Uniswap wallet profitability soars, but here’s what can stall UNI’s rally

- 60% Uniswap traders are sitting in income after a 122% achieve in 30 days.

- Pockets profitability is on the highest stage since 2021, rising the chance of profit-taking exercise.

Uniswap [UNI] has displayed a powerful bull run within the final 30 days after a 124% achieve. At press time, UNI traded at $15.55 with buying and selling volumes of greater than $1 billion per CoinMarketCap.

UNI’s rally seems to be cooling off after Bitcoin [BTC] drew consideration away from altcoins after pushing previous $100,000. Nonetheless, the altcoin stays in bullish territory amid an inflow in pockets profitability.

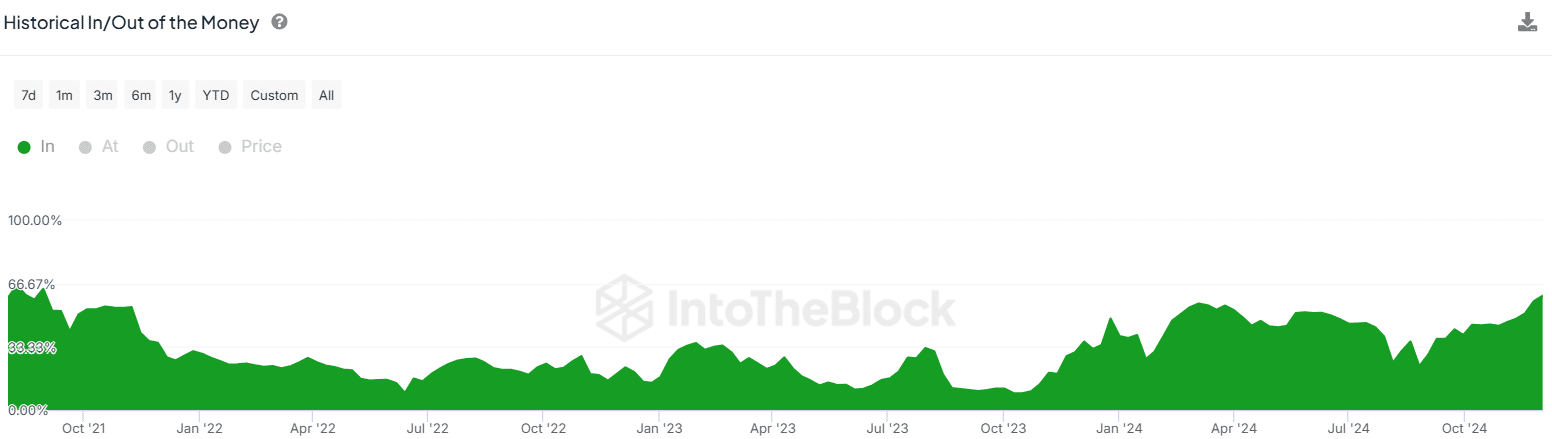

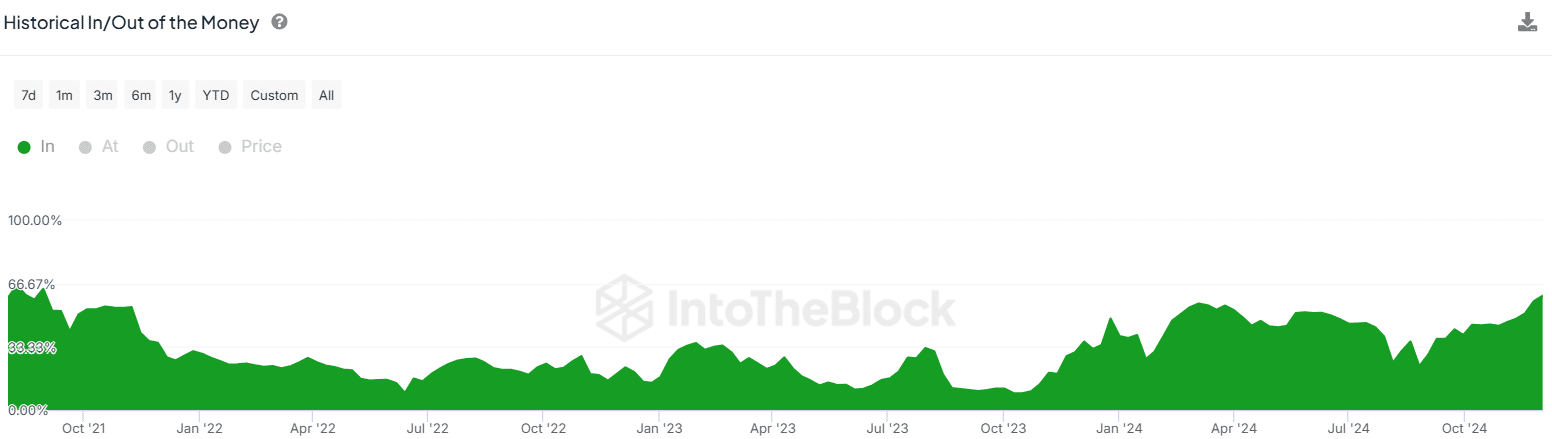

Information from IntoTheBlock exhibits that at present, greater than 60% of UNI holders are Within the Cash (in revenue), marking the very best stage of pockets profitability since mid-2021.

