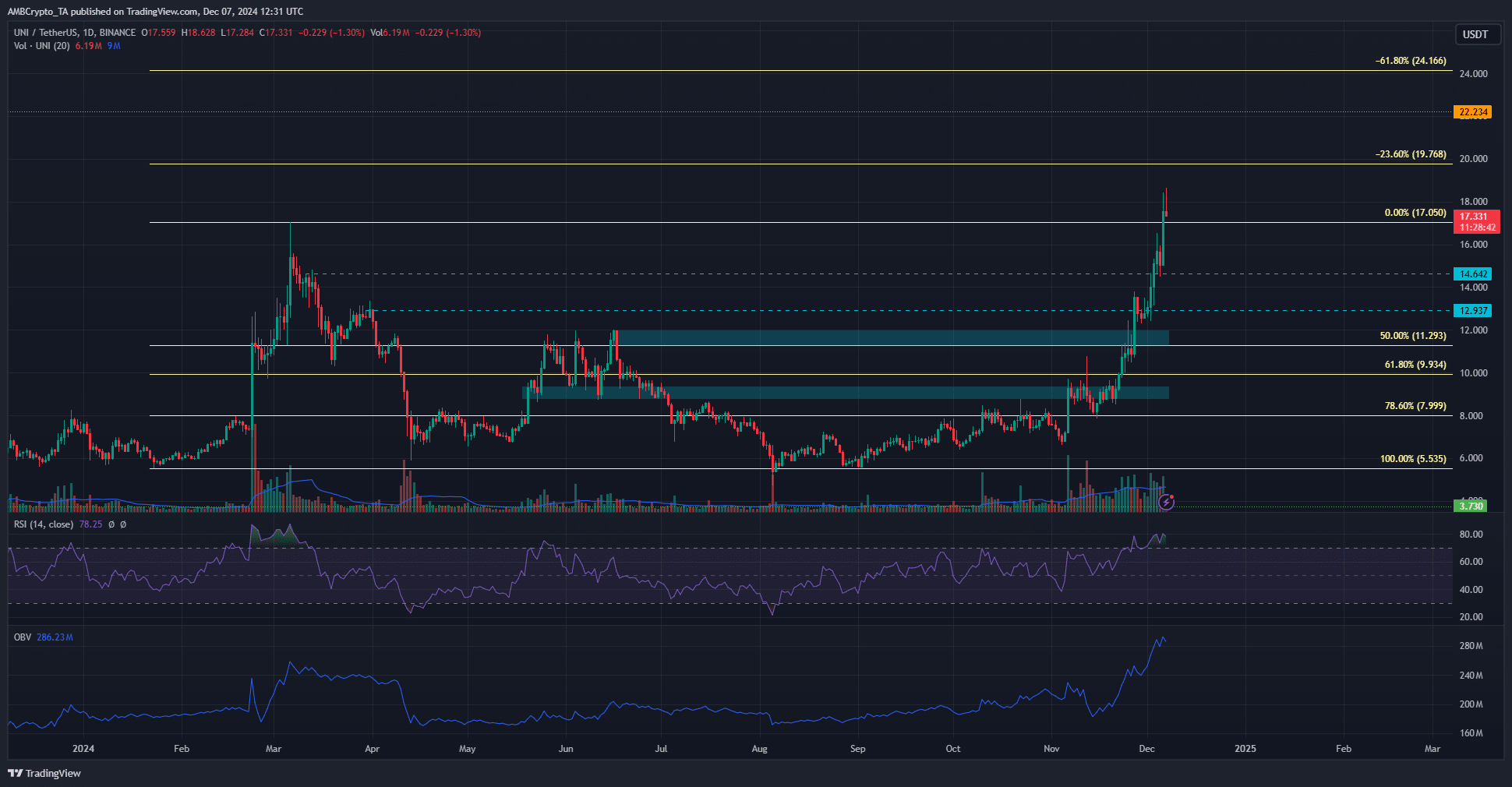

Key decrease highs have been retested as assist

Supply: UNI/USDT on TradingView

Uniswap bulls succeeded in climbing previous the $17.05-level that marked the March 2024 excessive. On the best way, the important thing decrease highs from that downtrend, set at $12.93 and #14.64, had been each retested as assist.

The OBV has been strongly rising in addition to the value, to showcase excessive demand. The RSI was in overbought territory at press time, however hadn’t made a bearish divergence but. A consolidation within the $16-$17 zone earlier than the following leg may materialize within the coming weeks.

The $15.45-$15.95 zone can be prone to be a agency demand zone ought to UNI’s worth see a southbound dip.

