Uniswap [UNI] price prediction – Why altcoin’s next run depends on $16-level

- UNI’s charts flashed sturdy bullish momentum after breaking out of a descending channel with rising quantity

- Optimistic on-chain metrics and falling change reserves might serve altcoin effectively

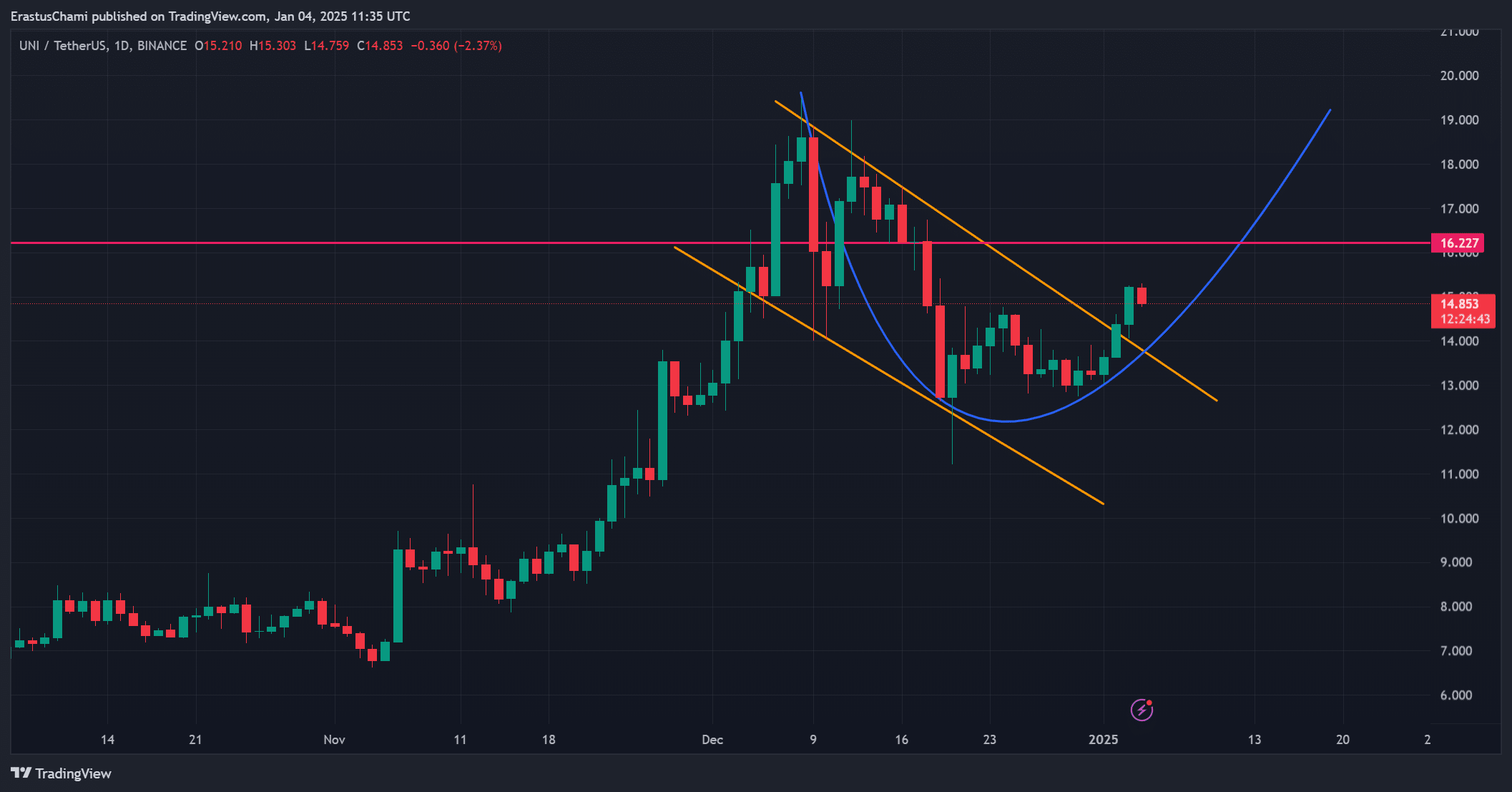

Uniswap [UNI] is within the information right this moment after it broke out of a descending channel after weeks of consolidation, exhibiting clear indicators of a possible pattern reversal. Buying and selling at $14.85 following positive aspects of two.32% at press time, the token has attracted important consideration with its rounded backside sample – An indication of bullish momentum.