Supply: IntoTheBlock

Every time the variety of wallets in income will increase because the rally exhibits indicators of exhaustion, merchants have a tendency to start out promoting to ebook income. This might trigger the rally to stall or set off a downturn.

UNI trade inflows on the rise

Some trades are already reserving income on UNI amid a surge in inflows to identify exchanges. Per CryptoQuant, Uniswap trade inflows reached a one-week excessive of 1.54M UNI, valued at greater than $24M, on the 4th of December.

Supply: CryptoQuant

The spike in trade inflows coincided with UNI rallying to an 8-month excessive of $16.52, a sign that this stage could have signaled an area prime.

Nonetheless, provided that netflows in the course of the day got here in unfavorable, it might recommend that there’s ample demand to stop a development reversal. Moreover, consumers stay lively, making the case for additional positive factors.

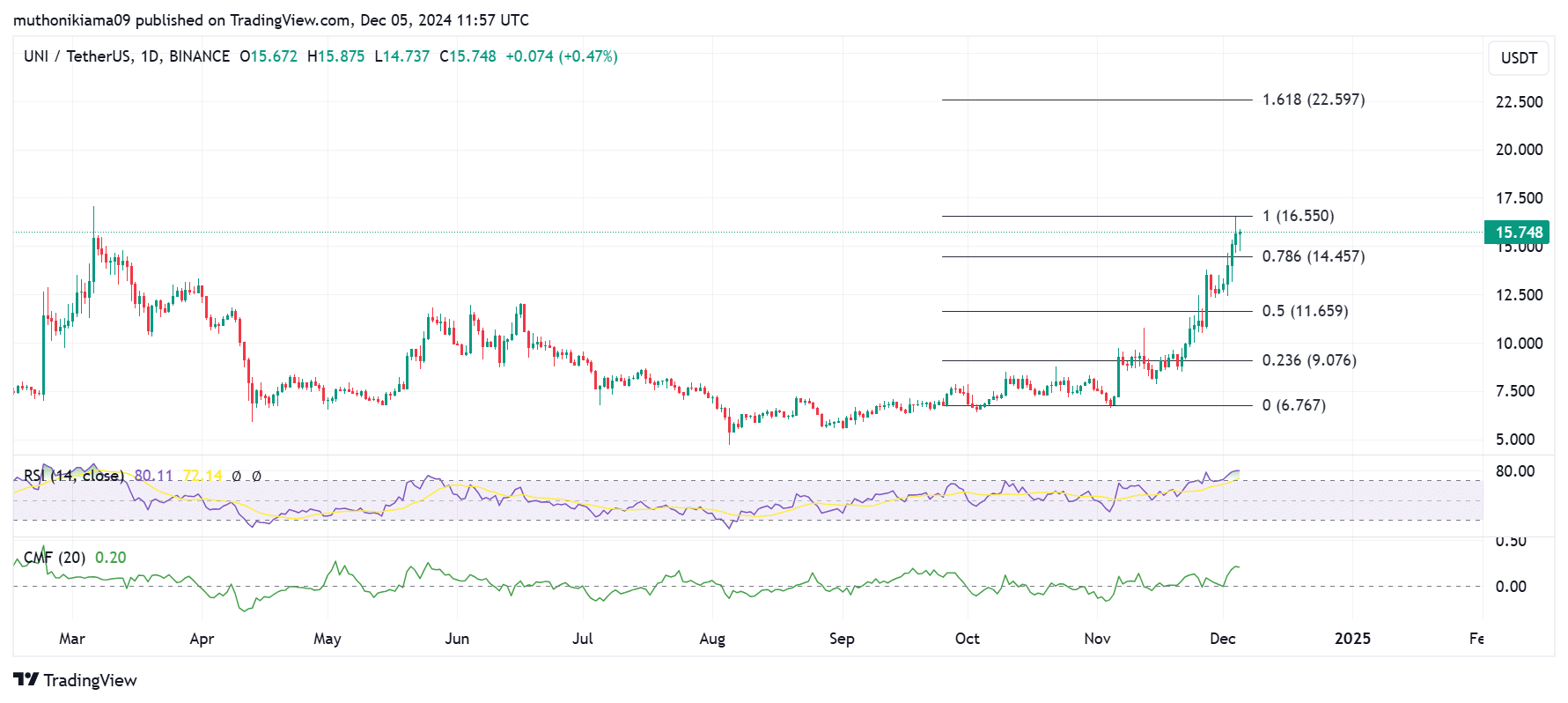

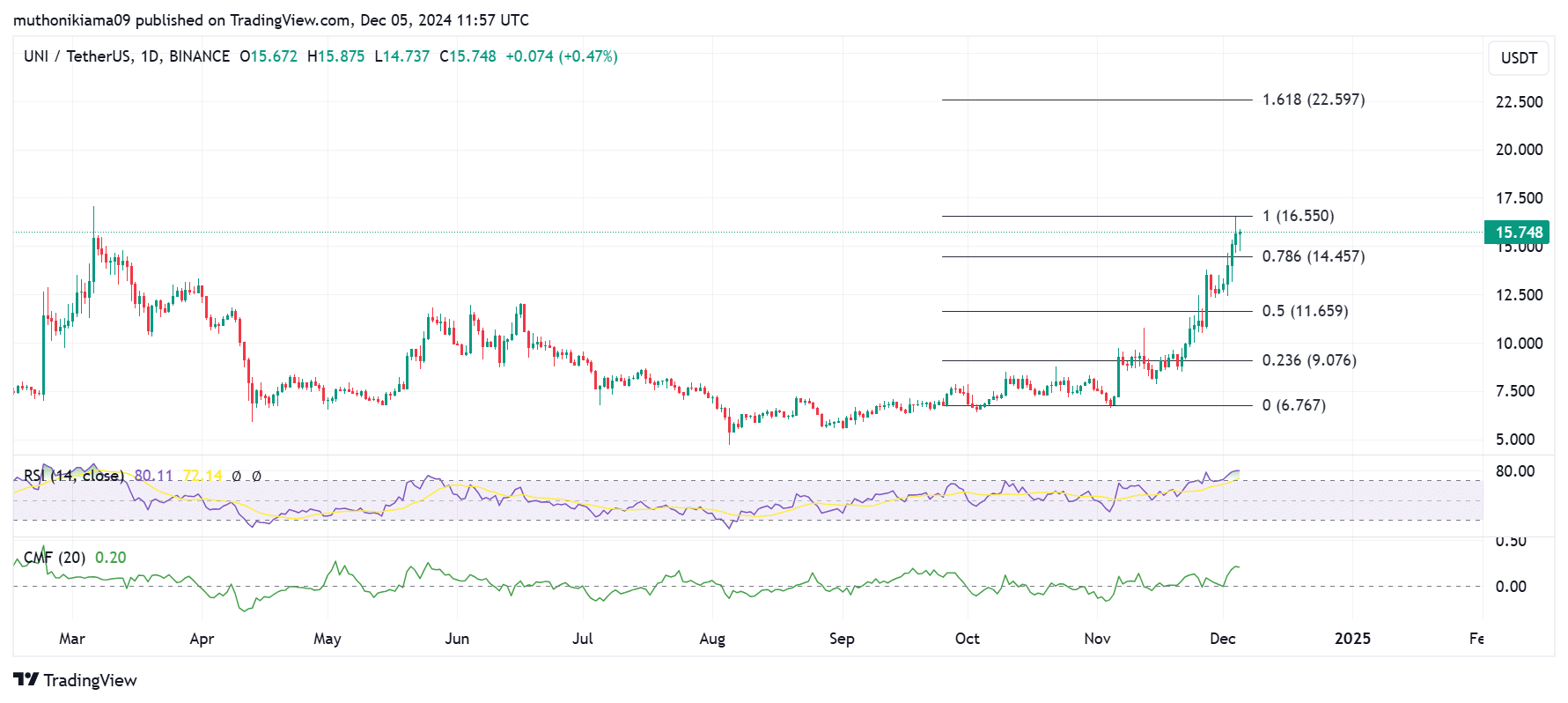

Uniswap’s RSI is at overbought ranges

Uniswap’s day by day chart exhibits that the altcoin is at an overbought stage after the Relative Energy Index (RSI) reached 78. This might precede a correction within the short-term, as has been the case up to now.

In the meantime, UNI’s Chaikin Cash Circulation (CMF) has reached 0.20, suggesting that purchasing exercise is at its highest stage in months.

(Supply: Tradingview)

If consumers sustain the momentum, UNI might surge in the direction of the 1.618 Fibonacci stage ($22.59), and attain its highest stage since early 2022. Conversely, a drop beneath $14.45 might gasoline one other downturn.