New addresses but to start uptrend

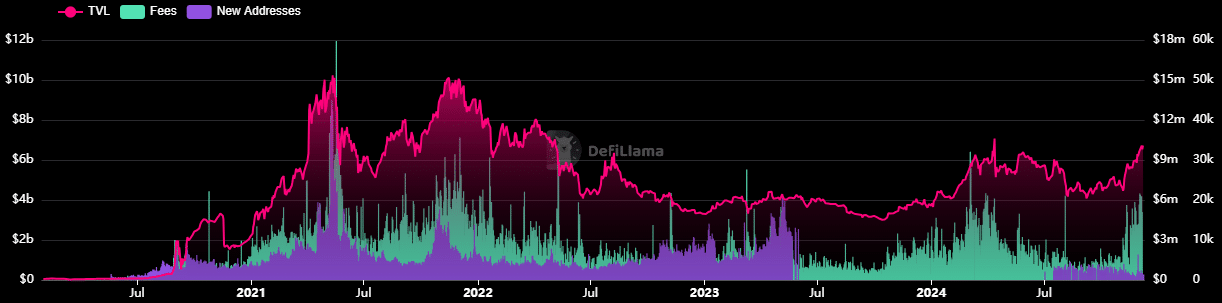

Within the earlier cycle, the launch of quite a few small cap cash on the Ethereum community noticed many new addresses created attempting on Uniswap, the most important decentralized alternate (DEX), to commerce these tokens. The same sight is taking part in out now, and has been, on the Solana [SOL] community with its memecoin frenzy.

Rising new addresses and better participation results in rising charges, particularly in the course of the later levels of the bull run. Evaluating 2021 to 2024, the brand new addresses depend and the community charges had been under these highs.

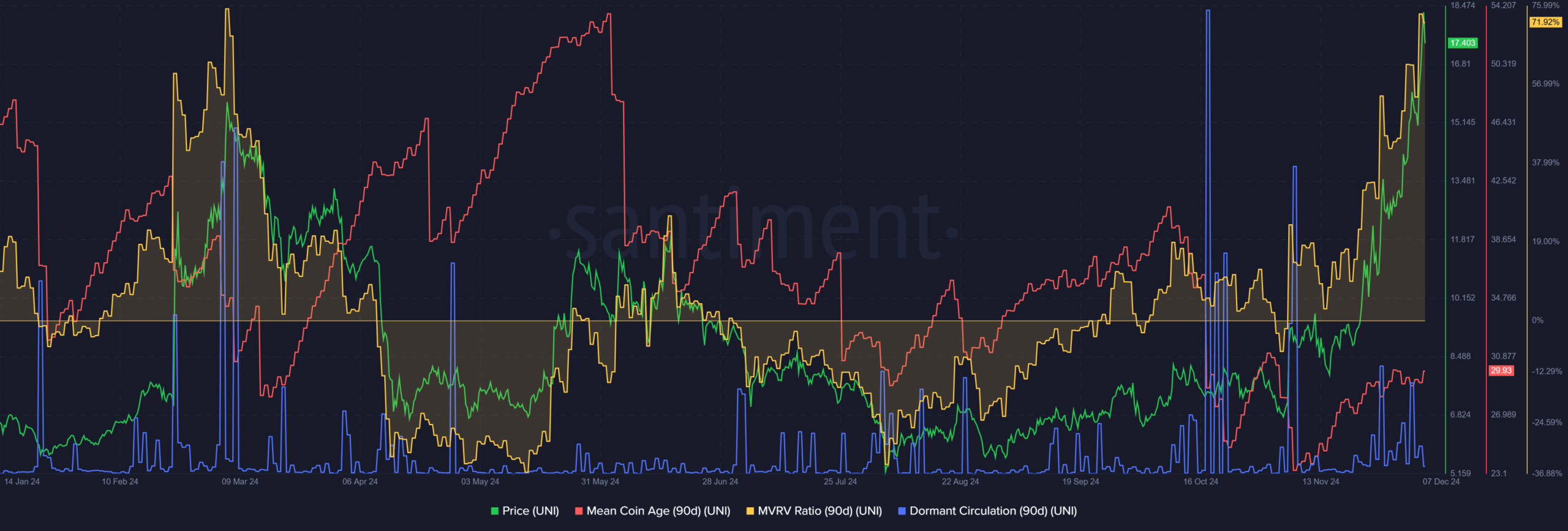

Whereas these metrics instructed that additional long-term development was doable, different metrics instructed {that a} short-term pullback is probably going. Uniswap noticed a distribution part in October and early November, characterised by the falling imply coin age.

Learn Uniswap’s [UNI] Worth Prediction 2024-25

In the meantime, the MVRV ratio surged larger and hit its March highs to point rising profitability. This revealed that the token could also be severely overvalued. Therefore, merchants and traders must be ready to take income and look forward to a dip to purchase extra UNI.