Moreover, UNI’s 24-hour buying and selling quantity surged by 30.48% too, highlighting rising market curiosity. Subsequently, the query stays – Can this momentum result in sustained positive aspects or not?

UNI value evaluation highlights key resistance

UNI’s value motion underlined rising optimism amongst merchants because it confirmed its breakout from the descending channel. In reality, the rounded backside sample on the charts additional supported the potential for sustained momentum.

Moreover, the token’s buying and selling quantity spike appeared to strengthen confidence, signaling heightened exercise out there.

Value noting, nonetheless, that the $16 resistance stage can be essential in figuring out whether or not UNI can proceed its rally or face non permanent setbacks. Therefore, merchants should monitor this key stage carefully.

Supply: TradingView

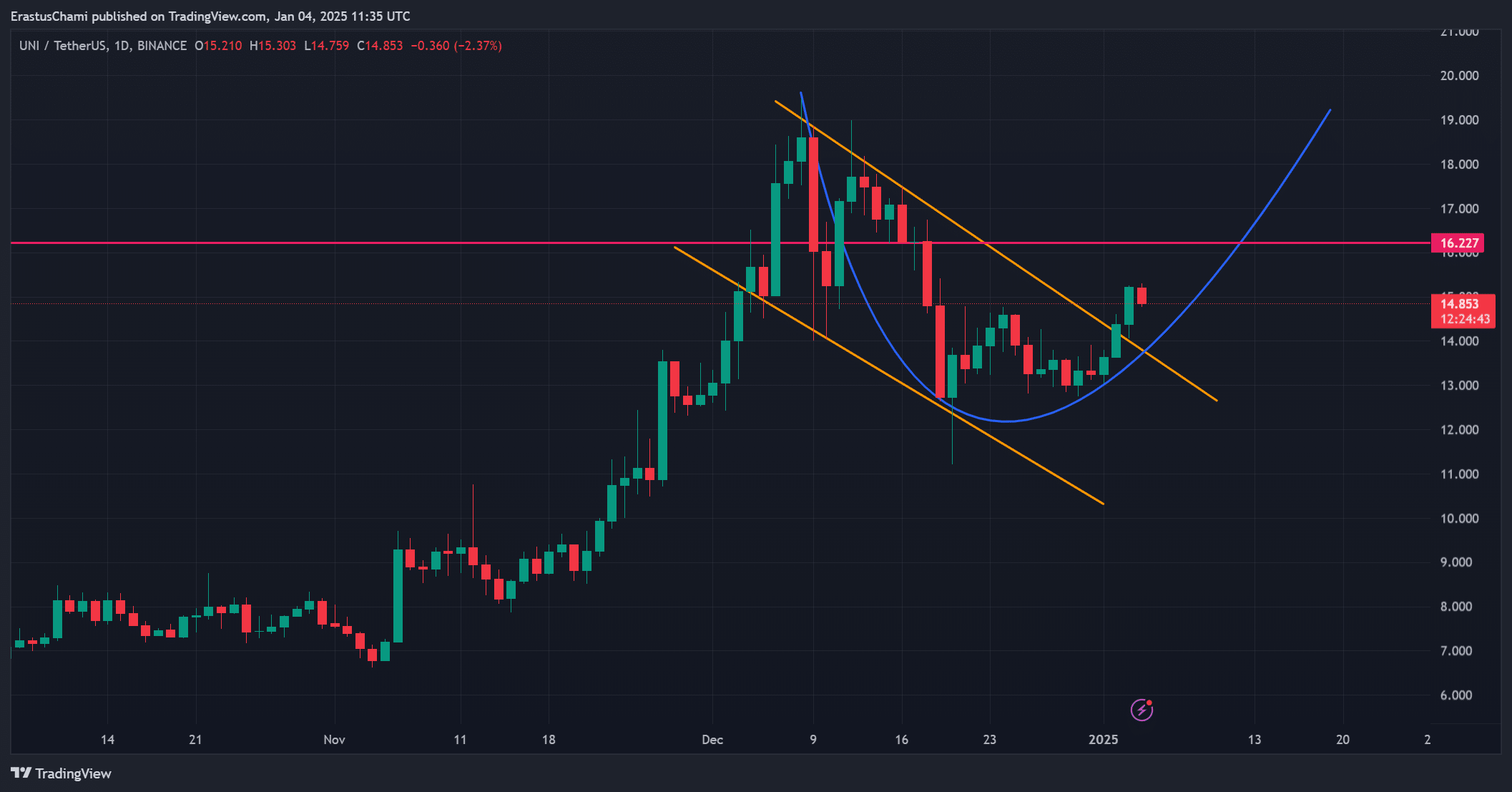

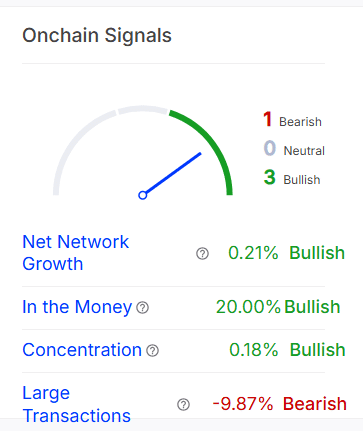

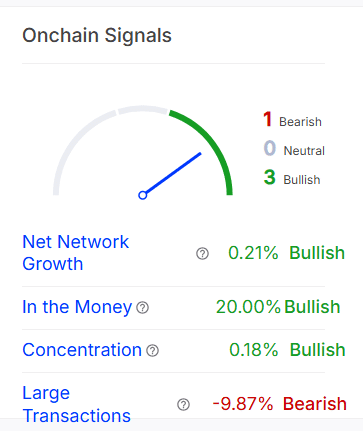

On-chain alerts present rising investor confidence

On-chain metrics supplied additional proof of bullish momentum for UNI. With 20% of addresses at the moment “within the cash,” investor sentiment stays sturdy. Moreover, internet community development rose by by 0.21% – An indication of regular adoption.

Focus ranges have additionally risen by 0.18%, reflecting accumulation by massive holders. Nevertheless, massive transactions declined by 9.87%, suggesting some institutional warning.

And but, regardless of every part, total on-chain knowledge supported UNI’s potential for additional development.