Learn Uniswap’s [UNI] Value Prediction 2024–2025

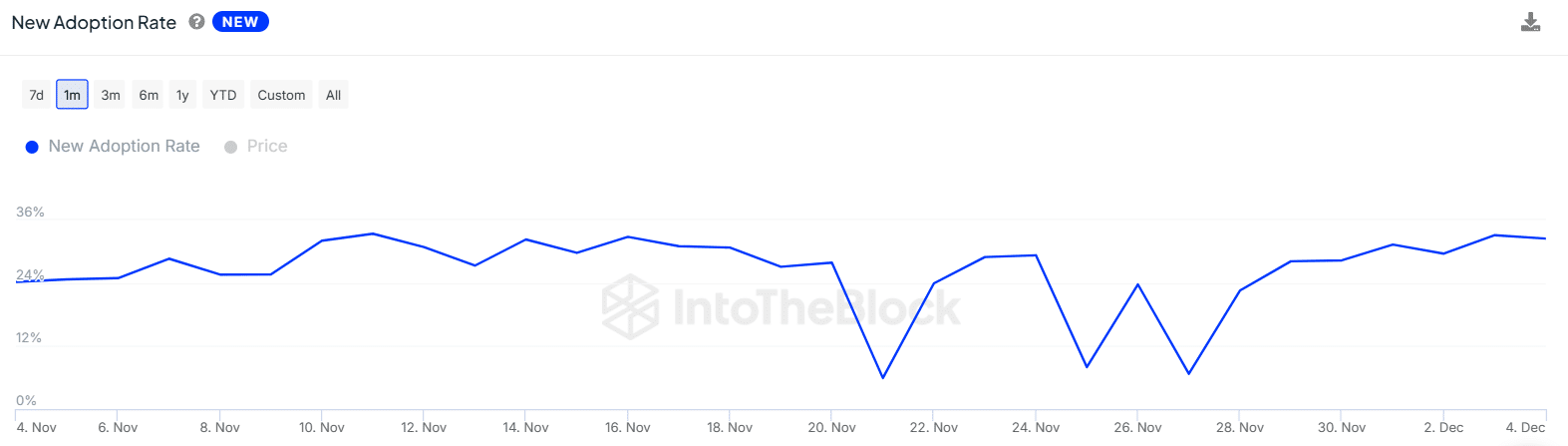

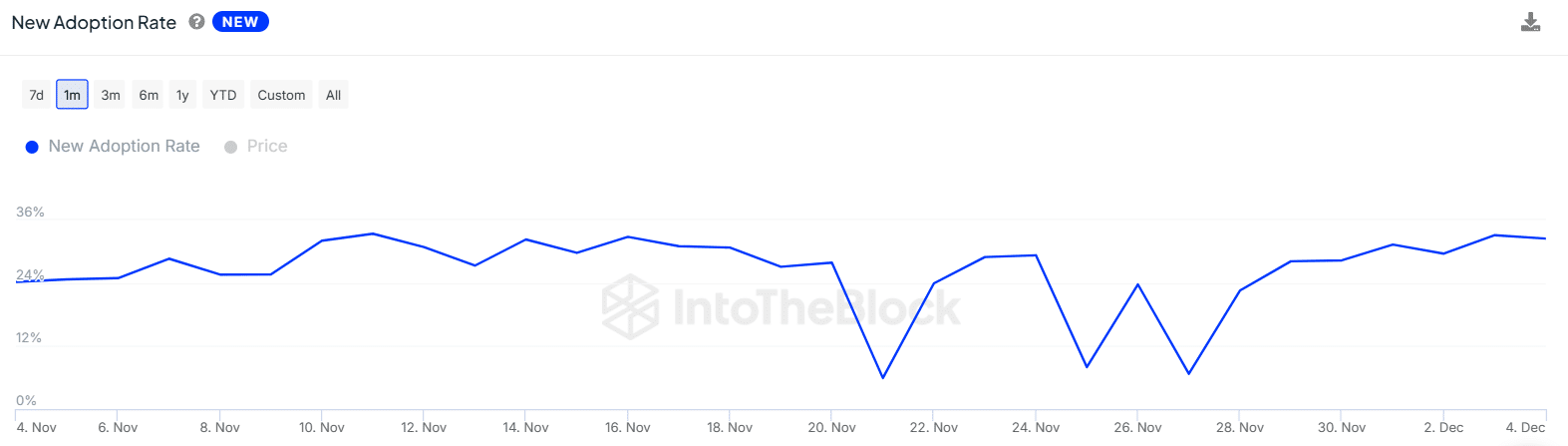

Rising new adoption fee suggests…

The brand new adoption fee has been on a gradual rise over the previous week per IntoTheBlock to 32.44%. This implies that there’s a excessive variety of new consumers accumulating Uniswap.

Supply: IntoTheBlock

A rise in new Uniswap addresses signifies retail FOMO, which might assist speed up the uptrend and drive extra positive factors for UNI.