Supply: IntoTheBlock

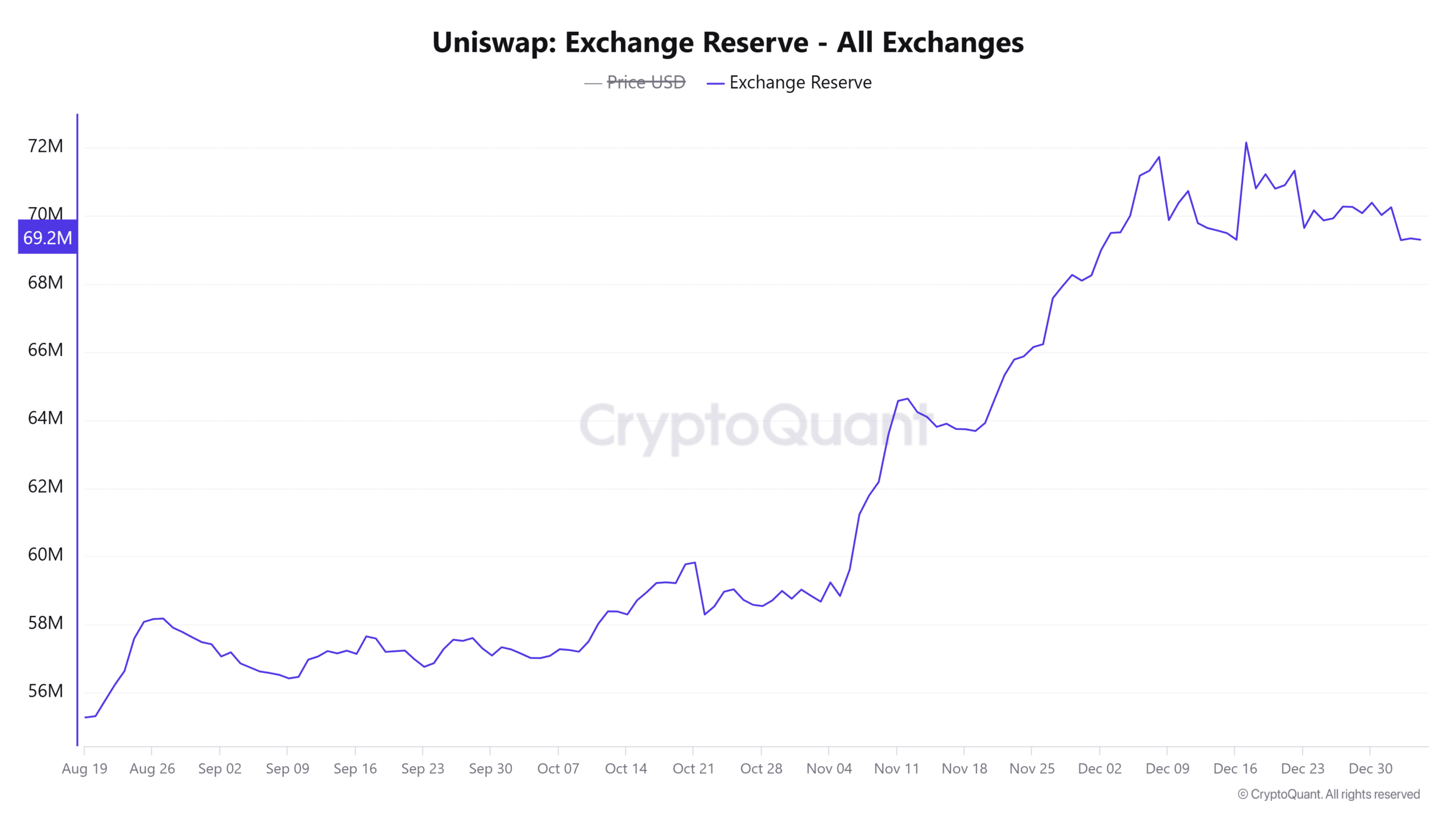

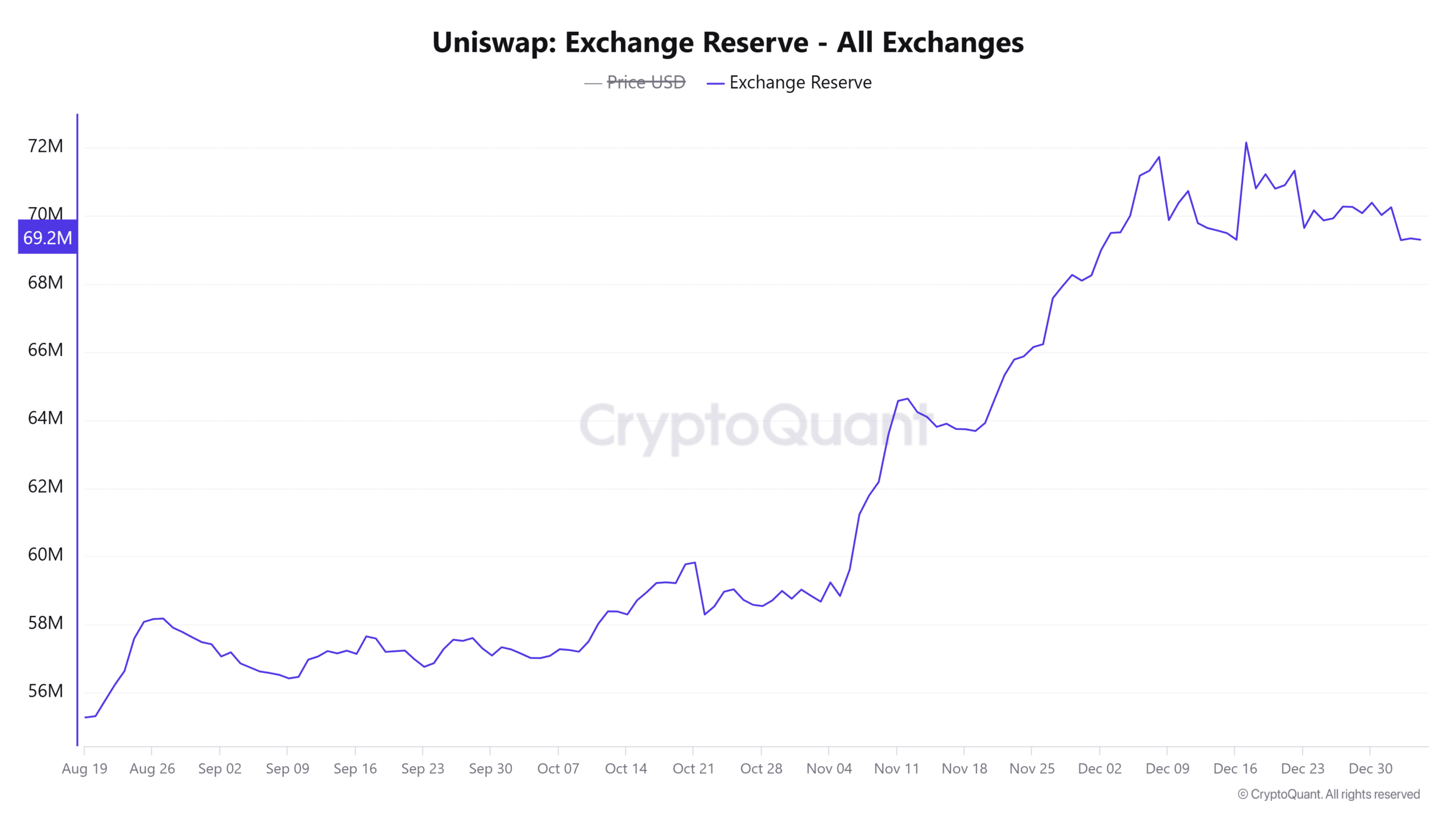

UNI change reserves trace at falling promoting stress

At press time, UNI’s change reserves stood at roughly 69.2996M, following a slight fall of 0.07% within the final 24 hours. This indicated that extra holders are transferring tokens off exchanges, lowering speedy promoting stress.

Moreover, this pattern appeared to suggest rising confidence in holding the token, somewhat than short-term profit-taking. Nevertheless, sudden modifications in reserves might alter market sentiment. Therefore, nearer remark is warranted right here.

Supply: CryptoQuant

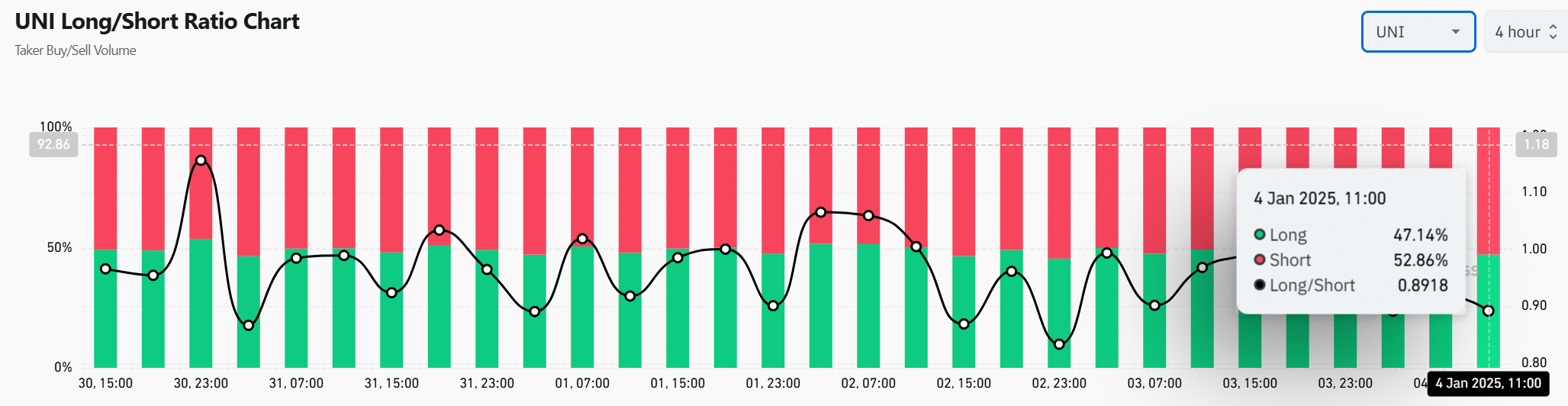

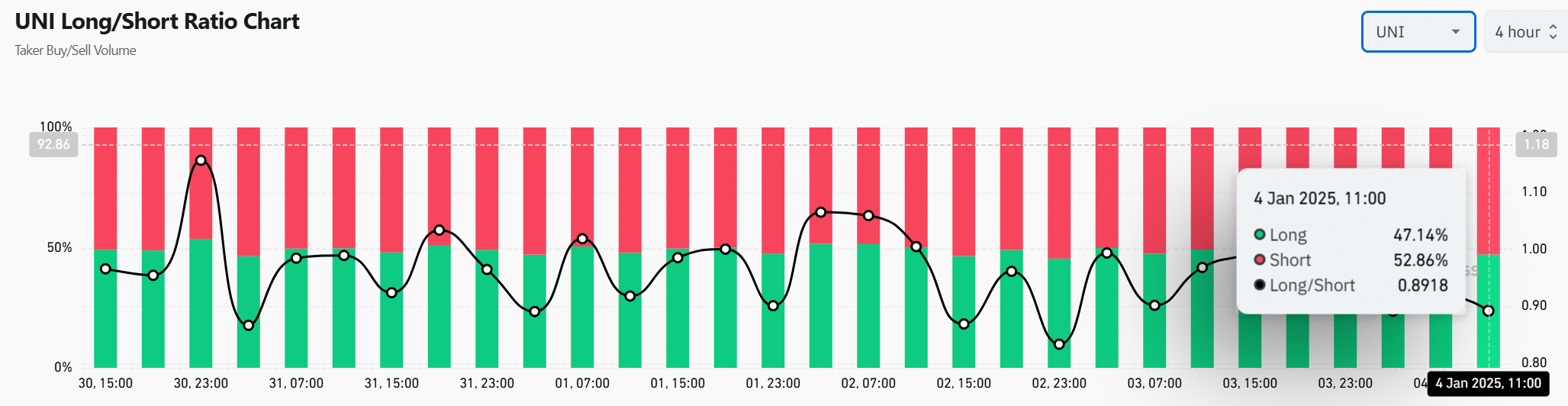

Merchants divided as lengthy/quick ratio reveals a break up

Lastly, the lengthy/quick ratio indicated blended sentiment, with 52.86% of merchants shorting UNI and 47.14% holding lengthy positions. Nevertheless, this slight quick bias might lead to a brief squeeze if bullish momentum accelerates.

Additionally, the upcoming value motion close to $16 will doubtless shift market dynamics additional. Subsequently, merchants ought to stay vigilant and adapt to evolving tendencies.

Supply: Coinglass

Learn Uniswap’s [UNI] Worth Prediction 2025–2026

UNI has the potential to maintain its bullish momentum if it breaks the $16 resistance stage.

With sturdy on-chain metrics and rising market curiosity, the outlook seems optimistic. Nevertheless, merchants ought to nonetheless watch key ranges carefully.